Definition of Break in Service

A break in service, in the context of financial advisors, refers to a period of time during which an advisor is not actively providing financial planning or investment management services. This could be due to personal, professional, or industry-related reasons.

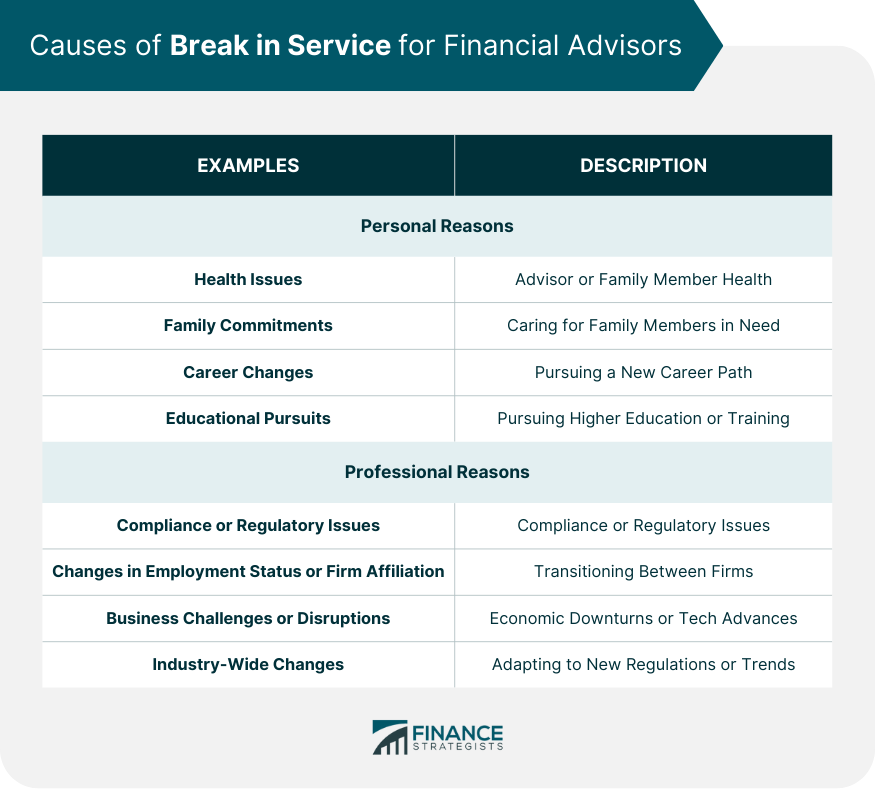

A break in service for financial advisors can result from various causes, such as personal, professional, or industry-related reasons.

The consequences of a break in service can be significant for both advisors and their clients, impacting their financial well-being, professional relationships, and overall satisfaction with the advisory services provided.

Causes of Break in Service for Financial Advisors

Personal Reasons

Health Issues

Health issues, either for the financial advisor or their family members, may require the advisor to take a break from providing financial planning and investment management services.

Family Commitments

Family commitments, such as caring for a newborn, an aging parent, or other family members in need, may necessitate a break in service for a financial advisor.

Career Changes

Financial advisors may decide to pursue a different career path, leading to a break in service as they transition to a new role or industry.

Educational Pursuits

Financial advisors may take a break from their practice to pursue higher education or specialized training to enhance their knowledge and skills.

Professional Reasons

Compliance or Regulatory Issues

Compliance or regulatory issues, such as violations or investigations, may force a financial advisor to take a break in service until the issues are resolved.

Changes in Employment Status or Firm Affiliation

Financial advisors may experience a break in service due to changes in their employment status or firm affiliation, such as transitioning from one firm to another or starting their own practice.

Business Challenges or Disruptions

Business challenges or disruptions, such as economic downturns or technological advancements, may impact a financial advisor's ability to provide continuous service to their clients.

Industry-Wide Changes

Industry-wide changes, such as new regulations or market trends, may require financial advisors to adapt their practices, potentially leading to a break in service as they adjust to the new landscape.

Impacts of Break in Service for Financial Advisors

On the Financial Advisor

Financial Consequences

A break in service may result in financial consequences for the financial advisor, such as reduced income, loss of clients, and potential difficulties in re-establishing their practice.

Loss of Client Relationships

Financial advisors may lose client relationships during a break in service, as clients may seek alternative financial advice in their absence.

Skill Deterioration or Knowledge Gap

During a break in service, financial advisors may experience skill deterioration or knowledge gaps, making it more challenging to provide effective financial planning and investment management services upon their return.

Emotional and Psychological Effects

Financial advisors may experience emotional and psychological effects during a break in service, such as stress, anxiety, or feelings of isolation, which may impact their well-being and ability to effectively serve clients.

On Clients

Disruption in Financial Planning and Investment Management

A break in service may disrupt clients' financial planning and investment management processes, potentially affecting their financial goals and overall satisfaction with their advisor's services.

Potential Concerns About Advisor's Reliability

Clients may question the reliability of their financial advisor during a break in service, leading to concerns about the quality and continuity of the financial advice they receive.

Increased Risk of Inadequate Financial Advice

A break in service may increase the risk of clients receiving inadequate financial advice if they must seek alternative sources of guidance during their advisor's absence.

Need for Alternative Financial Advisory Services

Clients may need to find alternative financial advisory services during their advisor's break in service, which may require additional time, effort, and resources.

Mitigating the Effects of a Break in Service for Financial Advisors

Strategies for Financial Advisors

Maintain Professional Networks and Industry Engagement

Financial advisors can mitigate the effects of a break in service by maintaining professional networks and staying engaged with industry developments, ensuring they remain up-to-date and connected with their peers and clients.

Pursue Continuous Learning and Professional Development

Financial advisors can minimize the impact of skill deterioration or knowledge gaps during a break in service by pursuing continuous learning and professional development opportunities, such as attending workshops, webinars, or obtaining relevant certifications.

Develop a Contingency Plan for Clients in Case of a Break in Service

To minimize disruptions for clients, financial advisors can develop a contingency plan outlining how clients can access financial planning and investment management services during their absence.

Seek Mentorship and Support From Peers and Industry Experts

Financial advisors can benefit from seeking mentorship and support from peers and industry experts during a break in service, helping them navigate the challenges associated with reestablishing their practice and maintaining client relationships.

Strategies for Clients

Establish a Clear Communication Plan With the Financial Advisor

Clients can minimize the impact of a break in service by establishing a clear communication plan with their financial advisor, ensuring they remain informed about any changes in service and can prepare accordingly.

Monitor the Financial Advisor's Performance and Reliability

Clients should regularly monitor their financial advisor's performance and reliability, enabling them to make informed decisions about whether to continue working with the advisor following a break in service.

Consider Diversifying Financial Advice Sources

Clients may consider diversifying their sources of financial advice to minimize the risk of disruptions during a break in service, ensuring they have access to consistent, high-quality guidance.

Stay Informed About Changes in the Financial Advisory Industry

By staying informed about changes in the financial advisory industry, clients can better understand the potential causes and consequences of a break in service and make more informed decisions about their financial planning and investment management needs.

Reintegrating After a Break in Service for Financial Advisors

Steps for Financial Advisors

Assess Personal and Professional Goals

Upon returning from a break in service, financial advisors should assess their personal and professional goals, ensuring they are aligned with their current practice and client needs.

Update Skills and Knowledge Through Training and Certifications

Financial advisors can update their skills and knowledge by participating in relevant training and obtaining certifications, ensuring they are well-prepared to provide high-quality financial planning and investment management services.

Rebuild Client Relationships and Trust

Reestablishing client relationships and trust is essential for financial advisors returning from a break in service. This can be achieved through open communication, addressing any concerns, and demonstrating a commitment to meeting clients' financial goals.

Develop a Strategic Plan for Business Growth and Client Retention

Financial advisors can create a strategic plan for business growth and client retention following a break in service, focusing on rebuilding their practice, attracting new clients, and maintaining existing relationships.

Steps for Clients

Evaluate the Financial Advisor’s Ability to Meet Their Needs Post-break

Clients should evaluate whether their financial advisor can continue to meet their needs following a break in service, taking into consideration any changes in the advisor's skills, knowledge, and service offerings.

Communicate Concerns and Expectations Openly

Open communication between clients and their financial advisor is crucial for addressing any concerns and setting expectations following a break in service. Clients should feel comfortable discussing their financial goals, risk tolerance, and any changes in their financial circumstances.

Monitor the Financial Advisor’s Performance Post-break

Clients should continue to monitor their financial advisor's performance after the break in service, ensuring the advisor remains capable of meeting their financial planning and investment management needs.

Be Patient and Supportive During the Reintegration Process

Clients should be patient and supportive during the reintegration process, understanding that it may take some time for their financial advisor to fully reestablish their practice and regain their footing in the industry.

Conclusion

A break in service for financial advisors can result from various personal, professional, or industry-related reasons, with significant consequences for both advisors and their clients.

Understanding the potential causes and impacts of a break in service can help both parties prepare for and manage any disruptions effectively.

Addressing breaks in service proactively is essential for financial advisors and their clients, ensuring the continuity of high-quality financial planning and investment management services.

While breaks in service can present challenges, they can also offer opportunities for growth and development.

For financial advisors, a break in service may provide the chance to reassess their career goals, update their skills and knowledge, and develop new strategies for business growth and client retention.

For clients, a break in service may encourage them to become more engaged with their financial planning and investment management processes and explore alternative sources of financial advice.

Both financial advisors and their clients can take steps to prepare for and manage breaks in service effectively, ensuring they continue to work towards their financial goals and maintain strong professional relationships.

By staying informed, engaged, and proactive, both parties can navigate the challenges associated with a break in service and emerge stronger and more resilient in the long term.

Break in Service FAQs

Break in service refers to a period of time during which an employee is not actively working for an employer, and is not receiving any pay or benefits from that employer.

A break in service can affect an employee's benefits in a number of ways, such as causing a loss of seniority, a reduction in vacation or sick leave accruals, or the loss of eligibility for certain benefits programs.

Yes, an employee can be rehired after a break in service. However, the length of the break in service may affect the employee's seniority, benefits eligibility, and other employment rights.

The maximum length of a break in service before an employee is considered a new hire varies by employer and industry. Some employers consider a break in service of six months or more to be a new hire, while others may have a longer or shorter cutoff.

Whether or not an employee can receive unemployment benefits during a break in service depends on the circumstances of the break. If the break is due to a layoff or termination, the employee may be eligible for unemployment benefits. However, if the break is voluntary or due to a leave of absence, the employee may not be eligible.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.