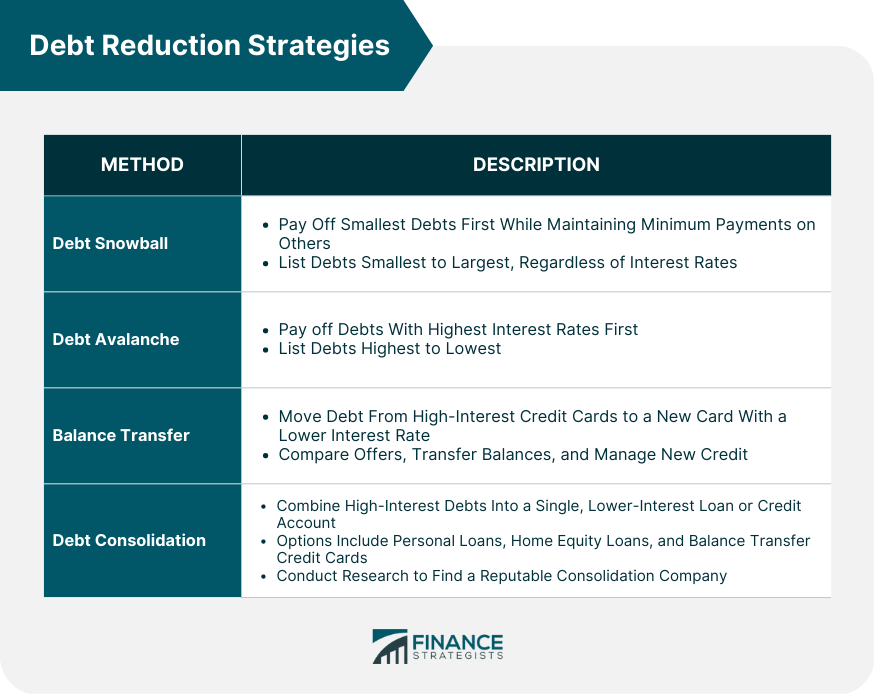

Debt reduction strategies are methods used to help individuals and businesses reduce their overall debt burden. Whether it's credit card debt, student loans, or mortgages, being in debt can be overwhelming and stressful. These strategies involve a variety of tactics such as budgeting, consolidating debts, negotiating with creditors, and prioritizing payments. By implementing these strategies, individuals can take control of their finances and work towards becoming debt-free. It's important to note that there is no one-size-fits-all approach to debt reduction, and what works for one person may not work for another. It's crucial to assess your financial situation, set realistic goals, and find a strategy that works best for you. Debt is a tool, not a jail sentence. Find the balance between progress and living. The debt snowball method focuses on paying off the smallest debt first while maintaining minimum payments on other debts. This strategy provides quick wins and motivation to continue debt reduction efforts. The debt snowball method helps build momentum and motivation by tackling smaller debts first. To implement, list all debts from smallest to largest, regardless of interest rates. Pay off the smallest debt first while maintaining minimum payments on others. Once the smallest debt is eliminated, move to the next smallest, and so on. The debt avalanche method prioritizes paying off debts with the highest interest rates first. This strategy saves money on interest payments in the long run. The debt avalanche method minimizes interest payments and accelerates debt reduction. Steps involved in this method is to list all debts in order of highest to lowest interest rate. Allocate extra funds towards the debt with the highest interest rate while maintaining minimum payments on others. Once the highest-interest debt is eliminated, move to the next highest, and so on. A balance transfer involves moving debt from one or more high-interest credit cards to a new card with a lower interest rate, often with a promotional period of 0% interest. Understanding Balance Transfer Offers: Many credit card companies offer balance transfer promotions to attract new customers. Be sure to read the fine print and understand the terms, fees, and length of the promotional period. Identifying Suitable Offers: Compare balance transfer offers and choose the one that best aligns with your debt reduction goals. Transferring Balances and Managing New Credit: Complete the balance transfer process and ensure timely payments to avoid penalties and interest rate increases. Debt consolidation involves combining multiple high-interest debts into a single, lower-interest loan or credit account. Types of Debt Consolidation:Options include personal loans, home equity loans, and balance transfer credit cards. Pros and Cons: Debt consolidation simplifies debt repayment and can lower interest costs but may also extend the repayment period and lead to increased overall debt if not managed responsibly. Finding a Reputable Debt Consolidation Company: Conduct research, read reviews, and consult trusted sources to find a reputable debt consolidation company that meets your needs. The first step in any debt reduction plan is to create a budget. A budget is a financial plan that outlines income and expenses over a given period. Identifying Income Sources:Make a list of all income sources, including salaries, freelance income, and other revenue streams. Listing Expenses: Categorize and record all expenses, such as housing, utilities, groceries, and entertainment. Prioritizing Needs vs Wants: Differentiate between essential expenses and discretionary spending, and prioritize paying off debt. The debt-to-income ratio is a financial metric that compares your total monthly debt payments to your gross monthly income. A lower ratio indicates better financial health. Calculate your debt-to-income ratio by dividing your total monthly debt payments by your gross monthly income and multiplying by 100 to get a percentage. Analyze your budget and debt-to-income ratio to pinpoint areas for improvement. Determine which expenses can be reduced or eliminated and allocate more funds towards debt repayment. Developing good financial habits is essential for long-term success in reducing debt and building wealth. Establishing an Emergency Fund: Create a savings account dedicated to covering unexpected expenses, aiming for three to six months' worth of living expenses. Contributing to Retirement Accounts: Contribute to retirement accounts such as 401(k)s or IRAs to secure your financial future. Exploring Other Investment Opportunities: Consider investing in stocks, bonds, or real estate to diversify your portfolio and grow your wealth over time. A spending plan helps you manage your money and prioritize expenses. Monitoring Expenses: Regularly review your expenses to ensure you are sticking to your budget and identify any spending patterns or areas for improvement. Setting Spending Limits: Establish spending limits for discretionary expenses, such as dining out or entertainment, to help keep your budget on track. Identifying Areas for Cost-Cutting: Assess your expenses and find opportunities to reduce costs, such as switching to a more affordable phone plan or cutting back on subscriptions. A higher credit score can lead to better interest rates on loans and credit cards, making it easier to reduce debt. Understanding the Factors Affecting Credit Score: Payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries all impact your credit score. Strategies for Improving Credit Score: Make timely payments, lower your credit utilization, maintain a mix of credit types, and minimize hard inquiries. Monitoring Credit Reports: Regularly review your credit reports from the three major credit bureaus to ensure accuracy and identify any errors or signs of fraud. Credit counseling services offer guidance and support for managing debt and improving financial habits. Credit counselors provide personalized advice, budgeting assistance, and debt management plans. Look for nonprofit organizations accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Counselors will review your financial situation, discuss potential solutions, and help you create a plan to reduce debt and improve financial habits. Debt relief programs offer various solutions for individuals struggling with debt, such as debt settlement, debt management, or bankruptcy. Types of Debt Relief Programs: Options include debt settlement (negotiating with creditors to reduce the amount owed), debt management plans (negotiating lower interest rates and fees), and bankruptcy (legal process to eliminate or repay debt). Pros and Cons: While debt relief programs can offer relief from overwhelming debt, they may also have negative consequences on credit scores and financial stability. Choosing the Right Program: Evaluate your financial situation and consult with professionals to determine the best debt relief option for your circumstances. Debt reduction is a crucial aspect of achieving financial freedom and securing a stable financial future. Effective debt reduction strategies involve a variety of tactics such as budgeting, consolidating debts, negotiating with creditors, and prioritizing payments. The debt snowball method and the debt avalanche method are two popular approaches to reducing debt. It's important to assess your financial situation, set realistic goals, and find a strategy that works best for you. Creating a budget, identifying areas for improvement, and building and maintaining good financial habits are essential for long-term success in reducing debt and building wealth. Improving your credit score and seeking professional help from credit counseling services or debt relief programs can also help you regain control of your finances. However, it's crucial to carefully evaluate the pros and cons of each strategy before making a decision and to choose the option that best aligns with your debt reduction goals and financial circumstances.Debt Reduction Strategies Overview

Debt Reduction Strategies

Debt Snowball Method

Debt Avalanche Method

Balance Transfer

Debt Consolidation

Assessing Your Financial Situation

Creating a Budget

Calculating Your Debt-To-Income Ratio

Identifying Areas for Improvement

Building and Maintaining Good Financial Habits

Saving and Investing

Creating a Spending Plan

Improving Credit Score

Seeking Professional Help

Credit Counseling Services

Debt Relief Programs

Conclusion

Debt Reduction Strategies FAQs

Key debt reduction strategies include the debt snowball method, debt avalanche method, balance transfers, and debt consolidation. Each of these strategies has its own benefits and can be tailored to your unique financial situation to help you achieve your debt reduction goals.

To choose the best debt reduction strategies for your situation, first assess your financial status by creating a budget, calculating your debt-to-income ratio, and identifying areas for improvement. Then, consider the advantages and disadvantages of each strategy and select the ones that align with your priorities, such as paying off high-interest debt first or achieving quick wins through the debt snowball method.

Yes, implementing debt reduction strategies can indirectly improve your credit score over time. As you pay down your debt and reduce your credit utilization, your credit score is likely to improve. Additionally, consistently making on-time payments and managing your debts responsibly will have a positive impact on your credit score.

Credit counseling services, debt relief programs, and financial education resources can provide support and guidance as you work to implement debt reduction strategies and improve your financial habits. Nonprofit organizations accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) are reputable sources of assistance.

To maintain momentum with your debt reduction strategies, stay accountable and motivated by tracking your progress, setting realistic goals, and connecting with others facing similar financial challenges. To avoid future debt, implement sustainable lifestyle changes, live within your means, and prioritize saving and investing for a secure financial future.