What Is the Financial Planning Process?

The financial planning process is a systematic approach to managing one's finances.

It involves evaluating an individual's or family's current financial situation, identifying financial goals, creating a plan to achieve those goals, implementing the plan, and regularly monitoring and adjusting the plan as needed.

The process can help individuals make informed decisions about their money, which can have a significant impact on their quality of life.

The financial planning process typically includes several key steps, such as gathering financial information, setting financial goals, analyzing the financial situation, developing a financial plan, implementing the plan, monitoring the plan, and making adjustments as needed.

By following this process, individuals can create a roadmap for achieving their financial objectives, such as saving for retirement, paying off debt, buying a home, or funding a child's education.

The process can be done on one's own, or with the help of a financial planner, who can provide expertise and guidance in areas such as investment planning, retirement planning, tax planning, and risk management.

The financial planning process is an ongoing one, as financial situations and goals can change over time, and it's important to regularly review and adjust the plan as necessary.

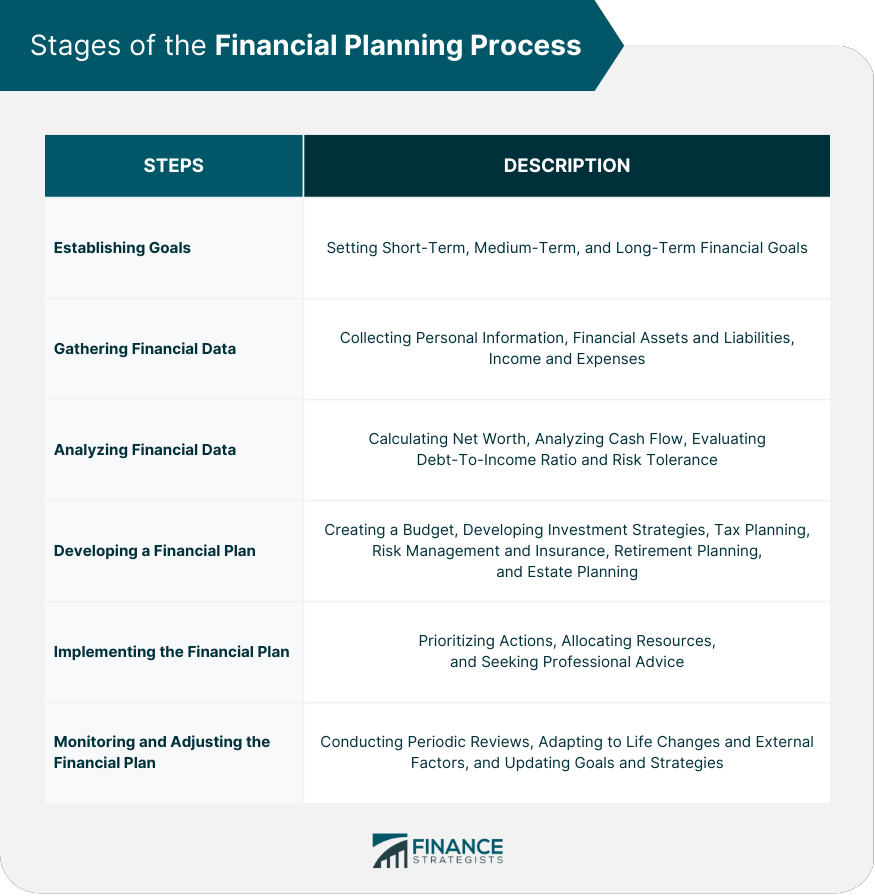

Stages of the Financial Planning Process

Establishing Goals

Short-Term Goals

Short-term goals typically range from three months to three years. Examples include building an emergency fund, paying off credit card debt, and saving for a vacation.

Medium-Term Goals

Medium-term goals have a time horizon of three to ten years. Examples include saving for a down payment on a house, funding a child's education, or starting a business.

Long-Term Goals

Long-term goals have a time horizon of more than ten years. Examples include saving for retirement, paying off a mortgage, or leaving a legacy.

Gathering Financial Data

Personal Information

Collect relevant personal information, such as age, marital status, number of dependents, and employment status.

Financial Assets and Liabilities

Compile a list of all financial assets (e.g., savings, investments, real estate) and liabilities (e.g., loans, credit card debt).

Income and Expenses

Record all sources of income and monthly expenses to understand your cash flow.

Analyzing Financial Data

Net Worth Calculation

Calculate net worth by subtracting total liabilities from total assets.

Cash Flow Analysis

Analyze income and expenses to identify patterns, potential savings, and areas for improvement.

Debt-To-Income Ratio

Calculate the debt-to-income ratio by dividing total monthly debt payments by gross monthly income. This ratio helps assess overall financial health.

Risk Tolerance Assessment

Evaluate your risk tolerance based on factors such as age, investment horizon, and financial goals.

Developing a Financial Plan

Budgeting and Cash Flow Management

Create a budget to manage income, expenses, and savings effectively.

Investment Strategies

Develop an investment strategy that aligns with your risk tolerance and financial goals.

Tax Planning

Implement strategies to minimize tax liabilities and maximize tax-advantaged opportunities.

Risk Management and Insurance

Evaluate and obtain appropriate insurance coverage to protect against potential financial losses.

Retirement Planning

Create a retirement plan that meets your desired lifestyle and financial needs in retirement.

Estate Planning

Develop an estate plan that ensures the efficient transfer of assets to beneficiaries and minimizes potential tax liabilities.

Implementing the Financial Plan

Prioritizing Actions

Determine which financial goals and strategies are most important and should be addressed first.

Allocating Resources

Allocate financial resources (e.g., savings, investments) to achieve your financial goals effectively.

Seeking Professional Advice

Consult financial professionals, such as financial planners or investment advisors, to ensure a well-informed financial plan.

Monitoring and Adjusting the Financial Plan

Periodic Reviews

Conduct regular reviews of your financial plan to track progress and make adjustments as needed.

Adapting to Life Changes and External Factors

Update your financial plan to account for changes in personal circumstances or external factors, such as job loss, marriage, or economic conditions.

Updating Goals and Strategies

Revise financial goals and strategies to align with your evolving financial situation and priorities.

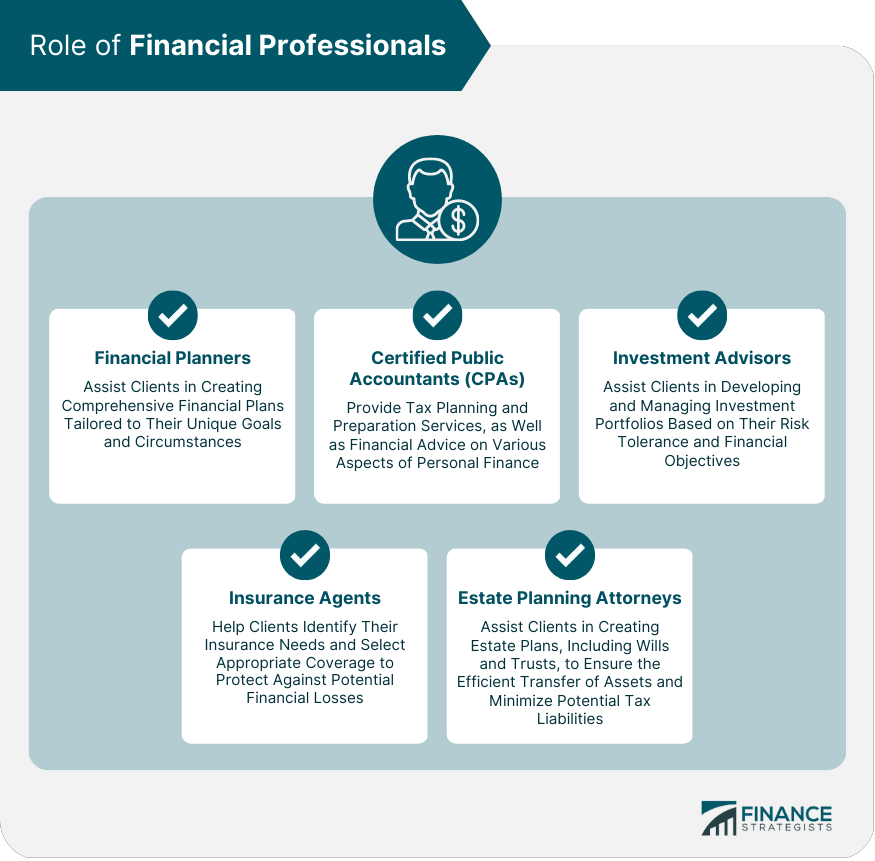

Role of Financial Professionals

Financial Planners

Financial planners help clients create comprehensive financial plans tailored to their unique goals and circumstances.

Certified Public Accountants (CPAs)

CPAs provide tax planning and preparation services, as well as financial advice on various aspects of personal finance.

Investment Advisors

Investment advisors assist clients in developing and managing investment portfolios based on their risk tolerance and financial objectives.

Insurance Agents

Insurance agents help clients identify their insurance needs and select appropriate coverage to protect against potential financial losses.

Estate Planning Attorneys

Estate planning attorneys assist clients in creating estate plans, including wills and trusts, to ensure the efficient transfer of assets and minimize potential tax liabilities.

Common Financial Planning Mistakes

Procrastination

Delaying financial planning can lead to missed opportunities and increased financial stress. Start planning early to maximize your financial potential.

Lack of Diversification

A well-diversified investment portfolio can help reduce risk and increase the potential for long-term returns. Avoid concentrating your investments in a single asset class or market sector.

Insufficient Insurance Coverage

Failing to obtain adequate insurance coverage can leave you vulnerable to financial losses. Regularly review your insurance needs and adjust coverage as necessary.

Inadequate Retirement Planning

Neglecting retirement planning can result in insufficient savings to maintain your desired lifestyle during retirement. Start saving early and regularly review your retirement plan.

Neglecting Estate Planning

Failing to create an estate plan can lead to confusion and disputes among your beneficiaries. Consult an estate planning attorney to develop a plan that reflects your wishes and minimizes potential tax liabilities.

Conclusion

The financial planning process is essential for achieving financial goals and maintaining overall financial well-being.

By establishing goals, gathering and analyzing financial data, developing a plan, implementing it, and regularly monitoring and adjusting the plan, individuals can take control of their personal finances.

Seeking the advice of financial professionals and avoiding common mistakes can further enhance the effectiveness of the financial planning process.

Financial Planning Process FAQs

The Financial Planning Process is a comprehensive and ongoing approach to managing one's finances. It involves evaluating one's current financial situation, identifying financial goals, creating a plan to achieve those goals, implementing the plan, and regularly monitoring and adjusting the plan as needed.

The Financial Planning Process is important because it helps individuals and families make informed decisions about their money, which can have a significant impact on their quality of life. It provides a roadmap for achieving financial goals, such as buying a home, saving for retirement, or paying for a child's education.

The steps in the Financial Planning Process typically include: (1) gathering financial information, (2) setting financial goals, (3) analyzing the financial situation, (4) developing a financial plan, (5) implementing the plan, (6) monitoring the plan, and (7) making adjustments as needed.

While it is possible to go through the Financial Planning Process on your own, many people find it helpful to work with a financial planner. A financial planner can provide expertise and guidance in areas such as investment planning, retirement planning, tax planning, and risk management.

It is recommended that you review your financial plan at least once a year or whenever there is a significant change in your financial situation, such as a change in income or an unexpected expense. Regular reviews can help ensure that your plan remains relevant and effective in helping you achieve your financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.