A financial plan review is a process of evaluating your existing financial plan to determine whether it still aligns with your financial goals and objectives. This review typically includes an analysis of your income, expenses, assets, liabilities, and investments to identify any gaps, inefficiencies, or areas that require adjustment. The purpose of a financial plan review is to ensure that your plan remains relevant and effective in helping you achieve your financial goals over time. Financial plan reviews are essential because they provide an opportunity to assess your progress and make necessary changes to your plan. A review can help you identify potential risks, opportunities, and financial priorities, as well as help you make informed decisions about your investments, retirement planning, and other financial goals. A financial plan review begins with reassessing one's financial goals. These goals may evolve over time due to changes in life circumstances, such as marriage, having children, or changing careers. Regularly revisiting these goals ensures that the financial plan remains aligned with an individual's current needs and priorities. Examining one's budget is an integral part of a financial plan review. This analysis involves evaluating income, expenses, and savings to identify areas of improvement, reduce unnecessary spending, and optimize financial resources. A review of investment performance is essential in determining whether the chosen investment strategies are yielding the desired results. This evaluation involves examining the performance of individual investments and overall portfolios, adjusting asset allocation, and identifying opportunities for diversification. Assessing one's risk tolerance is a vital component of a financial plan review. As individuals progress through different life stages, their risk tolerance may change. Regularly reassessing risk tolerance ensures that investment strategies align with one's current appetite for risk. A financial plan review should include an evaluation of one's retirement planning strategies. This involves assessing the progress towards retirement goals, considering factors such as current savings, estimated retirement expenses, and anticipated sources of income during retirement. Regularly reviewing insurance coverage ensures that individuals have adequate protection against unforeseen risks. This includes evaluating the appropriateness of existing policies, identifying gaps in coverage, and adjusting coverage levels as needed. A financial plan review should also involve assessing tax planning strategies. This includes evaluating current strategies for minimizing tax liabilities, identifying tax-saving opportunities, and ensuring compliance with tax laws and regulations. Finally, a financial plan review should include a review of one's estate planning documents. This involves ensuring that wills, trusts, and other estate planning documents are up to date and accurately reflect an individual's wishes. The financial plan review process begins with gathering relevant financial documents and assessing one's current financial situation. This includes reviewing account statements, investment portfolios, insurance policies, and other essential financial records. The next step is to compare the current financial situation to one's financial goals, evaluate investment performance, identify gaps in insurance coverage, assess tax planning strategies, and review estate planning documents. Based on the findings of the review and analysis, adjustments may be necessary to realign the financial plan with one's goals. This includes updating financial goals, optimizing budget and spending, adjusting investment strategies, updating insurance coverage, implementing tax-saving strategies, and revising estate planning documents. The final step in the financial plan review process is to implement the recommended adjustments and regularly monitor progress. This includes scheduling future financial plan reviews to ensure continued alignment with one's financial goals. A regular financial plan review offers several benefits that contribute to an individual's financial well-being and long-term success. These benefits include: One of the main benefits of a financial plan review is that it ensures alignment between an individual's financial plan and their goals. As life circumstances change and financial goals evolve, a regular review helps to make necessary adjustments to stay on track and maintain progress towards achieving these goals. A financial plan review provides an opportunity to analyze income, expenses, and savings to identify areas for improvement. By examining spending habits and optimizing budgets, individuals can effectively allocate their financial resources to achieve their financial goals more efficiently. Regularly reviewing insurance coverage as part of a financial plan review ensures that individuals have adequate protection against unforeseen risks such as illness, disability, or property damage. This helps to maintain financial stability and avoid potential financial hardships in the event of unexpected life events. A financial plan review involves assessing tax planning strategies to ensure compliance with tax laws and identify opportunities for tax savings. By regularly reviewing and adjusting tax strategies, individuals can minimize their tax liabilities and maximize their after-tax income. Regular financial plan reviews contribute to an individual's peace of mind by providing the confidence that their financial plan is aligned with their goals and that they are on track to achieve financial success. This sense of financial security can reduce stress and improve overall well-being. A financial plan review promotes proactive financial planning by encouraging individuals to regularly evaluate their financial situation and make adjustments as needed. This proactive approach can lead to better financial decision-making and improved long-term financial outcomes. For those who work with financial advisors, regular financial plan reviews facilitate ongoing collaboration and communication between the client and the advisor. This ensures that the advisor remains informed of any changes in the client's financial situation or goals, allowing them to provide tailored advice and recommendations to help the client achieve their objectives. Regular financial plan reviews are essential for maintaining financial health and achieving long-term financial success. By proactively reassessing financial goals, analyzing budgets, evaluating investment performance, and reviewing insurance coverage, tax planning strategies, and estate planning documents, individuals can ensure that their financial plans remain aligned with their evolving needs. Financial advisors can play a crucial role in the financial plan review process, offering expert guidance and recommendations tailored to an individual's unique financial situation. By committing to regular financial plan reviews and working with a trusted financial advisor, individuals can confidently navigate the complexities of personal finance and ultimately achieve their financial goals.What Is a Financial Plan Review?

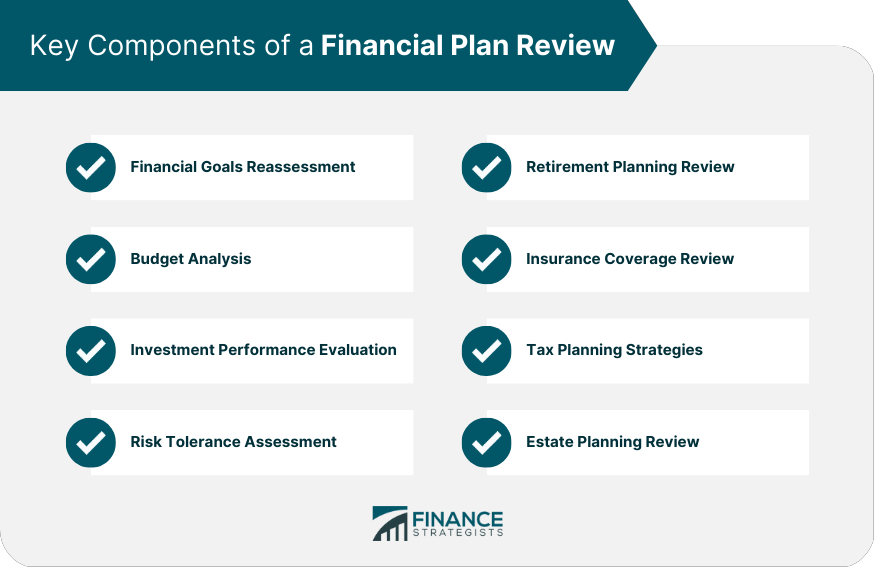

Key Components of a Financial Plan Review

Financial Goals Reassessment

Budget Analysis

Investment Performance Evaluation

Risk Tolerance Assessment

Retirement Planning Review

Insurance Coverage Review

Tax Planning Strategies

Estate Planning Review

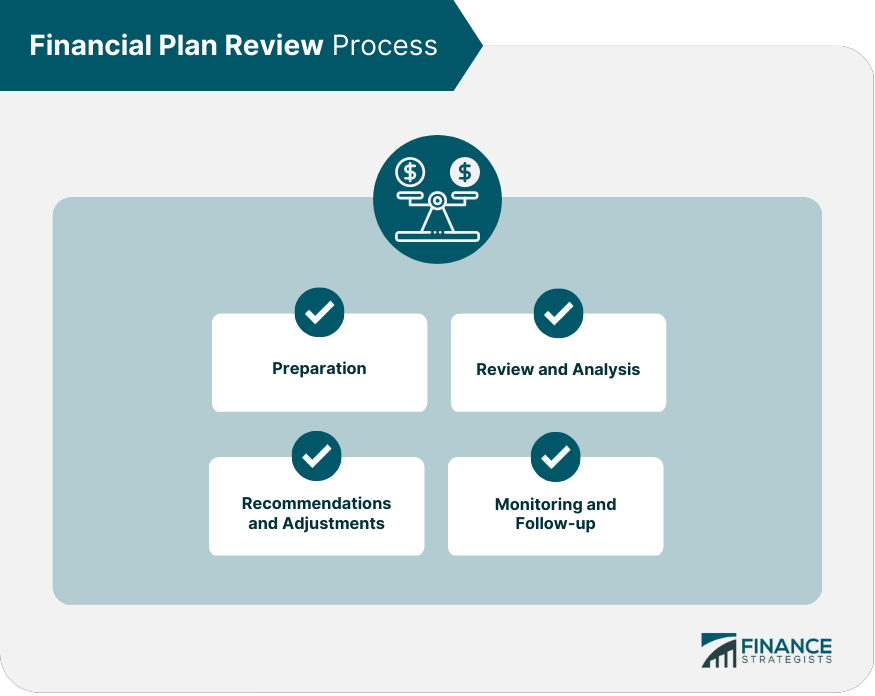

Financial Plan Review Process

Preparation

Review and Analysis

Recommendations and Adjustments

Monitoring and Follow-up

Benefits of a Financial Plan Review

Ensures Alignment With Financial Goals

Optimizes Financial Resources

Protects Against Unforeseen Risks

Helps Minimize Tax Liabilities

Provides Peace of Mind

Encourages Proactive Financial Planning

Facilitates Collaboration With Financial Advisors

Conclusion

Financial Plan Review FAQs

A financial plan review is an assessment of your current financial plan to ensure it is still aligned with your goals and objectives.

A financial plan review is important because it helps you stay on track towards achieving your financial goals. It can identify areas where you may need to make adjustments to your plan and help you avoid costly mistakes.

You should review your financial plan at least once a year or whenever there is a significant change in your financial situation, such as a new job, marriage, or the birth of a child.

A financial advisor can help you conduct a comprehensive financial plan review. They can provide objective advice and guidance on how to optimize your plan and make adjustments as needed.

During a financial plan review, you can expect to discuss your current financial situation, review your goals and objectives, assess your investment portfolio, and evaluate any changes that may be necessary to keep your plan on track.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.