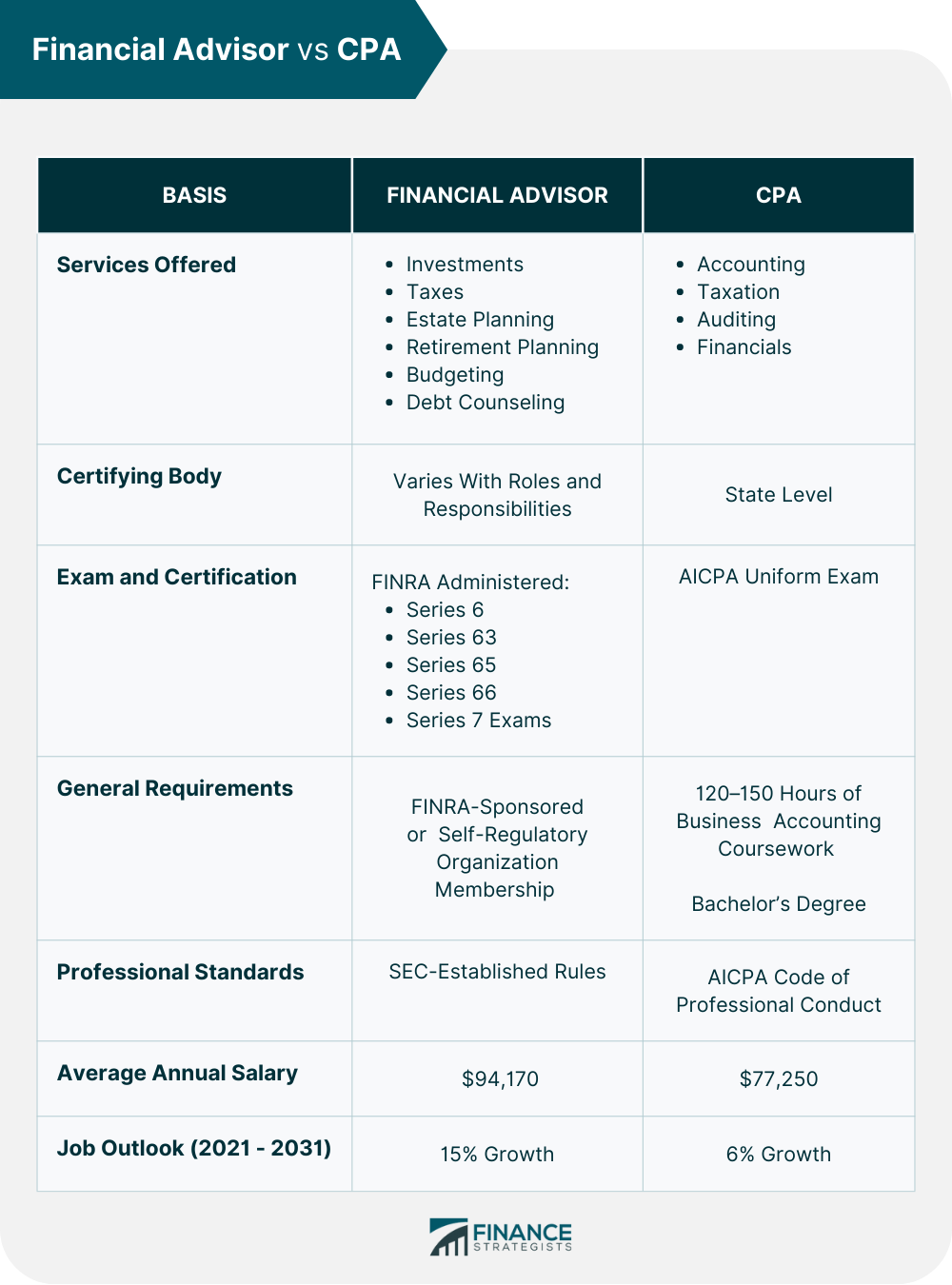

Financial advisors and Certified Public Accountants are essential financial professionals. Financial advisors can help clients expand their wealth from financial to investment planning. At the same time, CPAs manage various complicated financial concerns, including tax filing and internal auditing. Financial advisors can provide investment advice and create comprehensive financial and asset management plans. Portfolio construction, risk management, retirement income methods, estate planning, charity strategies, and other services may be provided by an advisor. On a related note, an accountant helps reduce the tax burden and may recommend tax-saving alternatives such as forming an individual retirement account. Taxes play a significant role in most financial services, and advisors and accountants frequently work together. A financial advisor is an expert who provides guidance and advice to individuals or businesses regarding investments, taxes, retirement, estate planning, and other areas of personal finance. They can help with specific and immediate financial problems such as investment management, stock purchase or sale, or the construction of an estate and tax plan. Financial advisors are part of a larger group that includes brokers, money managers, insurance agents, and bankers. They are often certified or registered with the appropriate regulatory organization in their respective states. A Certified Public Accountant is an accountant who has passed the Uniform CPA Examination approved by the American Institute of Certified Public Accountants (AICPA). CPAs advise businesses on tax matters and provide oversight to ensure that all financial records are accurate and up-to-date. They may also offer financial planning, auditing, and management consulting services. CPAs must adhere to a code of professional conduct set forth by the AICPA and maintain their knowledge base through continuing education courses. Financial advisors typically offer advice on investments, taxes, estate planning, retirement planning, budgeting, debt counseling, and more. On the other hand, most CPAs focus on tax laws and regulations. But they also provide general financial support in terms of record keeping, reports, audits, and forecasts for individuals and businesses. FINRA oversees the financial advisors' registration and licensing. While financial advisors have no particular licensing requirement, they must hold multiple securities licenses to sell investment products. They also need to register with state securities regulators or the Securities and Exchange Commission (SEC) depending on the value of the assets under management (AUM). Meanwhile, the AICPA administers CPA exams. However, accountants are primarily regulated at the state level. To register to conduct securities business, an individual must pass the Securities Industry Essentials (SIE) exam and a qualification exam suited for the type of business. The individual must be affiliated with a member firm to take a qualifying exam. In contrast, to become a CPA, you must pass all four parts of the Uniform CPA Exam approved by the AICPA. Financial advisors are required by hiring firms to have a college degree in finance or another related field, although it is a prerequisite to becoming one. At the same time, CPAs must possess an undergraduate degree in accounting, pass all four parts of the exam, and obtain two years of experience in public accounting. CPAs must have at least 150 hours of college credits with 30 semester hours in addition to an undergraduate degree to qualify for licensure. The SEC has established rules that financial advisors must abide by if registered with them. On the other hand, CPAs must adhere to the AICPA code of professional conduct, which includes confidentiality, integrity, and objectivity. The average annual salary for a financial advisor is $94,170, whereas the average yearly salary for a CPA is $77,250. The job outlook for financial advisors and CPAs is vital in the U.S. The Bureau of Labor Statistics projects a 15% increase in job opportunities for financial advisors between 2021 and 2031. CPAs are projected to experience a 6% growth during that period. If you have a complicated financial position, a financial advisor can help you plan and budget accordingly. They can help you whether you are looking for an investment strategy or creating a plan to minimize total debt. If you need someone to prepare your tax return, it makes more sense to go with a CPA. Similarly, they can help you with general accounting functions, auditing, and other financial-related reporting. In some cases, you may need to engage with both, such as starting a business, buying a new home, or planning retirement. A financial advisor can assist you with the acquisition and planning, while a CPA can handle the tax consequences of your chosen products, plan, or strategy. It is also important to note that financial advisors may not have the same legal and ethical obligations as CPAs. A financial advisor can be consulted for investment strategies and plans for future wealth accumulation. At the same time, a CPA is better equipped to help file taxes and set up accounting systems. A CPA can handle the tax implications of your selected business endeavors, financial plan, or investment choice. Aside from the nature of services, you can identify key differences between the two professions in terms of oversight or certifying body, professional standards, average salary, and job outlook. Both provide information on how to address long-term financial management, but it is critical to recognize how they differ so you can choose which will suit your needs.Financial Advisor vs Certified Public Accountant (CPA): Overview

What Is a Financial Advisor?

What Is a Certified Public Accountant (CPA)?

Key Differences Between a Financial Advisor and CPAServices Offered

Certifying Body

Exam and Certification

General Requirements

Professional Standards

Average Annual Salary

Job Outlook

Financial Advisor vs CPA: Which Is Right For You?

The Bottom Line

Financial Advisor vs Certified Public Accountant (CPA) FAQs

Although a CPA can also be an accountant, the two terms are not interchangeable. An accountant is trained in bookkeeping and financial record-keeping, while a CPA has additional certifications and qualifications that allow them to provide tax advice.

A financial advisor can provide valuable advice on managing and investing your money so you can reach your long-term financial goals. They can help you plan for retirement, build wealth, and find ways to save money.

A CPA can provide invaluable guidance regarding filing taxes, setting up business structures, and ensuring compliance with state or federal regulations. Additionally, they can identify opportunities for deductions and credits that can help you reduce your tax burden.

The most important responsibility of a CPA is to ensure that their clients comply with all applicable federal and state tax regulations. They must also maintain accurate records, provide financial advice, and adhere to ethical standards set forth by their professional body.

There are a few key differences between financial advisors and CPAs. Financial advisors typically provide advice on investments, retirement planning, and long-term wealth management. A CPA is an expert in taxation laws and can help file taxes and set up accounting systems and other short-term monetary goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.