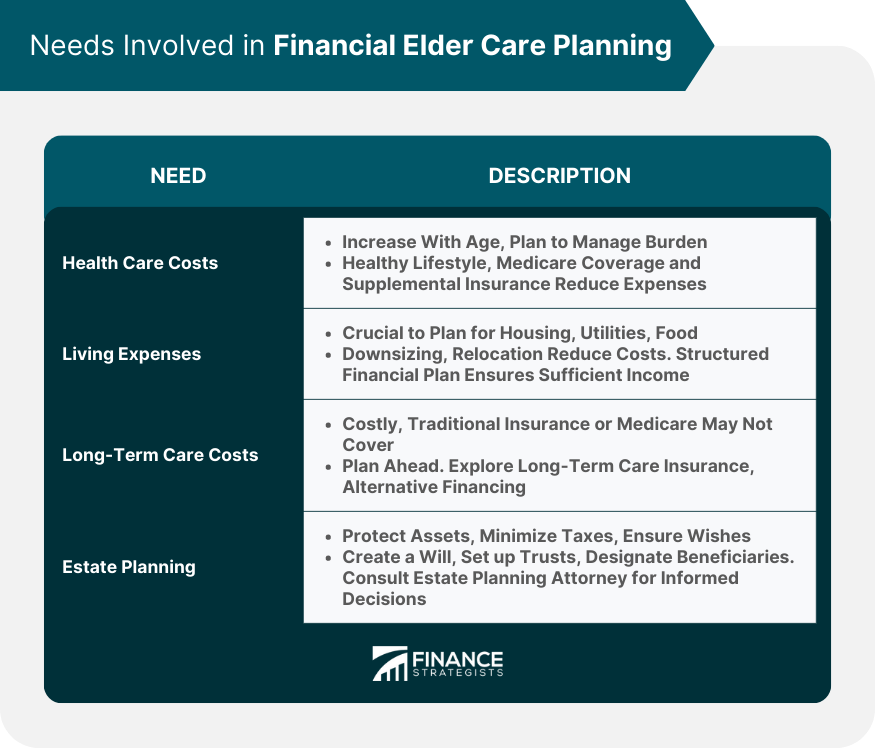

Financial elder care planning involves preparing for the financial needs and challenges that come with aging. This includes managing healthcare costs, living expenses, long-term care, and estate planning to ensure financial security and well-being in later years. Proper financial elder care planning is essential for ensuring a comfortable and secure retirement. By planning ahead, seniors and their families can avoid financial stress, protect assets, and maintain a high quality of life during their golden years. As individuals age, healthcare costs often increase due to the need for more frequent medical care, medications, and potential chronic health conditions. Planning for these expenses is essential to ensure access to proper healthcare and manage the financial burden associated with medical costs. Living a healthy lifestyle and investing in preventative care can help reduce healthcare expenses in the long run. It's also important to understand Medicare coverage and explore supplemental insurance options to better manage healthcare costs. Living expenses, such as housing, utilities, and food, must be considered when planning for elder care. Some seniors may choose to downsize or relocate to a more affordable area to reduce living expenses. In addition, it's essential to plan for inflation, which can impact the cost of living over time. Having a well-structured financial plan can help ensure seniors have sufficient income to cover their living expenses during retirement. Long-term care, including in-home care, assisted living, or nursing home care, can be expensive and may not be covered by traditional health insurance or Medicare. Planning for potential long-term care needs is crucial to avoid financial strain and ensure access to appropriate care when needed. Exploring long-term care insurance and alternative financing options can help seniors and their families prepare for these costs. It's important to start planning early, as the cost of long-term care insurance typically increases with age. Estate planning involves managing and distributing assets upon an individual's death. Proper estate planning can help protect assets, minimize taxes, and ensure that an individual's wishes are carried out. Estate planning may include creating a will, setting up trusts, and designating beneficiaries for assets and accounts. Consulting with an estate planning attorney can help seniors navigate the complexities of estate planning and make informed decisions. Understanding legal and regulatory issues related to financial elder care planning is essential for making informed decisions. This may include power of attorney, guardianship, and elder law considerations. Working with an elder law attorney can help seniors and their families navigate these issues and ensure compliance with all relevant laws and regulations. Taxes can have a significant impact on retirement income and assets. Planning for tax implications is crucial to minimize tax liabilities and protect assets for future generations. Seeking advice from a tax professional can help seniors understand their tax obligations and develop strategies to minimize taxes during retirement. Investment strategies should be adjusted as individuals approach and enter retirement. This may involve reducing risk, reallocating assets, and prioritizing income generation over growth. Working with a financial advisor can help seniors create an investment strategy that aligns with their risk tolerance, goals, and time horizon. Reviewing and adjusting insurance policies, such as life insurance and long-term care insurance, can help seniors ensure they have appropriate coverage for their needs. This may involve updating beneficiaries, adjusting coverage amounts, or purchasing additional policies. Consulting with an insurance professional can help seniors understand their options and make informed decisions about their insurance coverage. Understanding and maximizing Social Security and other retirement benefits is crucial for financial elder care planning. Seniors need to consider the optimal time to start claiming benefits and how their decisions can impact their overall retirement income. Working with a financial planner or Social Security expert can help seniors navigate the complexities of these benefits and ensure they are making the most of their entitlements. Developing a budget that accounts for all anticipated expenses during retirement is a crucial step in financial elder care planning. A budget can help seniors understand their financial needs and make adjustments to their spending habits and savings strategies accordingly. Regularly reviewing and updating the budget can help seniors stay on track and make any necessary adjustments as their needs and circumstances change over time. Creating a comprehensive, long-term financial plan can help seniors prepare for the various financial challenges they may face during retirement. This plan should include strategies for managing healthcare costs, living expenses, long-term care, and estate planning. Collaborating with a financial planner can provide seniors with valuable guidance and expertise in creating a financial plan that meets their unique needs and goals. Exploring options for long-term care and understanding the associated costs is essential for financial elder care planning. Seniors and their families should research various care options, such as in-home care, assisted living, and nursing home care, and determine which option best suits their needs and budget. Considering long-term care insurance and alternative financing options can help ensure seniors have access to the care they need without creating a significant financial burden. Developing a comprehensive estate plan is essential for protecting assets and ensuring that an individual's wishes are carried out upon their death. Estate planning may involve creating a will, setting up trusts, and designating beneficiaries for assets and accounts. Consulting with an estate planning attorney can help seniors navigate the complexities of estate planning and make informed decisions that protect their assets and legacy. Open communication between seniors and their families is essential for successful financial elder care planning. By discussing their needs, preferences, and concerns, seniors can ensure their family is aware of their wishes and can provide appropriate support when needed. Regular family discussions can also help address any changes in circumstances and make any necessary adjustments to the financial plan. Seeking professional advice from financial planners, elder law attorneys, tax professionals, and insurance experts can provide seniors and their families with valuable guidance and expertise. These professionals can help navigate the complexities of financial elder care planning and ensure all aspects are appropriately addressed. Financial elder care planning is essential for preparing for the financial needs and challenges that come with aging. Proper planning can help seniors avoid financial stress, protect their assets, and maintain a high quality of life during their golden years. Strategies for financial elder care planning include creating a budget, developing a long-term financial plan, considering options for long-term care, and estate planning. Open communication between seniors and their families is also crucial for successful planning, including regular family discussions and seeking professional advice from financial planners, attorneys, and other experts. By properly planning for their financial needs and working with professionals, seniors can ensure financial security and well-being in their later years. They can protect their assets, minimize tax liabilities, and distribute their assets according to their wishes, creating a legacy for their loved ones.What Is Financial Elder Care Planning?

Moreover, financial elder care planning is essential for protecting assets and creating a legacy. By doing so, older adults can ensure that their assets are distributed according to their wishes, and their loved ones are taken care of after they are gone.Needs Involved in Financial Elder Care Planning

Health Care Costs

Living Expenses

Long-Term Care Costs

Estate Planning

Factors to Consider in Financial Elder Care Planning

Legal and Regulatory Issues

Tax Implications

Investment Strategies

Insurance Policies

Social Security and Retirement Benefits

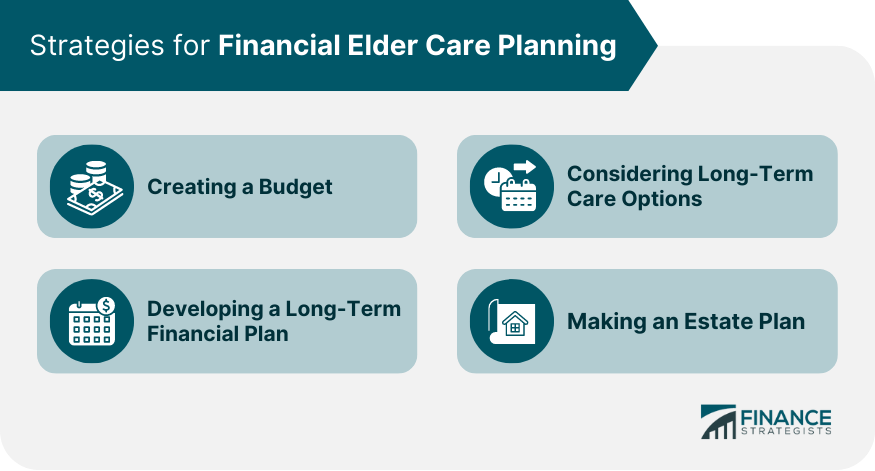

Strategies for Financial Elder Care Planning

Creating a Budget

Developing a Long-Term Financial Plan

Considering Long-Term Care Options

Making an Estate Plan

Importance of Communication In Financial Elder Care Planning

Family Discussions

Professional Advice

Conclusion

Understanding the financial needs of elderly individuals is essential for planning ahead. This includes managing healthcare costs, living expenses, long-term care, and estate planning.

Seniors must consider legal and regulatory issues, tax implications, investment strategies, insurance policies, and social security and retirement benefits.

Financial Elder Care Planning FAQs

Financial Elder Care Planning involves creating a comprehensive plan to address the financial needs of elderly individuals.

There are several strategies for financial elder care planning, including creating a budget that accounts for all anticipated expenses during retirement, developing a long-term financial plan that addresses healthcare costs and long-term care, exploring options for long-term care and understanding the associated costs, and developing a comprehensive estate plan that protects assets and ensures that an individual's wishes are carried out upon their death.

Factors to consider include legal and regulatory issues, tax implications, investment strategies, insurance policies, and Social Security and retirement benefits.

Communication is important to ensure that all family members are on the same page and that the elderly individual's wishes are understood and respected.

It's never too early to start Financial Elder Care Planning. The earlier you start, the more time you have to plan and ensure that all financial needs are met.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.