The FINRA Suitability Rule was created in 2011 to address the growing number of reports that financial planners were steering their older clients into risky investments without regard to the client’s assets. FINRA knows this type of investing is bad for many reasons. FINRA found that investment advisers were not always adhering to the suitability rule when recommending products like annuities and whole life insurance policies to their older clients. FINRA believed that creating a specific suitability rule could help financial professionals better understand how to recommend products that meet the needs of their clients while still conforming to ethical standards. Have a financial question? Click here. The FINRA Suitability Rule is important for a few reasons. For example, a newer investor with a high-risk tolerance may be frustrated by a broker’s refusal to recommend an investment or product even though they have been trained in compliance with the FINRA Suitability Rule. This rule helps define that risk tolerance. For example, a broker who recommended and sold an inappropriate annuity to an older client could face the possibility of a $50,000 fine and loss of license. For instance, a retirement planner might be required to discuss whether or not his or her client has outlived their financial resources and needs additional products that may provide future income stability. In general, the FINRA Suitability Rule requires that investment professionals consider financial objectives, risk tolerance, and other factors specific to the client when recommending a security or financial product. This means that recommendations may be based on age, investment objectives, financial resources, income needs, and other associated risks. This is called “suitability”. Specifically, this rule requires that every recommendation must abide by the following three obligations: This requires that the investment professional has a reasonable basis to believe that the recommendation is suitable for the client. The investment professional must have a reasonable basis to believe that the recommendation is in line with the client’s financial objectives. The investment professional must have a reasonable basis to believe that the client has enough information to make an informed decision about the recommendation. This means that the investment professional must take into account the customer’s financial profile and only recommend products that are appropriate for that customer. This also requires that any recommendation be made only after the investment professional conducts a suitability analysis, which is a thorough analysis of a client’s risk tolerance and financial objectives. The financial professional This means that the investment professional must use specific criteria to determine what investments can be recommended. These criteria could include quantitative measurements, such as total risk exposure and volatility of the product. This also means that the investment professional must monitor these measurements on a regular basis to make sure they are still appropriate. In addition, the rule recommends that the following measures be considered The degree to which the investment is consistent with the client’s other investments, financial goals, and overall risk tolerance. A financial professional who violates any of these three obligations could face a variety of penalties, including a fine, suspension, or loss of license. FINRA regulates more than 5,000 firms and 630,000 financial professionals. FINRA investigates complaints about investment professionals. If the complaint is found to be valid, sanctions may be imposed on the professional. The sanctioning process allows for an opportunity to submit a written response before fines are assessed. The FINRA Suitability Rule is important because it helps to ensure that recommendations are appropriate for the client. The rule requires that investment professionals consider a variety of factors when making a recommendation, including the customer’s risk tolerance and financial objectives. This rule helps to protect investors by ensuring that they are not being recommended products that are unsuitable for their profiles. Financial professionals are required to have a reasonable basis to believe that the recommendation is suitable for the client. This means that they cannot just recommend a product because it is performing well in the market. The FINRA Suitability Rule is an important part of protecting investors and ensuring that recommendations are appropriate for each individual investor.Definition and the Three Main Obligations

Importance of the FINRA 2111 Suitability Rule

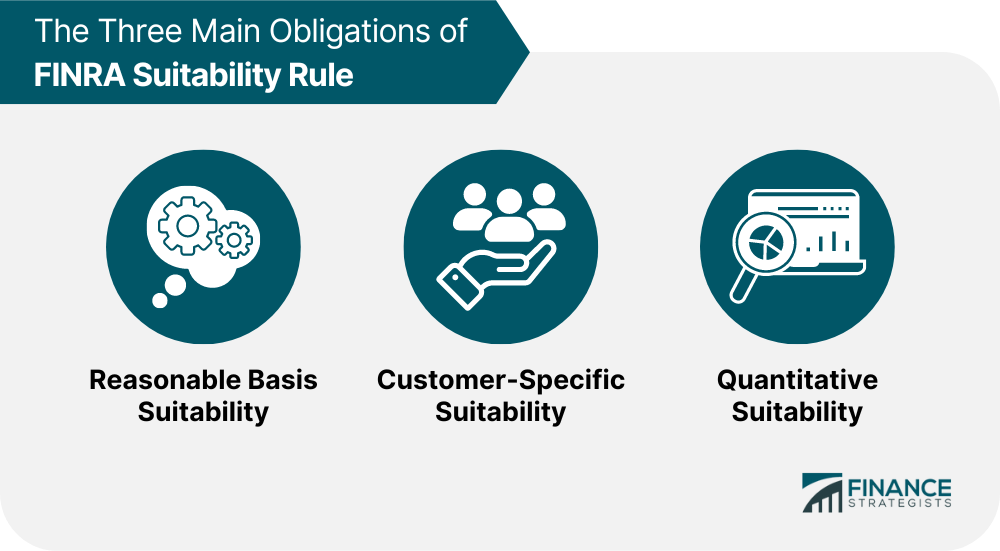

The Three Main Obligations

Reasonable Basis Suitability

Customer-Specific Suitability

Quantitative Suitability

Consequences of Violating the FINRA 2111 Suitability Rule

Final Thoughts

FINRA 2111 Suitability Rule FAQs

The FINRA Suitability Rule is a rule that requires investment professionals to consider a variety of factors when making a recommendation, including the customer’s risk tolerance and financial objectives.

The FINRA 2111 Suitability Rule was created to help ensure that recommendations are appropriate for the customer. Before the rule, investment professionals were only required to consider whether a product was suitable for the firm and not whether it was appropriate for the individual client.

The FINRA Suitability Rule helps keep customers safe by ensuring that they are receiving recommendations that take into account their risk tolerance and financial goals. The rule also helps to keep customers informed, as they can be confident that the investment professional has thoroughly analyzed their profile before making a recommendation.

The FINRA Suitability Rule requires financial professionals to take into account three factors when making a recommendation: reasonable basis, customer-specific and quantitative suitability. The professional must also monitor these measurements on a regular basis to ensure that they are still appropriate.

The FINRA 2111 Suitability Rule provides benefits to both the customer and the broker-dealer. By ensuring Fiduciary Duty standards are met, customers are provided with peace of mind that their investments are suitable for them given their financial situation and objectives. In addition, by following Fiduciary Duty standards, broker-dealers reduce the risk of litigation stemming from unsuitable investment recommendations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.