Family financial planning is the process of creating a financial plan that helps families manage their finances, save for the future, and achieve their financial goals. It entails evaluating your financial situation, establishing financial objectives, and developing a strategy to attain them. Family financial planning is essential because it helps families manage their finances effectively and prepare for unexpected expenses.

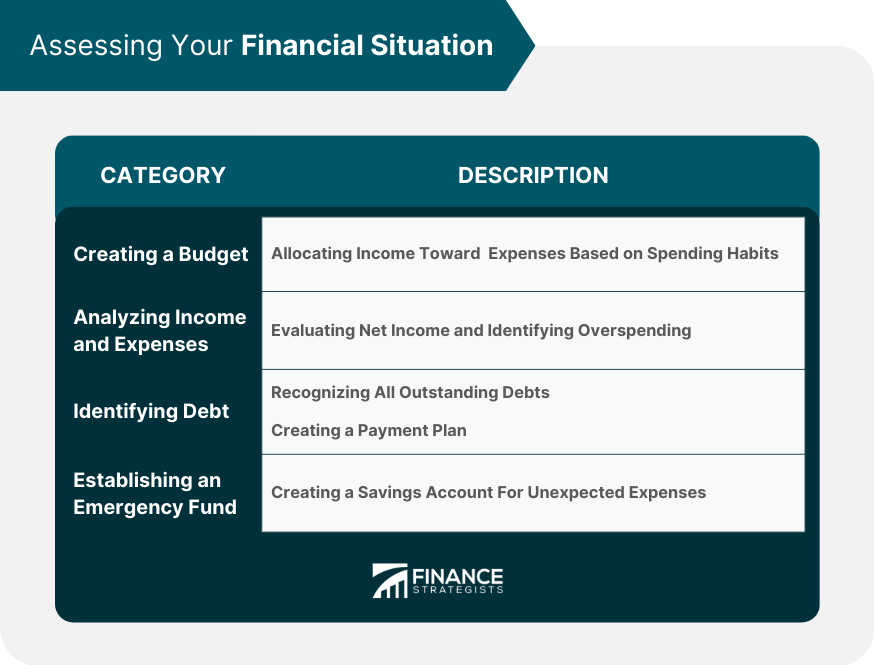

Assessing your financial status is the initial stage of family financial planning. This involves creating a budget, analyzing your income and expenses, identifying debt, and establishing an emergency fund. Creating a budget is the foundation of effective financial planning. A budget is a financial plan that assists in assigning your earnings to different expenses like rent, utilities, groceries, and leisure. You can establish a budget by recording your expenses over a few months to calculate your expenditures per category. Subsequently, allocate an appropriate amount of your income to each category based on your spending patterns. Analyzing your income and expenses is vital in assessing your financial situation. It aids in calculating your net income, which is your earnings after taxes and other deductions have been removed. It also helps you identify areas where you may be overspending, such as eating out or entertainment. Identifying debt is another crucial step in assessing your financial situation. Identifying all your debts, which may include credit cards, loans, and mortgages, is essential, as debt can significantly hinder you from accomplishing your financial objectives. Once you have identified your debts, create a plan to pay them off, starting with the highest interest rate debts first. Establishing an emergency fund is integral to family financial planning. An emergency fund is a savings account that covers unexpected expenses, such as car repairs or medical bills. You should save three to six months' worth of living expenses in your emergency fund. The next step in family financial planning is saving and investing. This involves setting financial goals, choosing the right savings and investment accounts, and planning retirement. Establishing financial goals may involve endeavors such as settling debts, accumulating funds for a home down payment, or devising a retirement plan. Once you have set your financial goals, create a plan to achieve them, including how much you need to save each month and how long it will take to achieve them. Retirement planning is an essential part of family financial planning. It involves creating a plan to save for retirement, including choosing the right retirement account and deciding how much you need to save each year. Managing risk with insurance is another important part of family financial planning. Insurance provides coverage that safeguards you and your family from unanticipated expenses, such as medical bills or property damage. Identifying your insurance needs involves determining the types of risks you are exposed to and choosing the right insurance coverage to protect yourself from those risks. For instance, in the case of a homeowner, it is essential to obtain homeowner's insurance to shield your property against potential damages. Choosing the right insurance policies is essential to family financial planning. Researching your options and choosing the policies that best fit your needs and budget is essential. When choosing insurance policies, consider coverage limits, deductibles, and premiums. Another crucial aspect of family financial planning involves preparing for significant life events. Major life events, such as buying a home, having children, starting a business, or paying for college, can significantly impact your finances. Planning ahead and creating a financial plan to help you achieve your goals is important. Buying a home is a significant financial decision. Researching your options, determining your budget, and choosing the right mortgage to fit your needs is essential. When buying a home, consider factors such as the location, size, and condition of the property. Having children is another major life event that can significantly impact your finances. Planning ahead and creating a budget for the added expenses, such as childcare and education, is important. Consider opening a college savings account to help pay for your child's education. Undertaking a business venture is a significant financial decision. Creating a business plan, determining your startup costs, and choosing the right financing options are essential. Consider working with a financial advisor to help you make informed decisions about your business finances. Paying for college is another major financial decision. It is important to research your options, including scholarships, grants, and student loans, and choose the right financing options. Additionally, consider establishing a college savings account to assist with the expenses. Estate planning is a crucial component of family financial planning that encompasses developing a strategy for transferring your assets to your beneficiaries after your passing. Estate planning aids in minimizing estate taxes and ensuring your assets are allocated according to your desires. It is crucial to work with an experienced estate planning lawyer to create a will, set up trusts, and name beneficiaries to ensure that your estate is handled in accordance with your wishes. A will is a legal document that outlines your wishes to distribute your assets after you pass away. Working with an attorney is vital to create a will that meets your needs and is legally valid. Setting up trusts can help you transfer your assets to your heirs without going through probate, which can be time-consuming and expensive. Many types of trusts are available, including revocable, irrevocable, and charitable trusts. Naming beneficiaries is also essential in estate planning. Beneficiaries are the individuals or organizations that will receive your assets after you pass away. Reviewing your beneficiary designations regularly and updating them as needed is important. Minimizing estate taxes is another essential part of estate planning. Estate taxes can take a significant portion of your assets, so it is vital to plan ahead and take steps to minimize your tax liability. Family financial planning is necessary to help families manage their finances effectively and achieve their financial goals. It involves assessing your financial situation, setting financial goals, and creating a plan to achieve those goals. Following the steps outlined in this guide, you can create a comprehensive financial plan that meets your needs and helps you achieve your goals. Remember to regularly review and update your financial plan to remain relevant and effective. Taking a proactive approach to your finances can create a solid foundation for a successful financial future.What Is Family Financial Planning?

Assessing Your Financial Situation

Creating a Budget

Analyzing Income and Expenses

Identifying Debt

Establishing an Emergency Fund

Saving and Investing

Setting Financial Goals

Retirement Planning

Managing Risk With Insurance

Identifying Your Insurance Needs

Choosing the Right Insurance Policies

Planning for Major Life Events

Buying a Home

Having Children

Starting a Business

Paying for College

Estate Planning

Creating a Will

Setting up Trusts

Naming Beneficiaries

Minimizing Estate Taxes

Conclusion

Family Financial Planning FAQs

Family financial planning is the process of creating a financial plan that helps families manage their finances, save for the future, and achieve their financial goals.

Family financial planning is important because it helps families manage their finances effectively and prepare for unexpected expenses. It can also help individuals and families achieve their long-term financial goals, such as retirement or buying a home.

To create a family financial plan, start by assessing your financial situation, setting financial goals, and creating a plan to achieve those goals. Consider working with a financial advisor to help create a comprehensive financial plan that meets your needs.

Common types of insurance coverage to consider in family financial planning include health, life, home, and auto insurance. Researching your options and choosing the coverage that best fits your needs and budget is important.

Estate planning can be included in family financial planning by creating a plan to transfer your assets to your heirs after you pass away. This can help minimize estate taxes and ensure that your assets are distributed according to your wishes. Consider working with an attorney to create a will and set up trusts that meet your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.