Antitrust laws, also known as competition laws, are legal regulations designed to promote and maintain fair competition in the marketplace. These laws aim to prevent monopolies, price-fixing, collusion, and other anti-competitive practices that can harm consumers and stifle innovation. Antitrust laws encourage competition by prohibiting anti-competitive behavior, regulating mergers and acquisitions to prevent undue concentration of market power, and enforcing fair business practices. The primary goal of antitrust laws is to protect consumer welfare and ensure a level playing field for businesses, fostering healthy market dynamics and promoting economic efficiency. The Sherman Antitrust Act was the first federal law aimed at curbing monopolies and promoting fair competition. The act prohibits contracts, combinations, and conspiracies that restrain trade or create monopolies. The Federal Trade Commission (FTC) Act established the FTC to prevent unfair methods of competition and deceptive business practices. The act empowers the FTC to enforce antitrust laws and protect consumers. The Clayton Antitrust Act aimed to strengthen the Sherman Act by addressing specific practices like price discrimination, exclusive dealing agreements, and tying arrangements that could harm competition. Antitrust laws strive to maintain competitive markets by preventing the formation of monopolies and prohibiting anti-competitive practices that could lead to monopolistic control. Price-fixing and bid-rigging are illegal under antitrust laws. These practices involve competitors conspiring to set prices or manipulate bids, harming consumers and stifling competition. Mergers and acquisitions can reduce competition, leading to higher prices and reduced innovation. Antitrust laws require regulatory oversight to prevent anti-competitive outcomes. Antitrust laws provide for penalties, including fines and imprisonment, to deter businesses from engaging in anti-competitive behavior. Antitrust laws contribute to a level playing field in the financial services industry, promoting competition and innovation while protecting consumers from unscrupulous practices. Financial advisors must ensure that their clients' mergers and acquisitions comply with antitrust laws to avoid penalties and protect consumers. Financial advisors must avoid participating in or facilitating collusion, price-fixing, or other anti-competitive practices that violate antitrust laws. Financial advisors have a fiduciary duty to act in their clients' best interests, which includes avoiding conflicts of interest and promoting fair competition. Financial advisors must disclose all relevant information, including potential conflicts of interest, to clients, ensuring transparency and upholding ethical standards. The FTC enforces antitrust laws, investigates potential violations, and takes legal action against businesses that engage in anti-competitive practices. The DOJ's Antitrust Division prosecutes criminal violations of antitrust laws and works alongside the FTC to ensure compliance. The SEC regulates the securities industry and enforces antitrust laws as they pertain to mergers, acquisitions, and other activities involving securities. Monopolies represent a significant concern in the realm of antitrust laws. A monopoly is a situation where a single company or entity holds exclusive control over a particular market or industry. Characteristics of a monopoly include the absence of competition, the ability to dictate prices and terms, and limited consumer choice. To prevent the abuse of dominant market power, antitrust laws prohibit certain actions that maintain or acquire monopoly power. These actions include predatory pricing, where a dominant company sets prices at a loss to drive competitors out of the market, and exclusive dealing, where a company demands exclusivity from suppliers or customers to limit competition. Other prohibited practices include tying arrangements, where a company conditions the sale of one product on the purchase of another, and refusal to deal, where a dominant company refuses to supply essential goods or services to competitors. Collusion and price-fixing are forms of anti-competitive practices that undermine market competition and harm consumers. Collusion occurs when companies conspire to limit competition by coordinating their actions rather than competing on merit. Price-fixing, a common form of collusion, involves companies agreeing to set prices at a certain level, restricting competition, and artificially inflating prices. Collusion can take various forms, including bid-rigging, where companies coordinate to manipulate the bidding process to favor a particular bidder. Market allocation is another form of collusion, where companies agree to divide markets or customers among themselves to avoid competition. These practices harm consumers by depriving them of competitive prices and choices. Engaging in collusion and price-fixing activities carries severe legal consequences and penalties. Violators may face civil litigation, hefty fines, and criminal charges. The merger control framework aims to prevent mergers and acquisitions that would substantially lessen competition or create anti-competitive market structures. Antitrust laws require companies to notify regulatory authorities of proposed mergers, allowing for a thorough review to assess potential anti-competitive effects. Pre-merger notification requirements vary by jurisdiction but typically apply to mergers that exceed certain thresholds, such as transaction value or market share. Regulatory bodies, such as the FTC in the United States, review mergers to determine their potential impact on competition and consumer welfare. Horizontal mergers occur between companies operating in the same industry or market. These mergers can lead to reduced competition by eliminating a competitor or consolidating market share. For example, if two major airlines merge, it may result in decreased competition and higher prices for consumers. Vertical mergers involve companies operating at different stages of the supply chain or in related markets. For instance, a merger between a manufacturer and a distributor can create concerns if it restricts competition or allows the merged entity to control access to key inputs or distribution channels. Vertical mergers can potentially harm competition by limiting choices and raising barriers to entry for new market participants. When evaluating horizontal and vertical mergers, antitrust considerations include market concentration, the potential for market foreclosure, impact on innovation, and the ability of the merged entity to exercise market power. Regulatory authorities assess these factors to determine whether the merger is likely to harm competition and whether remedies or conditions are necessary to mitigate any adverse effects. To ensure fair competition and protect consumers, antitrust laws address anti-competitive practices, including monopolies and abuse of dominant market power, collusion, and price-fixing, as well as merger control and antitrust review. Monopolies, characterized by exclusive control and limited consumer choice, are regulated to prevent abuse of market power. Collusion and price-fixing, where companies coordinate actions or set prices to restrict competition, are prohibited, carrying severe legal consequences. Merger control frameworks require companies to notify regulatory authorities of proposed mergers, assessing their potential impact on competition and consumer welfare. Horizontal mergers between companies in the same industry and vertical mergers between companies in different stages of the supply chain are scrutinized to ensure they do not harm competition or limit choices. Overall, antitrust laws play a crucial role in promoting fair competition, protecting consumers, and fostering a healthy marketplace.Definition of Antitrust Laws

History and Development of Antitrust Laws

Sherman Antitrust Act (1890)

Federal Trade Commission Act (1914)

Clayton Antitrust Act (1914)

Key Principles of Antitrust Laws

Preventing Monopolies and Promoting Competition

Prohibiting Price-Fixing and Bid-Rigging

Regulating Mergers and Acquisitions

Punishing Anti-competitive Behavior

Antitrust Laws and Financial Advisors

Ensuring Fair Competition in the Financial Services Industry

Compliance With Antitrust Regulations

Ethical Considerations for Financial Advisors

Role of Regulatory Bodies in Enforcing Antitrust Laws

Federal Trade Commission (FTC)

Department of Justice (DOJ)

Securities and Exchange Commission (SEC)

Anti-competitive Practices

Monopolies and Abuse of Dominant Market Power

Collusion and Price-Fixing

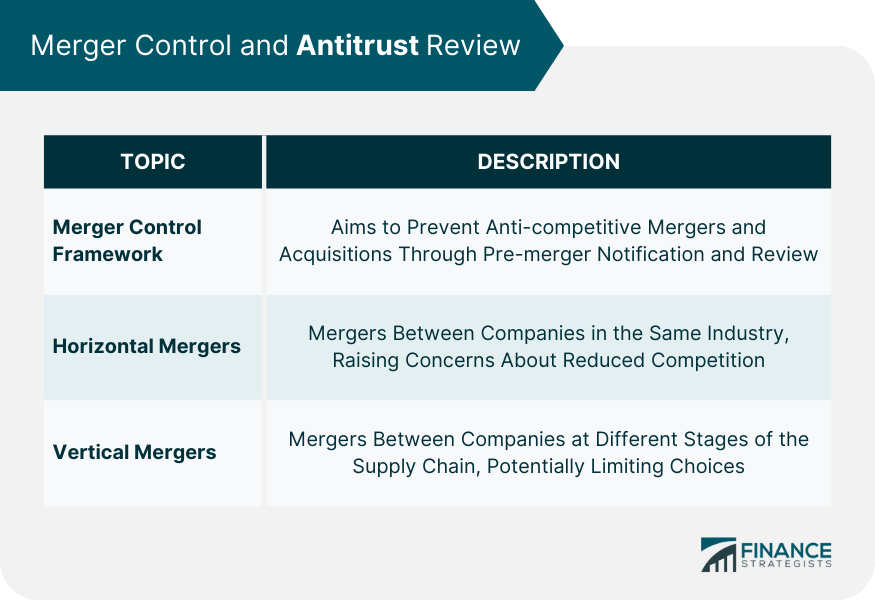

Merger Control and Antitrust Review

Merger Control Framework

Horizontal and Vertical Mergers

Conclusion

Antitrust Laws FAQs

The primary purpose of antitrust laws in the financial services industry is to maintain fair competition, promote innovation, and protect consumers from unscrupulous practices by preventing monopolies, prohibiting price-fixing and bid-rigging, and regulating mergers and acquisitions.

Antitrust laws impact the ethical responsibilities of financial advisors by requiring them to uphold fair competition, avoid conflicts of interest, and act in the best interests of their clients, ensuring transparency and disclosure in all their business dealings.

The Federal Trade Commission (FTC), Department of Justice (DOJ), and Securities and Exchange Commission (SEC) are the primary regulatory bodies responsible for enforcing antitrust laws in the financial services industry.

Financial advisors can ensure compliance with antitrust laws by performing due diligence in mergers and acquisitions, avoiding collusion and price-fixing, implementing robust compliance programs, and engaging in ongoing education and training on antitrust regulations and ethical principles.

Recent antitrust cases involving financial advisors include the Libor scandal and the foreign exchange market manipulation cases. Lessons learned from these cases include the importance of robust compliance programs, employee training on antitrust regulations, and fostering a culture of ethical behavior and accountability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.