Net worth analysis is crucial for understanding one's financial standing and progress. Regularly assessing net worth helps identify areas of improvement, track progress toward financial goals, and make informed decisions. Net worth is the value of an individual's or entity's assets minus liabilities. It represents the financial position at a specific point in time and can be a useful indicator of financial health. The key components of net worth analysis include identifying assets and liabilities, calculating net worth, and understanding factors that affect the net worth. This enables a thorough evaluation of one's financial situation. Financial Assets: Financial assets include cash, savings, investments, and retirement accounts. These can be easily converted into cash and are essential in determining an individual's net worth. Tangible Assets: Tangible assets are physical items of value, such as real estate, vehicles, and personal property. These assets contribute to an individual's net worth but may be harder to liquidate. Intangible Assets: Intangible assets are non-physical items of value, including intellectual property, business goodwill, and reputation. While harder to quantify, these assets can significantly impact the net worth. Secured Debts: Secured debts are obligations backed by collateral, such as mortgages and auto loans. Defaulting on these debts can lead to the loss of collateral and negatively impact the net worth. Unsecured Debts: Unsecured debts, including credit card debt and personal loans, are not backed by collateral. High-interest rates on these debts can erode net worth if not managed properly. Contingent Liabilities: Contingent liabilities are potential obligations that may arise due to specific events or conditions, such as lawsuits or loan guarantees. While uncertain, they should be considered in the net worth analysis. Formula and Process: Net worth is calculated by subtracting total liabilities from total assets. This simple formula provides a snapshot of one's financial position and is essential for informed decision-making. Frequency and Timing: Regularly monitoring net worth, such as annually or quarterly, allows for tracking progress and making necessary adjustments. Life events or significant financial changes may warrant more frequent evaluations. Higher-income and diversified income sources can positively impact net worth by enabling increased savings, investments, and debt reduction. Excessive spending and maintaining a high-cost lifestyle can hinder net worth growth by reducing the ability to save, invest, or pay off debt. A well-balanced investment strategy and risk tolerance can increase asset values over time, improving net worth. Proper debt management, such as paying off high-interest debts and avoiding excessive borrowing, can significantly impact net worth by reducing liabilities. Life events, such as job loss, divorce, or health issues, can substantially impact net worth by affecting income, expenses, and financial obligations. Debt-to-Equity Ratio: This ratio compares total debt to net worth, providing insight into financial leverage and risk. Lower ratios indicate less reliance on debt, which can positively impact net worth. Debt-to-Asset Ratio: This ratio measures the proportion of total debt to total assets. Lower ratios suggest healthier financial positions and greater net worth stability. Liquid Asset-to-Net Worth Ratio: This ratio compares liquid assets to net worth, indicating the ability to cover financial emergencies. Higher ratios suggest greater financial flexibility and resilience. Peer Comparison: Comparing one's net worth to peers with similar backgrounds, age, or income levels can provide valuable context and motivation for financial improvement. Industry Standards: Industry standards serve as a benchmark for individuals in specific professions, helping to gauge net worth relative to professional expectations. Personal Financial Goals: Assessing net worth against personal financial goals helps track progress and provides motivation for adjustments to achieve those goals. Net worth analysis serves as a tool to gauge overall financial health, allowing individuals to identify strengths and weaknesses in their financial situation. By analyzing net worth, individuals can pinpoint areas that require attention, such as reducing debt, increasing savings, or optimizing investments. Net worth analysis enables the establishment of realistic financial goals and the tracking of progress towards achieving those goals over time. Understanding net worth is crucial for retirement planning, as it helps determine the necessary savings and investments required to maintain a desired lifestyle post-retirement. Net worth analysis aids in estate planning by providing a clear picture of assets and liabilities, allowing for more informed decisions regarding inheritance and asset distribution. While net worth is an important metric, it should not be the only factor considered when evaluating financial success, as it may not capture the full picture of one's financial well-being. Ignoring illiquid or intangible assets can lead to an inaccurate representation of net worth, as these assets may hold a significant value that contributes to one's overall financial position. Failing to account for inflation and changes in purchasing power can result in an overestimation of net worth, as the real value of assets and liabilities may differ over time. Taxes can substantially impact net worth, and failing to consider their effects can lead to a misrepresentation of one's true financial position. Regularly monitoring net worth is essential for maintaining financial stability and success, as it allows for timely adjustments and informed decision-making. Net worth analysis plays a crucial role in achieving financial stability and success by enabling individuals to understand their financial position, identify areas for improvement, and track progress toward financial goals. Financial strategies should be continually adapted and reassessed based on net worth analysis to ensure alignment with financial goals and changing circumstances. A financial advisor can provide valuable guidance and support in net worth analysis, helping individuals make informed decisions to achieve their financial objectives.What Is Net Worth Analysis?

Calculating Net Worth

Identifying Assets

Identifying Liabilities

Calculation of Net Worth

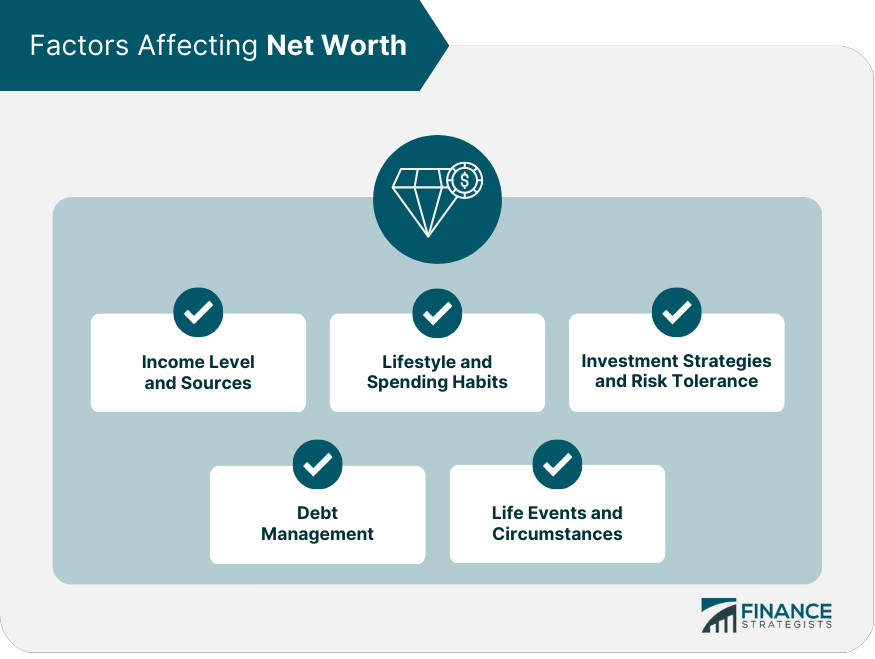

Factors Affecting Net Worth

Income Level and Sources

Lifestyle and Spending Habits

Investment Strategies and Risk Tolerance

Debt Management

Life Events and Circumstances

Net Worth Analysis Techniques

Financial Ratios

Benchmarking and Comparisons

Utilizing Net Worth Analysis for Financial Decision Making

Assessing Financial Health

Identifying Areas for Improvement

Setting and Tracking Financial Goals

Retirement Planning

Estate Planning

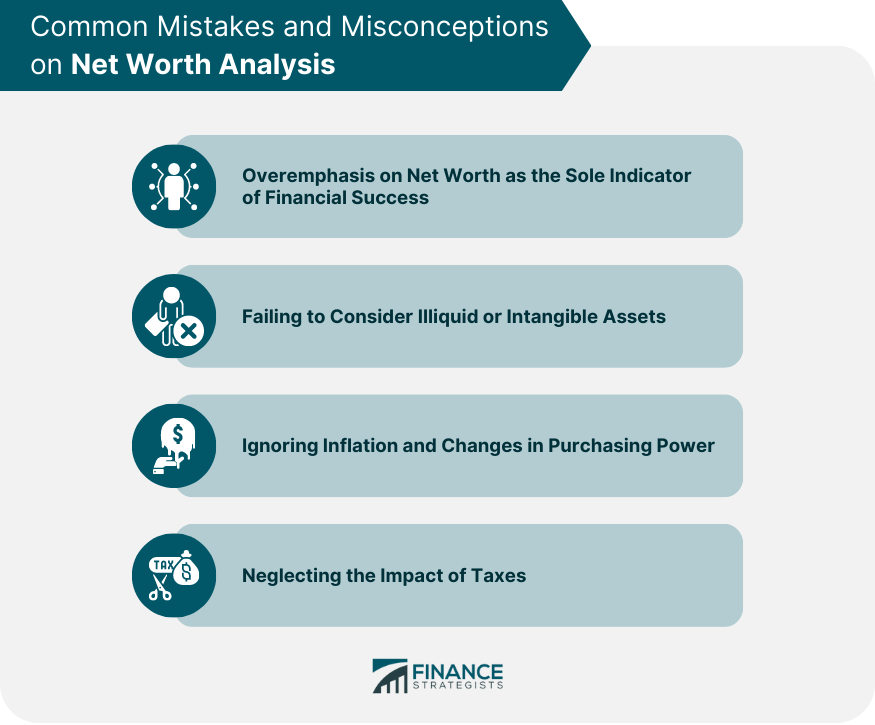

Common Mistakes and Misconceptions on Net Worth Analysis

Overemphasis on Net Worth as the Sole Indicator of Financial Success

Failing to Consider Illiquid or Intangible Assets

Ignoring Inflation and Changes in Purchasing Power

Neglecting the Impact of Taxes

Final Thoughts

Net Worth Analysis FAQs

Net worth analysis is a financial assessment that involves identifying assets and liabilities and calculating net worth to determine one's financial position.

Net worth is calculated by subtracting total liabilities from total assets. The resulting number provides a snapshot of one's financial position.

The key components of net worth analysis include identifying assets and liabilities, calculating net worth, and understanding factors that affect net worth.

Net worth analysis serves as a tool to assess financial health, identify areas for improvement, set and track financial goals, and aid in retirement and estate planning.

Some common mistakes and misconceptions about net worth analysis include overemphasizing net worth as the sole indicator of financial success, failing to consider illiquid or intangible assets, ignoring inflation and changes in purchasing power, and neglecting the impact of taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.