Certified Financial Educator is a professional certification designed to recognize individuals who are knowledgeable and skilled in providing financial education to individuals and groups. The CFEd certification is issued by the National Financial Educators Council (NFEC), a nonprofit organization dedicated to promoting financial literacy and providing resources to financial educators. Hiring a Certified Financial Educator can provide a more comprehensive and tailored approach to financial education. Hiring a CFEd professional ensures that you are working with an individual who has demonstrated knowledge and expertise in financial education. The CFEd certification indicates that the individual has met certain standards of education and experience in the field of financial education. CFEd professionals have demonstrated their ability to educate others about budgeting, saving, investing, debt management, credit scores, retirement planning, and insurance. CFEd professionals are committed to ethical standards and professional conduct. The NFEC has a code of ethics that all CFEd professionals must abide by. The code includes principles such as integrity, confidentiality, and client-focused service. Clients can trust that a CFEd professional will act in their best interest and provide unbiased financial advice. Each client has unique financial circumstances and goals, and a CFEd professional can tailor their education and advice to meet those specific needs. Whether a client is looking to save for retirement, pay off debt, or invest in the stock market, a CFEd professional can provide guidance and support. CFEd professionals can also provide clients with specific strategies to help them achieve their financial goals. Hiring a CFEd professional empowers clients to make informed financial decisions. CFEd professionals teach clients how to manage their finances, which gives them the knowledge and confidence to make smart financial decisions. Clients can learn how to budget, save, invest, and manage debt, among other important financial topics. CFEd professionals also teach clients about the risks and rewards of different financial products and services, allowing clients to make informed decisions about their financial future. Hiring a CFEd professional can be a cost-effective way to receive financial education. While financial advisors charge fees for their services, CFEd professionals typically charge lower fees for their education and advice. CFEd professionals can provide clients with education and advice on a wide range of financial topics, including budgeting, saving, investing, and debt management, at a lower cost than a financial advisor. CFEd professionals can also teach children about financial literacy. Financial education is essential for children to learn how to manage their finances and become responsible adults. CFEd professionals can teach children about budgeting, saving, investing, and debt management, among other financial topics. Teaching children about financial literacy at a young age can set them on the path to financial success in the future. To become a CFEd, an individual must meet certain eligibility requirements. These requirements include having a high school diploma or equivalent, completing a financial education course, and having a minimum of two years of experience in a related field such as finance, education, or counseling. Once the eligibility requirements are met, the individual must submit an application to the NFEC along with a fee. After the application is reviewed and approved, the individual must pass a certification exam, which is designed to test the individual's knowledge of financial education principles, strategies, and best practices. The CFEd certification exam is a 100-question multiple-choice test that covers a wide range of financial education topics, including budgeting, saving, investing, debt management, credit scores, retirement planning, and insurance. The exam is computer-based and must be completed within three hours. To pass the exam, an individual must score at least 75%. After passing the exam, the individual is awarded the CFEd certification. Continuing education is also required to maintain the CFEd certification. CFEd professionals must complete at least 12 hours of continuing education, which can include attending conferences, workshops, webinars, or other training events related to financial education. The CFEd certification opens up a variety of career opportunities in the financial education industry. CFEd professionals can work in a wide range of settings, including schools, colleges, universities, nonprofit organizations, government agencies, and private businesses. Some common job titles for CFEd professionals include financial educator, financial counselor, financial coach, financial planner, and financial analyst. The job outlook for CFEd professionals is strong. According to the Bureau of Labor Statistics, the employment of personal financial advisors is projected to grow 15% from 2021 to 2031, much faster than the average for all occupations. This growth is driven by the increasing demand for financial advice and planning services as the population ages and more individuals seek to manage their finances. CFEd professionals can also advance their careers by pursuing additional certifications or education. For example, a CFEd professional may choose to become a Certified Financial Planner (CFP) or a Chartered Financial Analyst (CFA) to expand their knowledge and skills in financial planning and investment management. Financial education is critical in today's society. Many individuals lack the knowledge and skills needed to manage their finances effectively, which can lead to financial difficulties and stress. Financial education can help individuals learn how to budget, save, invest, and manage debt, among other important financial topics. By providing financial education, CFEd professionals can help individuals and groups make informed decisions about their finances and improve their financial well-being. Financial education is also essential for the overall health of the economy. When financially literate, individuals are more likely to make smart financial decisions, such as saving for retirement, investing in the stock market, and avoiding high-interest debt. This can lead to greater economic stability and growth. The Certified Financial Educator certification is a valuable credential for individuals who are interested in providing financial education to others. Becoming a CFEd requires meeting certain eligibility requirements, passing a certification exam, and completing continuing education. Hiring a CFEd professional has numerous benefits, including assurance of knowledge and expertise, commitment to ethical standards and professional conduct, and personalized financial education and advice. CFEd professionals can pursue a variety of career opportunities in the financial education industry and can advance their careers through additional certifications or education. Ultimately, financial education is critical for individuals and the overall health of the economy, and CFEd professionals play a crucial role in promoting financial literacy.What Is a Certified Financial Educator (CFEd)?

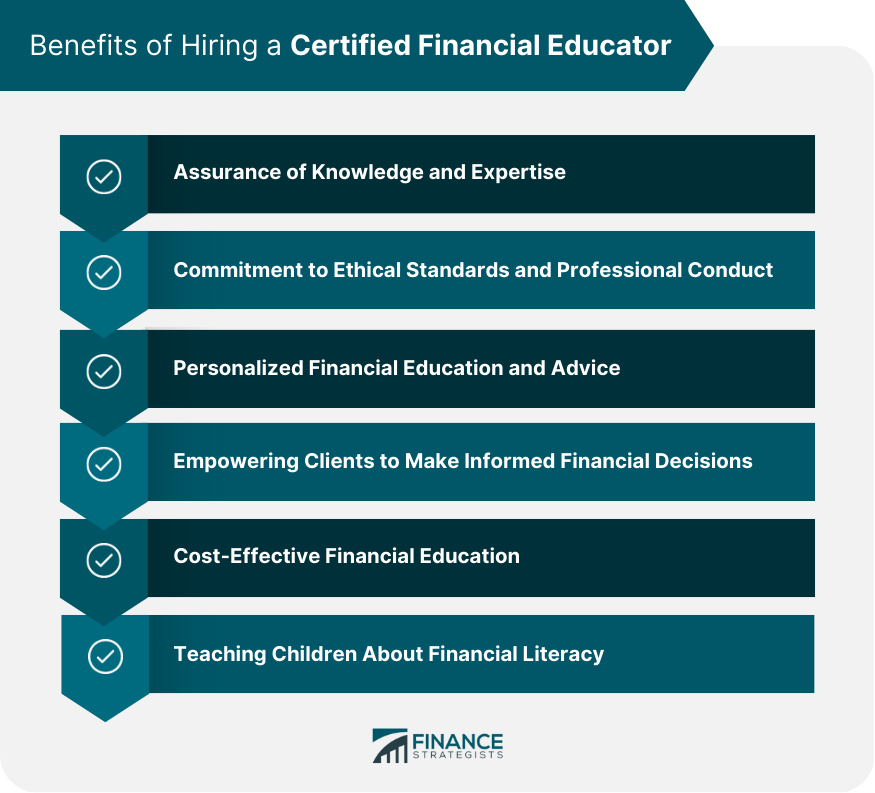

Benefits of Hiring a Certified Financial Educator

Assurance of Knowledge and Expertise

Commitment to Ethical Standards and Professional Conduct

Personalized Financial Education and Advice

Empowering Clients to Make Informed Financial Decisions

Cost-Effective Financial Education

Teaching Children About Financial Literacy

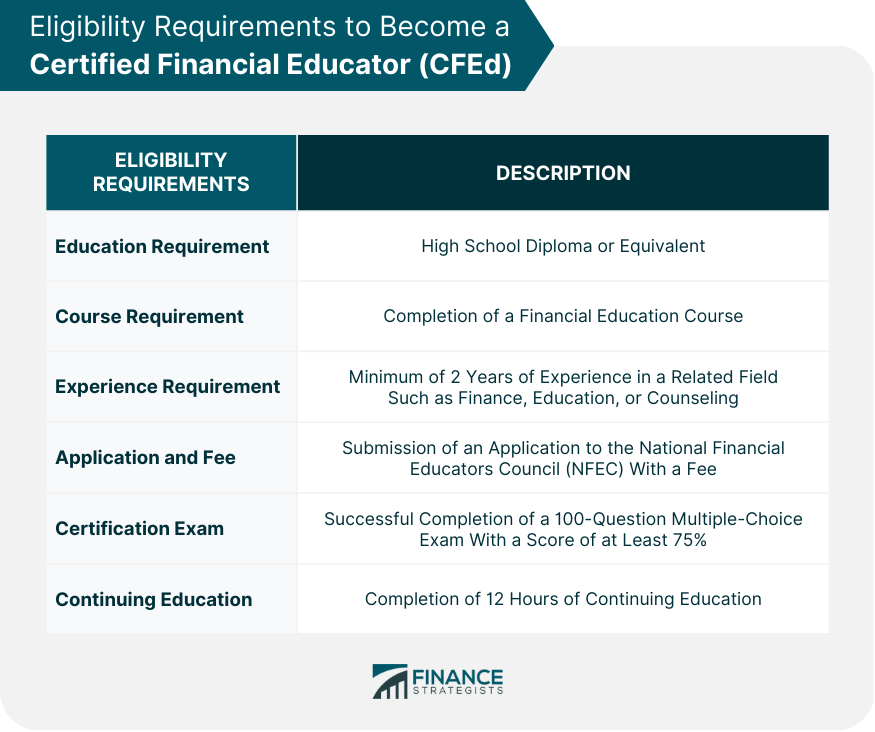

Becoming a Certified Financial Educator

Career Opportunities for Certified Financial Educators

The Importance of Financial Education

The Bottom Line

Certified Financial Educator FAQs

A Certified Financial Educator (CFEd) is a professional certification issued by the National Financial Educators Council (NFEC), indicating that an individual has demonstrated knowledge and expertise in financial education.

Hiring a CFEd professional ensures assurance of knowledge and expertise, commitment to ethical standards and professional conduct, personalized financial education and advice, empowering clients to make informed financial decisions, cost-effective financial education, and teaching children about financial literacy.

To become a CFEd, an individual must meet certain eligibility requirements, pass a certification exam, and complete continuing education. Eligibility requirements include having a high school diploma or equivalent, completing a financial education course, and having a minimum of two years of experience in a related field.

CFEd professionals can provide personalized financial education and advice on a wide range of financial topics, including budgeting, saving, investing, debt management, credit scores, retirement planning, and insurance. They can tailor their education and advice to meet the specific needs of each client.

CFEd professionals can teach children about financial literacy by providing education on budgeting, saving, investing, and debt management. They can also teach children about the importance of financial responsibility and the risks and rewards of different financial products and services. By teaching children about financial literacy, CFEd professionals can set them on the path to financial success in the future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.