Financial plan reassessment is the process of reviewing and evaluating your current financial plan to ensure that it is still aligned with your financial goals, risk tolerance, and current financial situation. This involves analyzing your income, expenses, investments, debts, and other financial factors, and making necessary adjustments to your plan to ensure that it remains relevant and effective in helping you achieve your financial objectives. Reassessing your financial plan regularly is important to ensure that you stay on track towards your financial goals and adapt to any changes in your life or the economy that may affect your financial situation. Marriage or Divorce: Changes in marital status often necessitate adjustments in financial plans, as these events impact income, expenses, and financial responsibilities. Birth or Adoption of a Child: The addition of a family member brings new financial obligations, such as childcare expenses, education savings, and life insurance needs. Job Loss or Promotion: Employment changes can significantly impact income and financial stability, warranting a reassessment of one's financial plan. Retirement or Career Change: As individuals approach retirement or change careers, their financial priorities may shift, requiring adjustments to their financial plans. Significant Changes in Income or Expenses: Large fluctuations in income or expenses can impact one's ability to meet financial goals and may necessitate a plan reassessment. Inheritance or Windfall: Receiving a large sum of money can create new opportunities and challenges, requiring a reevaluation of financial plans and investment strategies. Changes in Investment Performance: Fluctuations in the performance of investments may require adjustments to one's financial plan to ensure goals are still achievable. Changes in Economic Conditions: Economic changes, such as inflation, interest rates, or market conditions, can affect the viability of one's financial plan and may warrant a reassessment. Shift in Risk Tolerance: Changes in an individual's risk tolerance can impact their investment strategy and asset allocation, necessitating a financial plan reassessment. Changes in Financial Objectives: As life circumstances and priorities change, financial goals may evolve, requiring adjustments to one's financial plan. New Investment Opportunities: Emerging investment opportunities may prompt individuals to reassess their financial plans to capitalize on potential growth. Analyze Income, Expenses, Assets, and Liabilities: Assess the current financial situation by examining income, expenses, assets, and liabilities to gain a clear understanding of one's financial standing. Evaluate Financial Goals and Objectives: Review existing financial goals and objectives to determine if they are still relevant and achievable. Examine Impact of Life Events or Financial Changes: Assess the impact of significant life events or financial changes on one's financial situation and determine if adjustments to goals and objectives are necessary. Determine Necessary Adjustments to Goals and Objectives: Based on the identified changes in financial circumstances, adjust financial goals and objectives accordingly. Reevaluate Risk Profile and Asset Allocation: Assess one's risk tolerance and determine if the current asset allocation is still appropriate. Adjust Investment Strategy to Match Risk Tolerance and Goals: Update the investment strategy to align with the revised risk tolerance and financial goals. Adjust Budget and Spending Habits: Modify the budget and spending habits to accommodate changes in financial circumstances and goals. Revise Savings and Investment Plans: Update savings and investment plans to reflect new financial goals and objectives. Update Insurance Coverage and Estate Planning: Review and adjust insurance coverage and estate planning documents to ensure they remain aligned with one's financial goals and personal circumstances. Regularly Review Financial Plan and Performance: Periodically evaluate the financial plan and investment performance to ensure progress is being made toward achieving financial goals. Make Adjustments as Needed to Stay on Track: Continuously monitor and adjust the financial plan as necessary to address changes in personal circumstances, financial conditions, or investment performance. Financial advisors can provide valuable expertise and insights to help individuals navigate the complexities of financial plan reassessment, ensuring the process is conducted thoroughly and effectively. A financial advisor can offer an unbiased perspective on one's financial situation and goals, helping to identify necessary adjustments and develop realistic strategies to achieve those objectives. Financial advisors can assist with implementing changes to one's financial plan and provide ongoing support to monitor progress, making adjustments as needed to keep the plan aligned with evolving circumstances and objectives. Regular financial plan reassessment is crucial for ensuring one's financial strategy remains relevant and effective in achieving desired goals. By staying proactive and adapting financial plans to changing life circumstances, financial conditions, and personal preferences, individuals can better position themselves for long-term financial success and stability. Financial advisors can play a valuable role in guiding individuals through the reassessment process, offering expert advice and support to help navigate the complexities of financial planning and achieve lasting financial growth.What Is Financial Plan Reassessment?

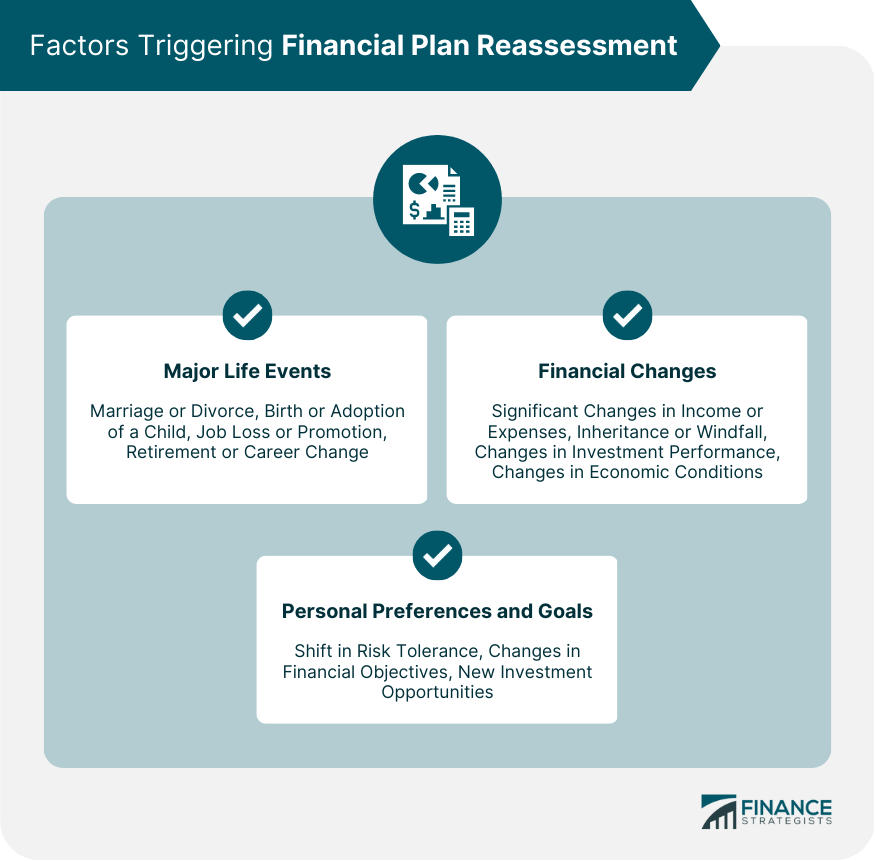

Factors Triggering Financial Plan Reassessment

Major Life Events

Financial Changes

Personal Preferences and Goals

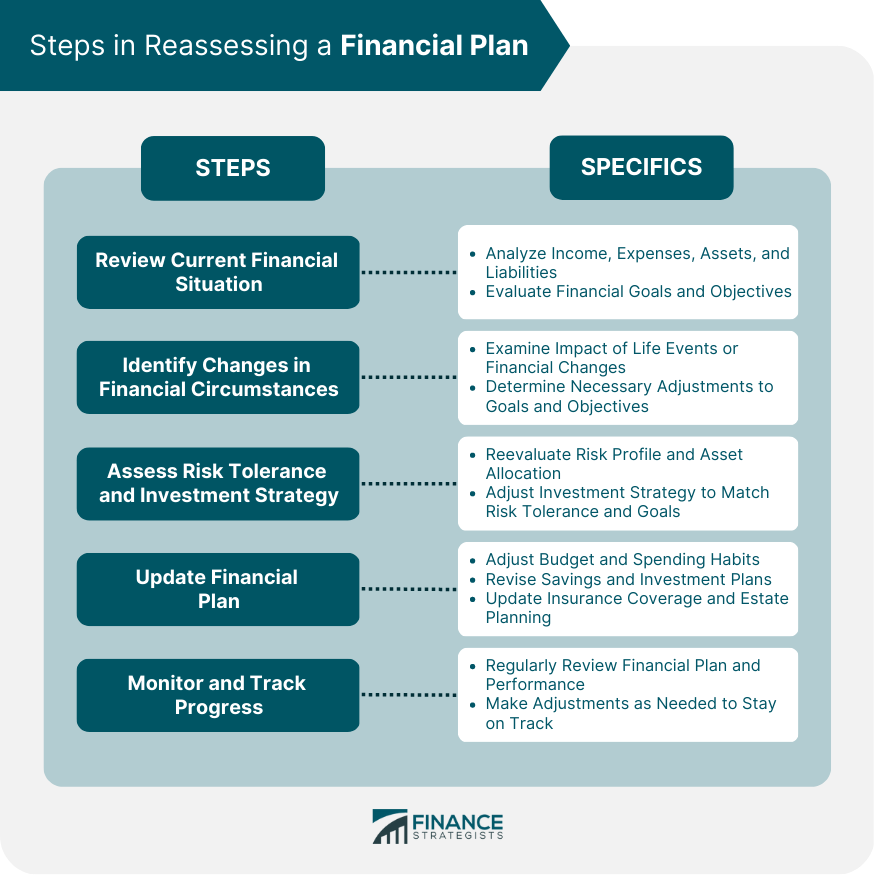

Steps in Reassessing a Financial Plan

Review Current Financial Situation

Identify Changes in Financial Circumstances

Assess Risk Tolerance and Investment Strategy

Update Financial Plan

Monitor and Track Progress

Role of Financial Advisors in Financial Plan Reassessment

Expert Guidance and Advice

Objective Evaluation of Financial Situation and Goals

Assistance With Implementing Changes and Monitoring Progress

Conclusion

Financial Plan Reassessment FAQs

Reassessing your financial plan allows you to ensure that your goals are still achievable and that your investments are still aligned with your risk tolerance. It also helps you to adjust your plan as your financial situation changes.

It is recommended to reassess your financial plan every year or whenever there is a significant change in your financial situation such as a new job, inheritance, or major life event such as marriage, divorce, or retirement.

It is recommended to review your financial plan annually or whenever there is a significant change in your life or financial situation. This will ensure that your financial plan remains relevant and effective.

Reassessing your financial plan can help you to identify any gaps or areas that need improvement. It can also help you to align your plan with your current goals and financial situation, reduce unnecessary expenses, and ultimately achieve financial success.

You can reassess your financial plan on your own if you have the necessary knowledge and skills, but it is recommended to seek professional help from a financial planner or advisor. They can provide valuable insights and recommendations, as well as help you to create a more comprehensive and effective financial plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.