Digital financial planning platforms are online tools or applications that provide individuals with a convenient and accessible way to create and manage their financial plans. These platforms use algorithms and data analytics to offer personalized recommendations and advice based on a user's financial goals, situation, and risk tolerance. Digital financial planning platforms typically offer a range of features, including budgeting tools, investment analysis and tracking, retirement planning, and debt management, among others. They may also incorporate automated financial management and robo-advisory services, which can help users make investment decisions and manage their portfolios. By leveraging technology and data-driven insights, digital financial planning platforms aim to democratize access to financial planning services and help users achieve their financial goals more effectively and efficiently. Digital financial planning platforms offer expense-tracking features, enabling users to categorize and monitor their spending habits. By consolidating all expenses in one place, users can identify areas where they may be overspending and adjust their budgets accordingly. These platforms also provide income management tools to help users track their various income sources, such as salaries, dividends, or rental income. This feature enables a holistic view of one's financial situation, allowing for better budgeting and financial planning. Setting and achieving savings goals is a crucial aspect of financial planning. Digital platforms provide tools that allow users to set specific goals, monitor progress, and make adjustments as needed to stay on track. Digital financial planning platforms often include features for analyzing investment portfolios. Users can track the performance of individual assets, view historical trends, and assess the overall health of their investment portfolios. Understanding and managing risk is a critical aspect of investing. Many platforms offer risk assessment tools that help users evaluate their risk tolerance, align their investment strategies accordingly, and maintain a well-balanced portfolio. Proper asset allocation is essential for long-term financial success. Digital platforms offer tools that guide users in diversifying their investments across various asset classes, ensuring a balanced and optimized portfolio. Retirement planning tools on digital platforms help users analyze their pension plans, projecting expected payouts and determining how much they need to save to maintain their desired lifestyle during retirement. These platforms also provide tools that estimate social security benefits based on individual circumstances, helping users understand how these benefits will impact their retirement income. Digital financial planning platforms offer guidance on long-term savings strategies, including investment options and tax-advantaged accounts tailored to retirement planning. Tax optimization tools help users identify potential deductions and credits, ensuring they take full advantage of tax-saving opportunities. Some platforms provide guidance on tax-efficient investment strategies, such as utilizing tax-advantaged accounts or implementing tax-loss harvesting techniques. Many digital financial planning platforms offer tax filing support, making the process of submitting tax returns more manageable and efficient. Setting short-term financial objectives is an essential aspect of financial planning. Digital platforms offer tools that help users establish, track, and achieve these goals. Similarly, these platforms provide tools for setting and monitoring medium-term milestones, ensuring users stay on track to achieve their financial goals. Digital financial planning platforms also support long-term goal setting and monitoring, helping users plan for major life events such as buying a home, starting a family, or retiring comfortably. Innovative fintech startups are at the forefront of the digital financial planning market, introducing disruptive technologies and solutions to traditional financial planning processes. Many traditional financial institutions have adopted digital financial planning platforms to stay competitive in the rapidly evolving financial services landscape. Robo-advisors are automated investment management platforms that use algorithms to provide users with financial planning and investment advice, making them a popular option for those seeking digital financial planning solutions. Financial planning software providers develop and maintain the underlying technology and tools that power digital financial planning platforms, playing a crucial role in the market's ongoing growth and development. One of the main advantages of digital financial planning platforms is their accessibility and convenience. Users can access these platforms anytime, anywhere, through their computers or mobile devices. Digital platforms are often more cost-effective than traditional financial planning services, making them an attractive option for individuals looking to manage their finances without incurring high fees or costs. Digital financial planning platforms provide personalized and customized financial advice based on individual circumstances, goals, and risk tolerance. This tailored approach enables users to make informed decisions that align with their unique financial objectives. These platforms prioritize data security and privacy, using advanced encryption and authentication methods to protect users' sensitive financial information. Digital financial planning platforms provide users with a wealth of information and tools to make informed financial decisions, leading to better financial outcomes and long-term success. One of the main challenges faced by digital financial planning platforms is the need for users to have a basic level of financial literacy to effectively use the tools and resources provided. Building trust and credibility among users is another challenge for digital financial planning platforms, as users may be skeptical of entrusting their financial information to a digital platform. Digital financial planning platforms must navigate complex regulatory and compliance requirements, which can be a barrier to entry and growth in the market. Some users may be hesitant to adopt digital financial planning platforms due to a lack of technological knowledge or concerns about security and privacy, presenting an ongoing challenge for the industry. Artificial intelligence is poised to play an increasingly significant role in digital financial planning platforms, enhancing personalization, decision-making, and predictive analytics. Blockchain technology and decentralized finance have the potential to transform the digital financial planning market by introducing new, secure, and transparent financial solutions. As mobile technology continues to advance, digital financial planning platforms will increasingly focus on mobile-first experiences, making financial planning more accessible and convenient for users. Future innovations in digital financial planning may include collaborative tools that allow users to work together with financial advisors, family members, or friends, fostering a more inclusive and supportive approach to financial planning. Digital financial planning platforms are transforming the way individuals manage their finances, offering a wealth of features, tools, and resources that empower users to make informed financial decisions. As technology continues to evolve, these platforms will become even more accessible, personalized, and powerful, helping individuals take control of their financial future. Ongoing innovation and adaptation within the financial planning industry will continue to shape the landscape, offering new opportunities and challenges for both users and providers alike.What Are Digital Financial Planning Platforms?

Features of Digital Financial Planning Platforms

Budgeting Tools

Expense Tracking

Income Management

Savings Goals

Investment Management

Portfolio Analysis

Risk Assessment

Asset Allocation

Retirement Planning

Pension Analysis

Social Security Projections

Long-Term Savings Strategies

Tax Optimization

Deductions and Credits

Tax-Efficient Investment Strategies

Tax Filing Support

Financial Goal Setting and Monitoring

Short-Term Objectives

Medium-Term Milestones

Long-Term Goals

Key Players in the Digital Financial Planning Market

Fintech Startups

Traditional Financial Institutions

Robo-Advisors

Financial Planning Software Providers

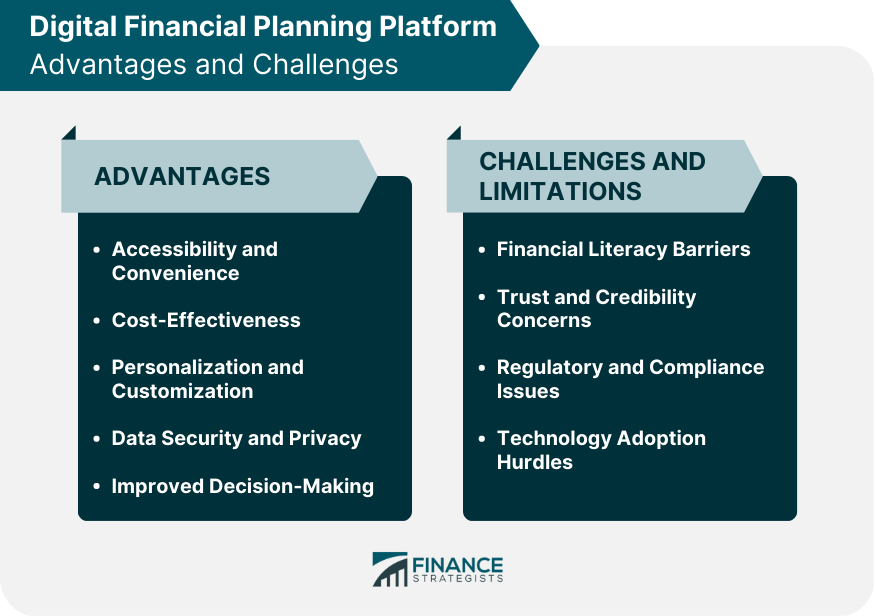

Advantages of Digital Financial Planning Platforms

Accessibility and Convenience

Cost-Effectiveness

Personalization and Customization

Data Security and Privacy

Improved Decision-Making

Challenges and Limitations

Financial Literacy Barriers

Trust and Credibility Concerns

Regulatory and Compliance Issues

Technology Adoption Hurdles

Future Trends and Innovations

Integration of Artificial Intelligence

Blockchain and Decentralized Finance

Mobile-First Financial Planning

Collaborative Financial Planning Tools

Final Thoughts

Digital Financial Planning Platforms FAQs

Digital financial planning platforms are online tools and services that simplify the process of managing personal finances, investments, and taxes. They are important because they provide users with a convenient, cost-effective, and personalized approach to financial planning, enabling them to make informed decisions and achieve their financial goals.

Digital financial planning platforms typically offer a range of features, including budgeting tools, investment management, retirement planning, tax optimization, and financial goal setting and monitoring. These features empower users to manage their finances effectively and make informed decisions tailored to their unique financial situations.

The main advantages of using digital financial planning platforms include accessibility and convenience, cost-effectiveness, personalization and customization, data security and privacy, and improved decision-making. These benefits make digital platforms an attractive option for individuals seeking efficient and user-friendly financial planning solutions.

Key players in the digital financial planning market include fintech startups, traditional financial institutions, robo-advisors, and financial planning software providers. These players contribute to the growth and development of the market by offering innovative solutions and technologies that cater to the evolving needs of users.

Digital financial planning platforms face challenges such as financial literacy barriers, trust and credibility concerns, regulatory and compliance issues, and technology adoption hurdles. Future trends in the industry include the integration of artificial intelligence, the adoption of blockchain and decentralized finance, mobile-first financial planning experiences, and the development of collaborative financial planning tools.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.