A student loan repayment strategy refers to a plan or approach that a borrower uses to manage and pay off their student loan debt effectively. This can involve various methods, such as making extra payments, utilizing loan forgiveness programs, taking advantage of employer assistance programs, and using tax deductions and credits to offset the cost of student loan interest. The goal of a student loan repayment strategy is to pay off the debt as quickly and efficiently as possible while minimizing the overall cost of interest. Before diving into various repayment strategies, it is crucial to understand your current student loan situation. The first step in managing your student loans is to organize them into federal and private loans. Federal loans are funded by the federal government, while private loans are funded by banks, credit unions, or other financial institutions. Knowing the type of loans you have will help you determine which repayment options are available to you. Next, familiarize yourself with the interest rates and terms for each of your loans. The interest rate is the percentage you will be charged for borrowing money, and it can significantly impact the total amount you pay back over time. The loan term is the length of time you have to repay the loan. Your current repayment plan determines your monthly payment amount and the total repayment period. It is essential to know which repayment plan you are on, as it will help you identify whether there are better options available. Federal student loans offer a variety of repayment plans that cater to different financial situations. Understanding these options can help you choose the best plan for your needs. The Standard Repayment Plan is the default option for most federal student loans. Under this plan, you make fixed monthly payments for a term of up to 10 years. This plan typically results in the lowest overall interest paid compared to other repayment options. The Graduated Repayment Plan is designed for borrowers who expect their income to increase over time. With this plan, your monthly payments start lower and increase every two years. The repayment term remains up to 10 years. The Extended Repayment Plan is available to borrowers with more than $30,000 in outstanding Direct Loan debt. This plan extends the repayment term to up to 25 years, resulting in lower monthly payments but higher overall interest costs. Income-driven repayment plans base your monthly payments on your income and family size. These plans offer forgiveness of any remaining balance after 20 or 25 years of qualifying payments. There are four income-driven repayment plans: Income-Based Repayment (IBR): IBR is available for both FFEL and Direct Loan borrowers. Your monthly payments are generally 10% or 15% of your discretionary income, depending on when you took out your loans. Pay As You Earn (PAYE): PAYE is available for Direct Loan borrowers only. Your monthly payments are generally 10% of your discretionary income but cannot be more than the Standard Repayment Plan amount. Revised Pay As You Earn (REPAYE): REPAYE is also available for Direct Loan borrowers only. Your monthly payments are generally 10% of your discretionary income, with no cap on the payment amount. Income-Contingent Repayment (ICR): ICR is available for Direct Loan borrowers, including those with Parent PLUS loans if consolidated into a Direct Consolidation Loan. Your monthly payments are the lesser of 20% of your discretionary income or the amount you would pay on a fixed 12-year repayment plan, adjusted for income. Private student loan repayment options are generally less flexible than federal loan options. However, some private lenders do offer various repayment plans to accommodate borrowers' needs. The Standard Repayment option for private student loans is similar to that of federal loans. You make fixed monthly payments for a predetermined term, which can range from 5 to 20 years, depending on the lender and the loan terms. Some private lenders offer an interest-only repayment option, where borrowers make interest-only payments for a specified period, typically during the initial years of repayment. This option can provide temporary relief for borrowers who need lower monthly payments, but it may result in higher overall interest costs. Graduated repayment plans are also available with some private student loans. With this option, your monthly payments start lower and gradually increase over time, usually every two years. This plan can be beneficial for borrowers who expect their income to grow in the future. Refinancing is a popular strategy for private student loan borrowers, as it allows them to consolidate multiple loans into one new loan with potentially better interest rates and repayment terms. This can lead to lower monthly payments and reduced overall interest costs, but it may also extend the repayment term. Now that you are familiar with the various repayment options for federal and private student loans, it's time to explore practical strategies to manage your student loan debt effectively. Making extra payments towards your student loans can help you save on interest and pay off your debt faster. There are two popular methods for making extra payments: Snowball Method: With the snowball method, you focus on paying off your smallest loan balance first, while making minimum payments on your other loans. Once the smallest loan is paid off, you move on to the next smallest loan, gradually tackling larger balances. Avalanche Method: The avalanche method prioritizes paying off loans with the highest interest rates first, while making minimum payments on other loans. This strategy can save you the most in interest costs over time. Several loan forgiveness programs are available to eligible borrowers, particularly those with federal student loans. These programs include: Public Service Loan Forgiveness (PSLF): PSLF offers loan forgiveness for borrowers who work in qualifying public service jobs and make 120 qualifying monthly payments under a qualifying repayment plan. Teacher Loan Forgiveness: This program offers forgiveness for eligible teachers who work in low-income schools for a specific number of years. Income-Driven Repayment Forgiveness: As mentioned earlier, income-driven repayment plans offer forgiveness of any remaining balance after 20 or 25 years of qualifying payments. Some employers offer student loan repayment assistance as part of their benefits package. Check with your employer to see if they provide any support for repaying your student loans. Certain tax deductions and credits can help offset the cost of student loan interest. The Student Loan Interest Deduction allows you to deduct up to $2,500 of student loan interest paid during the tax year, subject to income limits. The American Opportunity Tax Credit and Lifetime Learning Credit can also provide tax savings for eligible education expenses. Successfully managing your student loan repayment is just one aspect of your overall financial well-being. Creating and sticking to a budget can help you manage your finances, allocate funds towards loan repayment, and achieve other financial goals. Establishing an emergency fund can provide a financial safety net for unexpected expenses. Additionally, setting and working towards savings goals can help you achieve financial stability and independence. It's essential to balance your student loan repayment with other financial priorities, such as retirement savings, purchasing a home, or starting a family. Consider your long-term financial goals and allocate your resources accordingly. Understanding and staying informed about your student loan repayment options is crucial to effectively managing your debt. By exploring various repayment strategies and remaining flexible as your life situations change, you can successfully navigate your student loan journey while working towards long-term financial success. Remember that responsible loan repayment can positively impact your credit score, future borrowing opportunities, and overall financial health.What Is a Student Loan Repayment Strategy?

Assessing Your Student Loan Situation

Organizing Your Loans

Understanding Interest Rates and Loan Terms

Identifying Your Current Repayment Plan

Federal Student Loan Repayment Options

Standard Repayment Plan

Graduated Repayment Plan

Extended Repayment Plan

Income-Driven Repayment Plans

Private Student Loan Repayment Options

Standard Repayment

Interest-Only Repayment

Graduated Repayment

Refinancing

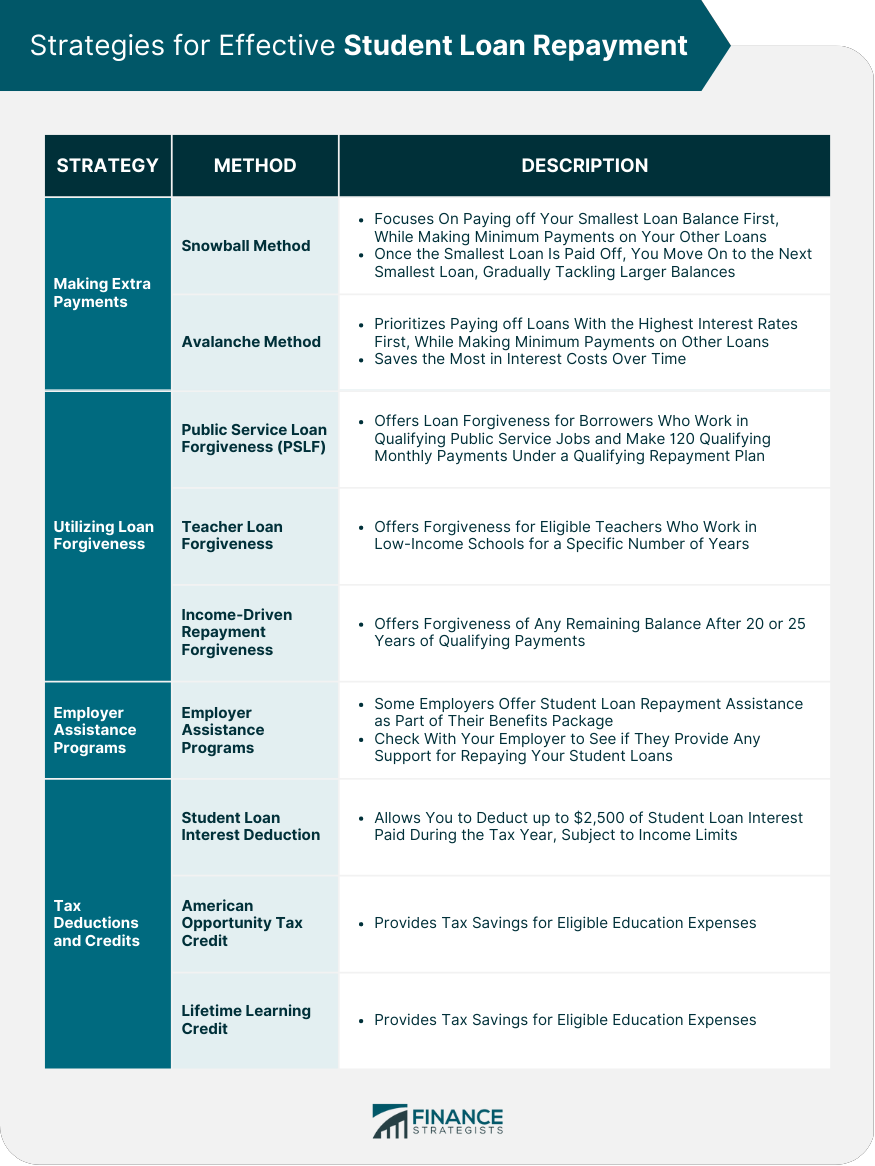

Strategies for Effective Student Loan Repayment

Making Extra Payments

Utilizing Loan Forgiveness Programs

Employer Assistance Programs

Tax Deductions and Credits

Planning for Long-Term Financial Success

Budgeting and Financial Planning

Emergency Fund and Savings Goals

Balancing Loan Repayment With Other Financial Priorities

Conclusion

Student Loan Repayment Strategies FAQs

Student loan repayment strategies are methods used to pay off student loans, including standard repayment, graduated repayment, extended repayment, and income-driven repayment plans.

The best student loan repayment strategy depends on your financial situation and goals. Consider your income, expenses, and loan amount to determine the repayment plan that works best for you.

Yes, you can change your student loan repayment strategy at any time. Contact your loan servicer to discuss your options and make the necessary changes.

When prioritizing loan payments, focus on paying off high-interest loans first. If you have multiple loans with the same interest rate, pay off the loans with the smallest balance first to gain momentum and motivation.

No, you cannot use multiple student loan repayment strategies at the same time. You must choose one repayment plan and stick to it, but you can change plans if needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.