Client appreciation events are an essential tool for financial advisors to demonstrate gratitude and foster loyalty among their clientele. By hosting these events, advisors can create a positive environment for networking and relationship-building, which benefits both the advisor and their clients. The primary goal of these events is to express gratitude and appreciation to clients for their trust and business. By hosting events that cater to clients' interests and needs, financial advisors can show their dedication to serving their clients and enhancing their overall experience. Client appreciation events provide a platform for financial advisors to connect with their clients on a personal level, strengthening the advisor-client relationship. This fosters increased client loyalty, leading to potential referrals and increased client retention. Organizing a successful client appreciation event requires careful planning and preparation. By setting clear objectives and managing the logistics, financial advisors can create a memorable experience for their clients. Defining the event's purpose and goals helps financial advisors to plan and execute a successful event. These goals may include client retention, referrals, or showcasing new services and offerings. Allocating a budget for the event ensures that all aspects are accounted for, from the venue and catering to marketing and promotional materials. Creating a realistic budget helps avoid overspending and allows for flexibility in case of unexpected expenses. Choosing the right venue is crucial for creating a comfortable and inviting atmosphere. Consider factors such as location, accessibility, and capacity to accommodate the expected number of attendees. There are various themes and ideas for client appreciation events that cater to different interests and preferences. By selecting the right theme, financial advisors can create an engaging and enjoyable experience for their clients. Offering educational sessions on relevant financial topics helps clients enhance their knowledge and understanding of financial planning. This adds value to the client experience and demonstrates the advisor's expertise in the field. Networking events provide a casual setting for clients to mingle with other clients and the financial advisor. This promotes a sense of community and strengthens relationships among attendees. Hosting events that support charitable causes allows financial advisors to showcase their commitment to social responsibility. This can help to build a positive brand image and foster client loyalty. To ensure a successful event, financial advisors need to effectively market and promote it. This includes utilizing various communication channels to reach their target audience. Leveraging social media and online marketing strategies helps to create awareness about the event and engage potential attendees. This can include promoting the event on social media platforms, creating engaging content, and using targeted advertising. Sending personalized invitations and updates about the event through email campaigns can help to generate interest and encourage attendance. Including relevant information and a clear call-to-action in the email can be highly effective. Distributing printed materials such as flyers, brochures, or postcards can help reach clients who may not be as active online. This traditional method can still be highly effective when combined with a targeted mailing list. To maximize the impact of client appreciation events, financial advisors must focus on providing value and fostering a positive experience for attendees. Ensuring that the event content is informative, relevant, and valuable helps to create a positive experience for clients. This can lead to increased client satisfaction and a stronger advisor-client relationship. Promoting interaction among clients and with the financial advisor can strengthen relationships and create a sense of community. Encourage conversations and networking opportunities by incorporating icebreakers, group activities, or designated networking sessions. Acknowledging loyal clients and celebrating their achievements during the event can help to foster a sense of appreciation and loyalty. Consider offering special recognitions, awards, or exclusive experiences to show gratitude for their continued business. After the event, it is crucial for financial advisors to follow up with attendees and analyze the event's success. This information can be used to improve future events and maintain strong client relationships. Assessing the event's success through feedback, attendance, and overall client satisfaction can help determine its return on investment. This evaluation can help guide future event planning and determine if the objectives were met. Collecting feedback from attendees and reviewing event logistics can help identify areas for improvement. This information can be used to enhance future events and ensure a better experience for clients. Continuing to engage with clients after the event is essential for maintaining strong relationships. Follow up with personalized emails, phone calls, or additional touchpoints to show ongoing appreciation and support. Applying the insights gained from previous events can help improve the planning and execution of future client appreciation events. By continually refining the event strategy, financial advisors can create increasingly successful and impactful experiences for their clients. Client appreciation events are a valuable tool for financial advisors to strengthen relationships with their clients, demonstrate their expertise in the field, and showcase their commitment to social responsibility. By carefully planning and executing these events, advisors can create a memorable experience for their clients, provide value through educational seminars and workshops, and promote networking opportunities to build a sense of community among attendees. Moreover, a successful event can generate new business leads, referrals, and ultimately contribute to the growth of the advisor's practice. However, organizing a client appreciation event requires a significant investment of time, effort, and resources. To maximize the event's impact, financial advisors must establish clear objectives, allocate a realistic budget, select an appropriate venue, and effectively market and promote the event. Additionally, post-event follow-up and analysis are essential to evaluate the event's success and identify areas for improvement. By incorporating lessons learned into future events and maintaining ongoing engagement with clients, advisors can continue to foster strong relationships and build a loyal client base.Overview of Client Appreciation Events for Financial Advisors

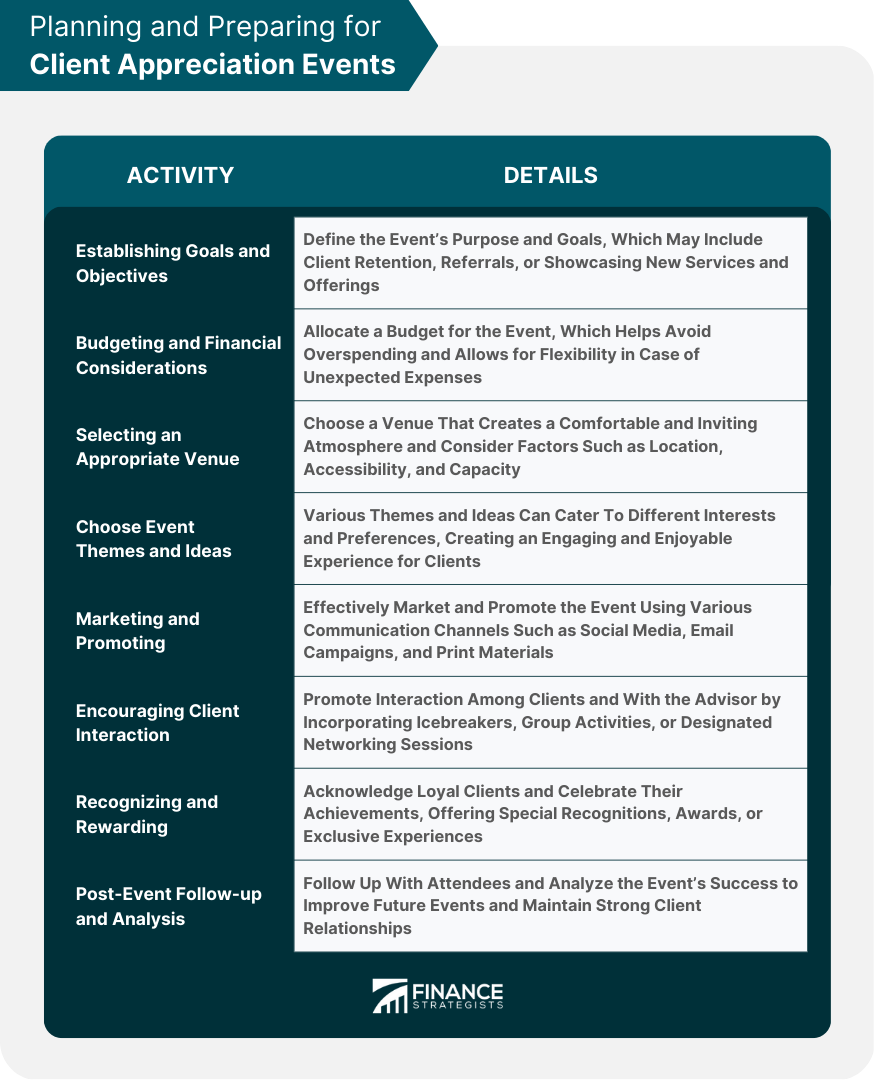

Planning and Preparing for Client Appreciation Events

Establishing Goals and Objectives

Budgeting and Financial Considerations

Selecting an Appropriate Venue

Event Themes and Ideas

Educational Seminars and Workshops

Networking and Social Mixers

Charity and Philanthropic Events

Marketing and Promoting Client Appreciation Events

Social Media and Online Marketing

Email Campaigns and Newsletters

Print Materials and Direct Mail

Engaging and Retaining Clients During Events

Providing Value and Relevant Content

Encouraging Client Interaction and Networking

Recognizing and Rewarding Client Loyalty

Post-Event Follow-up and Analysis

Evaluating Event Success and ROI

Identifying Areas for Improvement

Maintaining Client Engagement and Relationships

Incorporating Lessons Learned into Future Events

Final Thoughts

Client Appreciation Events for Financial Advisors FAQs

Client appreciation events are events hosted by financial advisors to express gratitude to their clients and deepen their relationships.

Hosting client appreciation events can help financial advisors strengthen relationships with their clients, increase client retention, and grow their business.

Some ideas for client appreciation events include a client dinner, a charity event, a holiday party, a sporting event, or a seminar on financial topics.

Financial advisors should plan client appreciation events by setting a budget, choosing a theme, selecting a venue, creating an invitation list, and providing activities or entertainment.

Financial advisors can measure the success of client appreciation events by tracking attendance, gathering feedback from clients, and monitoring any increase in referrals or business from clients who attended the event.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.