Financial life planning is a holistic approach to managing personal finances that considers an individual's values, goals, and life stages. It aims to create a customized financial strategy that helps individuals achieve their short-term and long-term objectives while maintaining financial stability and well-being. Financial life planning is crucial as it enables individuals to maintain control over their finances, prepares them for unexpected life events, and helps them make informed decisions to achieve their goals. A well-crafted financial plan also provides a sense of security and peace of mind, knowing that financial resources are being effectively managed. The primary goals of financial life planning are to identify financial priorities, develop a realistic budget, create an investment strategy, manage debt, plan for retirement, and establish a comprehensive estate plan. This process ensures that individuals can achieve financial independence and maintain a desired lifestyle throughout their lives. Effective budgeting and cash flow management are essential for financial stability. This involves tracking income and expenses, setting spending limits, and prioritizing savings. A well-organized budget enables individuals to allocate resources towards their financial goals and avoid unnecessary debt. Savings and investments are critical components of financial life planning. Individuals should develop a plan to consistently save a portion of their income and invest it in a diversified portfolio. This helps to build wealth over time and achieve long-term financial goals, such as purchasing a home or funding a child's education. Managing debt is a crucial aspect of financial life planning. It involves developing strategies to pay off existing debts, minimizing interest payments, and avoiding new debts that could derail financial progress. Proper debt management reduces financial stress and improves credit scores, which can lead to better borrowing terms in the future. Insurance planning is a risk management tool that helps protect individuals and their families from financial hardships caused by unforeseen events, such as illness, disability, or death. A comprehensive insurance plan should include life, health, disability, and property insurance to provide financial security in case of emergencies. Tax planning involves structuring financial transactions and investments to minimize tax liability. This can include strategies such as income splitting, maximizing deductions and credits, and utilizing tax-efficient investment vehicles. Effective tax planning helps individuals keep more of their hard-earned money and enhance their overall financial well-being. Retirement planning is the process of determining income goals for retirement, estimating the required savings, and implementing an investment plan to achieve those objectives. A well-designed retirement plan ensures that individuals can maintain their desired lifestyle after leaving the workforce and have a financially secure retirement. Estate planning involves creating a comprehensive plan to manage an individual's assets during their lifetime and distribute them to beneficiaries upon death. This may include drafting a will, establishing trusts, and designating power of attorney. Proper estate planning ensures that an individual's wishes are carried out and helps minimize potential conflicts among heirs. The first step in the financial life planning process is assessing the current financial situation. This includes gathering information on income, expenses, assets, liabilities, and insurance coverage. A thorough analysis provides a clear understanding of an individual's financial standing and identifies areas that require improvement. Financial life planning begins with identifying personal goals and values. This may include purchasing a home, funding a child's education, starting a business, or retiring comfortably. Aligning financial goals with personal values ensures that financial resources are being directed towards the most meaningful aspects of an individual's life. Based on the current financial situation and identified goals, a customized financial plan is developed. This plan should include detailed steps and strategies to achieve each financial objective. The plan should be comprehensive and cover budgeting, savings, investments, debt management, insurance, tax planning, retirement, and estate planning. Once the financial plan is developed, it's time to put it into action. This involves following the outlined strategies, adjusting spending habits, and making necessary investments. Consistent implementation of the plan is crucial for achieving financial goals and maintaining financial stability. Financial life planning is an ongoing process that requires regular monitoring and adjustments. As life circumstances change, the plan should be reviewed and modified accordingly. This ensures that the financial plan remains relevant and continues to support an individual's evolving goals and needs. Creating achievable financial goals is essential for successful financial life planning. SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound) provide clear direction and make it easier to track progress and make adjustments as needed. An emergency fund is a financial safety net that helps individuals cover unexpected expenses without incurring debt. It is recommended to have three to six months' worth of living expenses in a liquid, easily accessible account. Diversification is a risk management strategy that involves spreading investments across various asset classes, industries, and geographic locations. This reduces the impact of poor performance in one area and helps protect an individual's overall investment portfolio. Insurance is a vital component of financial life planning, providing protection against various risks. It is essential to periodically review and update insurance coverage to ensure that it remains adequate for an individual's changing needs and circumstances. Effective tax planning helps individuals keep more of their hard-earned money and contribute to their overall financial well-being. This involves seeking professional advice, taking advantage of deductions and credits, and using tax-efficient investment vehicles. A well-designed retirement plan is essential for financial security in later life. Individuals should start planning early, regularly review their progress, and make adjustments to ensure they are on track to achieve their desired retirement lifestyle. A comprehensive estate plan ensures that an individual's assets are distributed according to their wishes and minimizes potential conflicts among heirs. This involves drafting a will, establishing trusts, and designating power of attorney. Financial planners are professionals who help individuals create and implement a comprehensive financial plan. They analyze an individual's financial situation, identify goals, and develop customized strategies to achieve those objectives. Choosing a financial planner involves evaluating their qualifications, experience, and areas of expertise. Individuals should look for certified professionals and ask for references to ensure they are working with a competent and trustworthy planner. In addition to financial planners, individuals may need to collaborate with other financial experts such as accountants, tax advisors, and attorneys to address specific financial needs and ensure a comprehensive approach to financial life planning. Financial planning software and apps can help individuals track their income, expenses, savings, and investments. These tools provide a convenient way to monitor financial progress and make adjustments to stay on track with financial goals. A wealth of online resources is available to help individuals improve their financial literacy and make informed decisions. Websites, blogs, podcasts, and webinars offer valuable information on various financial topics and can enhance the effectiveness of financial life planning. Automating financial management tasks, such as bill payments, savings, and investments, can simplify the financial life planning process. Automation ensures that essential tasks are completed on time and reduces the risk of missed payments or delayed savings contributions, which can derail financial progress. Young professionals should focus on building a strong financial foundation by establishing a budget, building an emergency fund, managing student loans, and starting retirement savings. It's also essential to obtain necessary insurance coverage and begin investing to take advantage of compounding returns. Families must consider additional financial responsibilities, such as childcare, education, and housing. Financial life planning for families should include strategies to save for college, protect dependents with life insurance, and plan for future financial needs. Pre-retirees should focus on maximizing retirement savings, paying off debt, and reassessing their investment risk tolerance. It's also crucial to develop a detailed retirement income plan and review estate planning documents. Retirees need to manage their retirement income carefully to ensure it lasts throughout their lifetime. Financial life planning for retirees should involve adjusting investment strategies, managing withdrawal rates, and considering long-term care insurance. Financial life planning provides numerous benefits, including financial stability, the achievement of personal goals, and peace of mind. A comprehensive financial plan helps individuals navigate life's challenges and ensures that their financial resources are effectively managed. Financial education is an essential component of successful financial life planning. Continually learning about personal finance topics enables individuals to make informed decisions and adapt their plans as needed. Financial well-being is closely connected to overall well-being, as financial stress can negatively impact mental and physical health. By prioritizing financial life planning, individuals can improve their overall quality of life and enjoy a more secure, fulfilling future.What Is Financial Life Planning?

Key Components of Financial Life Planning

Budgeting and Cash Flow Management

Saving and Investment Strategies

Debt Management

Insurance Planning

Tax Planning

Retirement Planning

Estate Planning

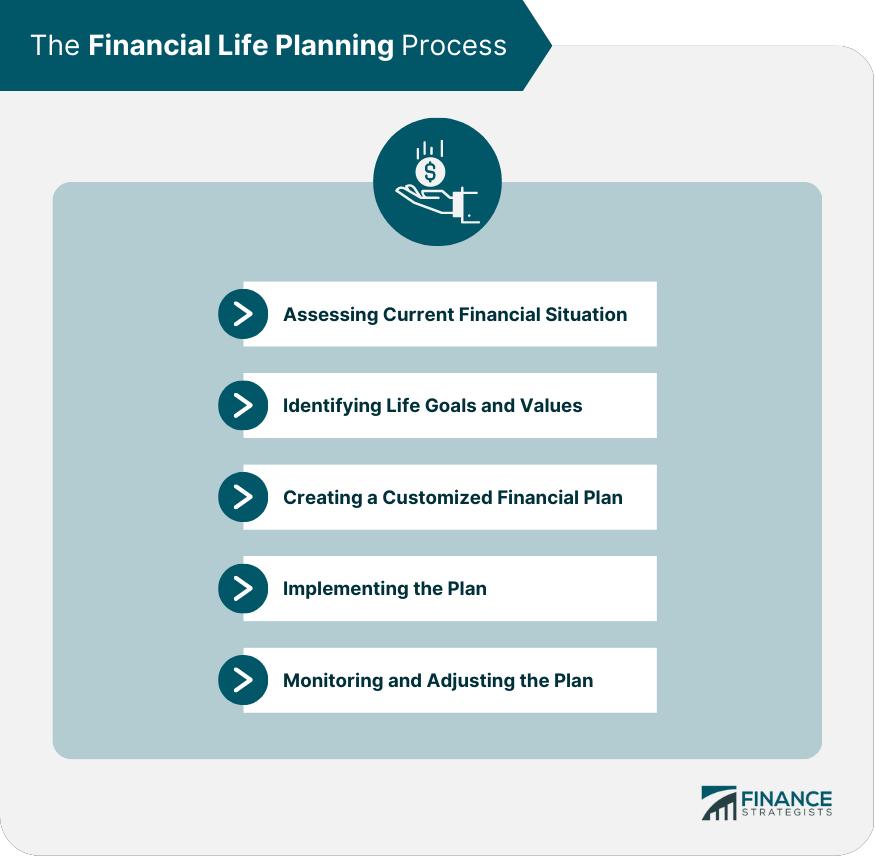

The Financial Life Planning Process

Assessing Current Financial Situation

Identifying Life Goals and Values

Creating a Customized Financial Plan

Implementing the Plan

Monitoring and Adjusting the Plan

Strategies for Successful Financial Life Planning

Setting SMART Goals

Building an Emergency Fund

Diversifying Investments

Managing Risks Through Insurance

Developing Tax-Efficient Strategies

Planning for Retirement

Creating a Comprehensive Estate Plan

Working With Financial Professionals

The Role of Financial Planners

Selecting the Right Financial Planner

Collaborating With Other Financial Experts

Technology and Financial Life Planning

Financial Planning Software and Apps

Online Resources for Financial Education

Automation and Financial Management

Financial Life Planning for Different Life Stages

Financial Planning for Young Professionals

Financial Planning for Families

Financial Planning for Pre-retirees

Financial Planning for Retirees

Conclusion

Financial Life Planning FAQs

Financial life planning is a holistic approach to financial planning that takes into account your life goals, values, and priorities, along with your financial resources. It is a personalized and comprehensive strategy that integrates your financial and life goals.

Financial life planning helps you to align your financial goals with your values and life goals. It allows you to create a personalized roadmap for achieving your financial objectives, while also living a fulfilling life. It can also help you to navigate life transitions and unexpected events.

Anyone who wants to achieve their financial goals while also living a fulfilling life can benefit from financial life planning. It is particularly helpful for those going through life transitions such as starting a family, changing jobs, or retirement.

Traditional financial planning focuses primarily on achieving financial goals such as retirement, investments, and insurance. Financial life planning, on the other hand, takes a more comprehensive approach that also considers your life goals and values, such as personal fulfillment and family relationships.

To get started with financial life planning, you can consult a financial planner who specializes in this approach. You should be prepared to discuss your values, life goals, and financial resources to develop a personalized plan that aligns with your priorities. It is important to review and update your plan regularly to ensure it remains relevant to your changing circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.