Family business governance refers to the systems, structures, and processes by which family-owned businesses are managed and controlled. It aims to strike a balance between the interests of the family and the business, ensuring the long-term success and sustainability of the enterprise. Effective governance can help prevent conflicts, facilitate smooth transitions, and foster a strong foundation for continued growth.

A family constitution is a formal document that outlines the values, principles, and policies guiding the family's business involvement. It is a foundation for decision-making and provides a clear roadmap for the family's roles and responsibilities. The constitution should be developed collaboratively, with input from all family members, to foster a sense of shared ownership and commitment. The board of directors is responsible for the strategic oversight and direction of the business. In a family-owned enterprise, the board should include a mix of family members, independent directors, and non-family executives. The presence of independent directors can help mitigate potential conflicts of interest, bring in fresh perspectives, and ensure that decisions are made in the business's best interest. A family council is a formal body representing the family's interests in the business. It provides a platform for communication, decision-making, and conflict resolution among family members. The family council can help maintain family harmony, preserve the family's values and culture, and facilitate the integration of new family members into the business. Shareholder agreements govern the relationship between the family shareholders and the business. They define the rights and obligations of shareholders, including provisions related to the ownership transfer, voting rights, dividend policies, and conflict resolution. These agreements can help prevent disputes and ensure a smooth transition of ownership when the time comes. Succession planning is the process of identifying and preparing the next generation of leaders to take over the family business. It involves the development of a clear and comprehensive plan that outlines the timeline, criteria for successor selection, and training and development programs. Succession planning is crucial for ensuring the continuity and long-term success of the family enterprise. The first step in establishing family business governance is to identify the core values and mission that underpin the family's involvement in the business. These values and mission should be clearly articulated and shared among all family members, providing a common vision and purpose for their collective efforts. To create a family constitution, family members should come together to discuss their goals, aspirations, and expectations for the business. The constitution should include sections on the family's values and mission, the roles and responsibilities of family members, governance structures, and policies related to decision-making, communication, and conflict resolution. Once completed, the family should formally adopt the constitution and review it periodically to ensure its continued relevance and effectiveness. The composition of the board of directors should reflect a balance between family members, independent directors, and non-family executives. Family members who serve on the board should possess relevant skills, experience, and a commitment to the success of the business. Independent directors should be selected based on their expertise, integrity, and ability to provide objective advice. The board of directors is responsible for setting the strategic direction of the business, monitoring performance, and ensuring that the company adheres to relevant laws and regulations. The board should also provide guidance and support to the management team, evaluate the effectiveness of governance structures, and address any potential conflicts of interest that may arise. To facilitate the efficient functioning of the board, various committees can be established to focus on specific areas, such as finance, audit, strategy, and governance. These committees should be comprised of a mix of family and independent directors with clearly defined roles and responsibilities. The primary purpose of a family council is to serve as a forum for communication, decision-making, and conflict resolution among family members. Its objectives include preserving family values and culture, facilitating the integration of new family members, and promoting family unity and harmony. The family council should be inclusive, with representation from all branches of the family. Its structure may vary depending on the size and complexity of the family, but it should include a chairperson, secretary, and other roles as needed. The council should meet regularly, with a predetermined agenda and clear procedures for decision-making. Family council meetings should be held on a regular basis, with the frequency determined by the needs of the family and the business. The agenda for each meeting should be prepared in advance, focusing on key issues that require discussion, decision-making, or input from family members. Shareholder agreements should clearly outline the ownership structure of the family business, including provisions related to the transfer of shares between family members and restrictions on the sale of shares to external parties. These provisions help maintain family control and ensure a smooth transition of ownership when needed. Shareholder agreements should also include mechanisms for conflict resolution, such as mediation, arbitration, or other forms of dispute resolution. This can help prevent disputes from escalating and damaging both the family and the business. Dividend policies should be clearly defined in the shareholder agreement, specifying the criteria for dividend distribution, the frequency of payments, and any restrictions on dividend payouts. This can help ensure that the financial interests of all shareholders are protected and managed fairly. Succession planning is crucial for a family business's continuity and long-term success. It helps to minimize the risk of a leadership vacuum, ensure a smooth transition of management, and maintain the stability and reputation of the business. The process of identifying potential successors should be objective, transparent, and based on predetermined criteria, such as skills, experience, education, and leadership qualities. Family members should be encouraged to pursue their interests and develop their abilities, allowing the most suitable candidates to emerge as potential successors. Once potential successors have been identified, they should undergo a comprehensive training and development program to prepare them for future roles. This may include job rotations, mentoring, formal education, and exposure to different aspects of the business. A clear transition plan should be established, outlining the timeline for the succession process, the roles and responsibilities of the incumbent and successor, and the mechanisms for monitoring and evaluating the transition. This plan should be communicated to all stakeholders to ensure their understanding and support. Key performance indicators (KPIs) should be established to assess the effectiveness of family business governance. These KPIs may include financial performance, operational efficiency, employee satisfaction, and adherence to governance policies and procedures. Regular reviews of the governance structures and processes should be conducted to identify areas for improvement and ensure that they remain relevant and effective. These reviews should involve input from all stakeholders, including family members, board members, and management. External assessments, such as audits or third-party evaluations, can provide valuable insights into the effectiveness of the family business governance structures. By benchmarking the performance of the business against industry peers and best practices, areas of strength and potential improvement can be identified. Open and transparent communication is essential for preventing and resolving conflicts within a family business. Regular meetings, both formal and informal, should be held to encourage the exchange of ideas, concerns, and aspirations among family members. Establishing clear conflict resolution mechanisms within the family constitution, board of directors, and shareholder agreements can help address disputes promptly and effectively. These mechanisms may include mediation, arbitration, or other forms of dispute resolution, depending on the nature and severity of the conflict. In some cases, it may be necessary to engage professional mediators or arbitrators to help resolve conflicts within the family business. These external experts can provide unbiased guidance and facilitate constructive dialogue, helping the family reach mutually acceptable solutions. As the family business grows and diversifies, the governance structures and processes may need to evolve to accommodate these changes. This may involve the creation of new board committees, the establishment of a subsidiary or holding company structures, or the revision of policies and procedures. As new family members join the business, the governance structures should be adjusted to ensure their integration and representation. This may involve updating the family constitution, expanding the family council, or providing training and development programs for new members. Continuous improvement and adaptation are key to the long-term success of family business governance. Regular reviews and assessments should be conducted to identify areas for improvement, address changing family dynamics, and ensure that the governance structures and processes remain relevant and effective. Strong family business governance is essential for the long-term success and sustainability of the family enterprise. By establishing clear and effective governance structures, family businesses can maintain family harmony, ensure smooth transitions of leadership, and foster a solid foundation for continued growth. It is important to continuously improve and adapt these structures in response to changing family dynamics and business needs, ensuring the ongoing success and longevity of the family business. If you need guidance in implementing or improving your family business governance, consider seeking the help of a professional financial advisor specializing in family businesses. They can provide valuable insights, support, and expertise to help you navigate the complexities of governance and secure the future of your family enterprise.What Is Family Business Governance?

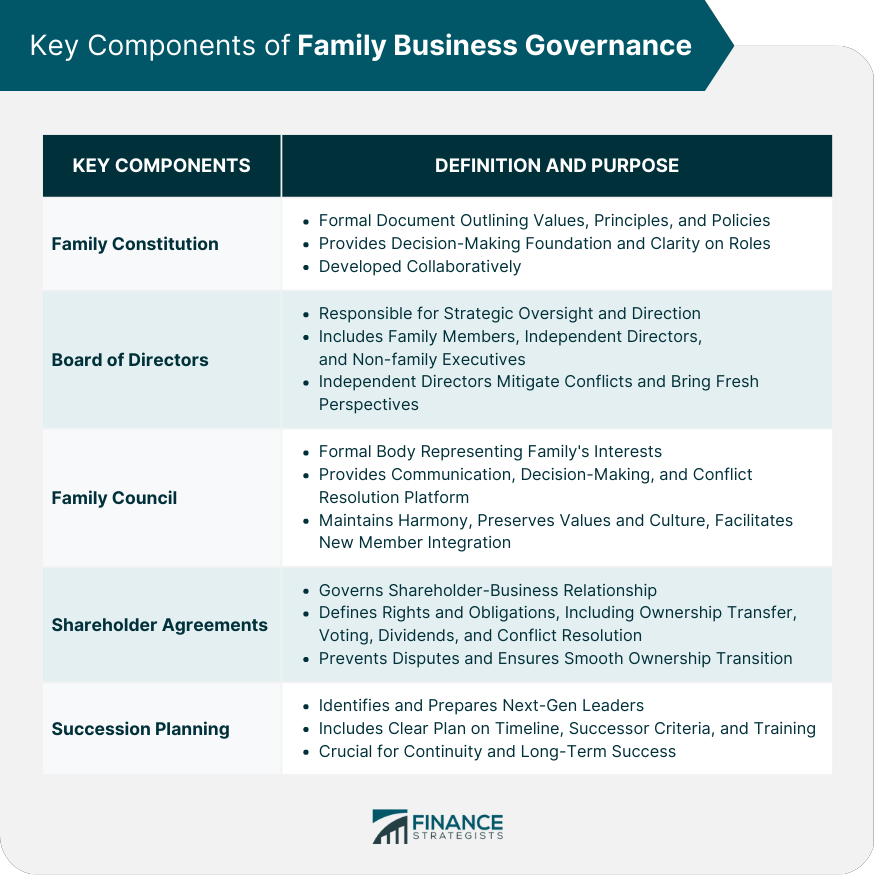

Key Components of Family Business Governance

Family Constitution

Board of Directors

Family Council

Shareholder Agreements

Succession Planning

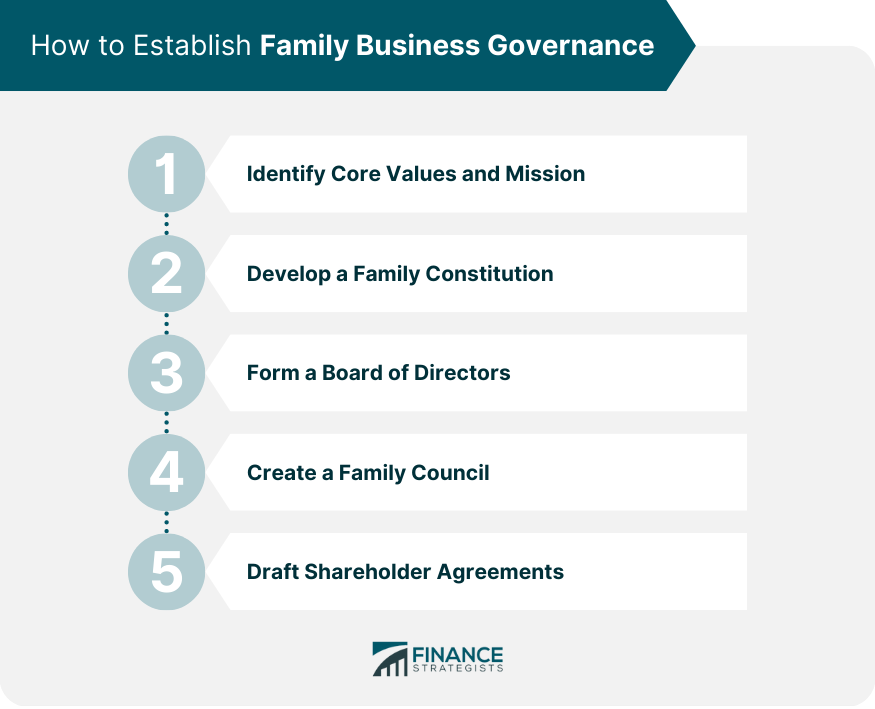

How to Establish Family Business Governance

Identify Core Values and Mission

Develop a Family Constitution

Form a Board of Directors

Composition and Qualifications

Roles and Responsibilities

Board Committees

Create a Family Council

Purpose and Objectives

Membership and Structure

Meeting Frequency and Agenda

Draft Shareholder Agreements

Ownership Structure and Transfer

Conflict Resolution

Dividend Policies

Family Business Governance and Succession Planning

Importance of Succession Planning

Identifying Potential Successors

Training and Development

Transition Process and Timeline

Monitoring and Evaluating Family Business Governance Performance

Key Performance Indicators

Periodic Reviews

External Assessments and Benchmarking

Managing Conflicts and Disputes in Family Business Governance

Importance of Communication

Conflict Resolution Mechanisms

Professional Mediation and Arbitration

Adapting Governance to Changing Family Dynamics

Growth and Diversification

Incorporating New Family Members

Adjusting Governance Structures and Processes

Final Thoughts

Family Business Governance FAQs

Family business governance refers to the systems, structures, and processes used to manage and control family-owned businesses. It is important because it helps balance the interests of the family and the business, prevents conflicts, facilitates smooth leadership transitions, and fosters a strong foundation for continued growth and success.

The key components of effective family business governance include a family constitution, a board of directors, a family council, shareholder agreements, and succession planning. These components work together to provide a clear framework for decision-making, communication, and conflict resolution within the family business.

To establish strong family business governance structures, family businesses should identify their core values and mission, develop a family constitution, form a balanced board of directors, create a family council, and draft shareholder agreements. In addition, succession planning should be a priority to ensure the long-term success and continuity of the business.

Best practices for monitoring and evaluating family business governance performance include setting key performance indicators (KPIs), conducting periodic reviews of governance structures and processes, and seeking external assessments or benchmarking against industry peers and best practices. These practices help identify areas of strength and potential improvement in the governance system.

Family business governance can adapt to changing family dynamics and business needs by continuously reviewing and updating governance structures and processes, incorporating new family members into the governance system, and adjusting policies and procedures to accommodate growth and diversification. This continuous improvement and adaptation ensure the ongoing success and longevity of the family business.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.