Overview of Financial Planning for Military Families

Financial planning for military families refers to developing a comprehensive strategy to manage finances and achieve financial goals while considering the unique challenges and opportunities that military families face.

These challenges may include frequent relocations, deployments, irregular income, and the need to plan for military-specific benefits and programs.

Financial planning for military families involves setting short-term, mid-term, and long-term financial goals, creating and maintaining a budget, managing debt, saving and investing, insurance planning, tax planning, and leveraging resources specifically designed for military families.

By addressing these aspects of personal finance, military families can navigate their unique financial landscape, achieve stability, and secure their financial future.

Military families are built for resilience. With strategic financial planning, they can translate that strength into financial security.

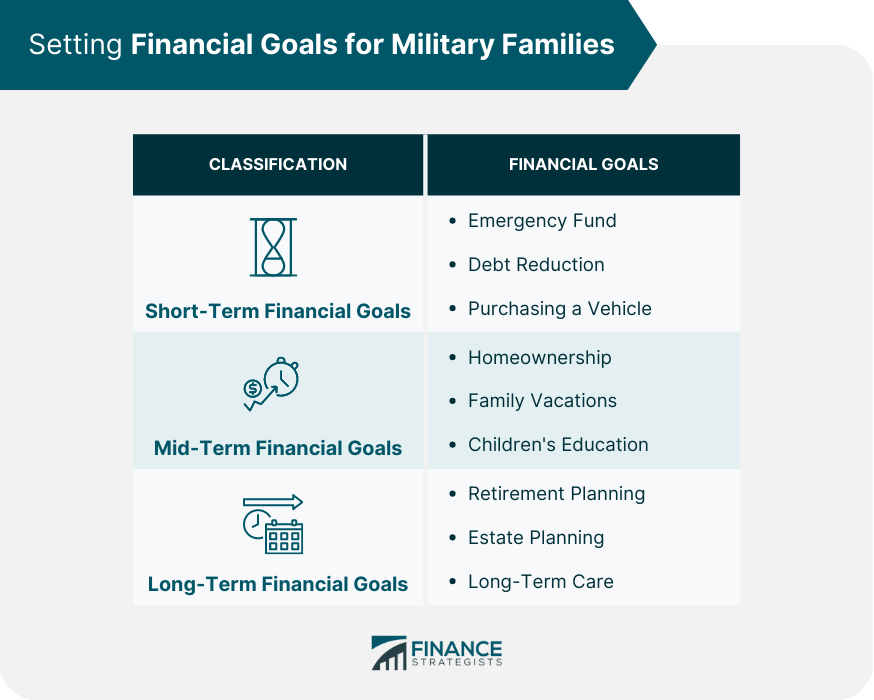

Setting Financial Goals for Military Families

To start, it's essential to identify and prioritize short-term, mid-, and long-term financial goals.

Short-Term Goals

Emergency Fund: Having an emergency fund in place is crucial for all families, especially military families who may face unexpected expenses related to deployments or other service-related events.

Aim to save at least three to six months' worth of living expenses in a liquid, easily accessible account.

Debt Reduction: Prioritize paying off high-interest debt, such as credit card balances or personal loans, to improve financial stability.

Purchasing a Vehicle: If needed, plan for the purchase of a reliable vehicle to minimize transportation costs and potential debt.

Mid-Term Goals

Homeownership: Consider purchasing a home that can provide stability and equity over time. Keep in mind the potential challenges of relocating as a military family.

Family Vacations: Budget for family vacations to ensure quality time together and create lasting memories.

Children's Education: Start saving for your children's education early, taking advantage of tax-advantaged savings vehicles such as 529 plans.

Long-Term Goals

Retirement Planning: Ensure a comfortable retirement by contributing to retirement savings vehicles like the Thrift Savings Plan (TSP) and Individual Retirement Accounts (IRAs).

Estate Planning: Develop a comprehensive estate plan, including a will, trust, and beneficiary designations, to protect your family's financial future.

Long-Term Care: Plan for potential long-term care needs, such as assisted living or nursing home care, to avoid burdening family members financially.

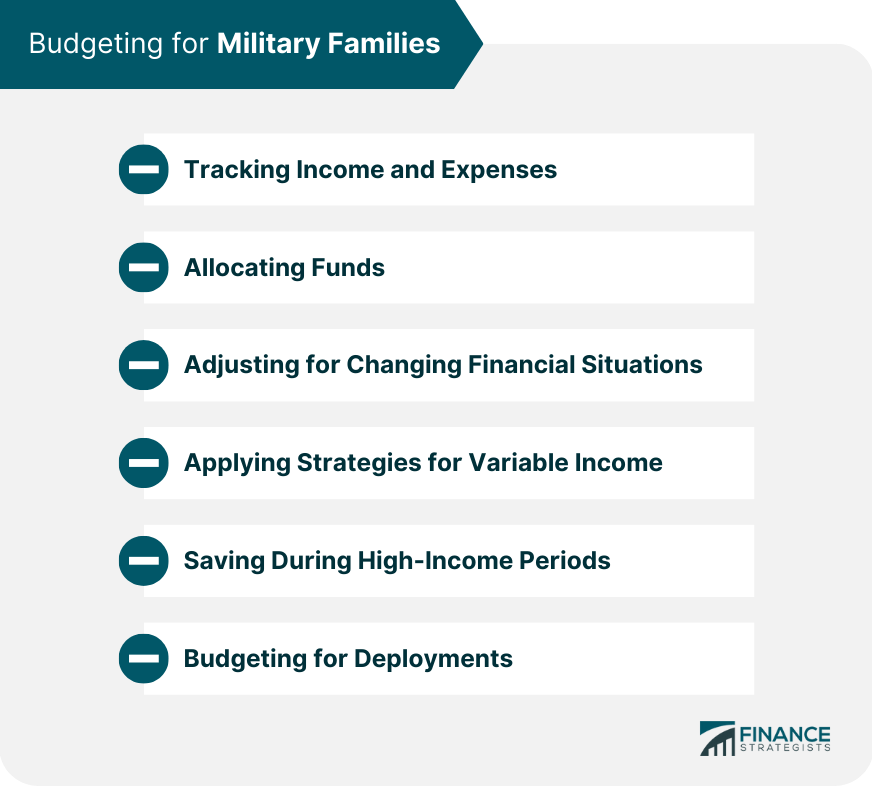

Budgeting for Military Families

Creating and maintaining a budget is a cornerstone of financial planning for military families.

Creating a Budget

Tracking Income and Expenses: Record all sources of income and expenses to identify spending patterns and areas for improvement.

Allocating Funds: Allocate funds to different spending categories, such as housing, food, transportation, and savings, based on your financial goals.

Adjusting for Changing Financial Situations: Review and adjust your budget regularly to account for income, expenses, or financial priorities changes.

Managing Irregular Income

Applying Strategies for Variable Income: Create a baseline budget using your lowest expected monthly income, and allocate extra funds to savings, debt repayment, or other financial goals during high-income months.

Saving During High-Income Periods: Use higher-income periods to build up an emergency fund, pay down debt, or contribute to long-term savings goals.

Budgeting for Deployments: Adjust your budget to account for deployment-related changes in income and expenses, such as reduced housing costs or increased childcare needs.

Managing Debt for Military Families

Effectively managing debt is crucial for financial stability and achieving long-term financial goals.

Understanding Types of Debt

Good Debt vs. Bad Debt: Differentiate between good debt, which can lead to increased net worth or income (e.g., mortgage, student loans), and bad debt, which typically has high-interest rates and does not improve your financial situation (e.g., credit card debt, payday loans).

Interest Rates and Repayment Terms: Understand your debts' interest rates and repayment terms to prioritize repayment and minimize interest costs.

Strategies for Debt Reduction

Debt Snowball Method: Pay off debts in order of smallest to largest balance while making minimum payments on all other debts to build momentum and motivation.

Debt Avalanche Method: Pay off debts in order of highest to lowest interest rate, while making minimum payments on all other debts to minimize interest costs.

Balance Transfers and Debt Consolidation: Consider balance transfer offers or debt consolidation loans to lower interest rates and simplify debt repayment.

Saving and Investing for Military Families

Saving and investing are essential components of financial planning for military families.

Emergency Fund

Importance of Having an Emergency Fund: An emergency fund provides financial security and peace of mind during unexpected events, such as job loss, medical emergencies, or vehicle repairs.

How Much to Save: Aim to save at least three to six months' worth of living expenses in an easily accessible account, such as a high-yield savings account or money market fund.

Where to Keep the Emergency Fund: Store your emergency fund in a liquid, low-risk account to ensure easy access when needed.

Retirement Savings

Thrift Savings Plan: Contribute to the TSP, a low-cost, tax-advantaged retirement savings plan specifically designed for military personnel.

Individual Retirement Accounts: Consider opening a traditional or Roth IRA to supplement your TSP contributions and take advantage of additional tax benefits.

Pensions and Benefits: Understand the military pension system and other retirement benefits available to you, such as the Survivor Benefit Plan.

Investment Strategies

Risk Tolerance and Time Horizon: Determine your risk tolerance and investment time horizon to select appropriate investment vehicles and asset allocation.

Diversification: Spread your investments across various asset classes, such as stocks, bonds, and real estate, to reduce risk and potentially increase returns.

Dollar-Cost Averaging: Invest a fixed amount at regular intervals, regardless of market conditions, to reduce the impact of market volatility and lower the average cost of your investments.

Insurance Planning for Military Families

Proper insurance coverage is a key aspect of financial planning for military families.

Life Insurance

Types of Life Insurance: Compare term life and permanent life insurance policies to determine the most suitable coverage for your needs.

Determining Coverage Needs: Calculate your life insurance coverage needs based on factors such as income replacement, debt repayment, and future expenses (e.g., children's education).

Health Insurance

TRICARE: Understand your TRICARE health insurance options and select the most appropriate plan for your family's needs.

Supplemental Insurance Options: Consider supplemental insurance policies, such as dental or vision coverage, to enhance your overall health insurance protection.

Property and Casualty Insurance

Homeowners/Renters Insurance: Ensure adequate homeowners or renters insurance coverage to protect your belongings and provide liability protection.

Auto Insurance: Maintain appropriate auto insurance coverage to safeguard your financial well-being in the event of an accident or vehicle damage.

Tax Planning for Military Families

Understanding tax benefits and utilizing tax-advantaged savings vehicles can significantly impact a military family's financial situation.

Understanding Military Tax Benefits

Tax-Free Allowances: Familiarize yourself with tax-free allowances, such as Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS), which can increase your take-home pay.

Combat Zone Tax Exclusion: Learn about the combat zone tax exclusion, which excludes certain military pay from taxable income while serving in designated combat zones.

Moving Expenses Deduction: Understand the moving expenses deduction available to military personnel who relocate due to a permanent change of station.

Tax-Advantaged Savings Vehicles

TSP and IRAs: Maximize contributions to tax-advantaged retirement accounts, such as the TSP and IRAs, to reduce taxable income and grow savings tax-free or tax-deferred.

529 Plans for Education Savings: Utilize 529 plans to save for your children's education expenses in a tax-efficient manner.

Filing Taxes While Deployed or Stationed Overseas

Filing Deadlines: Be aware of extended tax filing deadlines for deployed servicemembers and those stationed overseas.

Foreign Earned Income Exclusion: Understand the foreign earned income exclusion, which may apply to military personnel stationed abroad.

Financial Resources for Military Families

Take advantage of financial resources specifically designed for military families.

Financial Education and Counseling

Military OneSource: Access free financial counseling, resources, and tools through Military OneSource, a Department of Defense-funded program.

Financial Readiness Programs on Military Installations: Utilize financial readiness programs offered at military installations to receive financial education, counseling, and assistance.

Legal Resources

Legal Assistance Offices: Seek legal advice and assistance from legal assistance offices located on military installations.

Servicemembers Civil Relief Act (SCRA): Understand the protections and benefits provided by the SCRA, such as reduced interest rates on certain debts and protection from eviction or foreclosure.

Financial Planning During Deployments

Proper financial planning during deployments is essential to maintain financial stability and protect your family's well-being.

Pre-Deployment Checklist

Updating Beneficiary Information: Review and update beneficiary designations on life insurance policies, retirement accounts, and other financial assets.

Creating or Updating a Will and Power of Attorney: Ensure a current will and power of attorney are in place to address legal and financial matters in the event of incapacity or death.

Reviewing Insurance Coverage: Evaluate your insurance coverage to ensure it is adequate for your family's needs during deployment.

Managing Finances During Deployment

Automated Bill Payments: Set up automated bill payments to avoid late fees and maintain a positive credit history.

Communication With Family Members: Maintain open communication with family members to discuss financial matters and address any concerns.

Utilizing Resources Available to Deployed Servicemembers: Access financial resources and assistance available specifically for deployed servicemembers.

Transitioning Out of the Military

Transitioning out of the military presents new financial challenges and opportunities.

Preparing for Civilian Life

Assessing New Income Sources and Expenses: Evaluate potential changes in income and expenses as you transition to civilian life.

Updating Financial Goals: Review and update your financial goals to reflect your new situation and priorities.

Evaluating Insurance and Retirement Plan Options: Assess your insurance and retirement plan options in the civilian sector and make informed decisions.

Job Search and Education Resources

Transition Assistance Program (TAP): Utilize the TAP to access job search assistance, career counseling, and educational resources for transitioning servicemembers.

Veterans' Educational Benefits: Take advantage of veterans' educational benefits, such as the Post-9/11 GI Bill, to further your education and enhance your career prospects.

Networking and Job Placement Services: Leverage networking opportunities and job placement services specifically designed for veterans to find civilian employment.

Financial Considerations for Military Retirees

Pension and Benefits: Understand the military pension system and other retirement benefits available to you, such as the Survivor Benefit Plan.

Adjusting Investment Strategies: Reevaluate your investment strategies to align with your new financial situation and goals during retirement.

Tax Implications of Retirement Income: Familiarize yourself with the tax implications of your retirement income sources, such as military pensions and Social Security benefits.

Supporting Military Spouses' Financial Planning

Addressing the unique financial challenges faced by military spouses is essential to overall family financial stability.

Addressing Employment Challenges

Job Portability: Seek employment opportunities with portability, such as remote work or careers with a strong demand for workers nationwide.

Remote Work Opportunities: Explore remote work options that provide job stability and flexibility for military spouses.

Educational Resources for Career Advancement: Utilize educational resources and career development programs specifically designed for military spouses to improve employment prospects and earning potential.

Financial Independence

Budgeting and Financial Goal-Setting: Engage in budgeting and financial goal-setting to maintain financial independence and contribute to the overall family financial plan.

Retirement Planning: Participate in retirement planning by contributing to a spousal IRA or other retirement savings vehicles.

Managing Financial Risks: Understand and manage financial risks, such as job loss or unexpected expenses, to maintain financial stability.

Financial Planning for Military Children

Planning for your children's financial future is a crucial aspect of financial planning for military families.

Saving for Education

529 Plans: Utilize 529 plans to save for your children's education expenses in a tax-efficient manner.

Coverdell Education Savings Accounts: Consider contributing to Coverdell Education Savings Accounts to save for K-12 and college expenses.

Scholarships and Grants: Research and apply for scholarships and grants specifically available to military children to help cover education costs.

Teaching Financial Responsibility

Age-Appropriate Financial Lessons: Provide age-appropriate financial education to your children to foster responsible money management habits.

Encouraging Savings Habits: Encourage your children to save a portion of their allowance or earnings to instill the importance of saving from an early age.

Modeling Responsible Financial Behavior: Set a positive example of responsible financial behavior for your children to emulate.

Conclusion

Financial planning for military families is crucial for addressing their unique challenges and opportunities.

Military families can achieve financial stability and success by establishing clear financial goals across short-term, mid-term, and long-term timeframes, creating and maintaining a budget, effectively managing debt, and implementing saving and investment strategies.

Furthermore, understanding insurance, tax planning, and available resources tailored to military families can greatly improve their financial well-being.

Transitioning from military to civilian life and supporting military spouses and children's financial planning are also essential aspects to consider.

As military families adapt their financial plans to their unique circumstances, they should seek help and resources when needed to ensure financial security and prosperity.

Financial Planning for Military Families FAQs

Financial planning for military families takes into account specific challenges and opportunities, such as frequent relocations, deployments, irregular income, military-specific benefits, and programs like the Thrift Savings Plan and TRICARE health insurance.

Debt management is a crucial aspect of financial planning for military families, as managing debt effectively can improve financial stability. Strategies like the debt snowball, debt avalanche methods, and debt consolidation can help military families reduce and eventually eliminate debt.

Savings and investments play a key role in financial planning for military families. They should establish an emergency fund, contribute to retirement savings through the Thrift Savings Plan and IRAs, and adopt investment strategies based on risk tolerance, time horizon, and diversification.

Insurance planning for military families should encompass life insurance, health insurance (TRICARE), and property and casualty insurance. Ensuring adequate coverage in these areas can protect a military family's financial well-being in the face of unexpected events or losses.

Financial planning for military families can support the transition to civilian life by preparing for changes in income and expenses, updating financial goals, evaluating insurance and retirement plan options, and utilizing job search and education resources, such as the Transition Assistance Program and veterans' educational benefits.