Data gathering in financial planning refers to the process of collecting and analyzing relevant financial information about a client, including their financial goals, income, expenses, assets, liabilities, and risk tolerance. Accurate and comprehensive data gathering is a crucial component of effective financial planning, as it forms the foundation upon which all other aspects of the planning process are built. It is a critical aspect of financial planning that lays the foundation for a successful financial future. Financial planning involves assessing an individual's current financial status, identifying their financial goals, and developing a roadmap to achieve those goals. This information is used to create a comprehensive financial plan that addresses an individual's unique circumstances. Without accurate and reliable data, financial planning is difficult, if not impossible, and can lead to inaccurate assumptions, unrealistic expectations, and poor financial decisions. Therefore, data gathering is a crucial step in financial planning that sets the stage for sound financial decision-making and long-term financial success. Collecting personal and demographic information is essential for understanding a client's background and unique circumstances. This information includes: 1. Age, gender, and marital status 2. Number of dependents 3. Contact information Accurate financial data is necessary to assess a client's financial health and make informed decisions. Key financial data includes: 1. Income sources and amounts 2. Expenses and spending patterns 3. Assets and liabilities 4. Insurance coverage 5. Tax information To design an effective investment strategy, planners need to gather information about a client's investment preferences and existing portfolio. This includes: 1. Existing investment portfolio 2. Investment goals and risk tolerance 3. The time horizon for investments A comprehensive interview with the client can help gather relevant information for financial planning. Interviews can be conducted in person or via phone or video conferences. Questionnaires and surveys provide a structured way to collect data. These can be administered through online or paper-based forms and can be customized according to the client's needs. Reviewing financial records, such as bank statements, investment accounts, tax returns, and insurance policies, offers an accurate representation of the client's financial situation. Working with other professionals, such as accountants, estate planners, and insurance agents, can help gather additional insights and information pertinent to the client's financial plan. Comparing client-provided data with financial records and verifying with third-party sources can help ensure the accuracy and reliability of the information used in the financial planning process. By identifying discrepancies and gaps in the provided data, financial planners can address concerns and clarify uncertainties, ensuring that they have a complete and accurate understanding of the client's financial situation. Financial planners must adhere to ethical guidelines and maintain the confidentiality of their client's sensitive information. Implementing secure storage and handling procedures for sensitive client data is essential to protect privacy and comply with data protection regulations, such as GDPR and CCPA. Financial planners should analyze and interpret the collected data to gain insights into the client's financial strengths, weaknesses, and opportunities for growth. By evaluating the collected data, planners can identify areas where the client is performing well and areas that need improvement. Using the insights gained from the data analysis, financial planners can develop a comprehensive financial plan tailored to the client's specific goals and circumstances. Regularly reviewing and updating the financial plan based on the client's changing needs and circumstances ensures that the plan remains relevant and effective. To ensure accurate and comprehensive data gathering in financial planning, there are several best practices that individuals should follow. Firstly, individuals should ensure that they collect all relevant financial documents, such as tax returns, bank statements, investment statements, and debt statements. This ensures that all financial information is included in the data gathering process. Secondly, individuals should track their spending and income over a period of time to get an accurate picture of their financial habits. This helps to identify areas for improvement and potential savings. Thirdly, individuals should set clear financial goals and priorities, such as saving for retirement or paying off debt. This helps to guide the data gathering process and ensures that the financial plan is tailored to their specific needs. Lastly, individuals should consider seeking the assistance of a financial planner or advisor to ensure that their data gathering is thorough and accurate, and that their financial plan is sound and aligned with their goals. By following these best practices, individuals can gather the necessary data to create a comprehensive financial plan that sets them up for long-term financial success. Data gathering is a critical component of the financial planning process. By collecting accurate and comprehensive information, financial planners can develop tailored strategies to help clients achieve their financial goals. Adhering to best practices in data gathering, verification, and privacy ensures that clients can trust their financial planners with their sensitive information. Ultimately, the success of financial planning is heavily reliant on the quality of data collected and the expertise of the financial planner in analyzing and utilizing this data to create effective financial strategies.What Is Data Gathering in Financial Planning?

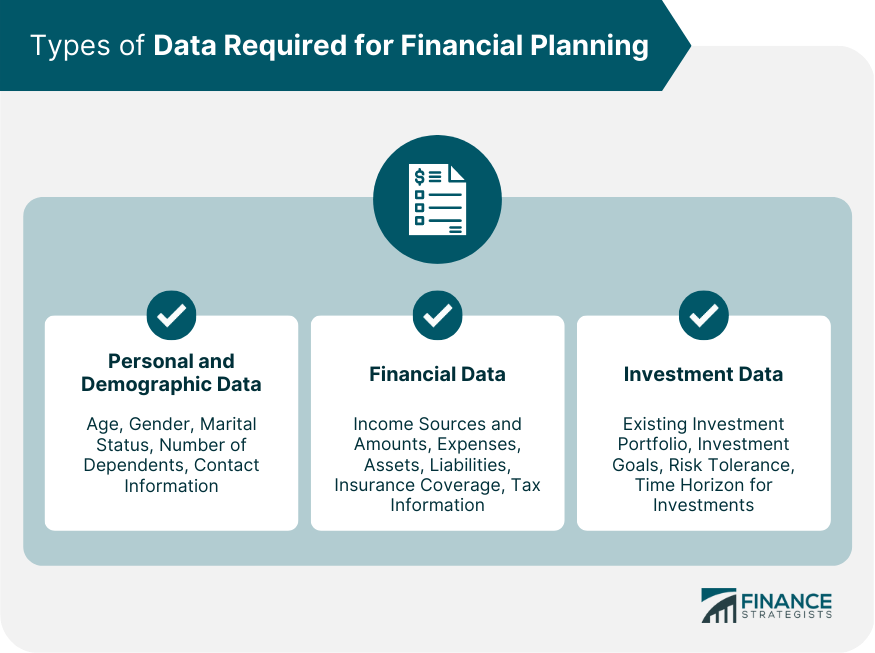

Types of Data Required for Financial Planning

Personal and Demographic Data

Financial Data

Investment Data

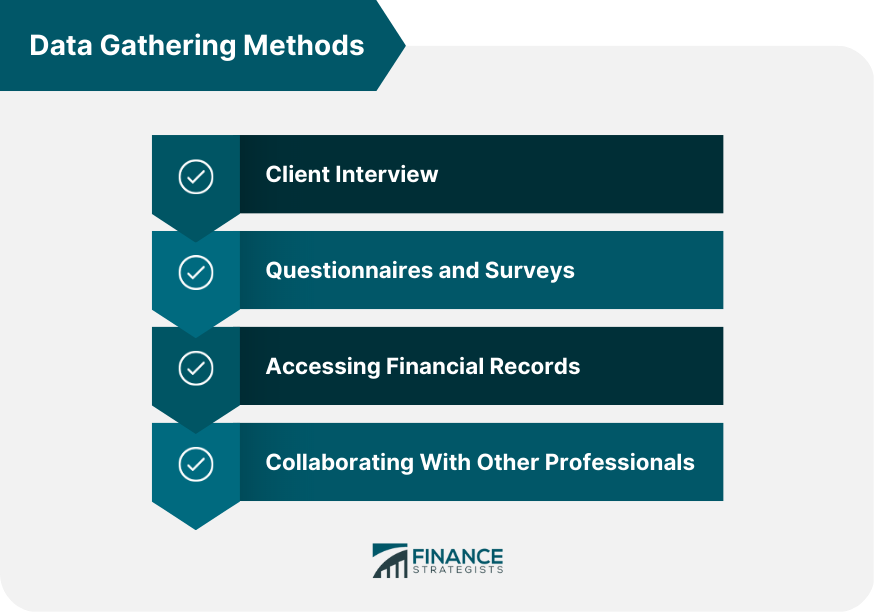

Data Gathering Methods

Client Interview

Questionnaires and Surveys

Accessing Financial Records

Collaborating With Other Professionals

Data Verification and Validation

Cross-Checking Information

Ensuring Data Accuracy and Completeness

Data Security and Privacy

Confidentiality and Ethical Considerations

Secure Storage and Handling of Sensitive Information

Utilizing Data for Financial Planning and Decision Making

Analyzing and Interpreting Collected Data

Identifying Client's Financial Strengths and Weaknesses

Developing a Comprehensive Financial Plan

Monitoring Progress and Adjusting the Plan as Needed

Best Practices in Data Gathering

Conclusion

Data Required for Financial Planning FAQs

Data gathering in financial planning is crucial because it provides the foundation for creating a comprehensive financial plan tailored to an individual's unique financial situation and goals. The accuracy and completeness of the collected data directly impact the effectiveness of the financial plan.

The key types of data required for data gathering in financial planning include personal and demographic data (age, gender, marital status, etc.), financial data (income, expenses, assets, liabilities, etc.), and investment data (existing portfolio, investment goals, and risk tolerance).

Common methods for data gathering in financial planning include client interviews (in-person or via phone/video conferences), questionnaires and surveys, accessing financial records (bank statements, tax returns, insurance policies, etc.), and collaborating with other professionals (accountants, estate planners, insurance agents).

Financial planners can ensure the accuracy of the data gathered in financial planning by cross-checking client-provided information with financial records, verifying data with third-party sources, and addressing any discrepancies or gaps in the information.

Financial planners maintain confidentiality and security during the data gathering in financial planning process by adhering to ethical guidelines, implementing secure storage and handling procedures for sensitive client data, and complying with data protection regulations such as GDPR and CCPA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.