BrokerCheck is an online tool provided by the Financial Industry Regulatory Authority (FINRA) that enables investors to research the professional backgrounds of brokers and brokerage firms. The primary objective of this tool is to promote transparency and empower investors to make informed decisions about the individuals and firms they choose to manage their investments. FINRA BrokerCheck aims to help investors perform due diligence on brokers and brokerage firms, allowing them to verify the background information and credentials of these professionals. Providing easy access to crucial information enables investors to assess the trustworthiness and competence of brokers and firms before entrusting them with their hard-earned money. FINRA BrokerCheck is essential for investors as it helps them protect themselves from potential fraud and misconduct by financial professionals. The tool allows investors to gain insight into a broker's or firm's history, qualifications, and disciplinary records, ensuring they make educated decisions when choosing whom to work with for their investments. FINRA BrokerCheck was developed as part of FINRA's mission to protect investors and ensure the integrity of the financial industry. The platform has evolved over the years, incorporating new features and improving its user experience to provide easy access to vital information about brokers and firms for investors. Since its inception, FINRA BrokerCheck has undergone several updates and enhancements to improve its functionality and provide users with a more comprehensive and user-friendly experience. These updates have included expanded search capabilities, more detailed information about brokers and firms, and improved search result presentation. FINRA BrokerCheck can be accessed through FINRA's website or by visiting brokercheck.finra.org. The tool is free to use and available to anyone with internet access, making it easy for investors to research brokers and firms from anywhere at any time. Users can search for an individual broker by entering the broker's name or Central Registration Depository (CRD) number. They can also refine their search by providing additional information, such as location, to narrow down the results. Users can enter the firm's name or CRD number to search for a brokerage firm. Similar to searching for individual brokers, additional search criteria can be provided to refine the results. Upon locating a broker through the search, users can view the broker's profile, which contains important information about the broker's background, including employment history, qualifications, regulatory actions, customer disputes, and disciplinary events. When searching for a brokerage firm, users can view the firm's profile, which contains information about the firm's history, registration status, types of business activities, disclosures, regulatory events, and associated personnel. The broker's employment history is provided, including the names of the firms they have been associated with and the duration of their employment. FINRA BrokerCheck displays the broker's qualifications, such as licenses held and industry examinations passed. The tool lists any regulatory actions taken against the broker, including fines, suspensions, or other sanctions imposed by regulatory authorities. Any customer disputes involving the broker, including allegations of misconduct and their outcomes, are disclosed in the broker's profile. The broker's profile includes information about any disciplinary events, such as terminations, fines, or other penalties related to violations of industry rules and regulations. FINRA BrokerCheck provides the firm's history, including the date of establishment, any mergers, acquisitions, or other significant changes to its structure. The tool displays the firm's current registration status with FINRA and other regulatory agencies, ensuring that the firm is authorized to conduct business. Users can view the types of business activities the brokerage firm engages in, such as investment advice, underwriting, or trading. The tool provides information on disclosures and regulatory events involving the firm, including any legal or regulatory actions taken against the firm and their outcomes. Brokerage firm profiles include a list of associated personnel, allowing users to view the backgrounds of individual brokers working for the firm. While FINRA BrokerCheck aims to provide accurate and up-to-date information, it is essential for users to verify the data independently and consider the possibility of errors or omissions. FINRA BrokerCheck offers a wealth of information about brokers and firms, but it may not cover all aspects of their backgrounds. Investors should consider additional sources of information to gain a complete understanding of the professionals they are considering. While FINRA BrokerCheck provides a useful starting point for comparing brokers and firms, investors should not solely rely on the tool for making decisions. They should also consider factors such as investment philosophy, fees, and performance when making their final decision. Investors should utilize other resources in addition to FINRA BrokerCheck, such as the SEC's Investment Adviser Public Disclosure (IAPD) database, state securities regulators, and third-party review websites, to gather a comprehensive understanding of a broker or firm. To ensure the accuracy of the information found on FINRA BrokerCheck, investors should cross-check the data with other sources and reach out to the broker or firm for confirmation if necessary. When researching brokers or firms, investors should not hesitate to ask questions or seek clarification about any information they find unclear or concerning. Investors need to evaluate brokers and firms based on their risk tolerance and investment goals to ensure that they choose professionals who align with their needs and objectives. Investors should periodically review their broker's and firm's profiles on FINRA BrokerCheck to stay informed about any changes in their backgrounds or regulatory records. FINRA BrokerCheck plays a vital role in investor protection by providing a valuable resource for researching brokers and brokerage firms. The tool helps investors make informed decisions and promotes transparency within the financial industry, reducing the likelihood of fraud and misconduct. Conducting due diligence on brokers and firms is a crucial part of the investment process. By using tools like FINRA BrokerCheck and other resources, investors can better protect their investments and ensure that they are working with trustworthy, competent professionals. While resources like FINRA BrokerCheck are invaluable in researching brokers and firms, it is also essential to recognize the benefits of seeking professional guidance from a financial advisor. Financial advisors can help investors navigate the complexities of the investment process, develop personalized strategies, and make informed decisions based on their unique financial goals and risk tolerance.What Is FINRA BrokerCheck?

History of FINRA BrokerCheck

Development of the Platform

Enhancements and Updates Over Time

How FINRA BrokerCheck Works

Accessing the Tool

Performing a Search

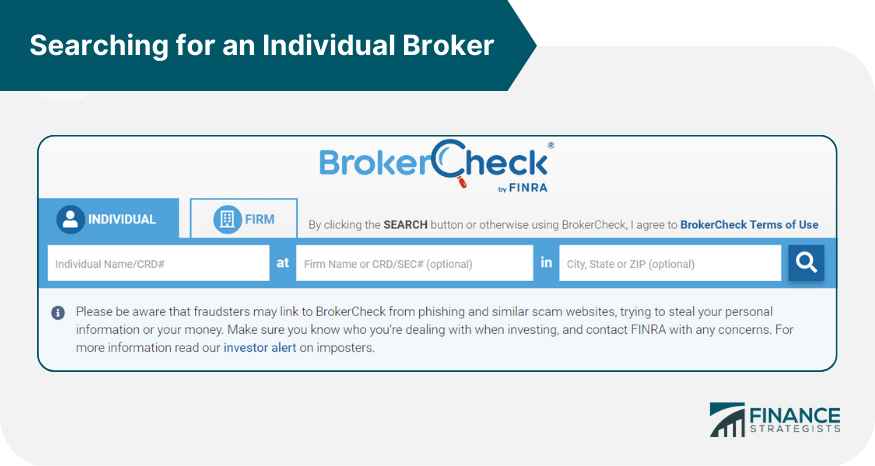

Searching for an Individual Broker

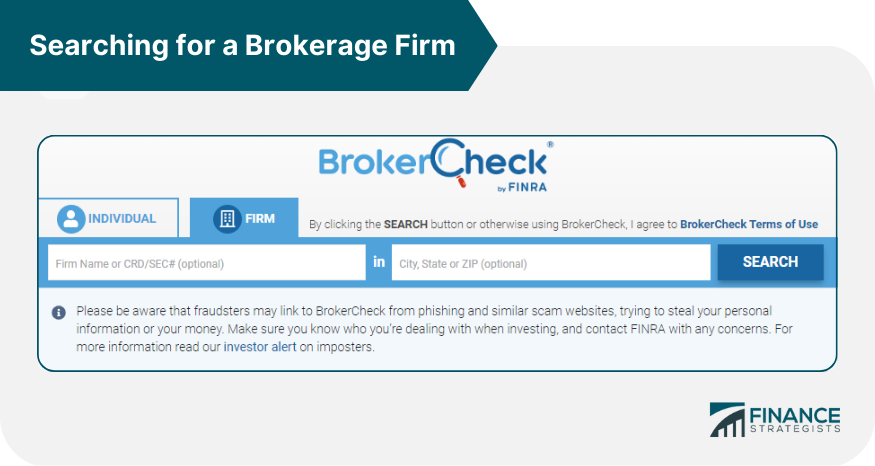

Searching for a Brokerage Firm

Understanding the Search Results

Broker's Profile

Firm's Profile

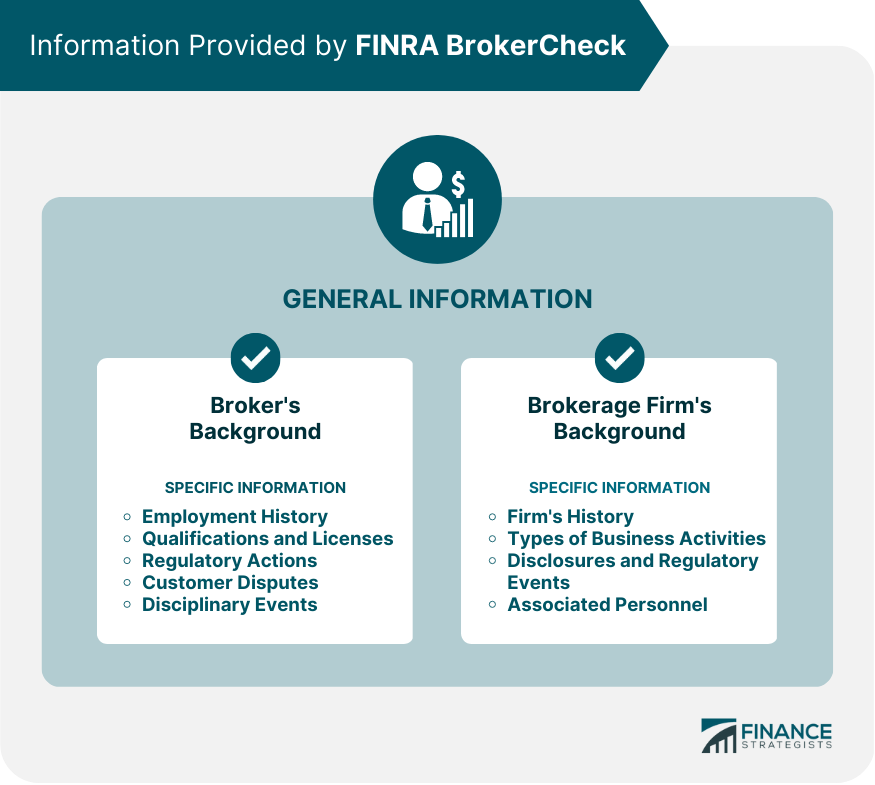

Information Provided by FINRA BrokerCheck

Broker's Background

Employment History

Qualifications and Licenses

Regulatory Actions

Customer Disputes

Disciplinary Events

Brokerage Firm's Background

Firm's History

Firm's Registration Status

Types of Business Activities

Disclosures and Regulatory Events

Associated Personnel

Limitations and Considerations

Information Accuracy and Timeliness

Scope of Information Provided

Comparing Brokers and Firms

Additional Resources for Research

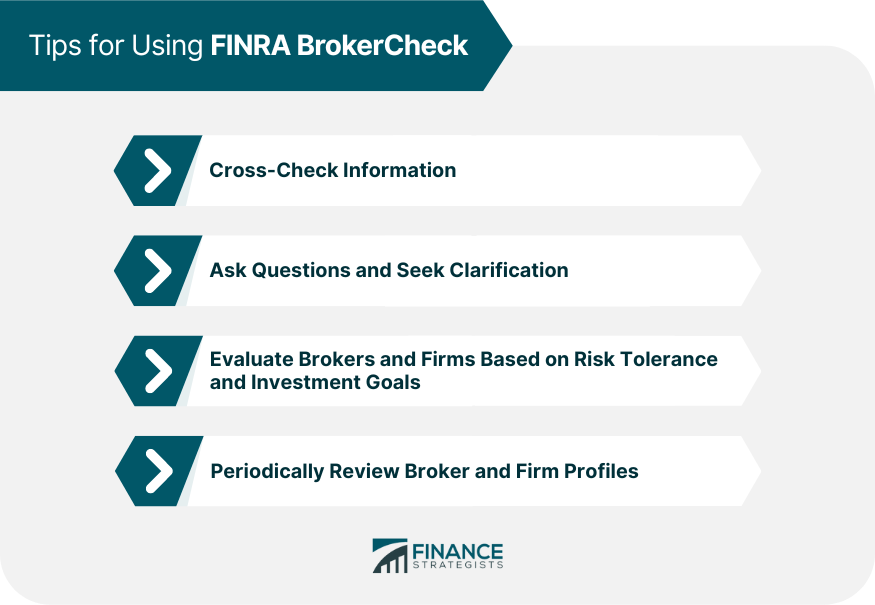

Tips for Using FINRA BrokerCheck

Cross-Checking Information

Asking Questions and Seeking Clarification

Evaluating Brokers and Firms Based on Risk Tolerance and Investment Goals

Periodically Reviewing Broker and Firm Profiles

Final Thoughts

FINRA BrokerCheck FAQs

FINRA BrokerCheck is an online tool provided by the Financial Industry Regulatory Authority (FINRA) that enables investors to research the professional backgrounds of brokers and brokerage firms. The primary objective of this tool is to promote transparency and empower investors to make informed decisions about the individuals and firms they choose to manage their investments.

Investors can access FINRA BrokerCheck through FINRA's website or by visiting brokercheck.finra.org. The tool is free to use and available to anyone with internet access, making it easy for investors to research brokers and firms from anywhere at any time.

FINRA BrokerCheck provides a wealth of information about brokers and firms, including their employment history, qualifications and licenses, regulatory actions, customer disputes, disciplinary events, types of business activities, disclosures, regulatory events, and associated personnel.

Yes, investors should consider the accuracy and timeliness of the information provided and cross-check it with other sources. They should also evaluate brokers and firms based on their risk tolerance and investment goals and not solely rely on the tool for making decisions. Additionally, investors should utilize other resources in addition to FINRA BrokerCheck, such as the SEC's Investment Adviser Public Disclosure (IAPD) database, state securities regulators, and third-party review websites, to gather a comprehensive understanding of a broker or firm.

Investors can cross-check information, ask questions and seek clarification, evaluate brokers and firms based on risk tolerance and investment goals, and periodically review broker and firm profiles to stay informed about any changes in their backgrounds or regulatory records.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.