The Department of Labor (DOL) fiduciary rule is a set of regulations designed to protect retirement investors from conflicts of interest when receiving financial advice. It requires financial advisors to act in their client's best interest and meet several requirements, including making full and fair disclosures to the client. The rule applies specifically to advisors who provide investment advice for retirement accounts, including 401(k)s and individual retirement accounts (IRAs). The DOL fiduciary rule has had a significant impact on the retirement industry since its implementation in 2017, affecting financial advisors, retirement plan sponsors, and plan participants. It has also been a controversial topic, with stakeholders on both sides of the issue voicing their opinions. At its core, the DOL fiduciary rule requires financial advisors to act in their client's best interests when providing investment advice for retirement accounts. Known as the fiduciary duty, it means the advisor must put their client's interests ahead of their own. It differs from the previous standard, which only required advisors to recommend suitable investments to their clients. The DOL fiduciary rule applies specifically to advisors who provide investment advice for retirement accounts, including advisors who receive compensation for their services, whether through fees or commissions. Advisors must disclose any fees or charges associated with their services, including those that may not be directly visible to the client. The rule also covers rollover recommendations, which occur when an advisor recommends that a client move funds from a 401(k) to an IRA. One key difference between the DOL fiduciary rule and other fiduciary standards is the best interest contract exemption (BICE). The BICE allows financial advisors to receive compensation that would otherwise be considered a prohibited transaction under the rule. To qualify for the exemption, the advisor must enter into a written contract with their client that acknowledges their fiduciary duty and discloses any potential conflicts of interest. The rule also affects retirement plan sponsors and plan participants as they are the ultimate beneficiaries of the fiduciary duty. When providing investment advice for retirement accounts, financial advisors must act as a fiduciary, which involves prioritizing their clients' interests over their own and refraining from any actions that may be influenced by conflicts of interest. It involves revealing any potential conflicts of interest that may influence the advisor's recommendations, such as compensation arrangements or other financial incentives. Furthermore, advisors must disclose all fees or charges associated with their services, even those that may not be immediately apparent to the client. Financial advisors are required to provide advice that is based on a careful and deliberate process. It entails thoroughly assessing the client's needs and investment objectives and recommending appropriate investments for their unique circumstances. Financial advisors are responsible for tracking clients' investments and providing regular advice and updates as required. It includes monitoring the performance of the investments and ensuring that they continue to align with the client's needs. PTEs allow advisors to receive compensation otherwise considered a prohibited transaction. One key PTE is the BICE, which mandates that advisors enter into a written and formal agreement with their clients. This agreement states the advisor's fiduciary duty and discloses any possible conflicts of interest. The DOL fiduciary rule has significantly affected the retirement industry since its implementation in 2017. It has made an impact on the following areas: The rule has increased the scrutiny and accountability advisors face when providing investment guidance for retirement accounts. Advisors must now meet higher standards of conduct, including a fiduciary duty to their clients. The DOL fiduciary rule has led to changes in compensation structures and business models for some advisors as they adjust to the new regulatory requirements. The DOL rule has increased the plan sponsors’ responsibility to monitor the investment options offered in their plans and ensure that they are in the best interest of participants. It has also led to changes in the selection and oversight of financial advisors that work with retirement plans. It has led to increased awareness of fees and charges associated with retirement accounts. Participants are now better equipped to evaluate the costs of their investments and understand the fiduciary duty of their financial advisors. The rule has also led to increased access to lower-cost investment options, such as index funds, which can help to reduce costs and improve long-term returns. The economic impact of the DOL fiduciary rule has been a subject of debate. Some industry groups claim that the rule places an undue burden on financial advisors and will result in increased costs for consumers. Others argue that the rule will lead to a more level playing field for financial advisors and will result in lower costs and better outcomes for retirement investors. The DOL fiduciary rule has been debated since its inception, with stakeholders on both sides of the issue voicing their opinions. One of the primary criticisms of the rule has been from financial industry groups, who claim that it places an unnecessary burden on financial advisors and will lead to increased costs for consumers. Some groups have even gone so far as to challenge the rule in court, claiming that it exceeds the DOL's regulatory authority. Consumer advocates, on the other hand, have generally supported the DOL fiduciary rule, claiming that it provides much-needed protection for retirement investors. They argue that the fiduciary duty is a basic principle of trust and that financial advisors should be required to act in their client's best interests at all times. The DOL fiduciary rule is a set of regulations designed to protect retirement investors from conflicts of interest when receiving financial advice. It requires financial advisors to always act in their client's best interest and meet several requirements, including making full and fair disclosures and prudent advice to the client. The rule has had a significant impact on the retirement industry, affecting financial advisors, retirement plan sponsors, and plan participants. The rule has also been controversial, with stakeholders on both sides of the issue voicing their opinions. The future of the DOL fiduciary rule remains uncertain, but the fiduciary duty will continue to be an important principle in the retirement industry for years to come. Consult a qualified financial advisor for further information on the DOL fiduciary rule. Exercising due diligence and understanding this rule can help retirement investors ensure that they reach their financial goals.What Is the DOL Fiduciary Rule?

How Does the DOL Fiduciary Rule Work?

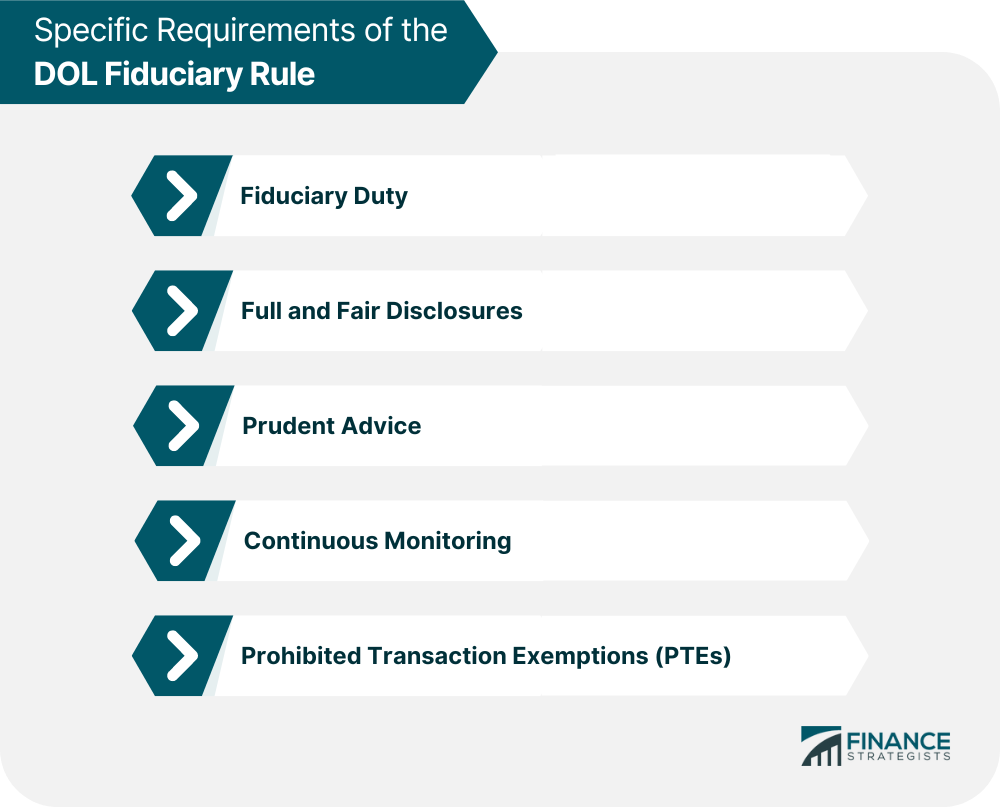

Specific Requirements of the DOL Fiduciary Rule

Fiduciary Duty

Full and Fair Disclosures

Prudent Advice

Continuous Monitoring

Prohibited Transaction Exemptions (PTEs)

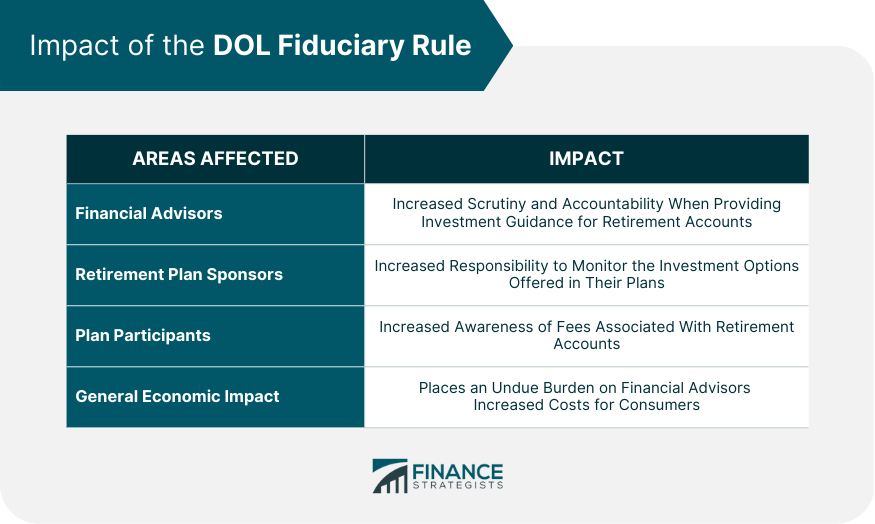

Impact of the DOL Fiduciary Rule

Financial Advisors

Retirement Plan Sponsors

Plan Participants

General Economic Impact

Controversies Surrounding the DOL Fiduciary Rule

The Bottom Line

DOL Fiduciary Rule FAQs

The rule applies to financial advisors who provide investment advice for retirement accounts, including 401(k)s and individual retirement accounts (IRAs).

Financial advisors must act as fiduciaries, make full and fair disclosures to clients, provide prudent advice, monitor clients' investments, and comply with prohibited transaction exemptions (PTEs).

The BICE allows financial advisors to receive compensation that would otherwise be considered a prohibited transaction under the rule. It requires advisors to enter into a written contract with their clients that acknowledges their fiduciary duty and discloses any potential conflicts of interest.

The rule has increased the level of scrutiny and accountability for financial advisors, increased responsibility for plan sponsors to monitor investments, and led to increased awareness of fees and charges for plan participants.

It has brought about significant changes to the retirement industry, including increased transparency and accountability for financial advisors, plan sponsors, and plan participants. The rule has also led to changes in compensation structures and business models for some advisors, increased responsibility for plan sponsors to monitor investments, and increased access to lower-cost investment options for plan participants.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.