Definition of Financial Planning for Allied Health Professionals

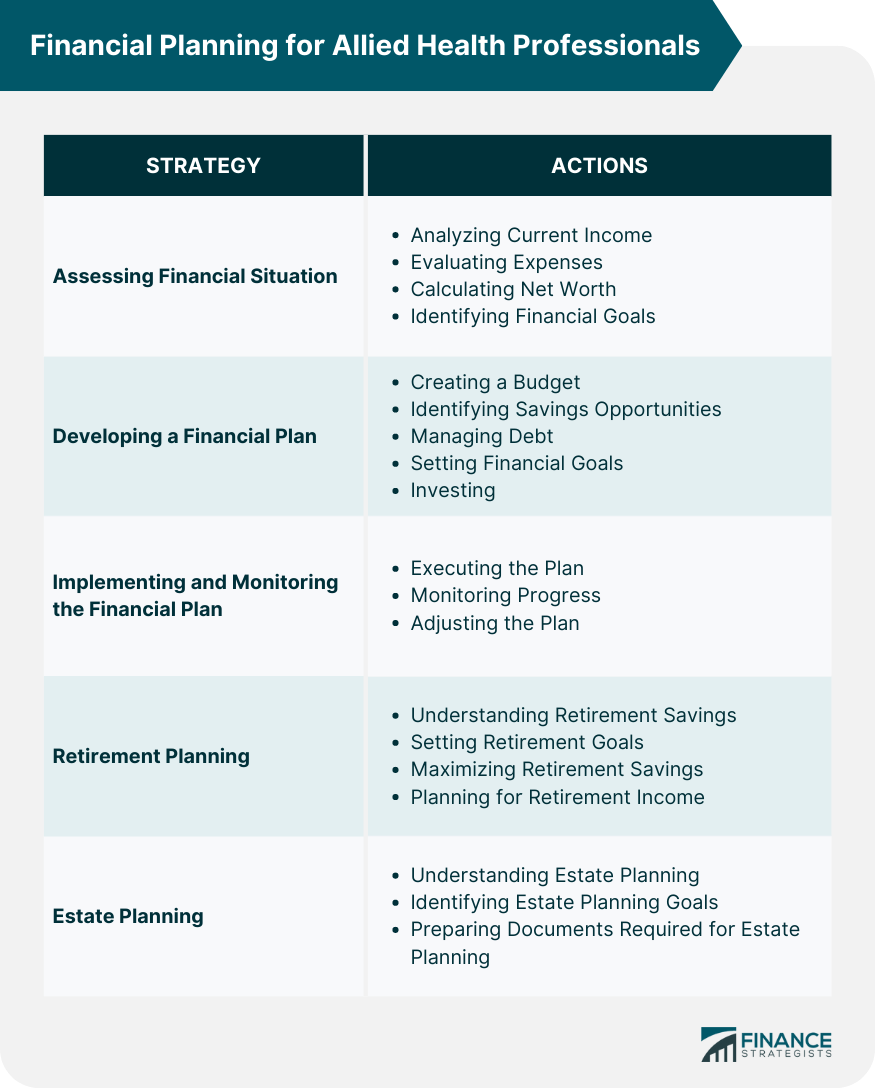

Financial planning for allied health professionals refers to the process of assessing their current financial situation, setting goals, and developing strategies to achieve those goals. This includes budgeting, saving, investing, and planning for retirement and estate.

As an allied health professional, it's essential to create a comprehensive financial plan to ensure financial stability and long-term success.

Financial planning is crucial for allied health professionals to manage their income, expenses, and investments effectively. It allows them to set realistic financial goals, make informed decisions, and achieve financial independence.

By engaging in financial planning, allied health professionals can ensure a stable financial future and focus on their career without financial stress.

Assessing Financial Situation of Allied Health Professionals

Analyzing Current Income of Allied Health Professionals

Understanding the current income of allied health professionals is the first step in financial planning. This includes salaries, bonuses, and any additional income sources.

Knowing their income helps allied health professionals create a realistic budget and identify potential areas for savings and investment.

Evaluating Expenses of Allied Health Professionals

Evaluating expenses is essential for allied health professionals to understand where their money is going. This includes both fixed expenses, such as rent or mortgage payments, and variable expenses, such as entertainment and dining out.

By tracking their expenses, allied health professionals can identify areas where they can cut costs and allocate more money towards savings and investments.

Calculating Net Worth of Allied Health Professionals

Calculating net worth involves subtracting total liabilities (debts) from total assets (savings, investments, and property). Knowing their net worth helps allied health professionals track their financial progress and determine their overall financial health.

Understanding net worth is a crucial step in setting realistic financial goals and creating a comprehensive financial plan.

Identifying Financial Goals of Allied Health Professionals

Allied health professionals should set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals may include saving for a down payment on a home, paying off student loans, or building an emergency fund.

Having clear financial goals provides a roadmap for developing a successful financial plan and helps keep allied health professionals motivated and focused.

Developing a Financial Plan for Allied Health Professionals

Creating a Budget for Allied Health Professionals

A budget is a financial plan that outlines expected income and expenses. It helps allied health professionals manage their money effectively, prioritize their spending, and allocate resources towards their financial goals.

Creating a budget is the foundation of financial planning and provides a clear picture of an allied health professional's financial situation.

Identifying Savings Opportunities for Allied Health Professionals

Identifying savings opportunities involves evaluating expenses and finding areas where costs can be reduced or eliminated. This may include cutting discretionary spending, reducing debt, or increasing income.

By maximizing savings, allied health professionals can allocate more resources towards their financial goals and achieve them more quickly.

Managing Debt for Allied Health Professionals

Managing debt is a crucial aspect of financial planning for allied health professionals. This includes creating a debt repayment plan, prioritizing high-interest debt, and exploring options for debt consolidation or refinancing.

Effectively managing debt can help allied health professionals reduce interest costs, improve their credit score, and achieve financial freedom.

Setting Financial Goals for Allied Health Professionals

Financial goals should be specific, measurable, achievable, relevant, and time-bound. Setting realistic financial goals helps allied health professionals stay focused and motivated throughout their financial planning journey.

By setting and working towards financial goals, allied health professionals can achieve financial stability and success.

Investing for Allied Health Professionals

Investing involves allocating resources into assets that can generate income or appreciate in value over time. For allied health professionals, this may include stocks, bonds, mutual funds, or real estate.

Investing is an important component of financial planning and can help allied health professionals achieve their long-term financial goals, such as retirement or financial independence.

Implementing and Monitoring the Financial Plan for Allied Health Professionals

Executing the Plan

After developing a financial plan, it's crucial to execute the plan and implement the strategies identified. This may include setting up automatic savings or investment contributions, negotiating debt repayment plans, or adjusting spending habits.

By taking action and implementing the financial plan, allied health professionals can achieve their financial goals and improve their financial health.

Monitoring Progress

Monitoring progress involves regularly tracking and evaluating financial goals and strategies. This may include reviewing monthly budgets, tracking investment performance, or evaluating debt reduction progress.

Monitoring progress helps allied health professionals stay on track and make necessary adjustments to their financial plan.

Adjusting the Plan

As financial circumstances change, it's essential to adjust the financial plan accordingly. This may include revising financial goals, adjusting the budget, or changing investment strategies.

By regularly evaluating and adjusting the financial plan, allied health professionals can ensure they remain on track to achieve their financial goals.

Retirement Planning for Allied Health Professionals

Understanding Retirement Savings

Retirement savings refers to setting aside money to fund living expenses during retirement. For allied health professionals, this may include contributing to a 401(k), IRA, or other retirement savings account.

Understanding retirement savings options is essential to developing a successful retirement plan.

Setting Retirement Goals

Setting retirement goals involves determining the amount of money needed to fund retirement living expenses and identifying potential sources of retirement income.

By setting clear retirement goals, allied health professionals can develop a successful retirement plan and ensure financial stability during retirement.

Maximizing Retirement Savings

Maximizing retirement savings involves contributing the maximum amount allowed to retirement savings accounts, taking advantage of employer contributions, and maximizing investment returns.

By maximizing retirement savings, allied health professionals can ensure they have enough funds to cover living expenses during retirement.

Retirement Income

Planning for retirement income involves identifying potential sources of income, such as Social Security, pensions, and investments. It's essential to develop a strategy for withdrawing retirement income and minimizing tax liabilities.

By developing a comprehensive retirement income plan, allied health professionals can ensure they have a stable income during retirement.

Estate Planning for Allied Health Professionals

Understanding Estate Planning

Estate planning involves preparing for the distribution of assets after death. This may include creating a will, setting up trusts, and designating beneficiaries.

Understanding estate planning is essential to ensure assets are distributed according to one's wishes and minimize potential tax liabilities.

Identifying Estate Planning Goals

Identifying estate planning goals involves determining how assets will be distributed and ensuring dependents are provided for.

By setting clear estate planning goals, allied health professionals can develop a successful estate plan and ensure their assets are distributed according to their wishes.

Strategies for Estate Planning

Estate planning strategies may include creating a will, setting up trusts, and designating beneficiaries. It's essential to work with legal and financial professionals to develop an estate plan that meets individual needs and circumstances.

By developing a comprehensive estate plan, allied health professionals can ensure their assets are distributed according to their wishes and minimize potential tax liabilities.

Documents Required for Estate Planning

Documents required for estate planning may include a will, trust documents, power of attorney, and healthcare directives.

By ensuring all necessary documents are in place, allied health professionals can ensure their assets are distributed according to their wishes and minimize potential legal challenges.

Conclusion

Financial planning is essential for allied health professionals to achieve their financial goals, maximize savings, and ensure financial stability.

By assessing their financial situation, developing a comprehensive financial plan, implementing and monitoring the plan, and planning for retirement and estate, allied health professionals can achieve financial success.

Financial planning is essential for allied health professionals to achieve their long-term financial goals and improve their financial health.

By understanding their financial situation, developing a comprehensive financial plan, and implementing and monitoring the plan, allied health professionals can maximize savings, manage debt, and achieve financial stability.

Planning for retirement and estate is also crucial for ensuring financial security during retirement and the distribution of assets after death.

It's essential for allied health professionals to work with financial and legal professionals to develop a plan that meets their individual needs and circumstances.

Overall, by prioritizing financial planning, allied health professionals can achieve financial success and improve their overall well-being.

Financial Planning for Allied Health Professionals FAQs

Financial planning for allied health professionals is the process of managing one's financial resources to achieve short- and long-term financial goals.

Financial planning is crucial for allied health professionals to ensure financial stability, secure their future, and meet their financial goals.

Some financial planning tips for allied health professionals include setting financial goals, creating a budget, managing debt, and investing for the future.

Financial planning can benefit allied health professionals by helping them save for retirement, pay off debt, invest wisely, and achieve financial freedom.

Yes, working with a financial planner can help allied health professionals develop a customized financial plan and receive guidance on investments, retirement planning, and debt management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.