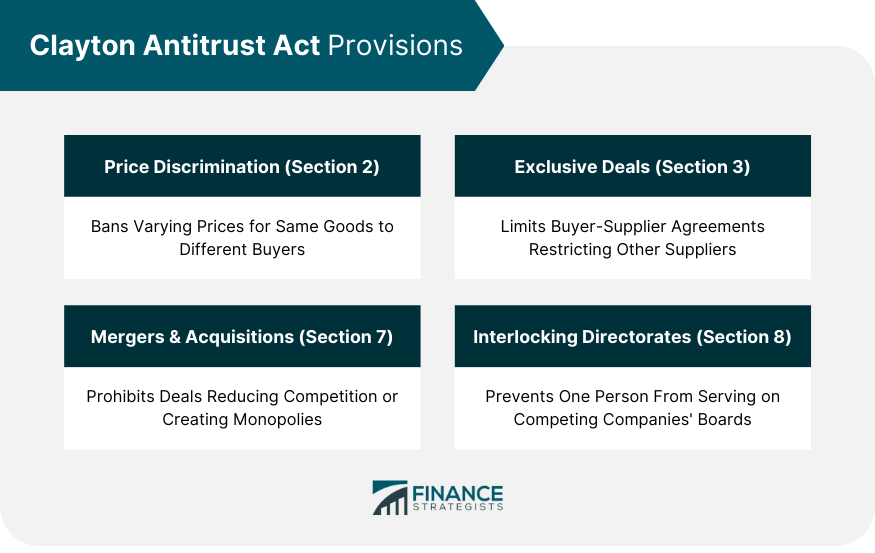

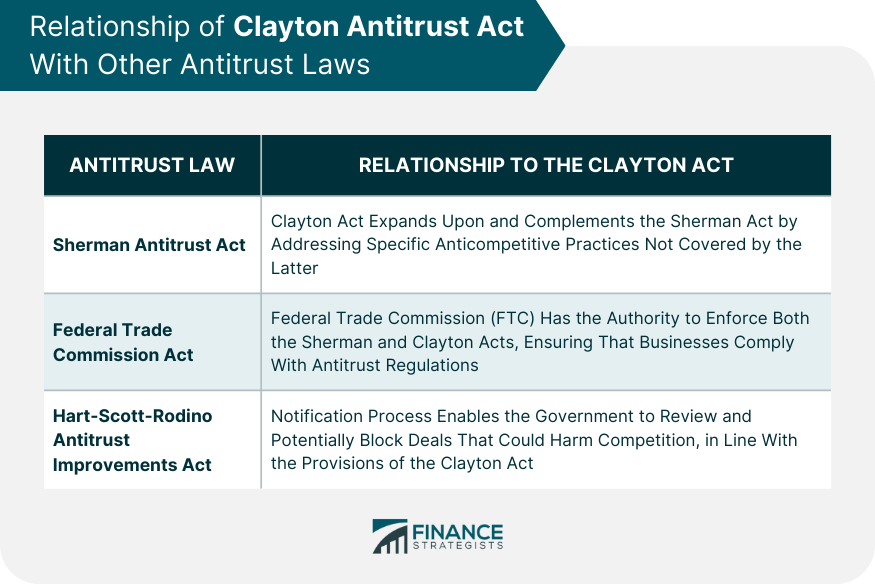

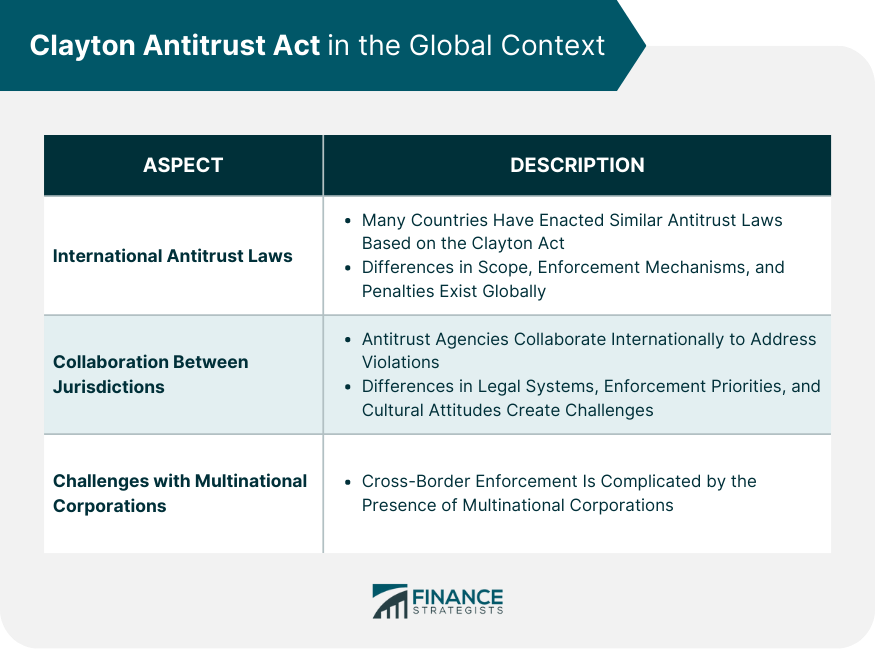

The Clayton Antitrust Act is a U.S. federal law enacted in 1914 with the aim of strengthening and supplementing the Sherman Antitrust Act of 1890. Its purpose is to prevent anti-competitive practices and promote fair competition in the marketplace. The act prohibits various activities that could restrict competition, such as price discrimination, exclusive dealing, and mergers that would substantially lessen competition. It also enhances the enforcement powers of the Federal Trade Commission (FTC) and provides individuals and businesses with legal remedies to seek damages for antitrust violations. Overall, the Clayton Antitrust Act serves as a crucial tool in maintaining a competitive economy by preventing monopolistic practices and preserving fair trade practices. The Clayton Act features several crucial provisions that significantly impact the financial industry. These provisions address price discrimination, exclusive dealing and tying arrangements, mergers and acquisitions, and interlocking directorates. Section 2 of the Act prohibits price discrimination, which occurs when a seller charges different buyers different prices for the same goods or services. This prohibition aims to ensure a level playing field for all market participants and prevent undue competitive advantages. Price discrimination can lead to predatory pricing, which may result in eliminating competition and forming monopolies. Section 3 of the Clayton Act addresses exclusive dealing and tying arrangements. These practices involve agreements between a supplier and a buyer that restrict the buyer's ability to purchase goods or services from other suppliers. Such arrangements can stifle competition and limit consumer choice. The Clayton Act makes these types of agreements unlawful if they significantly impact competition in a particular market. Section 7 of the Act focuses on mergers and acquisitions, which can lead to increased market concentration and reduced competition. Under the Clayton Act, mergers and acquisitions that may "substantially lessen competition, or tend to create a monopoly" are illegal. The law empowers the government to review and block transactions that could harm competition. Section 8 of the Clayton Act deals with interlocking directorates, a situation in which a single individual serves on the boards of competing companies. This provision aims to prevent collusion among competitors and maintain a competitive market environment. The Clayton Act is one of several key antitrust laws in the United States, including the Sherman Antitrust Act, the Federal Trade Commission Act, and the Hart-Scott-Rodino Antitrust Improvements Act. These laws work together to form a comprehensive antitrust framework. The Sherman Antitrust Act, enacted in 1890, is the foundation of U.S. antitrust law. This legislation prohibits contracts, combinations, or conspiracies that restrain trade, as well as monopolization and attempts to monopolize. The Clayton Act expands upon and complements the Sherman Act by addressing specific anticompetitive practices not covered by the latter. The Federal Trade Commission (FTC) Act, also passed in 1914, established the FTC to enforce antitrust laws and protect consumers from unfair business practices. The FTC has the authority to enforce both the Sherman and Clayton Acts, ensuring that businesses comply with antitrust regulations. The Hart-Scott-Rodino Antitrust Improvements Act of 1976 requires companies involved in certain large mergers or acquisitions to notify the FTC and the Department of Justice (DOJ) before completing the transaction. This notification process enables the government to review and potentially block deals that could harm competition, in line with the provisions of the Clayton Act. The Clayton Act has faced criticism and calls for reform throughout its existence. Some argue that the Act is outdated and ill-equipped to address modern antitrust issues, particularly those arising in the digital age. Others contend that the Act has not been effectively enforced, allowing anticompetitive practices to persist. Critics argue that the Clayton Act has not been as effective as intended, allowing powerful monopolies and oligopolies to emerge. They contend that the Act's provisions need to be more comprehensive and that enforcement needs to be consistent. This has led to calls for modernization and reform to address contemporary antitrust challenges better. As technology evolves and new business models emerge, some argue that the Clayton Act must be updated to remain relevant. Critics point to the rise of digital platforms and the increased concentration of economic power as evidence that the current antitrust framework is insufficient. Proposals for modernization include updating the Act's provisions to address digital markets and strengthening enforcement mechanisms. In response to these concerns, lawmakers have introduced legislative proposals to update and strengthen the Clayton Act and other antitrust laws. These proposals include measures to bolster enforcement capabilities, clarify merger review standards, and address anticompetitive practices in digital markets. As globalization continues to impact markets and businesses worldwide, the Clayton Act and other antitrust laws face new challenges in the global context. The Clayton Act serves as a model for antitrust laws in other jurisdictions. Many countries have enacted similar legislation to address anticompetitive practices and promote fair competition. However, variations exist in terms of scope, enforcement mechanisms, and penalties, reflecting different legal traditions and market structures. As companies increasingly operate across borders, antitrust enforcement agencies must collaborate to address potential violations effectively. The United States works with other countries and international organizations to coordinate enforcement efforts, share information, and develop best practices for promoting competition and regulating markets. This collaboration is essential to ensure that antitrust laws remain effective in an interconnected global economy. Enforcing antitrust laws across borders presents several challenges. Differences in legal systems, enforcement priorities, and cultural attitudes toward competition can create difficulties in coordinating investigations and enforcement actions. Additionally, the rise of multinational corporations and the growing importance of digital markets can further complicate cross-border enforcement efforts. The Clayton Antitrust Act is a significant U.S. federal law that aims to prevent anti-competitive practices and promote fair competition. Its key provisions include addressing price discrimination, exclusive dealing and tying arrangements, mergers and acquisitions, and interlocking directorates. The Act works in conjunction with other antitrust laws, such as the Sherman Antitrust Act, the Federal Trade Commission Act, and the Hart-Scott-Rodino Antitrust Improvements Act, to form a comprehensive antitrust framework. Despite its importance, the Clayton Act has faced criticisms and calls for reform, particularly regarding its effectiveness in addressing modern antitrust issues. Recent legislative proposals seek to update and strengthen the Act. In the global context, the Clayton Act serves as a model for other jurisdictions, but challenges in enforcing antitrust laws across borders persist due to differences in legal systems, enforcement priorities, and the complexities of multinational corporations and digital markets. Collaboration between jurisdictions is crucial to ensuring the effectiveness of antitrust laws in the interconnected global economy.What Is the Clayton Antitrust Act?

Key Provisions of the Clayton Antitrust Act

Price Discrimination (Section 2)

Exclusive Dealing and Tying Arrangements (Section 3)

Mergers and Acquisitions (Section 7)

Interlocking Directorates (Section 8)

Relationship With Other Antitrust Laws

Sherman Antitrust Act

Federal Trade Commission Act

Hart-Scott-Rodino Antitrust Improvements Act

Criticisms and Reforms of the Clayton Antitrust Act

Debate Over Effectiveness

Calls for Modernization

Recent Legislative Proposals

Clayton Antitrust Act in the Global Context

Comparison to International Antitrust Laws

Collaboration Between Jurisdictions

Challenges in Enforcing Antitrust Laws Across Borders

Conclusion

Clayton Antitrust Act FAQs

The Clayton Antitrust Act is a U.S. law enacted in 1914 to prevent anticompetitive practices in their incipiency. It was designed to supplement and strengthen the Sherman Antitrust Act of 1890 by prohibiting specific types of conduct that were not covered adequately by the earlier law.

The Clayton Antitrust Act includes several key provisions. It prohibits exclusive sales contracts, interlocking directorates, and certain types of price discrimination. It also restricts mergers and acquisitions that would substantially lessen competition or create a monopoly, and it makes corporate officers personally responsible for antitrust violations.

The Clayton Antitrust Act complements the broader Sherman Antitrust Act by specifically targeting practices like mergers and interlocking directorates that are not explicitly prohibited by the Sherman Act, but have the potential to restrict competition. Together, these acts aim to prevent anticompetitive practices and maintain fair trade in the marketplace.

The Clayton Antitrust Act has significantly impacted the business landscape in the U.S. by limiting certain types of anticompetitive behavior. It has influenced how businesses structure their operations and transactions, particularly in mergers and acquisitions. It has also led to the breakup of several large corporations deemed to be violating the Act.

The Clayton Antitrust Act is enforced by two federal agencies: the Federal Trade Commission (FTC) and the Antitrust Division of the Department of Justice (DOJ). Both agencies have the authority to bring enforcement actions against companies suspected of violating the Act. The FTC generally focuses on civil enforcement, while the DOJ handles both civil and criminal enforcement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.