Client confidentiality in the finance industry refers to the protection of a client's personal, financial, and transactional information from unauthorized access, disclosure, or misuse. Maintaining confidentiality is crucial for establishing trust between financial institutions and clients, and it is mandated by various legal and ethical frameworks. Explore the principles, legal framework, practices, and challenges surrounding client confidentiality in the finance sector. Trust is the foundation of any relationship between a financial institution and its clients. Clients rely on financial institutions to protect their sensitive information and maintain confidentiality. Upholding client confidentiality is essential for fostering long-lasting professional relationships and enhancing the reputation of the institution. Financial institutions collect and process a vast amount of sensitive data, such as client identification, account details, transaction records, and credit information. Ensuring privacy and data protection is vital for maintaining client confidentiality and complying with data protection laws and regulations. Client confidentiality is not absolute, as there may be certain exceptions where financial institutions are legally obligated to disclose client information. These exceptions include court orders, subpoenas, or specific regulatory requirements. Financial institutions must be aware of these boundaries and exceptions to ensure appropriate handling of client information. Several laws and regulations govern client confidentiality in the finance sector: 1. Bank Secrecy Act (BSA): This act requires financial institutions to maintain records and report certain transactions, such as large cash deposits, to the government to combat money laundering and other financial crimes. 2. Gramm-Leach-Bliley Act (GLBA): The GLBA mandates financial institutions to protect client information by implementing privacy policies, safeguarding data, and notifying clients about their privacy practices. 3. Securities and Exchange Commission (SEC) Regulations: The SEC enforces various rules and regulations to protect investors and maintain market integrity, including provisions related to client confidentiality. Financial professionals, such as certified financial planners, chartered financial analysts, and accountants, adhere to codes of conduct and ethics established by their professional organizations. These codes often include specific provisions on maintaining client confidentiality. Breaching client confidentiality in finance can result in severe consequences, including regulatory penalties, fines, legal actions, loss of professional licenses, and reputational damage to the financial institution and its professionals. Financial institutions should establish clear and comprehensive confidentiality policies and procedures that outline the responsibilities of employees, permissible information sharing, and guidelines for handling client data securely. Training employees and stakeholders on the importance of client confidentiality, legal requirements, and the institution's policies and procedures is crucial for ensuring that everyone understands their roles and responsibilities in maintaining confidentiality. Financial institutions should implement secure communication channels, such as encrypted email and messaging, to protect client information during transmission. Additionally, they should establish protocols for sharing client data with third parties, such as vendors or regulators, to prevent unauthorized access or disclosure. Banks must maintain client confidentiality to protect sensitive account information, transaction history, and personal identification details. They are also subject to stringent regulations, such as the BSA and GLBA, which mandate specific confidentiality and reporting requirements. Investment management firms, including mutual funds and hedge funds, must uphold client confidentiality to protect client assets, investment strategies, and financial goals. They are subject to SEC regulations that govern the handling of client information and ensure that investment managers act in the best interest of their clients. Insurance companies collect a vast amount of sensitive information about their clients, such as medical records, financial data, and personal details. They must maintain confidentiality to protect client privacy and comply with industry-specific regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) for health insurers. Financial planners and advisors work closely with clients to develop personalized financial plans, requiring access to confidential information about clients' financial goals, situations, and risk tolerance. They must uphold confidentiality to maintain trust and comply with professional codes of conduct and ethics. Credit reporting agencies collect and maintain credit information on millions of individuals and businesses. They are responsible for ensuring the confidentiality and accuracy of credit reports, which play a crucial role in lending decisions and other financial transactions. These agencies must adhere to the Fair Credit Reporting Act (FCRA) and other relevant regulations. Financial institutions should use encryption technologies and secure messaging platforms to protect sensitive client information during transmission. Encryption ensures that data remains confidential and can only be accessed by authorized parties. Implementing access controls and multi-factor authentication can help prevent unauthorized access to client information. Financial institutions should regularly review and update access permissions, ensuring that only necessary personnel have access to sensitive client data. Secure data storage and backup solutions are essential for safeguarding client information. Financial institutions should use encrypted storage, regularly back up data, and have a plan in place for recovering lost or compromised information. Financial institutions should use monitoring and auditing tools to track access to client data and detect any potential breaches or unauthorized activities. Regular audits can help identify vulnerabilities and ensure compliance with confidentiality policies and regulations. Financial institutions face the challenge of balancing client confidentiality with regulatory compliance requirements. They must navigate complex regulations and reporting obligations while ensuring the protection of sensitive client information. As technology evolves and cyber threats become more sophisticated, financial institutions must stay ahead of the curve by adopting new security measures and practices to maintain client confidentiality. The rapid growth of artificial intelligence (AI) and data sharing in finance presents both opportunities and challenges for maintaining client confidentiality. Financial institutions must carefully consider the ethical implications and potential risks associated with using AI and sharing client data in decision-making processes. In the finance industry, client confidentiality is crucial for establishing trust between financial institutions and clients, and it is mandated by various legal and ethical frameworks. Upholding confidentiality is essential for fostering long-lasting professional relationships and enhancing the reputation of the institution. The legal framework governing client confidentiality includes several laws and regulations such as the BSA, GLBA, and SEC regulations. Breaching client confidentiality can result in severe consequences, including regulatory penalties, fines, legal actions, loss of professional licenses, and reputational damage. Implementing confidentiality policies and procedures, educating employees and stakeholders, and ensuring secure communication are some of the best practices for maintaining client confidentiality. The financial sector must balance confidentiality with regulatory compliance, adapt to new technologies and cyber threats, and consider ethical implications while using AI and sharing client data. Overall, maintaining client confidentiality is vital for protecting sensitive information, complying with regulations, and fostering trust in the finance industry.What Is Client Confidentiality?

Principles of Client Confidentiality in Finance

Trust and Professional Relationships

Privacy and Data Protection

Confidentiality Boundaries and Exceptions in Financial Services

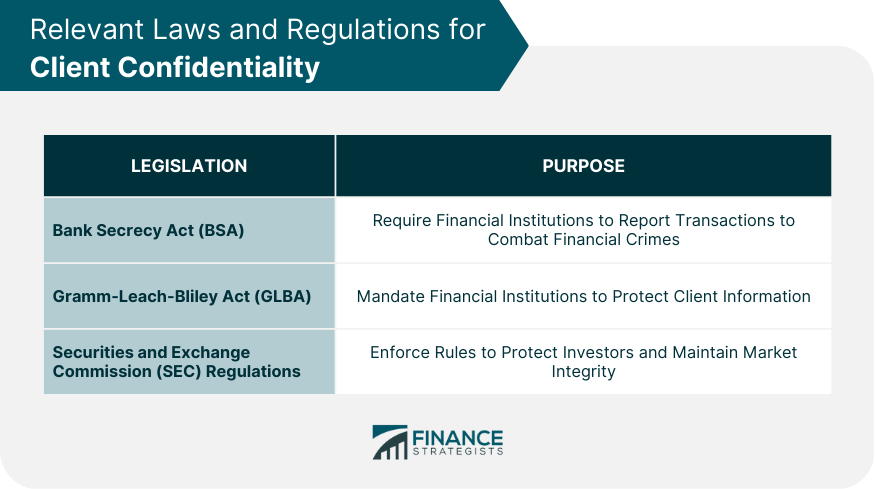

Legal Framework for Client Confidentiality in Finance

Relevant Laws and Regulations

Professional Codes of Conduct and Ethics

Consequences for Breaching Financial Confidentiality

Implementing Client Confidentiality Practices in Finance

Establishing Confidentiality Policies and Procedures

Educating Employees and Stakeholders

Ensuring Secure Communication and Information Sharing

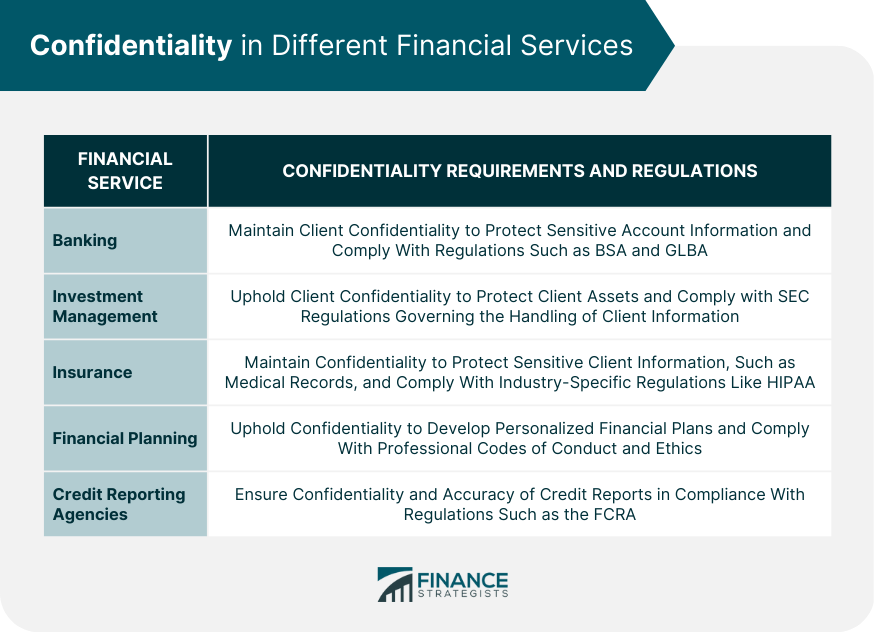

Confidentiality in Different Financial Services

Banking

Investment Management

Insurance

Financial Planning

Credit Reporting Agencies

Technological Tools for Maintaining Client Confidentiality in Finance

Encryption and Secure Messaging

Access Controls and Authentication

Data Storage and Backup Solutions

Monitoring and Auditing Tools

Challenges and Future Developments in Financial Client Confidentiality

Balancing Confidentiality With Regulatory Compliance

Adapting to New Technologies and Cybersecurity Threats

Confidentiality in the Age of Artificial Intelligence and Data Sharing in Finance

Conclusion

Client Confidentiality FAQs

Client confidentiality in finance refers to the obligation of financial institutions, such as banks, investment firms, and insurance companies, to protect the sensitive information of their clients, including personal identification, financial records, and transaction history.

Laws and regulations that govern client confidentiality in finance include the Bank Secrecy Act (BSA), Gramm-Leach-Bliley Act (GLBA), Securities and Exchange Commission (SEC) Regulations, Health Insurance Portability and Accountability Act (HIPAA), and Fair Credit Reporting Act (FCRA).

Client confidentiality is important in finance to protect the privacy and security of client information, prevent fraud and identity theft, maintain trust between financial institutions and clients, and comply with legal and ethical obligations.

Examples of confidential information in finance include account numbers, social security numbers, transaction history, investment strategies, medical records, credit reports, and personal identification details.

If a financial institution breaches client confidentiality, it may face legal and financial penalties, as well as damage to its reputation and loss of trust from clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.