The escrow account definition is a process by which two parties engaging in a transaction employ the use of an agreed-upon independent third party to hold the assets being moved until the obligations of both parties have been fulfilled. This is often used in cases where there is uncertainty that one or more parties may be unable to meet their obligations under the contract. Buying contexts in which escrow is a common service are real estate, mergers and acquisitions, large banking and internet transactions, and the acquiring of intellectual property. When two parties utilize an escrow service, the funds and assets being transacted are held by the third party until all of the obligations of the transaction have been met. This facilitates the primary function of an escrow service: ensuring that both parties are held to their promises before any transfer of funds is made. This helps maintain fairness and honesty in a financial agreement. Here is a common use of escrow: A buyer is interested in purchasing real estate, but only if the house first passes an inspection. In this event, the buyer and seller might both wish to use an escrow service; the buyer places the funds in escrow, assuring the seller that they can close the purchase. The seller can then fulfill their end with less risk of wasting time or money. After the home clears the inspection and any other stipulations, the third party releases the escrow funds to the seller and the buyer receives the deed to the home. In any escrow arrangement, the buyer kicks things off. They express a desire to purchase, but with a safety net. The buyer places their funds into an escrow account, effectively signaling their intent to purchase and their commitment to follow through, provided all conditions are met. The buyer, while keen to acquire, seeks assurance. Escrow provides them with a layer of protection, ensuring their hard-earned money doesn't vanish into thin air. On the flip side of the coin is the seller. They have something valuable, be it property, goods, or services. The seller agrees to the escrow arrangement, understanding that they'll receive the funds once they fulfill their end of the bargain. For sellers, escrow provides a sense of security. It assures them that the buyer is serious and that funds are waiting, ready to be transferred upon completion of the deal. The unsung hero of the escrow world, the escrow agent, operates in the background but holds all the strings. This neutral third party is responsible for ensuring that the transaction goes smoothly. They hold onto the buyer's funds, oversee the fulfillment of the contract, and release the money to the seller once all is in order. In this intricate ballet of transactions, the escrow agent plays the pivotal role of conductor, ensuring each party hits their mark and the performance is flawless. When purchasing property, buyers place their funds in escrow. These funds are then released to the seller only when all contractual obligations, like inspections and documentation, are fulfilled. This type of escrow safeguards both the buyer's money and the seller's property, ensuring that the intricate dance of real estate transactions remains harmonious and fair. As online transactions proliferate, so does the need for security mechanisms. Online escrow services have emerged as protectors in the vast world of e-commerce. Whether you're buying a rare artifact on an auction site or commissioning digital services, online escrow ensures that payments are released only when the product or service meets the agreed-upon standards. This cyber version of escrow brings brick-and-mortar safety to the digital marketplace, ensuring that trust remains intact in virtual transactions. Business escrow caters to more complex transactions, such as mergers, acquisitions, or bulk sales. Here, escrow ensures that the myriad conditions attached to business deals are met before funds change hands. In the high-stakes game of business transactions, escrow acts as a referee, ensuring the game is played fairly and to the satisfaction of all involved parties. Once both parties agree on terms, they select an escrow agent. The buyer then deposits their funds into the escrow account, signaling the official commencement of the process. This opening is more than a mere formality. It sets the stage for the ensuing steps, ensuring everyone is on the same page. As the escrow process unfolds, documentation and verification take center stage. Depending on the transaction's nature, various documents, ranging from sale agreements to verification forms, need to be filled out. The escrow agent then verifies these documents, ensuring that all the i's are dotted and the t's are crossed. This stage is crucial. It ensures that all contractual obligations are clear, understood, and ready to be fulfilled. With documentation in place, the focus shifts to funding. The buyer deposits the agreed-upon sum into the escrow account. This isn't just a token gesture. It's a tangible commitment, signaling the buyer's intent to proceed. But remember, while the money is in the escrow account, it's out of the buyer's hands but not yet in the seller's grasp. It's held in trust, waiting for the green light to move. The guardians of the escrow process don't operate for free. Escrow agents, for their role in ensuring a smooth transaction, charge a fee. This fee varies based on the transaction's complexity and size, but it's typically a small percentage of the total amount or a fixed charge. While some might grumble at this added cost, the peace of mind and security escrow agents bring to the table make it money well spent. Sometimes, escrow transactions require third-party services, such as appraisals, inspections, or title searches. These services come with their own fees, separate from the escrow agent's charges. These third-party fees ensure that all aspects of the transaction are above board and meet the required standards, ensuring no nasty surprises down the road. Closing out an escrow, like closing out a grand theatrical performance, comes with its own set of costs. These disbursement costs cover the final transfer of funds and any associated administrative charges. While they might seem like yet another line item in the expense column, they represent the final hurdle before the transaction's successful completion. Escrow isn't just about holding onto money. It's about protection. For buyers, escrow offers a safety net. It ensures they don't part with their money until they're sure they're getting what they paid for. This layer of protection is invaluable, ensuring that buyers can enter into transactions with confidence, knowing they won't be left out in the cold. Turn the tables, and sellers too reap the benefits of escrow. They're assured that the buyer is serious, with funds already deposited in the escrow account. Sellers can proceed with fulfilling their part, knowing that the payment awaits them once they meet their obligations. In a world rife with uncertainty, escrow offers sellers a beacon of security, ensuring they're rewarded for their efforts. Beyond buyer and seller protection, escrow brings an overarching benefit to the table – secure transactions. Whether it's a property deal, an online purchase, or a business merger, escrow ensures that the transaction process is transparent, fair, and secure from start to finish. In this age of cyber threats and fraud, such security isn't just a nice-to-have. It's an imperative. No system, however robust, is immune to risks. In the escrow world, fraud and scams are the lurking shadows. Unscrupulous parties sometimes set up fake escrow services to dupe unsuspecting victims. Or, in some instances, genuine escrow transactions might be targeted by cybercriminals. Awareness is the first line of defense. Both buyers and sellers must ensure they're dealing with reputable escrow services and be vigilant at every step. Not all escrow transactions go off without a hitch. Disputes can arise, be it over the quality of goods delivered, the timeliness of services, or contract interpretations. When such disagreements occur, the escrow process can become mired in delays. While escrow provides a framework for dispute resolution, the process can be time-consuming and, at times, frustrating. Whether due to documentation issues, disputes, or unforeseen challenges, escrow processes can sometimes stretch longer than anticipated. Such delays can be nerve-wracking for both buyers and sellers, adding a layer of uncertainty to an already complex process. An escrow account serves as a vital safeguard in financial transactions, ensuring fairness, and security. It acts as a neutral intermediary, holding funds until both parties fulfill their obligations. The nature of the relationship relies on the third-party role, promoting honesty and fairness. Escrow protects buyers' funds, helps sellers proceed with confidence, and provides secure transactions. Different escrow types cater to specific needs, from real estate to online purchases and business deals, all with the goal of building trust. However, risks like fraud, disputes, and delays exist, necessitating vigilance and proper resolution mechanisms. Despite these risks, when used wisely and in reputable services, escrow empowers secure and transparent financial dealings, making it an indispensable tool in various high-stakes transactions.Define Escrow Account

The primary purpose of escrow is to ensure fairness and security in transactions. In situations where mutual trust might be lacking or where the stakes are high, escrow acts as a neutral intermediary, ensuring both parties play by the rules.What Is the Nature of an Escrow Account Relationship?

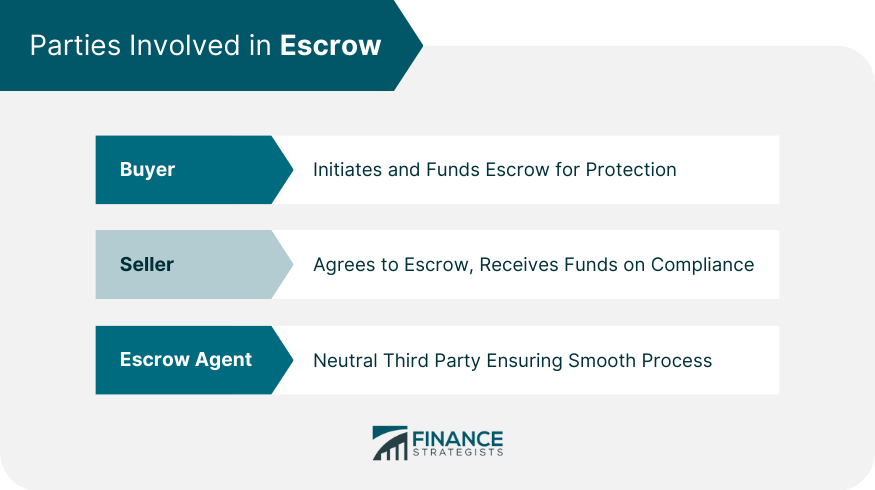

Parties Involved in Escrow

Buyer

Seller

Escrow Agent

Types of Escrow

Real Estate Escrow

Online Escrow

Business Escrow

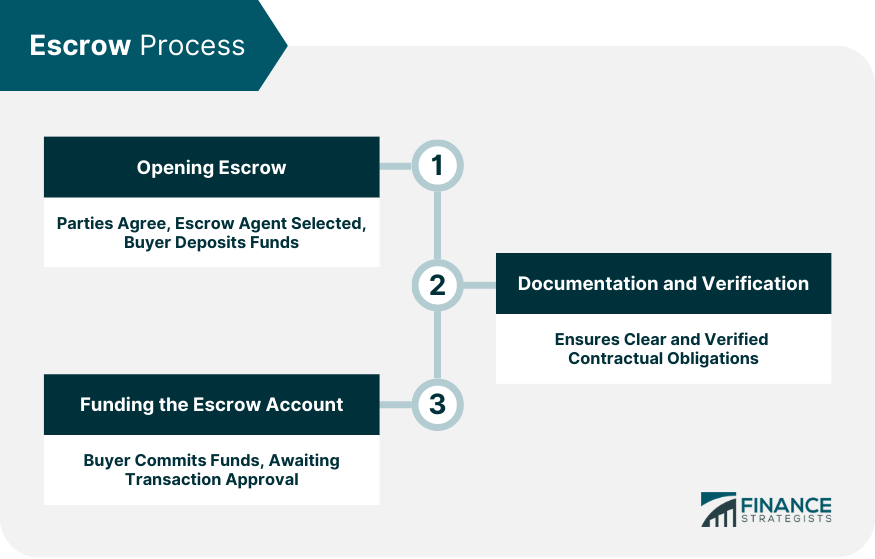

Escrow Process

Opening Escrow

Documentation and Verification

Funding the Escrow Account

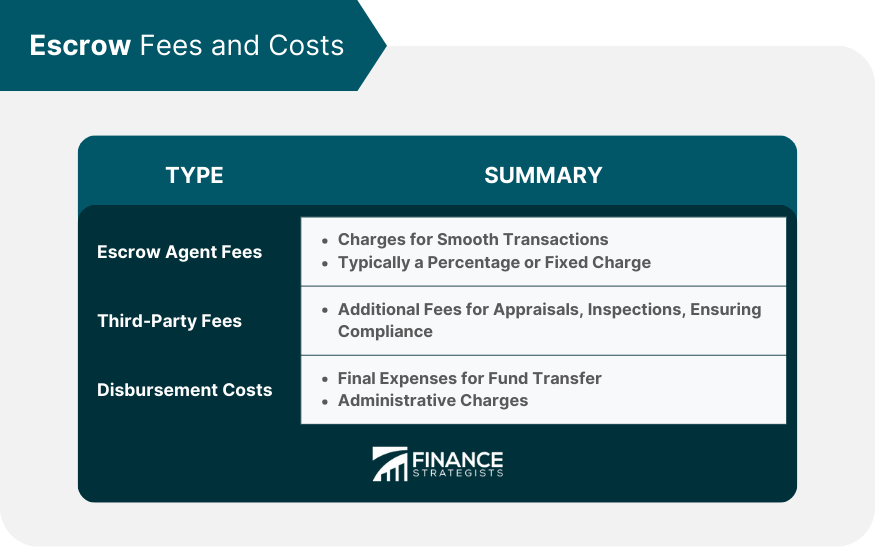

Escrow Fees and Costs

Escrow Agent Fees

Third-Party Fees

Disbursement Costs

Advantages of Escrow

Buyer Protection

Seller Protection

Secure Transactions

Risks in Escrow

Fraud and Scams

Dispute Resolution

Delays in Closing

Conclusion

Escrow FAQs

The escrow account definition is a process by which two parties engaging in a transaction employ the use of an agreed upon independent third party to hold the assets being moved until the obligations of both parties have been fulfilled.

Escrow accounts are often used in cases where there is the uncertainty that one or more parties may be unable to meet their obligations under the contract.

Escrow is a common service for real estate, mergers and acquisitions, large banking and internet transactions, and the acquiring of intellectual property.

In general, escrow accounts help maintain fairness and honesty in a financial agreement.

As with any business, an escrow company can go broke. Even if it is FDIC insured, it still may take some time to get your funds, which may delay your property tax or insurance payments. Also like other businesses, sometimes they just make mistakes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.