Financial planning for clergy and religious professionals involves the process of creating a long-term strategy for managing financial resources. This includes setting financial goals, creating a budget, saving and investing for the future, planning for retirement, and ensuring that appropriate measures are taken to protect assets and plan for the unexpected. For clergy and religious professionals, financial planning takes on a unique context due to their vocation. It includes considerations for the specific financial needs and circumstances that arise from being in ministry, such as managing housing allowances, tax exemptions, and unique retirement benefits. Financial planning for clergy and religious professionals is not just about managing money, but also about being responsible stewards of the resources entrusted to them. This involves making informed decisions and being intentional with financial choices, in alignment with one's values and mission. Ultimately, financial planning for clergy and religious professionals aims to create financial security, support the work of ministry, and provide a sense of financial well-being for the future. Financial security is crucial for clergy and religious professionals, as it provides stability and support for personal and ministry needs. This may include maintaining a stable income, managing debt, and building savings. Financial planning can help ensure financial security by identifying potential sources of income, creating a budget, and setting financial goals. As stewards of their resources, clergy and religious professionals have a responsibility to manage their finances in a responsible and ethical manner. This involves managing debt, saving for emergencies, and investing for the future. By prioritizing financial planning, clergy and religious professionals can fulfill their responsibilities as stewards and ensure they are using their resources in a responsible and effective manner. Financial planning can also provide support for ministry by ensuring clergy and religious professionals have the resources necessary to fulfill their ministry goals. This may include funding for education, travel, and other ministry expenses. By prioritizing financial planning, clergy and religious professionals can ensure they have the resources necessary to support their ministry and fulfill their calling. Budgeting and saving are crucial components of financial planning for clergy and religious professionals. This involves identifying sources of income, tracking expenses, and creating a spending plan. By developing a budget and saving regularly, clergy and religious professionals can build financial security and support their personal and ministry needs. Retirement planning is essential for clergy and religious professionals to ensure financial stability during retirement. This may include contributing to a retirement savings account, identifying potential sources of retirement income, and developing a retirement income plan. By prioritizing retirement planning, clergy and religious professionals can ensure they have the resources necessary to support themselves during retirement and continue their ministry work. Tax planning is a crucial component of financial planning for clergy and religious professionals due to unique tax considerations. This may include understanding clergy housing allowances, self-employment taxes, and charitable deductions. By understanding tax laws and planning accordingly, clergy and religious professionals can minimize tax liabilities and maximize their resources. Estate planning involves preparing for the distribution of assets after death. This may include creating a will, setting up trusts, and designating beneficiaries. By prioritizing estate planning, clergy and religious professionals can ensure their assets are distributed according to their wishes and minimize potential tax liabilities. Clergy and religious professionals may face challenges related to low income and benefits, making it difficult to achieve financial security. This may include limited retirement benefits or low salaries. By working with financial professionals and utilizing resources for financial planning, clergy and religious professionals can develop strategies to overcome these challenges and achieve financial success. Clergy and religious professionals may also face unique tax considerations, such as clergy housing allowances and self-employment taxes. It's essential to understand these considerations and plan accordingly. By working with tax professionals and utilizing resources for financial planning, clergy and religious professionals can minimize tax liabilities and maximize their resources. Clergy and religious professionals may face ethical and moral considerations related to their finances, such as stewardship and tithing. It's essential to prioritize these considerations and ensure finances are managed in a responsible and ethical manner. By prioritizing ethical and moral considerations and working with financial professionals, clergy and religious professionals can ensure they are using their resources in a responsible and effective manner. Professional financial advisors can provide guidance and support for clergy and religious professionals seeking to improve their financial health. This may include assistance with budgeting, retirement planning, tax planning, and estate planning. By working with a professional financial advisor, clergy and religious professionals can receive personalized advice and support for achieving their financial goals. Denominational resources can provide additional support and guidance for clergy and religious professionals seeking to improve their financial health. This may include financial education programs, counseling services, and resources for retirement and estate planning. By utilizing denominational resources, clergy and religious professionals can receive guidance and support that is tailored to their specific needs and circumstances. Seminaries and continuing education programs can provide additional education and training for clergy and religious professionals seeking to improve their financial literacy and skills. This may include courses in financial planning, budgeting, retirement planning, and tax planning. By participating in seminary and continuing education programs, clergy and religious professionals can improve their financial knowledge and skills and better manage their finances. Financial planning for clergy and religious professionals is an important process that involves creating a long-term strategy for managing financial resources. It is not just about managing money but also about being responsible stewards of the resources entrusted to them, aligning with their values and mission. Financial planning for clergy and religious professionals aims to create financial security, support the work of ministry, and provide a sense of financial well-being for the future. Budgeting and saving, retirement planning, tax planning, and estate planning are crucial components of financial planning for clergy and religious professionals. However, financial planning for clergy and religious professionals also presents unique challenges, such as low income and benefits, unique tax considerations, and ethical and moral considerations. Fortunately, there are resources available, such as professional financial advisors, denominational resources, and seminary and continuing education programs, that can provide guidance and support for clergy and religious professionals seeking to improve their financial health. By prioritizing financial planning and utilizing these resources, clergy and religious professionals can achieve financial success and better support their personal and ministry needs.Definition of Financial Planning for Clergy and Religious Professionals

Importance of Financial Planning for Clergy and Religious Professionals

Financial Security

Stewardship and Responsibility

Support for Ministry

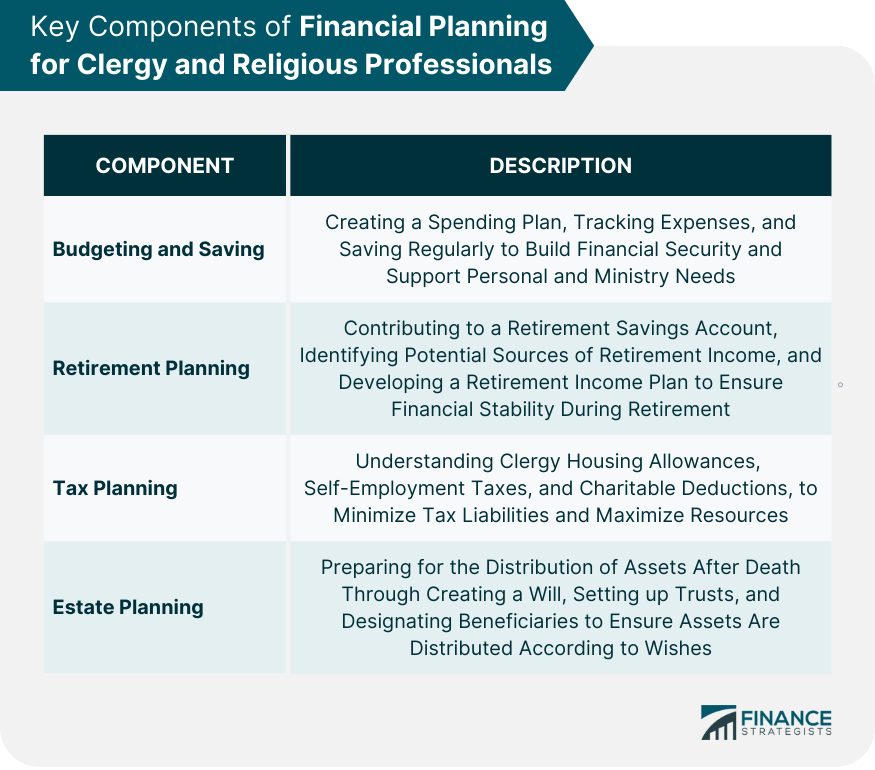

Key Components of Financial Planning for Clergy and Religious Professionals

Budgeting and Saving

Retirement Planning

Tax Planning

Estate Planning

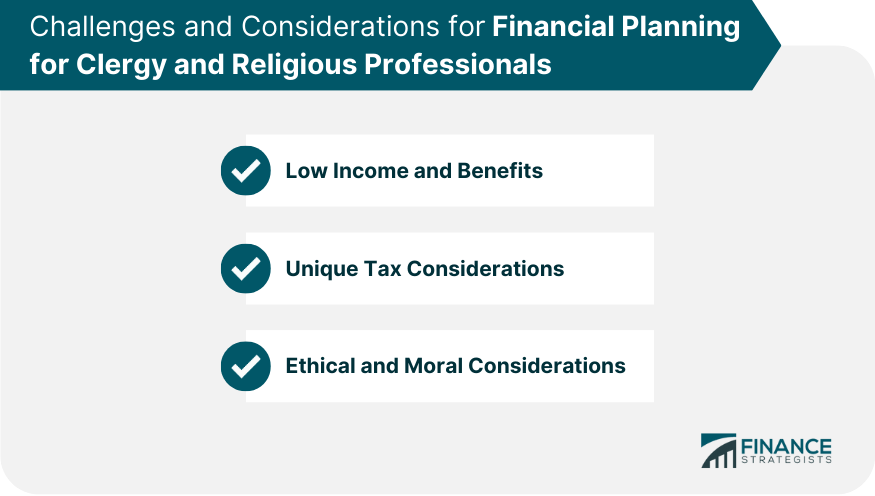

Challenges and Considerations for Financial Planning for Clergy and Religious Professionals

Low Income and Benefits

Unique Tax Considerations

Ethical and Moral Considerations

Resources for Financial Planning for Clergy and Religious Professionals

Professional Financial Advisors

Denominational Resources

Seminary and Continuing Education Programs

Conclusion

Financial Planning for Clergy and Religious Professionals FAQs

Clergy and religious professionals have unique tax considerations, retirement benefits, and housing allowances that need to be accounted for in their financial planning.

Financial planning helps to create financial security, support the work of ministry, and ensure responsible stewardship of resources in alignment with one's values and mission.

Budgeting and saving, retirement planning, tax planning, and estate planning are some key components of financial planning for clergy and religious professionals.

Professional financial advisors, denominational resources, and continuing education programs can provide guidance and support for clergy and religious professionals seeking financial planning assistance.

Clergy and religious professionals can overcome their financial planning challenges by working with experienced financial advisors who can help them create personalized financial plans that incorporate strategies such as budgeting, saving, and investing to build financial stability and plan for the future. Clergy and religious professionals can also take advantage of resources available for financial education and support to gain a better understanding of their finances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.