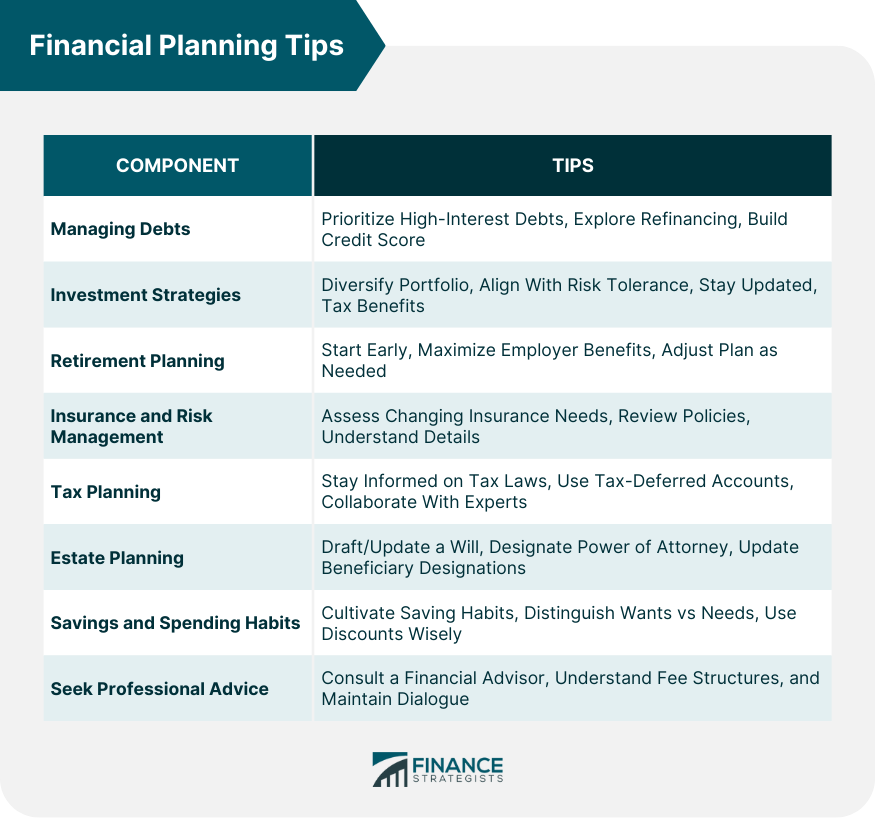

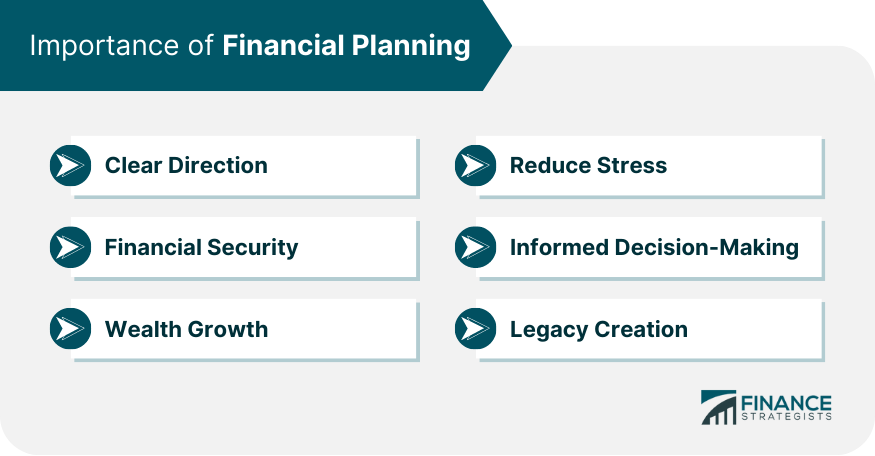

Financial planning is a systematic approach aimed at organizing one's financial affairs to achieve personal economic satisfaction and long-term goals. At its core, it involves analyzing an individual's current financial status, setting clear financial objectives, and devising strategies to achieve them. This encompasses a wide range of aspects, from budgeting and saving to investing and tax planning. Through this meticulous process, individuals can allocate their resources optimally, ensuring they are on track to meet both their immediate and future needs. Furthermore, in an unpredictable world, having a robust financial plan provides a safety net, ensuring one is prepared for unforeseen expenses or economic downturns. Prioritize High-Interest Debts: It's crucial to target and clear high-interest debts first, such as those from credit cards, because they can accumulate quickly and become burdensome. Refinancing Options: In the ever-evolving financial market, opportunities might arise where you can refinance existing loans, be it mortgages or student loans, at lower interest rates. This can save significant amounts over the loan's lifetime. Build a Good Credit Score: A robust credit score can open doors to better financial products. Ensure you're paying bills on time and using credit cards judiciously to maintain or improve your score. Diversify Your Portfolio: Spreading your investments across various asset classes can protect against adverse market movements affecting your entire portfolio. Align With Risk Tolerance: Everyone has a different appetite for risk. Ensure your investments mirror your comfort level with potential losses or gains. Stay Updated: The financial market is dynamic. Regularly educate yourself about global and local market trends to make informed investment decisions. Tax Implications: Not all investments are taxed the same way. Exploring those with tax benefits can enhance post-tax returns. Begin Early: The earlier you start saving for retirement, the more you benefit from compound interest, where you earn interest on the interest accumulated over the years. Utilize Employer Benefits: If your employer matches 401(k) contributions or offers similar benefits, maximize your contributions to leverage free money. Adjust as Needed: Life is unpredictable. Regularly review and adjust your retirement plan based on financial shifts or life events like marriage, children, or a job change. Assess Insurance Requirements: As you progress through life's stages, your insurance needs—be it life, health, disability, or long-term care—will change. Periodically assess and adjust coverage. Periodically Reevaluate Policies: An annual review of your insurance policies ensures they remain aligned with your current needs and lifestyle. Get Acquainted With Policy Details: Delve deep into the details of your insurance policies. Understand the associated premiums, the extent of coverage, any exclusions, and terms and conditions. Stay Informed on Tax Laws: Tax laws and regulations can change. Regularly update your knowledge to leverage deductions, credits, and other benefits. Take Advantage of Tax-Deferred Accounts: Accounts like IRAs or 401(k)s allow for investments to grow tax-free until withdrawal, maximizing growth potential. Collaborate With Experts: Navigating the intricate landscape of taxes can be challenging. Engage with tax professionals to ensure optimal strategies are implemented. Draft or Update a Will: A clear will minimizes potential disputes and ensures your assets are distributed as per your wishes after your passing. Determine Power of Attorney: Designate trusted individuals to make critical financial or health decisions on your behalf if you're incapacitated. Keep Beneficiary Designations Current: As life evolves, ensure that beneficiary designations on retirement accounts, insurance policies, and other assets are current. Cultivate Good Habits: Regularly save a portion of your income. Develop a resistance to impulse buying, focusing instead on planned purchases. Understand Wants vs Needs: Before spending, evaluate if a purchase is a luxury or a necessity. Prioritize essential expenses. Take Advantage of Discounts and Deals: Utilize sales and discounts but ensure purchases align with genuine needs rather than mere wants. Consult a Financial Advisor: Understand scenarios, like major life changes or investment decisions, where professional guidance can enhance outcomes. Understand Advisor Fee Structures: Different advisors have varied fee structures. Familiarize yourself with them to ensure transparency and value for money. Maintain an Open Dialogue: Your financial situation and goals will evolve. Regularly update your financial advisor to ensure aligned strategies and advice. Financial planning serves as a foundational pillar for achieving financial stability, security, and long-term prosperity. Its importance is underscored by a range of factors that directly impact every individual's life. Clear Direction: Financial planning sets a roadmap for individuals. With set goals and a plan in place, it provides a sense of purpose and direction, ensuring that financial efforts are targeted and not scattered. Financial Security: By making informed decisions on investments, savings, and insurance, financial planning offers a safety net. It ensures that individuals and their families are shielded from sudden financial hardships. Wealth Growth: With a strategic investment plan, individuals can maximize their returns, allowing their wealth to grow efficiently over time while also considering their risk tolerance. Reduces Financial Stress: Knowing that there's a plan in place to handle debts, emergencies, and other financial commitments can significantly reduce stress. It allows for better mental well-being and focuses on other aspects of life. Informed Decision Making: Whether it's buying a home, investing in stocks, or starting a business, proper planning ensures that decisions are based on sound financial analysis. Legacy Creation: Through estate planning, individuals can ensure that their wealth and assets are passed on according to their wishes, ensuring their loved ones are taken care of, and their legacy is preserved. Financial planning stands as a pivotal framework for achieving a solid financial foundation and securing long-term prosperity. This systematic approach encompasses diverse elements, including debt management, strategic investments, retirement planning, insurance coverage, tax optimization, estate planning, and prudent spending habits. Early retirement saving, understanding insurance needs, and staying informed about tax laws contribute to stability and growth. Regularly reviewing and adjusting plans in response to life changes ensures continued relevance and effectiveness. The benefits of financial planning are evident in its role in providing clear direction, ensuring financial security, optimizing wealth growth, reducing stress, promoting informed decision-making, and contributing to the creation of a lasting legacy. Ultimately, financial planning empowers individuals to take control of their financial destinies and navigate the complexities of an ever-changing financial world.What Is Financial Planning?

Financial Planning Tips

Managing Debts

Investment Strategies

Retirement Planning

Insurance and Risk Management

Tax Planning

Estate Planning

Savings and Spending Habits

Seek Professional Advice

Importance of Financial Planning

Conclusion

Financial Planning Tips FAQs

Prioritize high-interest debts, consider consolidating loans, avoid new debts, establish an emergency fund, and regularly review your financial plan to reduce debts and strengthen finances.

Diversify your portfolio, align investments with your risk tolerance, stay updated on market trends, and consider tax implications.

Start saving early to benefit from compound interest, maximize employer benefits like 401(k) matches, and adjust your plan as life evolves.

Assess changing insurance needs, periodically review policies, and understand policy details for comprehensive coverage.

Stay informed on tax laws, utilize tax-deferred accounts, and collaborate with tax experts to implement optimal strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.