Post-divorce debt management is the process of handling and repaying financial obligations acquired during a marriage after the dissolution of the union. This may involve budgeting, prioritizing debts, and rebuilding credit to achieve financial stability. Managing debt after divorce is crucial for maintaining financial stability and protecting one's credit score. Failure to address post-divorce debt can lead to long-term financial difficulties and hinder the ability to achieve future financial goals. The division of debts in a divorce depends on the state's laws, which fall into two categories: community property states and equitable distribution states. Community property states consider all assets and debts acquired during marriage as jointly owned, while equitable distribution states divide assets and debts based on fairness and individual contributions. Marital debts are those incurred during the marriage and are usually divided between both parties in a divorce. Separate debts, on the other hand, are those incurred before marriage or after separation and are typically the sole responsibility of the individual who incurred them. The divorce decree is a legally binding document that outlines the division of assets and debts between both parties. It is essential to understand and adhere to the terms of the decree to avoid legal and financial repercussions. To create a post-divorce budget, list all income sources, including salary, alimony, child support, and any other regular payments. This will clearly understand your financial situation and help create a realistic budget. Identify and list essential expenses such as housing, utilities, groceries, transportation, and healthcare. Prioritizing these costs will ensure that basic needs are met while managing post-divorce debt. Once essential expenses are accounted for, allocate funds for debt payments. Determine the minimum payments required for each debt and create a plan to pay them off in a timely manner. Post-divorce life may require adjusting to a single-income lifestyle, which may involve cutting discretionary expenses and finding ways to reduce costs. Embrace frugality and prioritize financial stability over short-term indulgences. Focus on paying off high-interest debts first, as these cost more in the long run. By tackling these debts, you can reduce the overall amount owed and improve your financial situation more quickly. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, simplifying the repayment process and potentially reducing the overall cost of debt. This strategy can be beneficial for those struggling with multiple debt payments. Negotiating with creditors can result in lower interest rates, extended payment terms, or even debt forgiveness. Open communication with creditors may lead to more manageable payment arrangements and reduced financial stress. Debt management plans, often offered by credit counseling agencies, can help individuals create a structured repayment plan and negotiate with creditors. These plans may reduce interest rates, waive fees, and provide the support needed to regain financial stability. An emergency fund is a financial safety net, providing a cushion for unexpected expenses or income loss. Having an emergency fund can prevent the need to take on additional debt during challenging times, ensuring greater financial stability. Saving money for an emergency fund may involve cutting discretionary expenses, finding additional income sources, or automating savings. Consistently setting aside a portion of income can help build an emergency fund over time. Striking a balance between paying off debt and saving for emergencies is crucial. Prioritize high-interest debt while still setting aside a portion of income for savings, ensuring both short-term stability and long-term financial security. Credit reports and scores significantly affect one's financial life, affecting loan eligibility and interest rates. After a divorce, it is crucial to understand how credit reports and scores work to rebuild credit and avoid potential pitfalls. To rebuild credit after divorce, separate joint accounts and update personal information with credit bureaus. This process helps establish independent credit and ensures accurate reporting, which is essential for rebuilding credit. Opening new lines of credit and managing them responsibly can help rebuild credit after divorce. Ensure timely payments and maintain low credit utilization to demonstrate creditworthiness to lenders and credit bureaus. Regularly monitoring credit reports allows for early detection and resolution of errors or issues that could harm credit scores. Address any discrepancies promptly to maintain accurate credit records and protect creditworthiness. Adopting healthy financial habits, such as budgeting, saving, and responsible credit use, is essential for maintaining financial stability and achieving long-term financial goals. Setting clear financial goals can provide direction and motivation for managing post-divorce debt and planning for the future. Goals may include debt repayment, building an emergency fund, or saving for retirement. Planning for retirement is crucial for long-term financial security. Invest in retirement accounts, create a diversified investment portfolio, and seek professional guidance to ensure a stable financial future. Managing post-divorce debt is essential for achieving financial stability and rebuilding credit. This involves understanding debt division, creating a budget, prioritizing debt payments, building an emergency fund, and seeking professional assistance. Post-divorce debt management can be challenging, but with perseverance, determination, and the right support, individuals can regain financial stability and achieve their financial goals. Financial advisors can assist with post-divorce finances, credit counseling services offer debt management and credit rebuilding support, and legal advisors provide guidance on legal aspects of debt management after divorce.What Is Post-Divorce Debt Management?

Understanding the Divorce Process and Debt Division

Community Property States vs Equitable Distribution States

Marital vs Separate Debts

Debt Obligations in the Divorce Decree

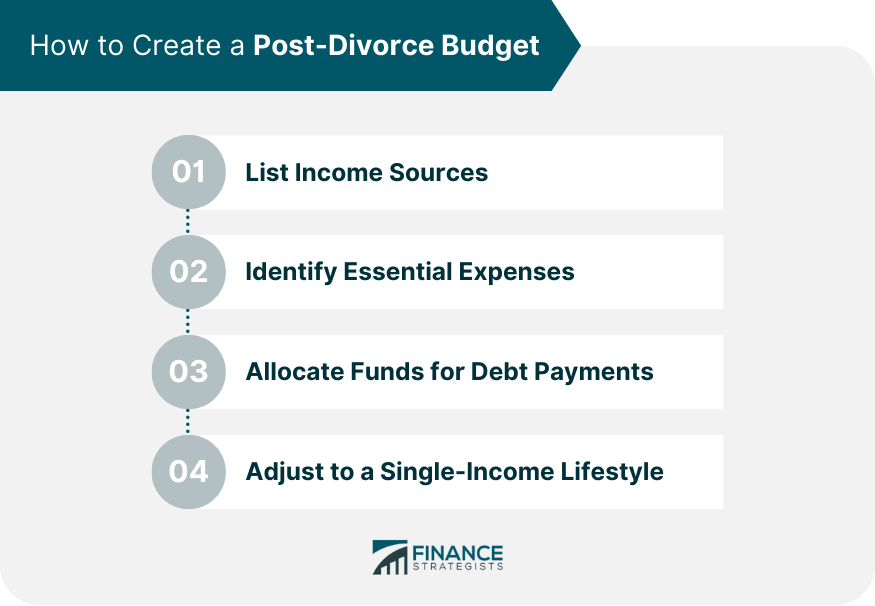

Creating a Post-Divorce Budget

List Income Sources

Identify Essential Expenses

Allocate Funds for Debt Payments

Adjust to a Single-Income Lifestyle

Strategies for Managing Debt

Prioritizing High-Interest Debts

Consolidating Debts

Negotiating with Creditors

Exploring Debt Management Plans

Building an Emergency Fund

Importance of Having a Financial Safety Net

Strategies for Saving Money

Balancing Debt Payments and Saving Goals

Rebuilding Credit After Divorce

Understanding Credit Reports and Scores

Removing Joint Accounts and Updating Personal Information

Establishing New Lines of Credit

Monitoring Credit and Addressing Issues Promptly

Maintaining Financial Stability and Planning for the Future

Developing Healthy Financial Habits

Setting Financial Goals

Planning for Retirement and Long-Term Financial Security

Final Thoughts

Post-Divorce Debt Management FAQs

Key steps you should take for post-divorce debt management include understanding the divorce process and debt division, creating a post-divorce budget, prioritizing and managing debts, building an emergency fund, and rebuilding your credit after divorce.

To create a post-divorce budget, list all your income sources, identify essential expenses, allocate funds for debt payments, and adjust to a single-income lifestyle. This will help you manage your finances and pay off debts more effectively.

To rebuild your credit after divorce, understand your credit reports and scores, remove joint accounts and update your personal information, establish new lines of credit, and monitor your credit reports to address any issues promptly.

Professionals who can help you with post-divorce debt management include financial advisors, credit counseling services, and legal advisors. They can provide guidance on debt management, budgeting, credit rebuilding, and legal aspects of your financial situation.

Building an emergency fund is crucial in post-divorce debt management as it serves as a financial safety net for unexpected expenses or income loss. It helps prevent taking on additional debt during challenging times and ensures greater financial stability for you.