Cross-purchase agreements are legally binding contracts between two or more parties that outline the terms and conditions of a future transaction. These agreements often specify the rights and obligations of each party in buying and selling assets or business interests. The primary purpose of cross-purchase agreements is to establish a clear and structured plan for the transfer of ownership or assets upon the occurrence of specific events. These agreements can offer various benefits, such as business continuity, tax advantages, flexibility in ownership structure, and protection for minority owners. Cross-purchase agreements are commonly used in situations involving business succession planning, real estate transactions, and business asset acquisitions. A cross-purchase buy-sell agreement is a type of cross-purchase agreement used for business continuation planning. This agreement outlines the process of transferring ownership among business partners upon the occurrence of specific triggering events, such as death, disability, or retirement. Cross-purchase buy-sell agreements provide a structured plan for maintaining the stability and continuity of a business when ownership changes take place. These agreements set forth the terms and conditions for transferring ownership interests among the parties involved when certain triggering events occur. A cross-purchase option agreement is another type of cross-purchase agreement commonly used in real estate transactions and business asset acquisitions. Cross-purchase option agreements allow parties to buy or sell real estate assets at predetermined terms, providing a clear and structured framework for real estate transactions. These agreements can also be used for acquiring business assets, such as machinery or intellectual property, at specified terms and conditions. A cross-purchase agreement must clearly identify the parties involved in the transaction and their respective roles and responsibilities. The agreement should provide a detailed description of the assets or business interests being bought or sold, including any accompanying rights and obligations. Cross-purchase agreements should define the specific events that trigger the buy-sell process, such as the death, disability, or retirement of a business owner. The agreement must establish a clear and agreed-upon method for determining the value of the assets or business interests being transferred. Cross-purchase agreements should outline the terms of payment, including the purchase price, payment schedule, and available financing options. The agreement must specify the rights and obligations of each party involved, including any restrictions on future transactions or actions. Cross-purchase agreements provide a structured plan for maintaining business continuity when ownership changes occur, reducing potential disruptions and ensuring smooth transitions. These agreements can offer tax benefits, such as avoiding potential estate tax liabilities or capital gains taxes, depending on the specific terms and structure of the agreement. Cross-purchase agreements provide flexibility in designing the ownership structure of a business, allowing parties to adapt to changing circumstances and needs. These agreements can offer protection for minority owners by ensuring their rights and interests are considered in the transfer of ownership or assets. Cross-purchase agreements can help establish a fair market value for the assets or business interests being transferred, providing a transparent and equitable process for all parties involved. Cross-purchase agreements may involve complex valuation processes, particularly when dealing with intangible assets or unique business interests. Accurate and fair valuation is critical for a successful agreement. Securing adequate funding for the purchase of assets or business interests can be a challenge, especially for smaller businesses or those with limited resources. Parties involved in a cross-purchase agreement should consider various financing options to address this issue. Conflicts of interest may arise in cross-purchase agreements, especially if the parties have competing goals or objectives. Addressing potential conflicts upfront and establishing clear lines of communication can help mitigate these issues. Cross-purchase agreements must comply with applicable laws and regulations, such as securities laws, tax laws, and corporate governance rules. Parties should engage professional advisors to ensure the agreement is legally sound and compliant. To ensure a well-drafted cross-purchase agreement, parties should engage professional advisors, such as attorneys and accountants, who are experienced in drafting and reviewing these types of agreements. The terms of a cross-purchase agreement should be clear, comprehensive, and unambiguous to minimize potential misunderstandings or disputes among the parties. Cross-purchase agreements should be reviewed and updated regularly to account for changes in business circumstances, such as growth, new ownership, or changes in laws and regulations. Parties should ensure that adequate funding mechanisms are in place to support the purchase of assets or business interests when the agreement is triggered. Cross-purchase agreements should include provisions for addressing potential conflicts and disputes, such as mediation or arbitration clauses, to ensure a timely and efficient resolution. Cross-purchase agreements play a vital role in ensuring business continuity, protecting minority owners, and facilitating fair and transparent asset transfers. These agreements can provide significant benefits when properly structured and implemented. To successfully implement a cross-purchase agreement, parties should engage professional advisors, establish clear and comprehensive terms, regularly review and update the agreement, ensure adequate funding mechanisms, and address potential conflicts and disputes. As the business landscape evolves and becomes more complex, cross-purchase agreements will likely continue to play a crucial role in managing ownership transitions and asset transfers. Future trends may include the use of technology to streamline the agreement process, an increased focus on addressing potential conflicts of interest, and a growing awareness of the importance of these agreements in business planning.What Are Cross-Purchase Agreements?

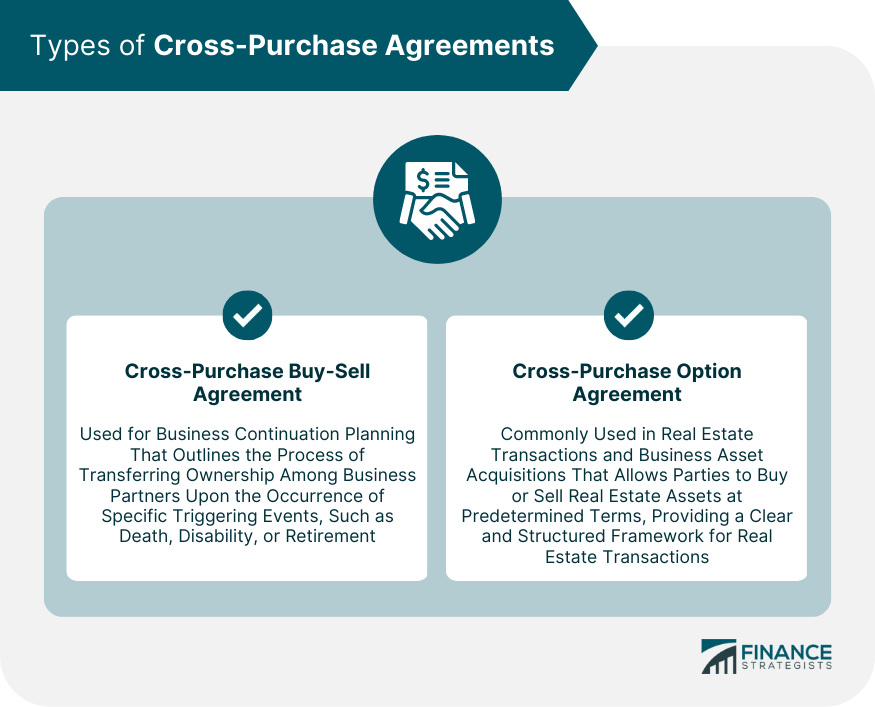

Types of Cross-Purchase Agreements

Cross-Purchase Buy-Sell Agreement

Business Continuation Planning

Ownership Transfer Upon Triggering Events

Cross-Purchase Option Agreement

Real Estate Transactions

Business Asset Acquisitions

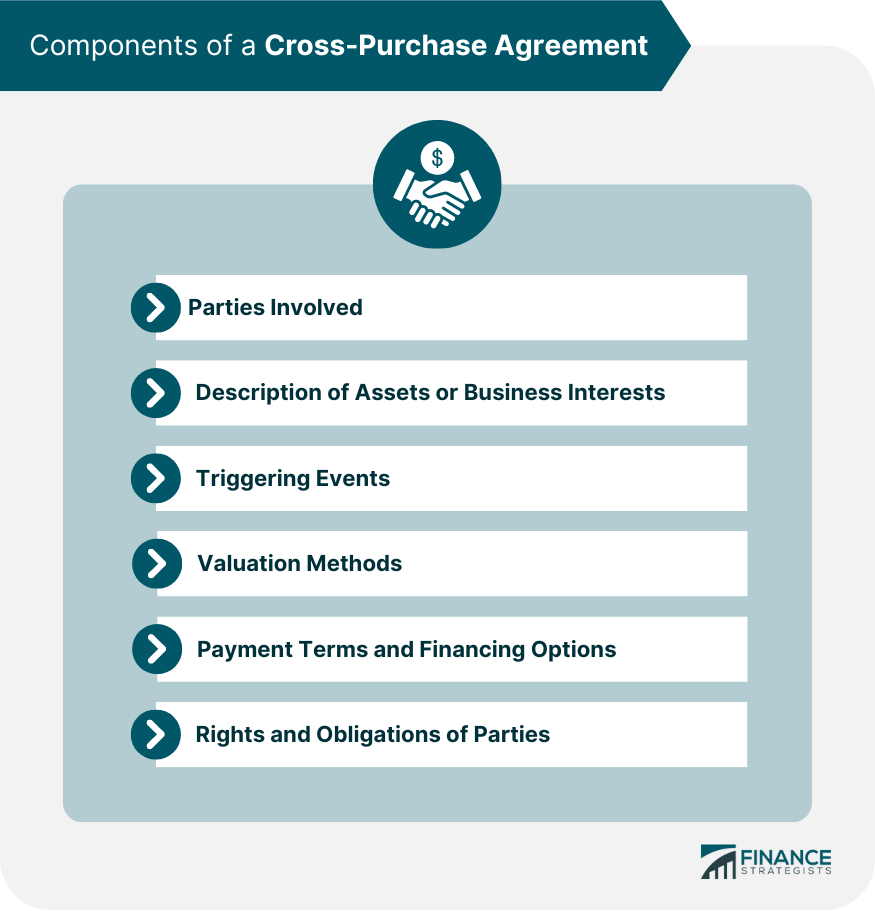

Components of a Cross-Purchase Agreement

Parties Involved

Description of Assets or Business Interests

Triggering Events

Valuation Methods

Payment Terms and Financing Options

Rights and Obligations of Parties

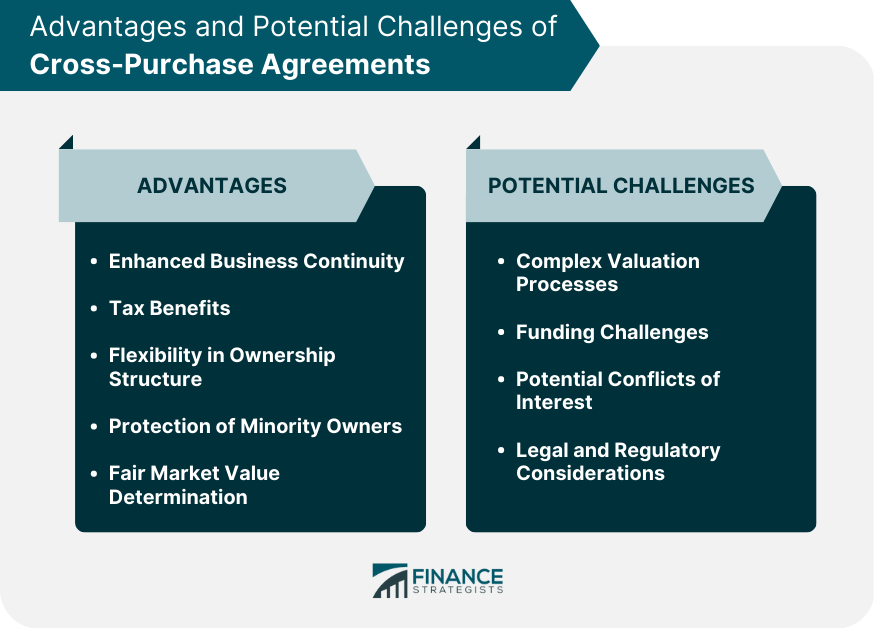

Advantages of Cross-Purchase Agreements

Enhanced Business Continuity

Tax Benefits

Flexibility in Ownership Structure

Protection of Minority Owners

Fair Market Value Determination

Potential Challenges and Limitations

Complex Valuation Processes

Funding Challenges

Potential Conflicts of Interest

Legal and Regulatory Considerations

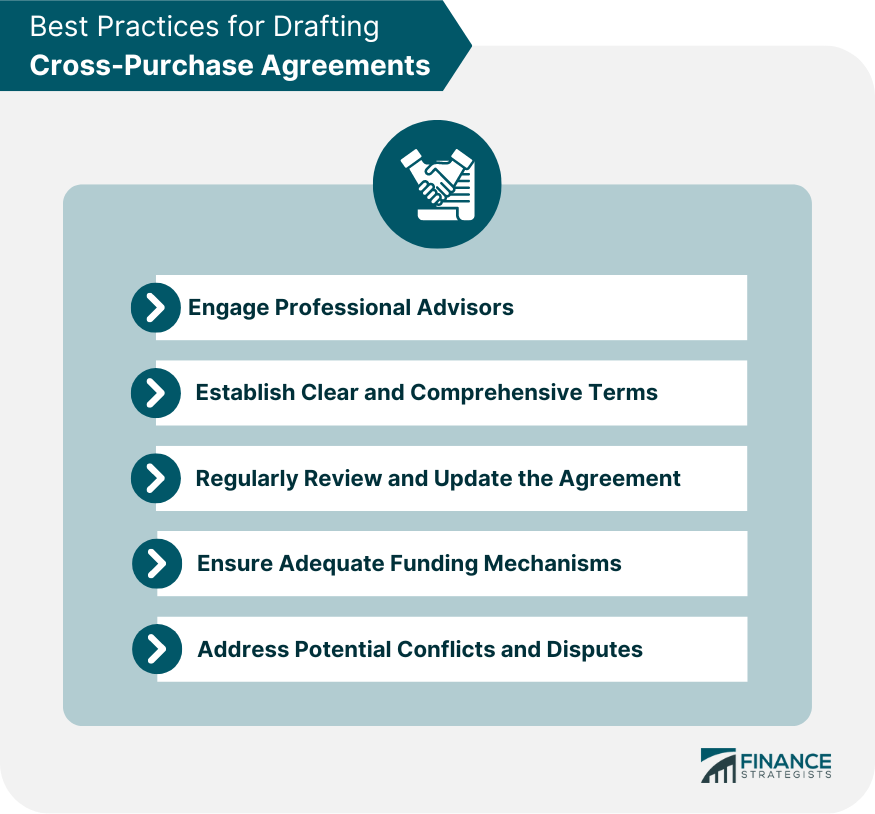

Best Practices for Drafting Cross-Purchase Agreements

Engaging Professional Advisors

Establishing Clear and Comprehensive Terms

Regularly Reviewing and Updating the Agreement

Ensuring Adequate Funding Mechanisms

Addressing Potential Conflicts and Disputes

Conclusion

Cross-Purchase Agreements FAQs

Cross-purchase agreements are legally binding contracts between two or more parties that outline the terms and conditions of a future transaction involving assets or business interests. They are important for establishing a clear and structured plan for transferring ownership or assets, ensuring business continuity, and providing tax benefits, among other advantages.

Key components of cross-purchase agreements include identifying the parties involved, describing the assets or business interests, defining triggering events, specifying valuation methods, outlining payment terms and financing options, and stating the rights and obligations of each party.

The main advantages of using cross-purchase agreements include enhanced business continuity, tax benefits, flexibility in ownership structure, protection for minority owners, and fair market value determination for the assets or business interests being transferred.

Challenges in implementing cross-purchase agreements may include complex valuation processes, funding challenges, potential conflicts of interest, and legal and regulatory considerations. To address these challenges, parties should engage professional advisors, establish clear and comprehensive terms, ensure adequate funding mechanisms, and address potential conflicts and disputes proactively.

To ensure the successful implementation of cross-purchase agreements, parties should engage professional advisors, create clear and comprehensive terms, regularly review and update the agreement, provide adequate funding mechanisms, and address potential conflicts and disputes through effective communication and dispute resolution provisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.