Pump and dump schemes are a type of financial fraud that involve artificially inflating the price of an asset, such as a stock or cryptocurrency, through manipulation and misinformation. Once the asset reaches an inflated price, the fraudsters behind the scheme sell their holdings, causing the price to collapse and leaving unsuspecting investors with significant losses. Fraudsters typically target stocks or assets with low trading volumes and limited public information. These characteristics make it easier to manipulate prices and spread misinformation. In this phase, the perpetrators accumulate the targeted asset, often buying up large quantities to create a sense of demand and scarcity. This activity can lead to an initial increase in the asset's price. Once they have established a sizable position, the fraudsters begin promoting the asset, using false or misleading information to attract new investors. This can include spreading rumors, issuing fake news releases, or employing social media and online forums to create hype around the asset. The goal is to convince potential investors that the asset is undervalued or poised for significant growth. This is often achieved through a combination of exaggerated claims, fabricated news stories, and unfounded predictions. Fraudsters use social media platforms, chat rooms, and online forums to amplify their message and create a sense of urgency among potential investors. These channels enable them to reach a large audience quickly and inexpensively. In some cases, fraudsters may enlist the help of celebrities or social media influencers to promote the asset, lending credibility and generating additional interest. As the promotion phase generates interest and new investors begin buying the asset, the price continues to rise. At this point, the fraudsters behind the scheme begin to sell their holdings, often in large quantities. This selling pressure causes the asset's price to collapse, leaving the unsuspecting investors who bought at inflated prices with significant losses. These schemes typically target small-cap stocks with low trading volumes and limited public information. They often involve the use of fraudulent press releases, email campaigns, and message board postings to spread false information and create a sense of urgency among potential investors. Cryptocurrency markets are particularly vulnerable to pump and dump schemes due to their relatively low levels of regulation and oversight. Fraudsters may target lesser-known cryptocurrencies or create new digital tokens specifically for the purpose of perpetrating a scheme. These schemes involve the manipulation of microcap stocks, which are shares of companies with a market capitalization of under $300 million. Microcap stocks are often thinly traded and subject to less stringent reporting requirements, making them an attractive target for pump and dump fraudsters. Some pump and dump schemes are orchestrated by online trading groups, which consist of members who coordinate their buying and selling activities to manipulate asset prices. These groups often operate in private chat rooms or through encrypted messaging apps, making it difficult for regulators to monitor their activities. The Securities and Exchange Commission (SEC) enforces federal securities laws and has the authority to bring enforcement actions against individuals and entities that engage in pump and dump schemes. These actions can result in civil penalties, criminal charges, and other sanctions. Participating in a pump and dump scheme can result in serious legal consequences, including fines, disgorgement of profits, and even imprisonment. Both the organizers of the scheme and those who knowingly participate in the manipulation can face penalties. As pump and dump schemes often involve cross-border activities, international cooperation is essential for effective enforcement. Regulatory bodies from different countries may collaborate and share information to identify and prosecute those involved in such schemes. There are several warning signs that can help investors identify potential pump and dump schemes, including: Conducting thorough due diligence before making an investment is crucial to avoiding pump and dump schemes. Investors should research the asset, verify the legitimacy of promotional materials, and consult reliable sources of information. Adopting a cautious investment approach can help minimize the risk of falling victim to a pump and dump scheme. This may include diversifying one's portfolio, setting realistic expectations, and seeking professional advice when necessary. Pump and dump schemes pose a significant threat to financial markets and investor trust. By understanding how these schemes work and learning to identify the warning signs, investors can protect themselves and minimize their risk of falling victim to financial fraud. Regulators and enforcement agencies play a critical role in combatting these schemes, and ongoing efforts to improve detection and prevention will be essential in maintaining the integrity of financial markets.What Are Pump and Dump Schemes?

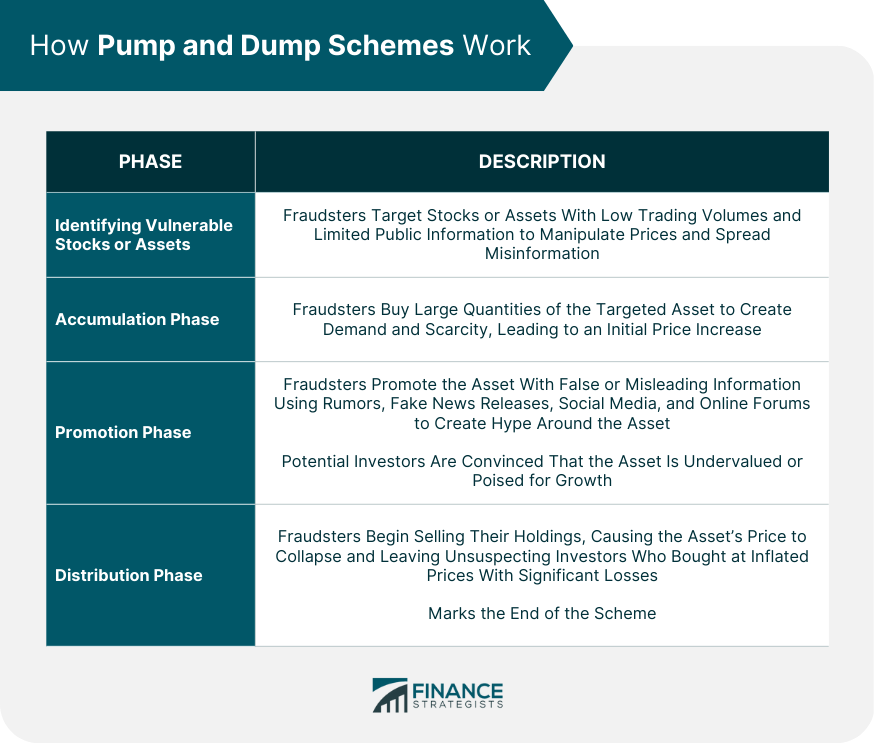

How Pump and Dump Schemes Work

Identifying Vulnerable Stocks or Assets

Accumulation Phase

Promotion Phase

Spreading False or Misleading Information

Social Media and Online Forums as Tools

Celebrity Endorsements and Influencers

Distribution Phase

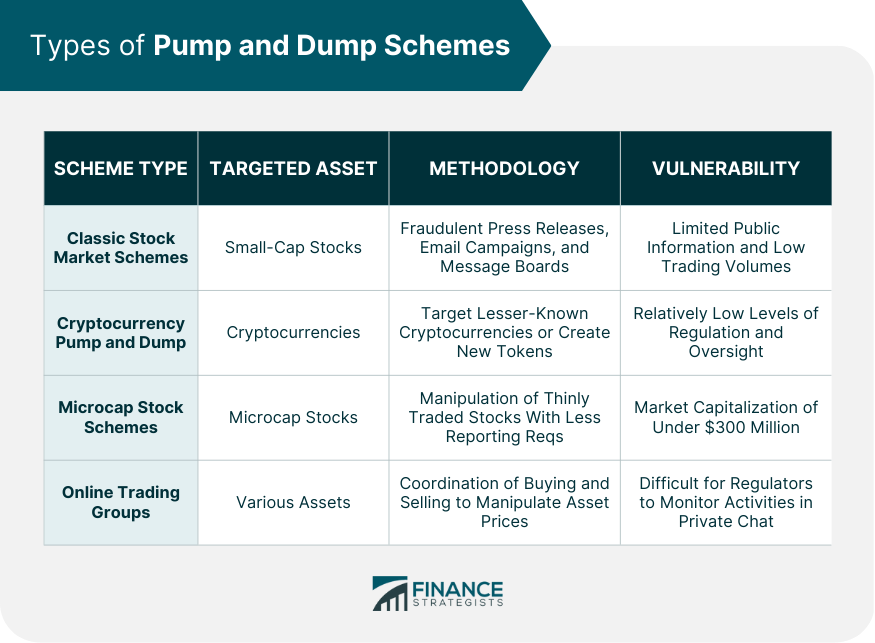

Types of Pump and Dump Schemes

Classic Stock Market Schemes

Cryptocurrency Pump and Dump Schemes

Microcap Stock Schemes

Online Trading Groups

Legal and Regulatory Framework

Securities and Exchange Commission (SEC) Rules and Regulations

Legal Consequences of Participating in Pump and Dump Schemes

International Cooperation and Enforcement

Detecting and Avoiding Pump and Dump Schemes

Red Flags and Warning Signs

Importance of Due Diligence

Investment Strategies to Minimize Risk

Conclusion

Pump and Dump Schemes FAQs

Pump and dump schemes are fraudulent financial practices that involve artificially inflating the price of an asset, such as stocks or cryptocurrencies, through manipulation and misinformation. Once the price is inflated, the fraudsters behind the scheme sell their holdings, causing the price to collapse and leaving unsuspecting investors with significant losses.

Perpetrators execute pump and dump schemes by first accumulating the targeted asset, then promoting it using false or misleading information. They often use social media, online forums, and even celebrity endorsements to create hype and attract new investors. Once the asset's price is inflated, the fraudsters sell their holdings, causing the price to collapse and leaving investors with losses.

There are several types of pump and dump schemes, including classic stock market schemes that target small-cap stocks, cryptocurrency pump and dump schemes that exploit the less regulated nature of digital assets, microcap stock schemes that manipulate shares of companies with a market capitalization under $300 million, and schemes orchestrated by online trading groups that coordinate their activities to manipulate asset prices.

Investors can detect and avoid pump and dump schemes by looking for red flags and warning signs, such as sudden spikes in trading volume or price, aggressive promotional campaigns with unrealistic claims, and limited or inconsistent information about the asset. Performing thorough due diligence before investing, consulting reliable sources of information, and adopting cautious investment strategies can help minimize the risk of falling victim to these schemes.

Individuals and entities involved in pump and dump schemes can face severe legal consequences, including fines, disgorgement of profits, and even imprisonment. Regulatory bodies like the Securities and Exchange Commission (SEC) enforce federal securities laws and collaborate with international enforcement agencies to identify and prosecute those involved in such schemes. Advances in technology, such as data analytics and artificial intelligence, also help regulators detect and prevent pump and dump schemes more effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.