A financial plan is a comprehensive blueprint designed to help individuals or businesses achieve specific financial goals and objectives within a certain time frame. It encompasses various elements, including budgeting, saving, investing, risk management, and retirement planning. By evaluating one's current financial status, setting short-term and long-term objectives, and developing strategies to achieve these goals, a financial plan acts as a roadmap guiding financial decisions. Though an effective financial plan is crucial for any endeavor, it has certain limitations. Formulating one can be time-consuming, and it can prevent flexibility in one’s expenses. Having a financial plan can also lead to complacency and an overreliance on it. There are also legal, technological, and regulatory limitations that need to be considered. While having a sound financial plan is imperative, one must also look into its limitations in order to ensure that all your bases are covered. Effective financial planning demands a significant investment of time. It's not merely about plotting out a savings plan; it's about considering various investment vehicles, understanding market trends, and aligning one's financial goals holistically. This time commitment can be daunting for many, leading to potential oversights. While a detailed plan is beneficial, it can sometimes lead to paralysis by analysis. Opportunities might be missed because of the time taken to thoroughly analyze every financial decision, leaving individuals or businesses at a standstill. Strict adherence to a financial plan can sometimes be a double-edged sword. Life is unpredictable, and an overly rigid financial strategy might lack the flexibility needed to adapt to unexpected life events or opportunities. Emergent opportunities or financial demands might require a shift in one's financial trajectory. An established plan might make it challenging to pivot quickly, potentially leading to missed opportunities or unaddressed financial challenges. While professional guidance can offer invaluable insights, it also comes with a cost. Hiring financial advisors or planners might not be feasible for everyone, especially those with limited resources. Certain financial products, especially complex ones, might have hidden fees or costs. Without a thorough understanding, individuals might find themselves paying more than anticipated, diminishing the value of their investments. Choosing the right investment strategies is crucial for achieving your financial goals. However, this process can be complex and fraught with potential pitfalls. A well-diversified portfolio can help mitigate risk by spreading investments across different asset classes (stocks, bonds, real estate, etc.) and industries. This approach ensures that if one investment performs poorly, others can offset the losses. Steve Goffner, advisor at 11 Financial says, "Investing in ETFs like SPY, QQQ, or VTI diversifies your portfolio, reducing the impact of individual stock fluctuations." There are two primary investment approaches – active (trying to beat the market through stock picking or market timing) and passive (tracking a market index). Each has its pros and cons, and the choice often depends on individual risk tolerance and investment goals. Financial advisors can provide valuable guidance in selecting appropriate investment strategies based on your circumstances and risk profile. However, it's important to be aware of the potential biases and conflicts of interest that advisors may have. Financial plans often focus heavily on numbers: returns, interest rates, and savings amounts. However, a holistic approach should also consider qualitative aspects, like an individual's life goals, values, and aspirations, which are often overshadowed in a number-centric approach. Not all life goals can be quantified. Aspects like happiness, personal growth, or family well-being, while crucial, might not always fit neatly into a traditional financial plan, leading to potential misalignment between life goals and financial strategies. Financial planning isn't immune to human biases and emotions. Whether it's an unwarranted attachment to specific investments or decisions influenced by recent market events, subjective factors can sway the planning process, leading to potentially suboptimal outcomes. Different planners bring different perspectives, biases, and expertise. This can result in contrasting advice for the same financial scenario. Hence, relying solely on one viewpoint might not always offer a comprehensive picture. A well-crafted financial plan can provide a sense of security. However, this shouldn't translate to overconfidence. No plan is foolproof, and mistaking it for a guaranteed path to success can lead to complacency. Financial landscapes evolve. Sticking rigidly to a plan without periodically reassessing it in light of new information can be detrimental. Regular reviews and adjustments are paramount for a plan's continued relevance and effectiveness. Modern financial planning heavily relies on technology. While tools and software simplify the process, they're only as good as their algorithms and data inputs. Over-reliance can sometimes mask the need for human judgment and intuition. Using outdated financial tools or software might result in miscalculations or misinterpretations. Furthermore, technological glitches or inaccuracies can misguide one's financial strategy, potentially leading to losses or inefficiencies. The legal landscape surrounding finance and investments is continually evolving. Tax laws, investment regulations, and financial compliance standards can shift, requiring plans to be updated to remain compliant and effective. Maintaining a financial plan in tandem with evolving legal and regulatory standards can be taxing. It necessitates continuous updates, demanding additional time and effort and potentially leading to inadvertent oversights. The modern approach to financial planning prioritizes numerical data, such as returns, interest rates, and savings amounts. This precision is invaluable for setting benchmarks and tracking progress. However, an overemphasis can lead to potential pitfalls: Neglecting Personal Aspirations and Values: By focusing solely on numbers, there's a risk of sidelining the qualitative dimensions of one's financial journey. For instance, while an investment might promise high returns, it might not align with an individual's ethical beliefs or long-term aspirations. Financial plans, when heavily quantitative, can sometimes be too narrow: Missing the Bigger Picture: Not all crucial life objectives can be distilled into numbers. Factors like personal well-being, family happiness, or aspirations to contribute to a cause might not fit neatly into a spreadsheet but are no less significant. Risk of Misalignment: Focusing solely on quantifiable targets can create a disconnect between one's financial strategies and broader life objectives, leading to potential regrets in the long run. Financial planning serves as a pivotal roadmap to achieving financial goals, encompassing elements like budgeting, investing, and retirement planning. However, its efficacy is not without limitations. The process can be time-consuming, demanding meticulous research that might delay crucial decisions. A rigid adherence to plans can limit flexibility, potentially preventing adaptation to sudden financial shifts. Costs associated with professional advice, hidden fees in financial products, and an overemphasis on quantitative data can pose challenges. Furthermore, personal biases, technological dependencies, and ever-changing legal regulations introduce potential pitfalls. While financial planning offers invaluable insights for wealth accumulation and security, it's imperative to recognize its constraints. Balancing the analytical rigor of planning with adaptability, ongoing updates, and a holistic view of both quantitative and qualitative life goals is key to its success.What Is a Financial Plan?

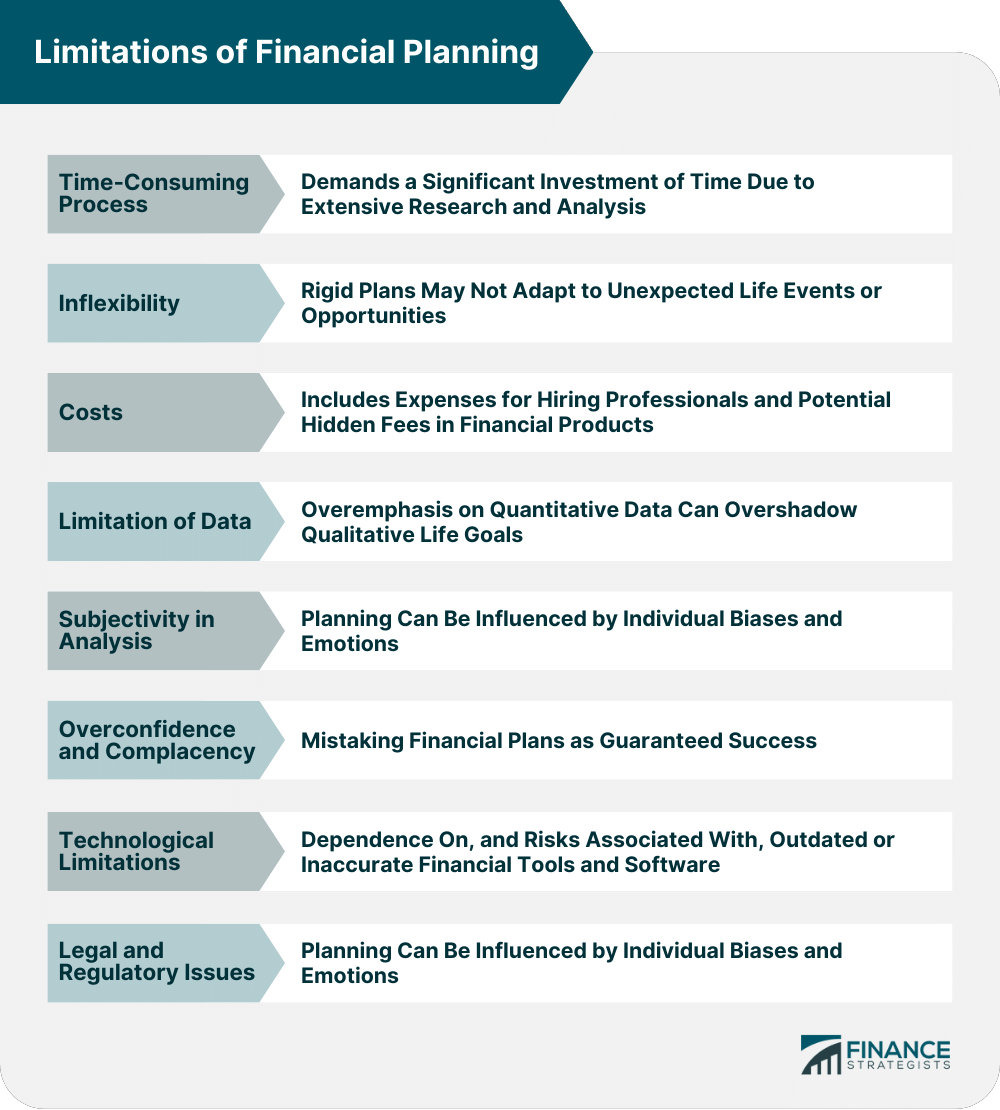

What Are the Limitations of Financial Planning?

Time-Consuming Process

Required Extensive Research and Analysis

Delay in Decision-making Due to Comprehensive Planning

Potential for Inflexibility

Dangers of Being Too Rigid or Strict With a Financial Plan

Difficulty of Adapting to Sudden Financial Changes or Opportunities

Costs Associated With Financial Planning

Expense of Hiring Professional Financial Planners or Advisors

Possible Hidden Costs in Financial Products or Plans

Investment Strategies and Diversification

Importance of Diversification

Active vs Passive Investing

Role of Professional Advice

Limitation of Quantitative Data

Overemphasis on Numerical Data and Potential Oversight of Qualitative Factors

Ignoring Personal Aspirations, Values, or Non-quantifiable Goals

Tedd Shimp, ChFC®, reminds, "While financial numbers are important, do not overlook your personal values and non-quantifiable goals when crafting your financial plan."Subjectivity in Analysis

Influence of Individual Biases and Emotions on Planning

Variability in Advice From Different Financial Planners

Overconfidence and Complacency

Mistaken Belief That a Financial Plan Guarantees Success

Potential for Overlooking New Information or Failing to Reevaluate the Plan

Technological Limitations

Dependence on Financial Software and Tools

Risks Associated With Outdated or Inaccurate Technology

Legal and Regulatory Constraints

Changing Laws and Regulations That Can Affect Financial Strategies

Need for Continuous Updates to Stay Compliant

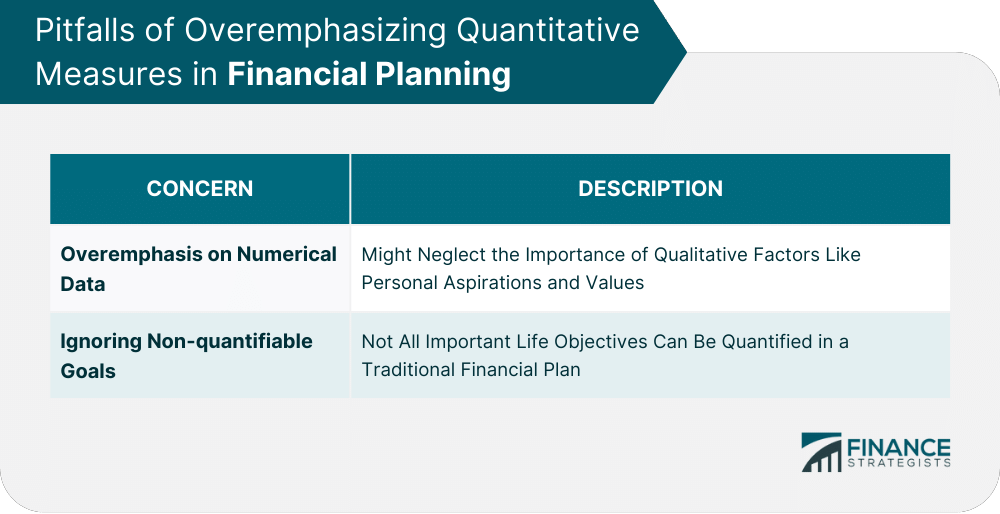

Pitfalls of Overemphasizing Quantitative Measures in Financial Planning

Overemphasis on Numerical Data

Ignoring Non-quantifiable Goals

Conclusion

Limitations of Financial Planning FAQs

One of the primary limitations of financial planning in predicting markets is the inherent unpredictability of economies. Historical data doesn't guarantee future performance, and unforeseen events can easily disrupt predictions.

The thorough research and analysis required in financial planning can sometimes lead to delays, making it harder to seize timely opportunities. This limitation highlights the importance of blending detailed planning with swift decision-making.

Yes, financial planning often emphasizes quantitative data, which might overshadow qualitative factors like personal values, aspirations, and non-quantifiable goals. This limitation can sometimes lead to a misalignment between financial strategies and broader life objectives.

Over-reliance on financial software and tools can lead to overconfidence in technology-driven decisions, potentially masking the importance of human judgment. Outdated or inaccurate tools can also misguide financial strategies.

Absolutely. As laws and regulations evolve, a financial plan that doesn't adapt can become outdated or non-compliant. This limitation underscores the need for continuous updates and alignment with the current legal landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.