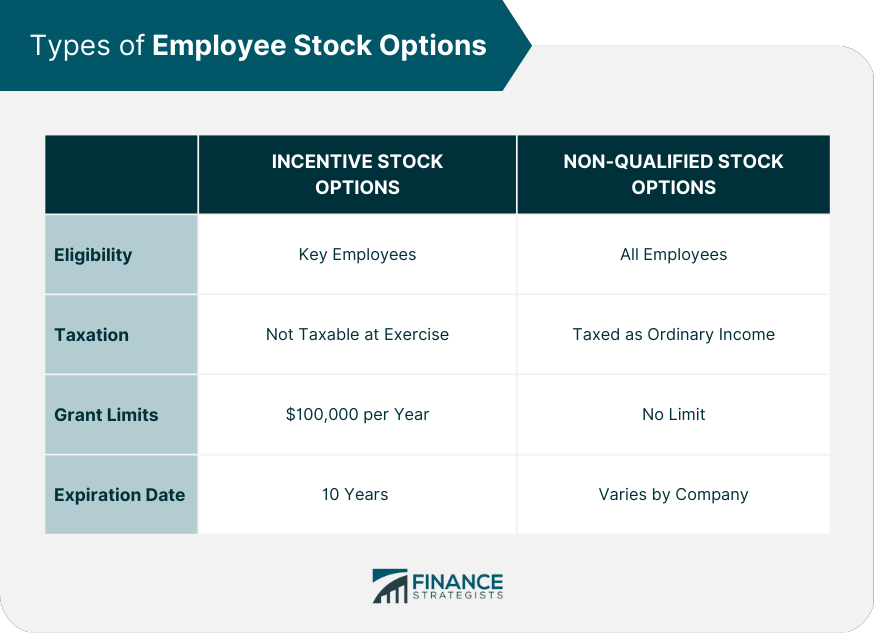

An employee stock option (ESO) is a form of equity compensation granted to employees by their employer. ESOs give employees the right to purchase company stock at a preset price, known as the exercise price or strike price, within a certain period of time, typically 10 years. The exercise price is usually set at the market price of the stock during the period that the option is granted. ESOs provide employees with the potential to benefit from the company's growth and success through the appreciation of the stock price. If the stock price increases above the exercise price, the employee can purchase the stock at the lower exercise price and sell it at the higher market price, thus realizing a profit. ESOs typically come with vesting periods. An employee is not entitled to exercise the option until a certain period of time has passed or until certain performance criteria have been met. Vesting periods may also be staggered, with a percentage of the options vesting each year over a multi-year period. ESOs also come with risks, as the value of the stock can decrease or become worthless, leaving the employee with worthless options. It is important for employees to carefully consider the risks and potential benefits of ESOs. Two primary kinds of ESO exist: Incentive stock options have more favorable tax treatment than the other type of ESO, but they are subject to more restrictive eligibility requirements and certain holding periods. Incentive stock options are granted to key employees and executives. They are designed to encourage long-term retention and performance. With incentive stock options, the employee is not taxed when the option is exercised, but the gain is taxed as a capital gain when the stock is sold, provided the holding period requirements are met. In order to qualify, employees must meet certain eligibility criteria, including being a regular employee, holding the stock for a minimum of two years after the grant date, and being employed by the company for at least one year after the exercise date. The most common type of ESO is the non-qualified stock options. They provide greater flexibility in terms of exercise price and timing, and they are not subject to as many restrictions as incentive stock options. These stock options are usually granted to all employees, regardless of position or level. The employee pays taxes on the difference between the grant price and the fair market value of the stock during the time of exercise, which is taxed as ordinary income. Employee stock options come with several important concepts that employees should understand when considering their use. ESOs are considered vested when employees are permitted to exercise their options and purchase the company's stock. Vesting schedules vary, but typically require a certain amount of time to pass before an ESO can be exercised. Companies may avoid the risk of employees making a quick gain and leaving the company by delaying the vesting of shares. Employees exercise their ESOs by notifying their employer and providing payment for the shares they wish to purchase. Once exercised, they become shareholders in the company. The exercise price specified in the options agreement is the record price for the shares, regardless of the actual market price of the stock. Receiving stock through an ESO can have tax implications for employees. Some ESO agreements may include a reload option. The reload option allows the employee to receive additional ESOs when they exercise their currently available ESOs. This can extend the life of an employee's ESOs and provide additional opportunities for financial gain. ESOs do not have an immediate tax liability upon being granted. Taxation begins upon exercise. When employees exercise ESOs, they are required to report the difference between the fair market value of the stock during the time of exercise and the exercise price as ordinary income. This amount is then subject to taxes. The sale of the acquired stock is also a taxable event. If the employee sells the shares within one year of exercise, it is considered a short-term capital gain and taxed as ordinary income. Also, if the employee holds onto the shares acquired for a certain period of time, they may be eligible for preferential long-term capital gains tax treatment. The exact tax treatment of ESOs can vary depending on several factors. These factors include the type of ESO, the holding period, and the employee's tax bracket. It is recommended that employees receive professional tax services to fully understand the tax implications. The time value and intrinsic values of ESOs determine their overall value. The time value of an ESO refers to the amount of remaining time until the option expires, which determines the likelihood that the stock price will increase above the exercise price. The longer the time until expiration, the greater the time value of the option. The intrinsic value of an ESO, on the other hand, is the difference between the exercise price and the market price of the option. If the stock price has higher value than the exercise price, the option has intrinsic value. If the stock price has lower value than the exercise price, the option has no intrinsic value. ESOs can gain or lose value over time based on changes in the stock price and the time remaining until expiration. If the stock price increases above the exercise price, the option gains intrinsic value and its overall value increases. However, if the stock price decreases or remains stagnant, the option may lose intrinsic value or become worthless. In addition, the time value of an ESO decreases as the option approaches expiration. This is because there is less time for the stock price to increase above the exercise price. As a result, ESOs that are closer to expiration have less overall value than those with more time remaining. Exercising an ESO captures intrinsic value but often results in giving up time value, if any remains, resulting in a hidden opportunity cost that could be significant. Employees should be aware of the risks, such as the potential for the stock price to decrease or for the option to expire and become worthless. Employee stock options and listed options differ in several ways. ESOs can be challenging to value, unlike exchange-traded options that have high liquidity and frequent trading, making it easier to determine their portfolio value. Since ESOs lack a market price reference point, their value can be difficult to assess. The input variables in option pricing models, such as the expected length of employment, estimated holding period before exercise, and volatility assumptions, can significantly impact the option prices. Listed options have a standardized contract structure, which includes the number of shares underlying the options contract and the expiration date, among other details. This uniformity enables options trading for any optionable stock. ESOs have similar rights to listed options, but their specific terms and conditions are not standardized and are specified in the options agreement. The right to buy shares with ESOs is not standardized and can vary widely depending on the agreement. In contrast to listed options, ESOs do not have an automatic exercise feature. Employees must proactively decide to exercise their options before the expiration date, unlike listed options where in-the-money options are automatically exercised at expiration. Employees have more control over the exercise of their ESOs. They can decide when to exercise the options based on market conditions and their financial goals. However, it puts the responsibility on the employee to monitor the expiration date and take action if they wish to exercise their options. Listed options have strike prices that are standardized and predetermined with increments based on the price of the underlying security. In contrast, ESOs have no standardized strike prices, and the typical approach is to set the strike price at the stock's closing price on a particular day. ESO backdating involves granting an option at a previous date instead of the current date, giving an instant gain to the option holder. However, the Sarbanes-Oxley Act requires companies to report option grants within two business days, making ESO backdating more difficult. In some cases, ESOs may have a vesting schedule, which means that the employee must wait a certain amount of time before they can exercise the option. This is often used as an incentive for the employee to remain with the company for a specified period. Additionally, some ESOs may also have restrictions on the acquired stock, such as a lock-up period. During this period, the employee may not be able to sell the acquired stock immediately, which can limit their ability to realize the full value of the option. Counterparty risk refers to the possibility that one party in a financial transaction may default on their obligation, resulting in losses for the other party. In the case of ESOs, the employer is the counterparty to the employee's option contract. The value of the option is directly linked to the financial health and performance of the employer. If the employer's stock price decreases or the company experiences financial difficulties, the value of the option may decrease as well. This can leave the employee with a lower payout or no payout at all upon exercise of the option. Therefore, employees should carefully consider the financial stability and performance of their employer before exercising their ESOs. Concentration risk is a potential drawback of ESOs. Employees may have a significant portion of their compensation tied up in the stock of their employer. This lack of diversification in their investment portfolio can leave employees vulnerable. Employees may incur potentially significant losses if the company's stock performs poorly. This is particularly true if employees fail to take proactive steps to diversify their investment portfolio beyond their employer's stock. Employers offer various types of equity compensation to their employees beyond just ESOs. This is a type of equity compensation that involves the employer granting shares of company stock to the employee, subject to certain vesting requirements. Unlike ESOs, RSUs do not require the employee to purchase company stock at a set price. The value of the grant is tied directly to the market value of the stock at the time of vesting. RSUs offer the potential for long-term appreciation in value, but they may not provide the same financial incentives as ESOs due to their lack of flexibility. Employee stock purchase plans allow employees to purchase company stock at a discount. These plans often have specific enrollment periods and may be offered at a discount of up to 15% of the market price of the stock. All employees are able to purchase employee stock purchase plans, but they typically require the employee to hold the stock for a certain period of time before selling it, and they are subject to certain tax implications. Phantom stock involves receiving a bonus based on the hypothetical value of a specified number of shares at a particular time, without any actual transfer or exercise of shares. Unlike ESOs, phantom stock does not involve the actual issuance of company stock. Stock Appreciation Rights are another type of equity compensation that offer employees the right to receive cash payments based on the appreciation in the company's stock value, which is the difference between the stock price at the time of grant and the stock price at the time of exercise. Here are some tips for maximizing the benefits of ESOs: This strategy entails regularly investing a predetermined sum of money at consistent intervals throughout a specific duration. This approach can help to reduce the impact of market volatility on the value of ESOs. By investing a fixed amount regularly, employees can take advantage of fluctuations in the stock price, buying more shares when the price is low and fewer when it is high. This can result in a lower average cost per share and potentially higher returns over time. ESOs pose a concentration risk of ESOs. It is recommended that individuals diversify their investment portfolio. This is because ESOs are dependent on the performance of a single company. Diversification can be accomplished by investing in various assets. By diversifying the portfolio, the risk is spread across different investments, which can reduce the impact of any single investment on the overall portfolio. It is important to understand the tax consequences of exercising and selling ESOs. Exercising ESOs can trigger a taxable event, resulting in ordinary income tax on the difference between the strike price and the market price at the time of exercise. Selling ESOs can also trigger capital gains tax, depending on how long the individual hold the shares. Utilizing tax services can help individuals understand the tax implications of ESOs and develop a tax-efficient strategy. Employee Stock Options are a type of equity compensation given by an employer to their employees, which allows them to buy company stock at a predetermined exercise or strike price during a specified time period. There are two main types of employee stock options: the incentive stock option and non-qualified stock option. The key differences between these types of ESOs include eligibility criteria, tax implications, grant limits and the expiration date. Employee stock options are subject to concepts, including vesting and exercise. Vesting requires a certain amount of time to pass before an ESO can be exercised. ESOs have a deferred tax liability, which begins upon exercise. ESOs are different from other options in terms of difficulty in valuation, lack of standardization, and concentration risk. Other types of grant strategies are also available, such as restricted stock units and phantom stock plans. Individuals can maximize their ESOs by using the strategy of dollar-cost averaging, diversifying their portfolio, and understanding the tax implications of exercising and selling. ESOs can incentivize employees to work harder and make decisions that benefit the company.What Is an Employee Stock Option (ESO)?

Types of ESO

Incentive Stock Options

Non-qualified Stock Options

ESOs Important Concepts

Vesting and Exercise

Receiving Stock and Reload Option

ESO Tax Implications

ESO Time Value & Intrinsic Value

Differences Between ESOs and Listed Options

ESOs Are Difficult to Value

Non-standardized Specification

No Automatic Exercise

Strike Prices

Restrictions on Vesting and Acquired Stock

Counterparty Risk

Concentration Risk

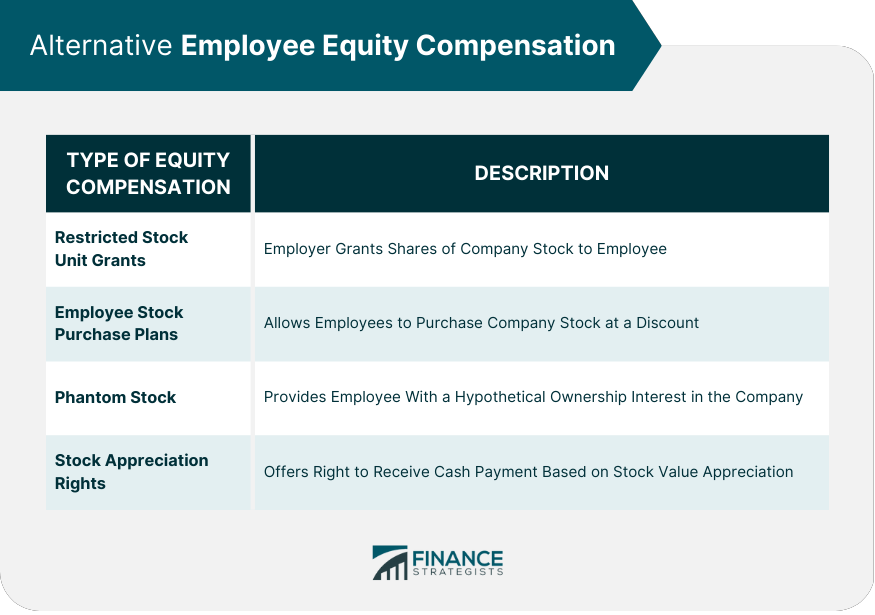

Other Types of Employee Equity Compensation

Restricted Stock Unit Grants

Employee Stock Purchase Plans

Phantom Stock

Stock Appreciation Rights (SARs)

Maximizing the Benefits of Employee Stock Options

Consider Dollar-Cost Averaging

Diversify Your Portfolio

Understand the Tax Implications

Final Thoughts

Employee Stock Options (ESOs) FAQs

An ESO or Employee Stock Option is a type of equity compensation that grants employees the right to purchase a company's stock at a predetermined price, known as the exercise price or strike price, within a certain period of time. ESOs are typically offered as part of an employee's compensation package and are often used to incentivize employees to work harder and make decisions that benefit the company.

Incentive stock options offer potentially more favorable tax treatment than non-qualified stock options, with no tax upon exercise and any gains upon sale taxed as long-term capital gains. Non-qualified stock options are taxed as ordinary income upon exercise, and any gains upon sale are taxed as short-term or long-term capital gains. Non-qualified stock options are available to all employees, while incentive stock options can be granted to key employees. Incentive stock options have a limit of $100,000 in aggregate fair market value that can become exercisable in any given year, while NSOs do not have this limit.

ESOs are typically taxed when they are exercised. At the time of exercise, the difference between the fair market value of the exercise price and the stock is taxed as ordinary income. If the employee holds the shares acquired through exercising the ESOs for at least one year from the date of exercise and two years from the date of grant, the employee may be eligible for long-term capital gains tax treatment.

Companies give stock to employees as part of their compensation package for several reasons. One reason is to align the interests of employees with the interests of the company's shareholders. When employees own stock in the company, they have a say in the company's success and are motivated to work hard to increase its value. This can lead to better productivity, innovation, and ultimately, higher profits for the company.

ESOs are non-standardized, lack a readily available market price, and do not have standardized specifications, making them difficult to value. ESOs may have lower strike prices than listed options, which can increase the value of the option. ESOs have restrictions on vesting and acquired stock, expose employees to counterparty risk and can pose concentration risk, while listed options provide standardized terms, automatic exercise, and easier valuation but do not provide the same potential for significant returns as ESOs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.