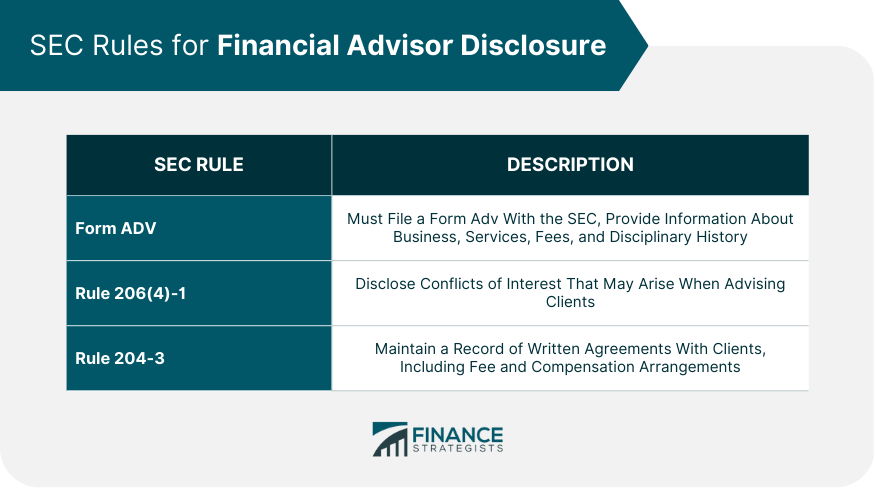

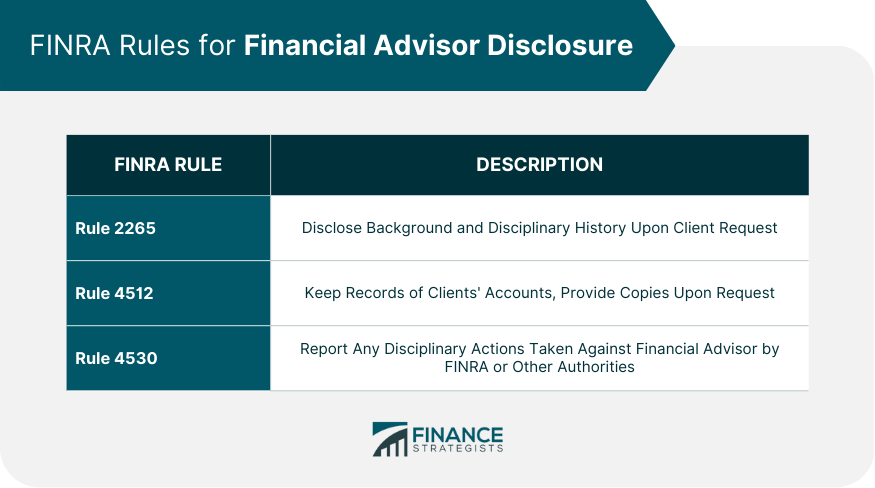

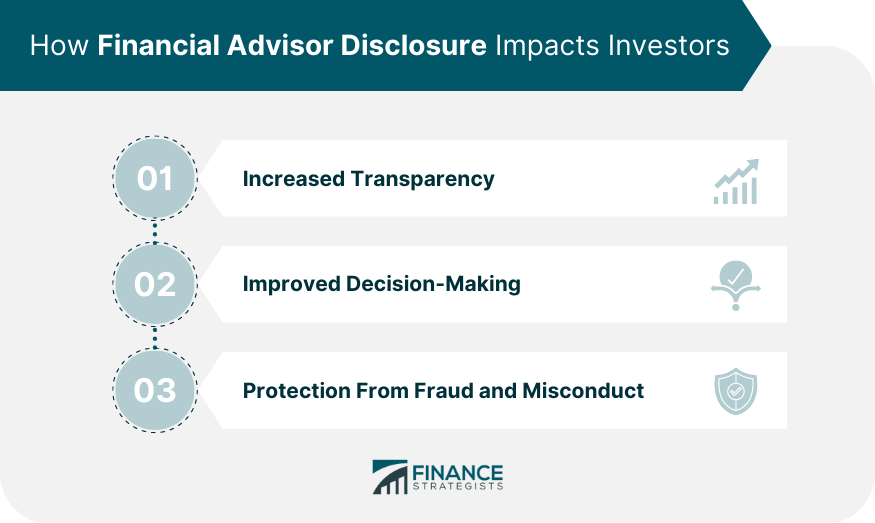

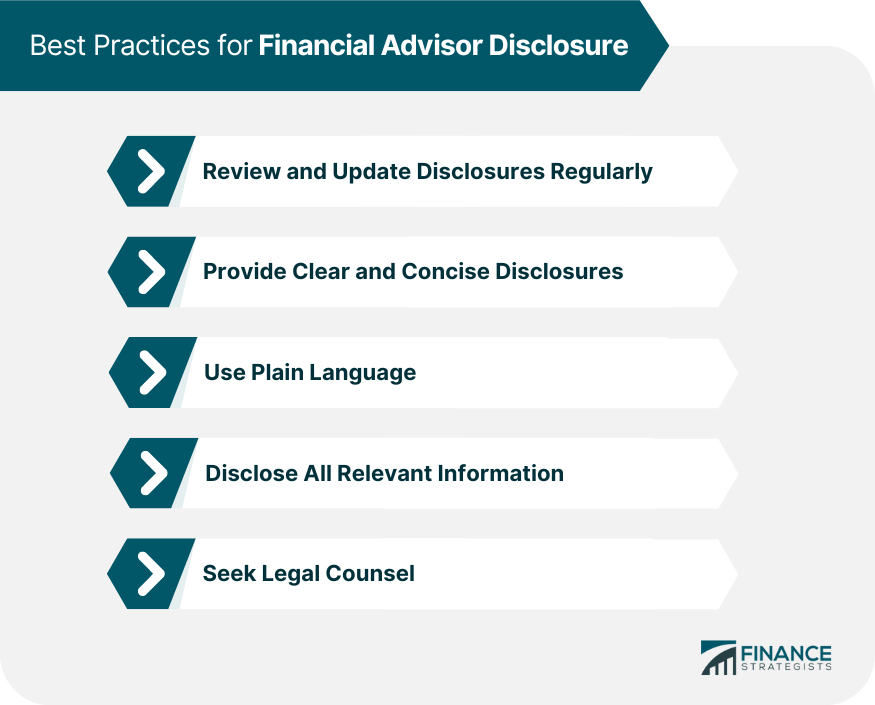

Financial advisor disclosure refers to the information financial advisors must disclose to their clients about their services, compensation, conflicts of interest, and disciplinary history. Financial advisor disclosure is essential for investors to make informed investment decisions and understand the risks and benefits involved. The importance of financial advisor disclosure cannot be overstated. Investors need to have access to accurate, complete, and timely information to make informed investment decisions. Without adequate disclosure, investors may not fully understand the risks associated with their investments, leading to potential financial losses and legal disputes. There are three types of financial advisor disclosures that investors need to be aware of: conflicts of interest, fees and compensation, and disciplinary history. Financial advisors must disclose any conflicts of interest that may arise when advising their clients. A conflict of interest is a situation where a financial advisor's personal interests may conflict with the best interests of their clients. For example, a financial advisor who is also a broker-dealer may recommend investments that are not in the best interest of their clients but may generate higher commissions for the advisor. Financial advisors must disclose all fees and compensation they receive for their services. There are various types of fees and compensation that financial advisors may receive, such as commissions, sales charges, markups, and management fees. Investors need to understand how financial advisors are compensated to determine if their recommendations are influenced by compensation. Financial advisors must disclose any disciplinary history they may have. Disciplinary history includes any criminal convictions, civil judgments, customer complaints, or regulatory actions taken against the advisor. Investors need to be aware of the advisor's disciplinary history to evaluate the advisor's credibility and trustworthiness. Financial advisor disclosure is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). The following are the regulatory requirements for financial advisor disclosure: The SEC requires financial advisors to disclose information about their services, fees, compensation, and disciplinary history through several rules, including: Financial advisors must file a Form ADV with the SEC, which provides information about their business, services, fees, and disciplinary history. Rule 206(4)-1 Financial advisors must disclose any conflicts of interest that may arise when advising their clients. Rule 204-3 Financial advisors must maintain a record of all written agreements they have with their clients, including fee and compensation arrangements. FINRA also has rules that require financial advisors to disclose certain information to their clients, including: Rule 2265 Financial advisors must disclose their background and disciplinary history to clients upon request. Rule 4512 Financial advisors must keep records of their clients' accounts and provide clients with copies of these records upon request. Rule 4530 Financial advisors must report any disciplinary actions taken against them by FINRA or other regulatory authorities. Financial advisor disclosure has several benefits for investors, including: Financial advisor disclosure provides investors with access to accurate and complete information about their investments, services, fees, and compensation. Financial advisor disclosure allows investors to make informed investment decisions based on their individual financial goals, risk tolerance, and investment objectives. Financial advisor disclosure helps investors protect themselves from fraudulent or unethical practices by financial advisors. Financial advisors should follow these best practices when disclosing information to their clients: Review and Update Disclosures Regularly Financial advisors should review and update their disclosures regularly to ensure that they are accurate and up-to-date. Provide Clear and Concise Disclosures Financial advisors should provide clear and concise disclosures that are easy for clients to understand. Use Plain Language Financial advisors should use plain language that is easy for clients to understand, avoiding technical jargon and legal language. Disclose All Relevant Information Financial advisors should disclose all relevant information to their clients, including any conflicts of interest, fees, compensation, and disciplinary history. Seek Legal Counsel Financial advisors should seek legal counsel to ensure that their disclosures comply with regulatory requirements and best practices. Financial advisor disclosure is essential for investors to make informed investment decisions and protect themselves from fraudulent or unethical practices by financial advisors. By disclosing information about their services, fees, compensation, conflicts of interest, and disciplinary history, financial advisors can increase transparency, improve decision-making, and protect investors from financial harm. A qualified financial advisor should follow best practices for disclosure and comply with regulatory requirements to ensure that their disclosures are accurate, complete, and timely.What Is Financial Advisor Disclosure?

Types of Financial Advisor Disclosure

Disclosure of Conflicts of Interest

Disclosure of Fees and Compensation

Disclosure of Disciplinary History

Regulatory Requirements for Financial Advisor Disclosure

SEC Rules

FINRA Rules

How Financial Advisor Disclosure Impacts Investors

Increased Transparency

Improved Decision-Making

Protection From Fraud and Misconduct

Best Practices for Financial Advisor Disclosure

Final Thoughts

Financial Advisor Disclosure FAQs

Financial advisor disclosure refers to the information that financial advisors must disclose to their clients about their services, compensation, conflicts of interest, and disciplinary history. It is a critical component of the relationship between the advisor and the client, as it ensures transparency and enables the client to make informed investment decisions.

Financial advisor disclosure is essential because it allows clients to understand the risks and benefits associated with their investments fully. It promotes transparency and trust in the relationship between the advisor and the client, and helps prevent fraudulent or unethical practices by financial advisors.

Financial advisor disclosures may include information about conflicts of interest, fees and compensation, and disciplinary history. Conflicts of interest refer to any situation where the advisor's personal interests may conflict with the best interests of the client. Fees and compensation refer to the types and amounts of compensation that the advisor receives for their services. Disciplinary history includes any criminal convictions, civil judgments, customer complaints, or regulatory actions taken against the advisor.

Financial advisors comply with regulatory requirements for disclosure by following rules and guidelines set forth by regulatory bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These rules and guidelines require advisors to provide clients with accurate, complete, and timely disclosures about their services, compensation, conflicts of interest, and disciplinary history.

Best practices for financial advisor disclosure include reviewing and updating disclosures regularly, providing clear and concise disclosures that are easy for clients to understand, using plain language, disclosing all relevant information, and seeking legal counsel to ensure compliance with regulatory requirements and best practices. These practices help ensure that clients receive accurate, complete, and timely disclosures and can make informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.