Chapter 7 bankruptcy is a legal process designed to provide individuals or businesses with a fresh financial start by eliminating most of their debts. It is the most common form of bankruptcy in the United States. When filing for Chapter 7, a trustee is appointed to oversee the liquidation of non-exempt assets, which are sold to repay creditors. However, many assets, such as household goods and certain personal belongings, are protected by exemptions. Once the assets are sold, and creditors are paid, the remaining eligible debts are discharged, relieving the debtor from any further obligation to repay them. Chapter 7 bankruptcy can offer individuals or businesses a chance to rebuild their financial lives. In a Chapter 7 bankruptcy, your car is treated as an asset. Whether you can keep your car depends on several factors, including whether you're current on your loan payments, the value of your car, and the specific exemption laws in your state. If your car has significant equity that is not covered by an exemption, the trustee may sell it to repay your creditors. Understanding how your car is treated in a Chapter 7 bankruptcy is critical because it can significantly impact your daily life. Knowing what to expect can help you make an informed decision and potentially protect your vehicle. Each state has its own exemption laws which determine how much equity in your vehicle you can protect. Equity refers to the difference between the market value of your car and any outstanding loan on the vehicle. If your equity is less than the allowed exemption amount, you will typically be able to keep your car. Some states allow a "wildcard" or a "homestead" exemption that can be applied to any property. You could use this exemption to protect a portion of your vehicle equity if the vehicle exemption isn't enough to cover it. The specific amount varies by state, so you'll need to check your local laws. If your car has a low market value, it's less likely the bankruptcy trustee will sell it, especially if the cost of selling the car would leave little or no money to pay back your creditors. If you're behind on your car loan payments or if the vehicle is more trouble than it's worth, you might choose to surrender it to the lender. The loan will be discharged, and you won't owe any deficiency balance. If you wish to keep your car and continue making payments, you might consider a reaffirmation agreement. This is a new contract in which you agree to pay all or a portion of the money owed, despite the bankruptcy filing. In return, the lender agrees not to repossess the vehicle as long as you abide by the new agreement terms. In some cases, you might be able to keep your vehicle by paying the lender a lump sum equal to the car's current value. This is known as redemption. It can be a good option if you owe significantly more on the car loan than the car is worth. If your vehicle is fully exempt, or if the trustee abandons the vehicle (decides it's not worth selling), you may keep it. You'll need to continue making payments if the car is financed. When it comes to protecting your car in Chapter 7 bankruptcy, it is crucial to understand the exemption laws specific to vehicles in your jurisdiction. These laws determine the maximum value of equity that can be exempted, allowing you to keep your car. Familiarize yourself with these laws to ensure you meet the eligibility criteria and protect your vehicle from being sold or liquidated. Open lines of communication with your car lender and bankruptcy trustee are essential for protecting your car. If you intend to keep your car and continue making payments, it is crucial to inform your lender about your bankruptcy filing and discuss the options available, such as reaffirming the car loan. Additionally, maintaining open communication with the bankruptcy trustee ensures compliance with the legal process and allows you to address any concerns related to your car. Consulting with a bankruptcy attorney who specializes in Chapter 7 cases can provide invaluable guidance on protecting your car. An experienced attorney will help you navigate the complex legal requirements, analyze your specific situation, and recommend the most appropriate strategies to safeguard your vehicle. They can provide insights into exemptions, negotiate with creditors, and ensure your rights are protected throughout the bankruptcy process. A Chapter 7 bankruptcy can significantly impact your car ownership. Your vehicle's fate depends on your equity in the car, your ability to make ongoing payments, exemption laws, and the trustee's decision. Whether you choose to surrender, reaffirm, or redeem your car, the decision should be based on your financial situation and personal needs. Although a Chapter 7 bankruptcy can disrupt your life, it's often a necessary step toward financial recovery. When it comes to your vehicle, understanding the implications can help you better prepare for the process. It's essential to consult with a bankruptcy attorney to fully explore your options and protect your assets.What Is a Chapter 7 Bankruptcy?

Cars in a Chapter 7 Bankruptcy

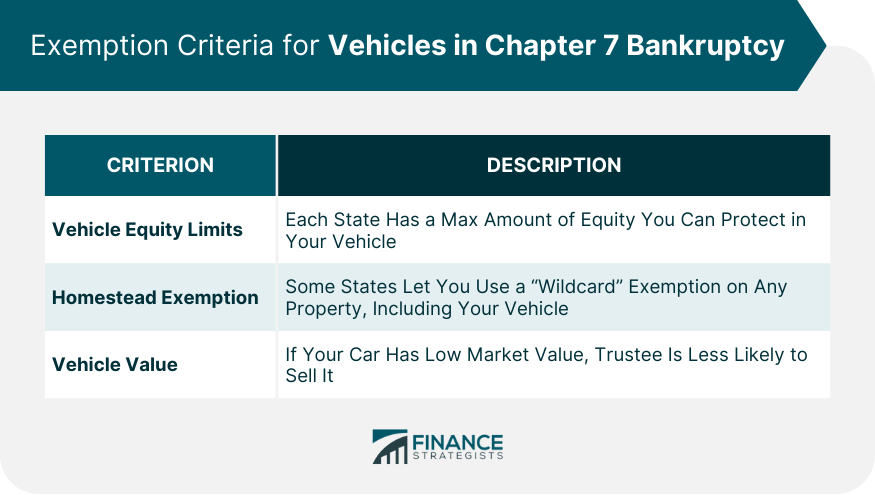

Exemption Criteria for Vehicles in Chapter 7 Bankruptcy

Vehicle Equity Limits

Homestead Exemption

Vehicle Value

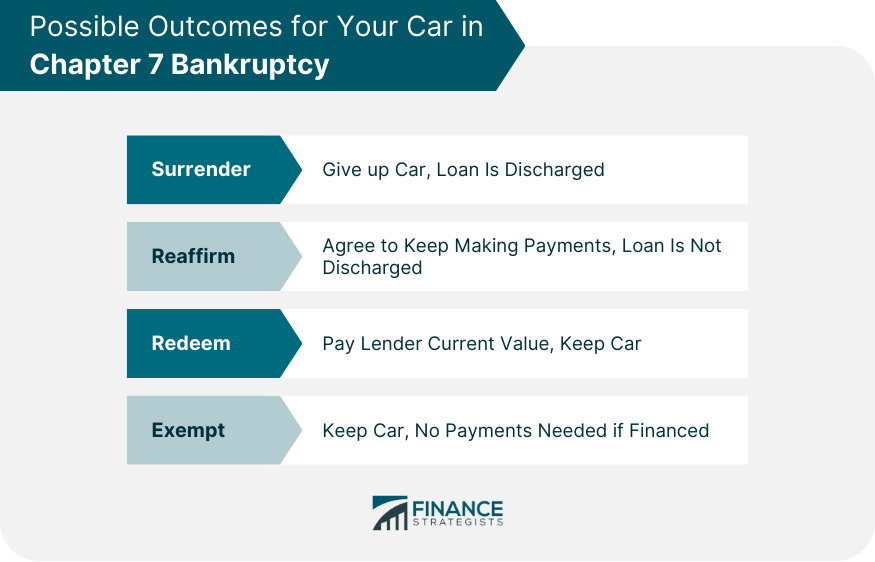

Possible Outcomes for Your Car

Surrendering the Vehicle

Reaffirmation of the Car Loan

Redemption of the Vehicle

Exercising Exemption Rights

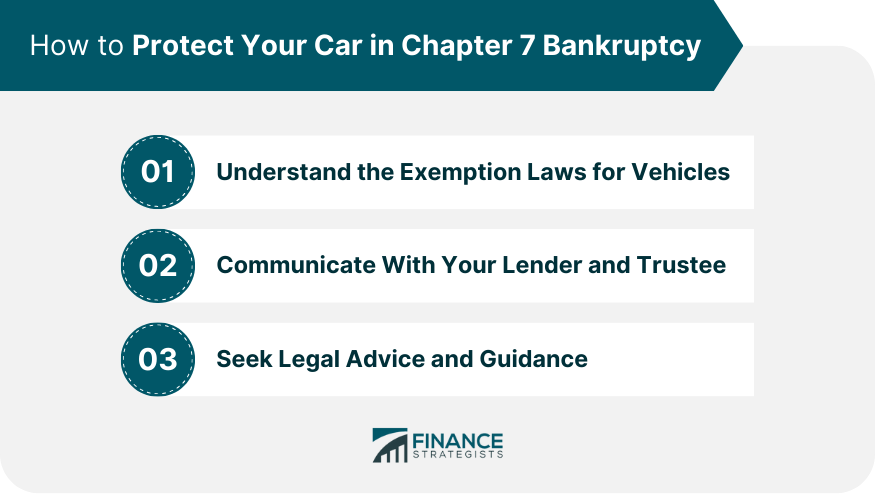

How to Protect Your Car in Chapter 7 Bankruptcy

Understand the Exemption Laws for Vehicles

Communicate With Your Lender and Trustee

Seek Legal Advice and Guidance

Conclusion

What Happens to My Car in Chapter 7 Bankruptcy? FAQs

Whether you can keep your car during a Chapter 7 bankruptcy depends on several factors, including the amount of equity you have in your car, your state's exemption laws, and whether you are up-to-date on your loan payments. If you're current on your payments and the equity in your car falls within your state's exemption limit, you might be able to keep your vehicle.

A reaffirmation agreement is a new contract between you and your car lender that you sign during your bankruptcy case. In this agreement, you reaffirm your commitment to pay your car loan under its original terms. This means the lender retains its right to repossess the car if you default, but it also means that you can keep your car as long as you keep up with payments.

Redeeming your car in a Chapter 7 bankruptcy involves making a lump sum payment to the lender equal to the car's current market value. Redemption can be beneficial if your car is worth significantly less than the remaining balance on your loan. By redeeming the vehicle, you effectively purchase the car for its current value and discharge the remaining loan balance.

If you choose to surrender your car during a Chapter 7 bankruptcy, you give up the car and stop making payments. The car lender then sells the car, and any unpaid loan balance gets discharged as part of your bankruptcy. Surrendering your vehicle can be a good option if you can't afford the payments or if the car is worth less than the remaining loan balance.

A bankruptcy attorney can provide valuable guidance on managing your car during a Chapter 7 bankruptcy. They can help you understand your options, such as surrendering, reaffirming, or redeeming your car, and the implications of each. They can also assist with legal paperwork and negotiations with the car lender, helping you make the best decision based on your financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.