An Annual Plan Review is a systematic and regular evaluation of an individual's or a company's financial plan to ensure that the plan remains aligned with current goals and objectives. The importance of an Annual Plan Review must be considered. It enables individuals and businesses to monitor their financial progress, identify potential issues, and make necessary adjustments to stay on track to achieve their goals. The primary goals and objectives of an Annual Plan Review include: Assessing the current financial situation Identifying areas for improvement Setting new or revising existing financial goals Developing an action plan to achieve these goals It's crucial to select a suitable time for the Annual Plan Review, ideally at the end of the fiscal year or the beginning of the calendar year. This timing allows for a comprehensive assessment of the previous year's financial performance and a fresh start for the new year. Invite all relevant stakeholders, including family members, business partners, and financial advisors, to participate in the Annual Plan Review. Their input will ensure a thorough analysis of the financial situation and a collaborative approach to decision-making. Before the review meeting, gather all necessary financial documents and information, including: Tax documents Investment statements Insurance policies Analyze the previous year's financial performance by comparing actual results to the budget. Identify areas where the actual performance deviated from the budget and determine the reasons for these variances. Understanding the reasons behind variances will help make informed decisions about adjusting the financial plan. This may involve cutting expenses, reallocating resources, or modifying investment strategies. Examine the current asset allocation to ensure it aligns with the individual's or company's risk tolerance and financial goals. This may involve adjusting the mix of stocks, bonds, and other investment types. Assess the risk tolerance of the individual or company to ensure the investment portfolio reflects the desired level of risk. Depending on the risk appetite, this may require adjusting the investment strategy to be more aggressive or conservative. Evaluate the portfolio's investment returns, comparing them to relevant benchmarks and considering the overall performance in the context of the individual's or company's financial goals. Examine the tax efficiency of the investment portfolio, identifying opportunities to minimize tax liability through tax-advantaged accounts, such as IRAs or 401(k)s, and tax-efficient investments, such as municipal bonds. Review the available tax deductions and credits to ensure the individual or company takes full advantage of tax-saving opportunities. Consider year-end tax planning strategies to minimize further tax liability, such as deferring income, accelerating deductions, or harvesting tax losses. Determine the appropriate amount of life insurance coverage needed to protect dependents and meet financial obligations in the event of the policyholder's death. Examine existing life insurance policies, compare the benefits and costs of term and permanent life insurance options, and consider making adjustments to ensure adequate coverage. Review health insurance options to ensure the individual or company has the most suitable coverage, taking into account factors such as premiums, out-of-pocket expenses, and network availability. Analyze out-of-pocket expenses, such as deductibles, copayments, and coinsurance, to ensure they align with the individual's or company's financial situation and risk tolerance. Review homeowner's or renters' insurance policies to ensure adequate coverage for the property, its contents, and liability protection. Evaluate auto insurance policies to ensure appropriate coverage levels, considering factors such as collision, comprehensive, and liability coverage, as well as deductibles and premium costs. Examine liability insurance policies, such as umbrella policies, to ensure sufficient protection against potential lawsuits and other liability risks. Determine the appropriate level of disability insurance coverage needed to replace income in the event of a disability that prevents the individual from working. Evaluate existing disability insurance policies, compare the benefits, costs, and coverage periods, and consider making adjustments to ensure adequate income protection. Ensure that beneficiary designations on wills, trusts, and other financial accounts are up to date and accurately reflect the individual's or company's wishes. Examine the provisions of wills and trusts to ensure they align with the individual's or company's intentions for asset distribution upon death. Review financial power of attorney documents to ensure that the designated agent is still appropriate and capable of managing financial affairs in the event of incapacity. Examine health care power of attorney documents to ensure that the designated agent is still appropriate and capable of making health care decisions in the event of incapacity. Review estate planning strategies to minimize potential estate taxes, such as gifting assets, establishing trusts, or utilizing life insurance to cover potential tax liabilities. Based on the outcomes of the Annual Plan Review, set new or revised existing financial goals, taking into consideration short-term, mid-term, and long-term objectives. Create a prioritized list of action steps to achieve the financial goals, including a timeline for implementation and a clear plan for monitoring progress. Identify the resources and support needed to achieve the financial goals, such as financial advisors, tax professionals, and estate planning attorneys. Implement the action plan by making necessary adjustments to investments, updating insurance coverage, and executing tax strategies. Schedule periodic check-ins to track goal achievement and adjust the plan as needed, ensuring continued progress toward financial objectives. An Annual Plan Review is a crucial aspect of financial planning that enables individuals and businesses to monitor their progress towards their financial goals, identify potential issues, and make necessary adjustments. The review process involves a comprehensive analysis of various financial aspects, such as investments, insurance, and estate planning. A thorough Annual Plan Review can help individuals and businesses assess their current financial situation, identify areas for improvement, set new or revise existing financial goals, and develop an action plan to achieve these goals. By making Annual Plan Reviews a priority, individuals and businesses can maintain financial stability and work towards achieving their long-term objectives. Remember to consult with professionals, such as financial advisors, tax services, and estate planning attorneys, to get the expert guidance needed to make informed decisions and optimize financial strategies. What Is an Annual Plan Review?

This review is typically conducted once a year and involves an in-depth analysis of various financial aspects, such as investments, insurance, and estate planning.Importance of Conducting an Annual Plan Review

The review process also serves as an opportunity to reassess priorities, evaluate investment strategies, and optimize tax planning.Goals and Objectives of an Annual Plan Review

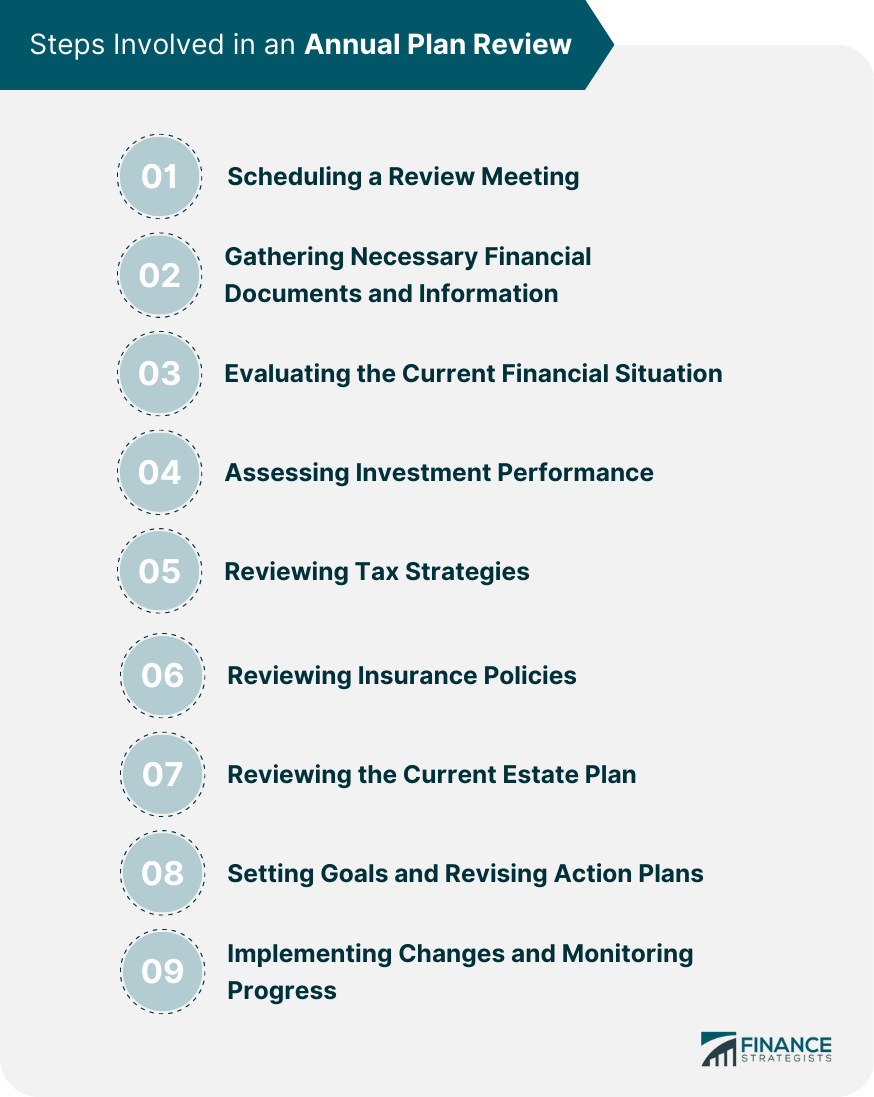

Scheduling a Review Meeting

Gathering Necessary Financial Documents and Information

Evaluating the Current Financial Situation

Assessing Investment Performance

Reviewing Tax Strategies

Reviewing Insurance Policies

Life Insurance

Health Insurance

Property and Casualty Insurance

Disability Insurance

Reviewing the Current Estate Plan

Reviewing Wills and Trusts

Evaluating Power of Attorney Documents

Assessing Strategies for Minimizing Estate Taxes

Setting Goals and Revising Action Plans

Implementing Changes and Monitoring Progress

Conclusion

Annual Plan Review FAQs

An Annual Plan Review is a process of evaluating and assessing an organization's goals and objectives over the past year and creating a plan for the upcoming year.

An organization's management team is usually responsible for conducting an Annual Plan Review. However, sometimes a specific committee or group of individuals may be assigned to lead the review process.

An Annual Plan Review can help an organization identify areas where they excel and need to improve. It can also help to ensure that the organization is aligned with its goals and objectives and can help to identify any new opportunities or challenges.

An organization should conduct an Annual Plan Review once a year, typically at the end of the fiscal year, to evaluate its performance over the past year and plan for the upcoming year.

An Annual Plan Review may include reviewing the organization's financial performance, goals and objectives, and strategies. It may also include an analysis of the organization's strengths and weaknesses, opportunities, and threats.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.