What Are Bankruptcy Lawyers?

Bankruptcy lawyers are specialized legal professionals who guide individuals or businesses through the process of filing for bankruptcy.

Their expertise includes evaluating the client's financial situation, preparing the bankruptcy petition, and representing clients in court.

They provide invaluable assistance in formulating a suitable plan for discharging debts or creating a repayment plan, based on the type of bankruptcy filed. Their services are crucial in navigating the complexities of bankruptcy laws and ensuring a fair legal process.

While hiring bankruptcy lawyers can be costly, the benefits they provide, such as expert advice, timely and accurate filing, and court representation, often outweigh the expense.

Their roles may vary depending on the bankruptcy chapter, such as Chapter 7 for individuals or Chapter 11 for businesses. Their professional guidance plays an integral part in achieving the best possible outcomes in bankruptcy proceedings.

How Bankruptcy Lawyers Work

Initial Consultation

The process usually begins with an initial consultation, where the lawyer evaluates the client's financial situation. During this meeting, they assess the client's debts, income, expenses, and overall financial goals.

This step is vital for determining whether bankruptcy is the best option and, if so, under which chapter to file.

Prepare and File the Bankruptcy Petition

After the consultation, the bankruptcy lawyer prepares the bankruptcy petition, which includes detailed information about the client's debts, assets, income, and a list of property exemptions.

Ensuring that this document is accurate and complete is crucial to avoid potential legal issues or delays in the process.

Represent Clients in Court Proceedings

Once the bankruptcy petition is filed, the court initiates the proceedings. The bankruptcy lawyer represents the client during these proceedings, which may include a meeting of creditors and hearings in bankruptcy court.

Assist With Debt Discharge or Repayment Plan

Depending on the type of bankruptcy filed, the lawyer aids in formulating a plan for discharging debts or repaying creditors.

A Chapter 7 bankruptcy involves selling non-exempt assets to pay off debts. In a Chapter 13 bankruptcy, the lawyer helps create a repayment plan approved by the court.

Role of Bankruptcy Lawyers in Different Types of Bankruptcies

Chapter 7 Bankruptcy

In a Chapter 7 bankruptcy, the lawyer will help you understand if you're eligible to file under this chapter.

They'll assist in preparing and filing the necessary documents, representing you at the creditors' meeting, and guiding you through the process until your debts are discharged.

Chapter 13 Bankruptcy

In a Chapter 13 bankruptcy, the lawyer not only helps in preparing and filing the documents but also plays a crucial role in formulating a repayment plan. They will negotiate this plan with your creditors and represent you in court until the plan is approved.

Chapter 11 Bankruptcy

In a Chapter 11 bankruptcy, typically filed by businesses, the lawyer's role is more complex. They will assist in preparing a reorganization plan, negotiating with creditors, and guiding the business through the entire process.

Criteria for Choosing the Right Bankruptcy Lawyer

Verify Qualifications and Experience

Ensure your potential lawyer is licensed and has experience in bankruptcy law. You want a lawyer who is familiar with the local court system and the trustees within it.

Understand Fee Structure

Understanding the fee structure is vital before hiring a bankruptcy lawyer. Some lawyers charge a flat fee for their services, while others charge an hourly rate. Make sure you're clear about what's included in their fee to avoid surprises later.

Assess Communication Skills and Client Comfort Level

You'll be working closely with your bankruptcy lawyer, so it's crucial you're comfortable with them. They should be able to communicate effectively, explaining complex legal terms in a way you can understand.

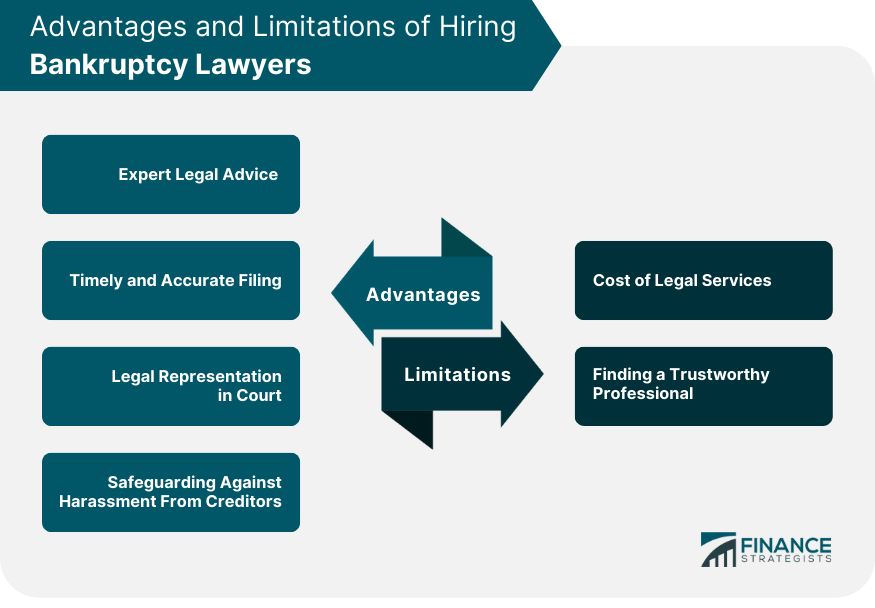

Advantages of Hiring Bankruptcy Lawyers

Expert Legal Advice

Bankruptcy lawyers offer essential advice on the complex procedures and laws governing bankruptcy. They help clients understand their legal rights and options, making sure they are making informed decisions.

Timely and Accurate Filing

Filing for bankruptcy involves a lot of paperwork that must be accurately filled out and submitted on time. A bankruptcy lawyer ensures that all documents are accurately completed and filed promptly, thus avoiding delays or dismissals.

Legal Representation in Court

Having a lawyer to represent you in court proceedings is crucial. They defend your interests, handle any disputes, and negotiate with creditors on your behalf.

Safeguarding Against Harassment From Creditors

When you file for bankruptcy, creditors are required to stop all collection efforts. If they continue, a bankruptcy lawyer can step in to protect you from harassment or illegal collection tactics.

Risks of Hiring Bankruptcy Lawyers

Cost of Legal Services

Hiring a bankruptcy lawyer can be expensive, and these costs might be prohibitive for those already struggling financially. However, it's essential to weigh this against the financial impact of potentially losing more assets without legal representation.

Finding a Trustworthy Professional

Finding a competent and reliable bankruptcy lawyer can be challenging. It requires thorough research, including checking qualifications, reviews, and even seeking recommendations.

Conclusion

Bankruptcy lawyers are specialized legal professionals who navigate the complexities of bankruptcy procedures, providing critical guidance to individuals or businesses seeking to file for bankruptcy.

Their work ranges from initial consultation to evaluating the financial situation, preparing the bankruptcy petition, and representing clients in court proceedings.

Importantly, they help formulate a suitable debt discharge or repayment plan based on the bankruptcy chapter filed.

These lawyers provide a range of benefits such as expert legal advice, accurate filing, court representation, and protection from creditor harassment. However, costs and finding a reliable professional are potential limitations.

Key considerations in selecting a bankruptcy lawyer include qualifications, experience, a clear understanding of fee structure, and effective communication skills.

Their role varies significantly in different bankruptcy chapters, with duties becoming more complex in business-related cases like Chapter 11.

What Are Bankruptcy Lawyers? FAQs

Bankruptcy lawyers are responsible for guiding clients through the process of filing for bankruptcy. This involves evaluating the client's financial situation, preparing the bankruptcy petition, representing the client in court, and assisting with the formulation of a debt discharge or repayment plan.

Hiring a bankruptcy lawyer is essential for navigating the complex procedures and laws surrounding bankruptcy. They provide expert advice, ensure timely and accurate filing of necessary documents, represent clients in court, and protect clients from creditor harassment.

When hiring a bankruptcy lawyer, it's crucial to verify their qualifications and experience, understand their fee structure, and assess their communication skills. You should feel comfortable with them as they'll guide you through a potentially stressful process.

In Chapter 7 bankruptcy, lawyers assist in filing the documents, representing clients at the creditors' meeting, and guiding them until debts are discharged. In Chapter 13, they additionally help formulate a repayment plan and negotiate this plan with creditors.

The cost of hiring a bankruptcy lawyer can be high, but it's essential to weigh this against the potential financial impact of losing more assets without legal representation. It's crucial to understand the fee structure before engaging their services.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.