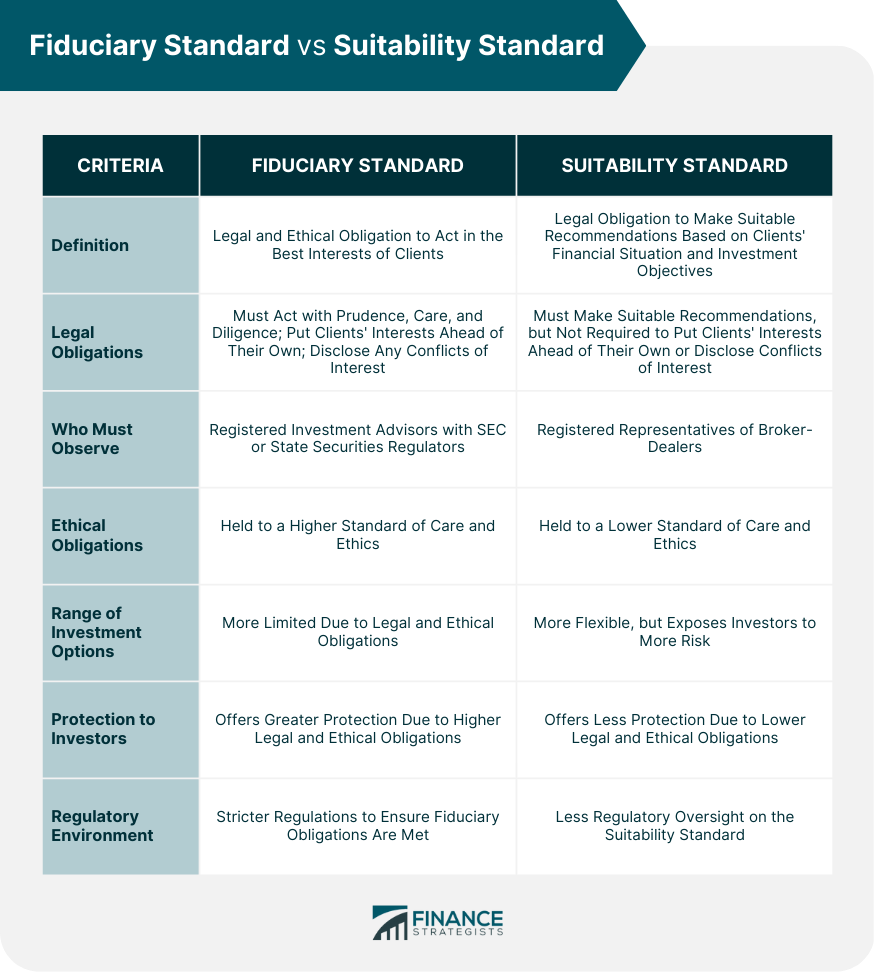

When it comes to financial advice and recommendations, investors often turn to financial advisors for guidance. Fiduciary and suitability standards are two different sets of guidelines that financial advisors, brokers, and other financial professionals follow when making recommendations to their clients. These standards dictate how these professionals should act in the best interest of their clients, and each has its own level of responsibility and obligation. Understanding the difference between these standards is important for investors and advisors alike, as it can impact investment outcomes, the relationship between advisors and investors, and the regulatory environment. The fiduciary standard is a legal and ethical obligation that requires financial advisors to act in the best interests of their clients. Fiduciaries are held to a higher standard of care and are required to put their clients' interests ahead of their own. The legal and ethical obligations of financial advisors who operate under the fiduciary standard are significantly higher than those who operate under the suitability standard. Fiduciaries are legally and ethically required to act in the best interests of their clients and to disclose any conflicts of interest that may arise. They must put their clients' interests ahead of their own and must avoid any actions that could lead to a conflict of interest. Fiduciaries are also required to act with prudence, care, and diligence when making recommendations and managing their clients' assets. The fiduciary standard applies to financial advisors who are registered investment advisors (RIAs) with the Securities and Exchange Commission (SEC) or state securities regulators. RIAs are legally and ethically required to act in the best interests of their clients and to disclose any conflicts of interest that may arise. They must also follow a strict set of rules and regulations that are designed to protect investors. The suitability standard requires advisors to make recommendations that are suitable for their clients based on their financial situation and investment objectives. They must ensure that their recommendations are suitable for their clients. The legal obligations of the suitability standard require financial advisors to make recommendations that are suitable for their clients. They are not required to put their clients' interests ahead of their own, and they do not have to disclose any conflicts of interest that may arise. The suitability standard applies to financial advisors who are registered representatives of broker-dealers. Registered representatives are not held to the same legal and ethical obligations as RIAs. The differences between the fiduciary standard and suitability standard can have a significant impact on investment advice and recommendations. Advisors who operate under the fiduciary standard are legally and ethically required to put their clients' interests ahead of their own, which means that they must act in a way that is most beneficial to their clients. This can lead to more conservative investment strategies and a focus on long-term investment goals. Fiduciaries are also required to disclose any conflicts of interest that may arise, which can help investors make more informed decisions. Advisors who operate under the fiduciary standard tend to prefer more conservative investment strategies and a focus on long-term investment goals. This can help investors achieve their financial objectives while minimizing risk. In contrast, advisors who operate under the suitability standard may be more likely to recommend investments that are riskier or that offer higher commissions. This can lead to investors taking on more risk than they are comfortable with and making decisions based on incomplete or biased information. This can lead to poor investment outcomes and erode the trust between advisors and investors. The choice of standard can also impact the regulatory environment. In recent years, there has been a push to expand the fiduciary standard to cover all financial advisors. This would provide greater protection to investors and help to restore trust in the financial industry. However, there are concerns that this could limit the range of investment options available to investors and increase the regulatory burden on financial advisors. The fiduciary standard and suitability standard are two different sets of rules that govern the behavior of financial advisors. Understanding the difference between these standards is important for investors and advisors alike, as it can impact investment outcomes, the relationship between advisors and investors, and the regulatory environment. While the fiduciary standard offers greater protection to investors, it can also limit the range of investment options available to them. On the other hand, the suitability standard offers investors greater flexibility in terms of investment options, but it also exposes them to more risk. Investors should carefully consider their own investment objectives and risk tolerance when choosing an advisor and the standard that they operate under. It is also important to work with a financial advisor who is transparent about their fees, commissions, and any conflicts of interest that may arise. By working with a trusted advisor and choosing the right standard, investors can achieve their financial goals and protect their assets for the future.Overview of the Fiduciary and Suitability Standards

What Is Fiduciary Standard?

Legal Obligations

Who Should Observe This Standard

What Is Suitability Standard?

Legal and Ethical Obligations

Who Should Observe This Standard

Impact of the Fiduciary and Suitability Standard on Investment Advice and Recommendations

Importance of Choosing the Right Standard

Final Thoughts

Fiduciary vs Suitability Standard FAQs

The fiduciary standard is a legal and ethical obligation that requires financial advisors to act in the best interests of their clients, while also disclosing any conflicts of interest that may arise.

The fiduciary standard applies to financial advisors who are registered investment advisors (RIAs) with the Securities and Exchange Commission (SEC) or state securities regulators.

The suitability standard requires advisors to make recommendations that are suitable for their clients based on their financial situation and investment objectives, but they are not required to put their clients' interests ahead of their own or disclose any conflicts of interest that may arise.

The fiduciary standard offers greater legal and ethical protection to investors, while the suitability standard offers more flexibility for financial advisors but less protection to investors.

The choice of standard can impact investment outcomes and the relationship between advisors and investors, as the fiduciary standard requires advisors to act in the best interests of their clients and to disclose any conflicts of interest, while the suitability standard does not have the same level of legal and ethical obligations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.