Rebuilding credit after bankruptcy is the process of improving your credit score following a bankruptcy discharge. It involves a variety of steps designed to demonstrate financial responsibility, increase your creditworthiness, and regain the trust of lenders. The purpose of rebuilding credit after bankruptcy is vital for individuals who have undergone bankruptcy, as it allows them to regain their financial stability and prepare for future financial goals. It's important because a good credit score is not only required for obtaining loans or credit cards, but it can also impact other aspects like insurance rates, housing applications, and even job opportunities. The first step in rebuilding credit after bankruptcy is understanding what factors determine your credit score. These typically include your payment history, the amount of debt you owe, the length of your credit history, the types of credit you use, and the frequency of new credit applications. Rebuilding credit involves several steps that should be carried out over a period of time. These steps include analyzing your financial situation, developing a budget, paying bills on time, not taking on more debt than you can manage, and slowly applying for more credit as your score improves. Post-bankruptcy, it's crucial to establish a budget and savings plan. This will help you track your income and expenses, ensure that you live within your means, and help you save money for emergencies and future goals. Responsible use of credit is crucial for rebuilding credit after bankruptcy. This means paying your bills on time, using less than your credit limit, and not applying for new credit impulsively. Secured credit cards can be an effective tool for rebuilding credit. They require a security deposit which is typically equal to your credit limit. By using a secured card responsibly, you can show lenders that you are capable of managing credit, thus improving your credit score. Credit-builder loans are another useful tool for improving your credit score. These loans are offered by some credit unions and banks to help individuals rebuild their credit. Consistently making timely payments on all your debts is crucial for rebuilding credit after bankruptcy. Late payments can significantly damage your credit score, so ensure that all bills are paid on time. Rebuilding credit after bankruptcy has numerous advantages. Improved credit scores can open up a range of financial opportunities. This includes better terms and rates on loans and credit cards, which can save you significant amounts of money in the long run. With a better credit score, you have a higher chance of being approved for loans. This can be essential when you are looking to make significant financial moves, such as buying a home or starting a business. Better credit scores usually result in lower interest rates on loans and credit cards. This means you pay less over time. Some insurance companies use credit scores to determine your insurance premiums. Thus, having a better credit score can lead to lower insurance premiums. Rebuilding credit post-bankruptcy comes with its own set of challenges. Rebuilding credit is not a quick process. It requires a significant amount of time, effort, and financial discipline. Initially, you may find that the only credit you qualify for comes with high-interest rates and fees. Over time, as your credit improves, you'll qualify for better rates. Following bankruptcy, you might find it difficult to get approved for new credit. However, secured credit cards and credit-builder loans can be viable options in these situations. There can also be a social stigma associated with bankruptcy. It's essential to understand that bankruptcy is a legal tool designed to help individuals and businesses resolve their financial difficulties. Consider seeking the help of a financial advisor. They can guide you in managing your finances, staying on track, and achieving your financial goals. Commitment to a comprehensive financial plan is crucial. This includes a budget, savings plan, and debt repayment plan. Stick to your plan and make adjustments as needed. Use credit monitoring services to keep track of changes to your credit score. These tools can help you understand how your financial behavior impacts your credit score. Maintaining good credit is important for your financial health. It gives you better financial opportunities and allows you to save money in the long run. Sustainable practices include making payments on time, using credit responsibly, and keeping your credit balances low. These practices should become a part of your financial routine. It's crucial to manage your debt effectively. This includes not taking on more debt than you can handle and paying off your debt as quickly as possible. Reestablishing financial health after bankruptcy is a gradual and strategic process, which involves understanding the determinants of credit score, implementing a robust budget and savings plan, and making timely payments. The judicious use of secured credit cards and credit-builder loans can prove highly beneficial in the journey. While the process may be challenging due to the time required, high-interest rates, and initial credit access difficulties, overcoming these with professional financial advice and a comprehensive financial plan can lead to numerous advantages. These include increased financial opportunities, better loan approval chances, lower interest rates, and improved insurance premiums. Lastly, maintaining good credit is crucial for long-term financial well-being and involves sustainable practices such as responsible credit usage and effective debt management. By adhering to these principles and strategies, one can effectively navigate the path of rebuilding credit after bankruptcy.What Is Rebuilding Credit After Bankruptcy?

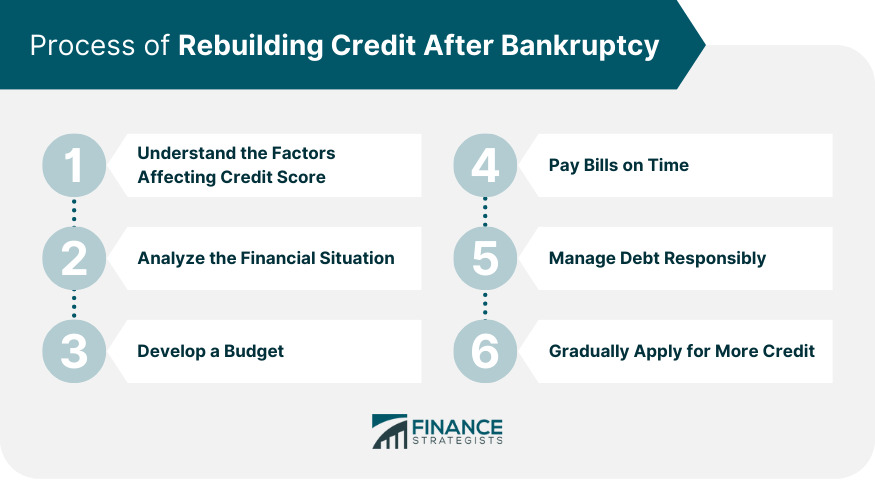

Process of Rebuilding Credit After Bankruptcy

Understand Credit Score Determinants

Steps Involved in the Rebuilding Process

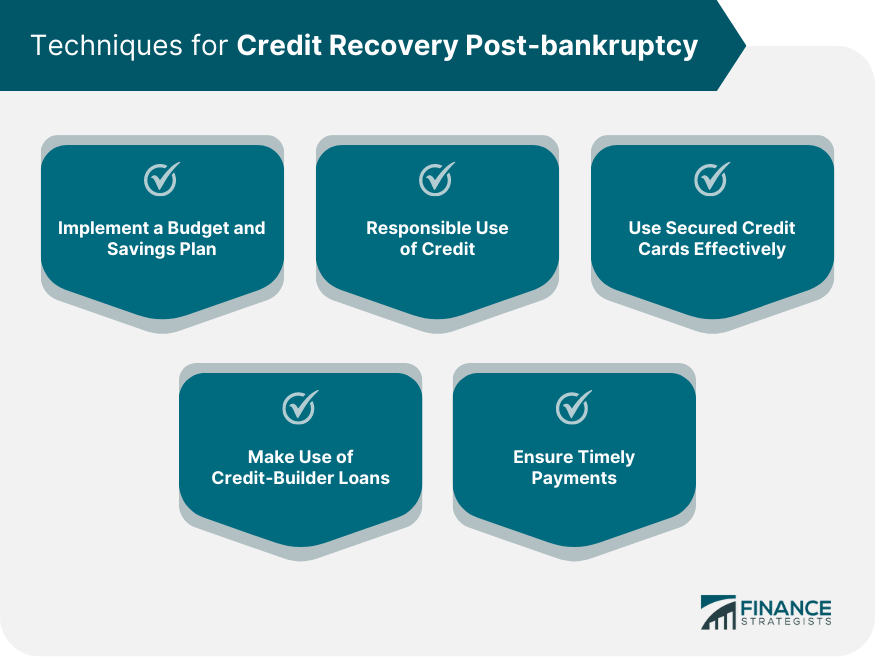

Techniques for Credit Recovery Post-bankruptcy

Implement a Budget and Savings Plan

Responsible Use of Credit

Use Secured Credit Cards Effectively

Make Use of Credit-Builder Loans

Ensure Timely Payments

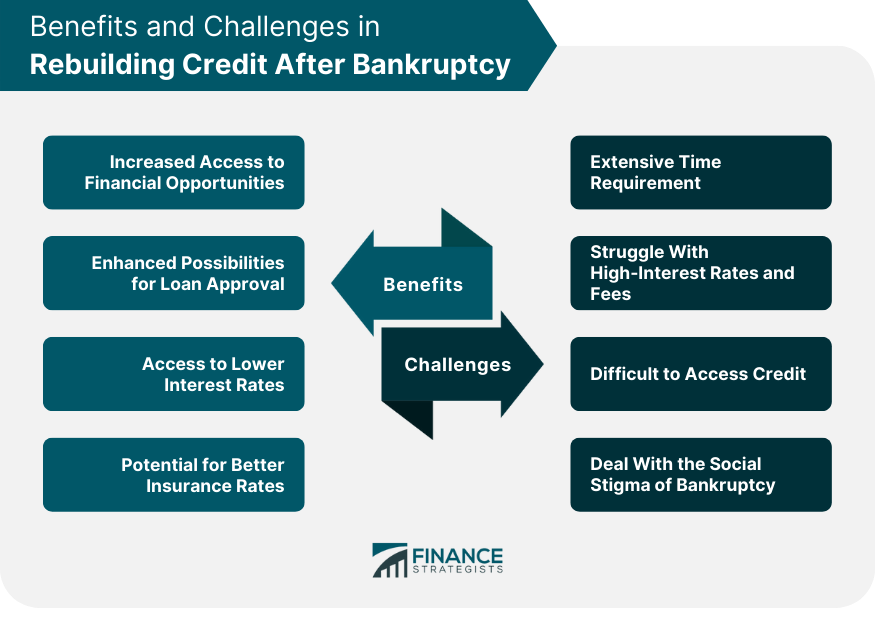

Advantages of Rebuilding Credit After Bankruptcy

Increased Access to Financial Opportunities

Enhanced Possibilities for Loan Approval

Access to Lower Interest Rates

Potential for Better Insurance Rates

Challenges in Rebuilding Credit After Bankruptcy

Extensive Time Requirement

Struggle With High-Interest Rates and Fees

Difficult to Access Credit

Deal With the Social Stigma of Bankruptcy

Strategies to Overcome Credit Rebuilding Challenges

Utilize Professional Financial Advice

Commitment to a Comprehensive Financial Plan

Employ Tools for Effective Credit Monitoring

How To Maintain Good Credit After Bankruptcy

Final Thoughts

Rebuilding Credit After Bankruptcy FAQs

Rebuilding credit after bankruptcy involves several steps, such as understanding what influences your credit score, creating and sticking to a budget, making payments on time, responsibly using credit, and gradually applying for more credit as your score improves.

Secured credit cards are an excellent tool for rebuilding credit after bankruptcy. They require a security deposit that typically equals your credit limit. By using a secured card responsibly, for instance, making timely payments and not maxing out the credit limit, you can show lenders that you're capable of managing credit.

Rebuilding credit after bankruptcy provides several advantages. It opens up a range of financial opportunities, enhances the possibility of loan approval, grants access to lower interest rates, and can lead to better insurance rates.

The process of rebuilding credit after bankruptcy can be time-consuming and require significant financial discipline. You may have to deal with high-interest rates and fees initially, and you may find it difficult to get approved for new credit. Additionally, there can be a social stigma associated with bankruptcy.

Maintaining good credit after successfully rebuilding it post-bankruptcy involves practices such as making payments on time, using credit responsibly, and keeping your credit balances low. It's also crucial to manage your debt effectively, including not taking on more debt than you can handle and paying off your debt as soon as possible.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.