Financial planning is essential for military spouses to secure their financial future and adapt to the unique challenges that military families face. Military spouses are the rock, the glue, and the unsung heroes. Proper planning helps reduce their stress, achieve financial goals, and maintain financial stability. Military families face unique challenges, including frequent relocations, deployments, and adapting to different cost-of-living situations. These factors can make financial planning more complex, requiring military spouses to be flexible and proactive in managing finances. An emergency fund is a critical safety net that provides financial security during unforeseen events, such as job loss, illness, or unexpected expenses. Military spouses should aim to save three to six months of living expenses in an easily accessible account. Paying off high-interest debt, like credit card balances or personal loans, should be a priority. Reducing debt saves money on interest payments and improves overall financial stability. Owning a home can provide long-term financial benefits, such as building equity and potential tax advantages. Military spouses should consider saving for a down payment while exploring options like VA loans for more favorable terms. Investing in education or career advancement can lead to increased earning potential and job satisfaction. Military spouses should explore educational opportunities, vocational training, or certifications that align with their career goals. Retirement planning ensures financial security in later years. Military spouses should contribute to retirement accounts and consider other investment options to maximize their retirement savings. Saving for children's education can help reduce the burden of student loans and provide more opportunities for higher education. Military families can take advantage of tax-advantaged accounts like 529 plans to save for their children's future education expenses. A monthly budget is a fundamental tool for managing finances effectively. It allows military spouses to allocate income towards essential expenses, savings, and debt repayment while monitoring their financial progress. Tracking and categorizing expenses helps military spouses identify spending patterns, detect areas for improvement, and adjust their budgets accordingly. Various tools, such as mobile apps and spreadsheets, can assist in managing expenses effectively. Military families often experience changes in income, expenses, and financial priorities. Adjusting the budget to accommodate these changes is essential for maintaining financial stability and achieving financial goals. An emergency fund provides a financial buffer for unexpected expenses or income disruptions. Military spouses should prioritize establishing this fund before focusing on other savings goals or investments. The TSP is a tax-advantaged retirement savings plan for service members and federal employees. Military spouses should consider contributing to the TSP to take advantage of its low fees and diversified investment options. IRAs, such as traditional or Roth IRAs, offer tax benefits and flexible investment options. Military spouses can contribute to an IRA in addition to the TSP to diversify their retirement savings. Military spouses can also consider other investment options, such as stocks, bonds, or real estate, to grow their wealth over time. Consulting a financial advisor can help determine the best investment strategy based on individual goals and risk tolerance. Diversifying investments reduces risk and enhances potential returns. Military spouses should create a balanced portfolio across asset classes and investment types. Debt repayment strategies, such as the debt snowball or debt avalanche method, can help military spouses prioritize and pay off debts more efficiently. Reducing debt improves financial stability and frees up resources for other financial goals. The SCRA offers various financial protections for active-duty service members, including interest rate caps and eviction protections. Military spouses should be aware of these benefits to minimize debt and avoid financial hardships. The MLA provides additional financial protections for service members, such as capping interest rates on certain loans and prohibiting mandatory arbitration clauses. Understanding these protections can help military spouses make informed borrowing decisions. Avoiding new debt is crucial for maintaining financial stability. Military spouses should prioritize savings, minimize reliance on credit cards, and consider alternative financing options before taking on additional debt. SGLI is a low-cost, government-sponsored life insurance program for active-duty service members. Military spouses should consider enrolling to ensure financial protection for their families in the event of the service member's death. FSGLI offers life insurance coverage for military spouses and dependents at competitive rates. It can provide financial security for the family in case of the spouse's death. Depending on individual needs and preferences, private life insurance policies can supplement or replace government-sponsored coverage. Military spouses should compare different policy options to find the best coverage for their families. TRICARE is the primary healthcare program for military families, providing comprehensive health coverage at low or no cost. Military spouses should familiarize themselves with available benefits, coverage options, and enrollment procedures. Supplemental insurance policies can fill gaps in TRICARE coverage or provide additional benefits, such as dental or vision coverage. Military spouses should evaluate their healthcare needs and consider supplemental policies as needed. Disability insurance replaces a portion of income if a service member becomes disabled and unable to work. Military spouses should consider obtaining disability insurance to protect their family's financial security in case of unforeseen events. A pre-deployment financial checklist helps military spouses prepare for financial challenges during deployment. This includes updating essential documents, establishing a power of attorney, and reviewing insurance coverage. Managing finances during deployment can be challenging for military spouses. Utilizing online banking, creating a deployment budget, and communicating regularly with the deployed service member can help ensure financial stability during this time. Post-deployment reintegration may require financial adjustments, such as updating budgets, reassessing financial goals, and addressing any debt accumulated during deployment. Military spouses should be proactive in making these adjustments to maintain financial stability. The MyCAA Scholarship Program offers financial assistance for military spouses seeking education, training, or certifications in portable career fields. Military spouses should explore this program to help advance their careers and increase their earning potential. The MyCAA program provides financial support for military spouses pursuing licenses, certifications, or associate degrees in high-demand, portable career fields. This program can help military spouses overcome barriers to career advancement and enhance their employment prospects. The Military Spouse Employment Partnership (MSEP) connects military spouses with employers committed to hiring and supporting military families. Military spouses should leverage this resource to find job opportunities and gain access to supportive work environments. Networking is crucial for career advancement and job search success. Military spouses should attend local events, join professional associations, and utilize online platforms to connect with other professionals and expand their networks. Due to moving expenses and adjusting to new living situations, PCS moves can be financially challenging. Military spouses should create a PCS budget, research housing options, and explore potential cost-saving strategies, such as using the Do-It-Yourself (DIY) move program. Relocation expenses, such as transportation, temporary housing, and shipping household goods, can strain a military family's budget. Developing a detailed relocation budget and identifying potential cost-saving measures can help mitigate financial stress during the move. Transitioning to civilian life requires financial adjustments, such as adapting to a new career, adjusting to different benefits, and potentially relocating. Military spouses should begin financial planning well before the transition to ensure a smooth adjustment to civilian life. Military spouse financial planning is crucial for achieving financial stability and securing their future. With unique challenges such as frequent relocations, deployments, and adapting to different cost-of-living situations, military spouses must be flexible and proactive in managing their finances. Setting short-term, mid-term, and long-term financial goals, creating a monthly budget, tracking expenses, saving and investing, managing debt, and insurance and risk management are critical components of military spouse financial planning. Education and career advancement, networking, and financial planning for transitions and relocation are also essential for achieving financial security. By prioritizing financial planning and utilizing available resources, military spouses can navigate the challenges and uncertainty of military life while securing their financial future.Overview of Military Spouse Financial Planning

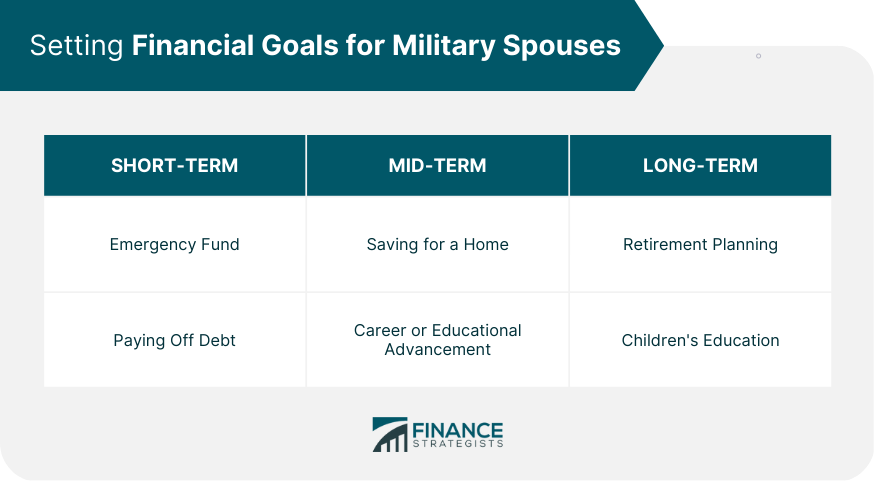

Setting Financial Goals for Military Spouses

Short-Term Goals

Emergency Fund

Paying Off Debt

Mid-Term Goals

Saving for a Home

Career or Educational Advancement

Long-Term Goals

Retirement Planning

Children's Education

Budgeting and Expense Tracking of Military Spouses

Creating a Monthly Budget

Tracking and Categorizing Expenses

Adjusting Budget for Military-Related Changes

Saving and Investing of Military Spouses

Establishing an Emergency Fund

Retirement Savings Options

Thrift Savings Plan (TSP)

Individual Retirement Accounts (IRAs)

Other Investment Options

Diversifying Investments

Managing Debt of Military Spouses

Strategies for Paying Off Debt

Utilizing Military Benefits to Reduce Debt

Service Member's Civil Relief Act (SCRA)

Military Lending Act (MLA)

Avoiding New Debt

Insurance and Risk Management for Military Spouses

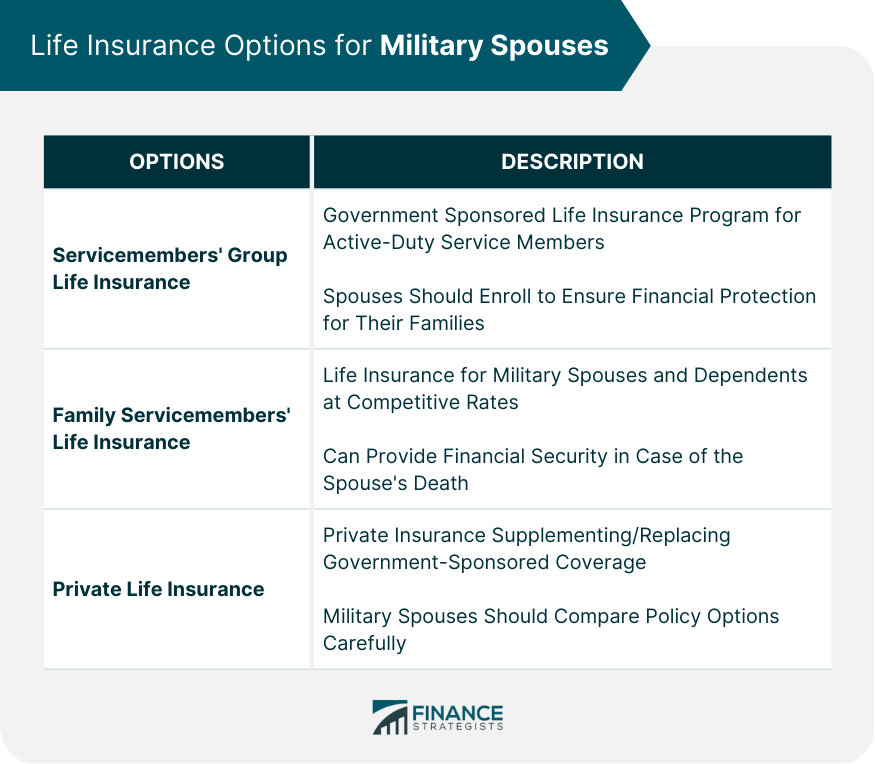

Life Insurance Options

Servicemembers' Group Life Insurance (SGLI)

Family Servicemembers' Group Life Insurance (FSGLI)

Private Life Insurance

Health Insurance and Healthcare Options

TRICARE

Supplemental Insurance

Disability Insurance

Financial Planning During Deployments

Pre-Deployment Financial Checklist

Managing Finances While Deployed

Reintegrating and Adjusting Finances Post-Deployment

Education and Career Advancement

Military Spouse Education Benefits

MyCAA Scholarship Program

Military Spouse Career Advancement Account (MyCAA)

Job Search Resources and Networking

Military Spouse Employment Partnership

Networking Opportunities

Financial Planning for Transitions and Relocation

Preparing for Permanent Change of Station (PCS) Moves

Budgeting for Relocation Expenses

Financial Planning for Transition to Civilian Life

Final Thoughts

Military Spouse Financial Planning FAQs

Financial planning is important for military spouses because it helps reduce stress, achieve financial goals, and maintain financial stability despite the unique challenges that military families face.

Military spouses can manage their debt effectively by utilizing debt repayment strategies, taking advantage of military benefits to reduce debt, and avoiding new debt by prioritizing savings and minimizing reliance on credit cards.

Some important financial goals for military spouses to consider include setting up an emergency fund, paying off debt, saving for a home, investing in education or career advancement, retirement planning, and saving for children's education.

Military spouses can take advantage of resources such as the MyCAA Scholarship Program, Military Spouse Career Advancement Account, Military Spouse Employment Partnership, and networking opportunities to advance their education and career prospects.

Military spouses can prepare for financial transitions and relocations by creating a detailed budget, researching housing options, exploring cost-saving strategies, and beginning financial planning well before the transition to ensure a smooth adjustment to civilian life.