A nonqualified deferred compensation (NQDC) plan is an arrangement where employees can defer receiving a portion of their compensation until a later date, typically retirement. Unlike qualified retirement plans such as 401(k)s, NQDC plans do not have the same tax benefits or contribution limits. NQDC plans are primarily designed to provide a way for highly compensated executives and employees to defer income and potentially reduce their current tax liabilities. These plans can also be used as a tool to attract and retain top talent within a company. NQDC provides flexibility to employees in terms of when they receive their deferred compensation. By deferring income until retirement, employees can potentially reduce their taxable income during their highest-earning years and defer taxes until they are in a lower tax bracket. NQDC plans can also be used to supplement other retirement plans, such as 401(k)s, and provide an additional source of retirement income. For employers, offering NQDC plans can help to attract and retain highly skilled employees, which can be critical in today's competitive job market. Have questions about Nonqualified Deferred Compensations? Click here. Unlike qualified plans such as 401(k)s, NQDC plans do not receive preferential tax treatment, and the deferral is not subject to the same limits as qualified plans. Rather, the deferred compensation is held by the employer, and it is taxed at the time it is paid out to the employee. NQDC plans are typically offered to executives and highly compensated employees and can be a useful tool for tax planning and retirement savings. NQDC plans are typically offered to a select group of highly compensated employees, such as executives or key employees. This is due in part to legal requirements that NQDC plans must satisfy to avoid being classified as discriminatory. Under these requirements, NQDC plans must satisfy one of two tests: the top hat plan exemption or the substantial participation test. The top hat exemption applies to plans that are maintained primarily for the purpose of providing deferred compensation to a select group of management or highly compensated employees. The substantial participation test applies to plans in which at least 20% of the employer's highly compensated employees participate. In both cases, the plans must be unfunded, meaning that the deferred compensation is not held in trust, and the benefits are payable only from the general assets of the employer. Below are the advantages of nonqualified deferred compensation plans: NQDC plans can be an effective tool for tax planning, particularly for high-income earners. By deferring compensation, employees can reduce their current tax liability and potentially pay taxes on the deferred compensation when they are in a lower tax bracket. Employers can also benefit from tax savings by deducting the deferred compensation when it is paid out to employees. NQDC plans are customizable, allowing employees to tailor their deferral amounts and payout schedules to fit their individual financial goals and needs. NQDC plans provide employees with flexibility in terms of when and how they receive their deferred compensation. Employees can choose to receive their deferred compensation as a lump sum, annual payments, or in installments, depending on their financial needs and goals. NQDC plans can be a valuable tool for retirement savings, particularly for highly compensated employees who may be subject to contribution limits on qualified plans. These plans can provide an additional source of retirement income and help employees meet their retirement savings goals. It is important to note that nonqualified deferred compensation plans have the potential drawbacks: Participating in a nonqualified deferred compensation plan comes with several risks that individuals must consider before investing. One such risk is the potential for reduced protections and greater risk. By participating in an NQDC plan, individuals become creditors of the company, which means they could lose part or all of their investment if the company becomes insolvent and declares bankruptcy. An employer cannot currently deduct any nonqualified deferred compensation amounts until the employee receives the payment as income. This means that if an employer makes contributions to a nonqualified deferred compensation trust for key employees, the contributions are not considered gross income or transfers of property until the amounts are transferred, paid, or made available to the participants. Similarly, maintaining bookkeeping accounts under a nonqualified deferred compensation plan for highly compensated employees is not considered a transfer of property or gross income until the amounts from the accounts are actually paid or transferred to the participants. Furthermore, unexpected payout acceleration is another risk associated with NQDC plans. Even if individuals choose a flexible payout option over time, the company may have the right to accelerate the payout should they leave unexpectedly. This can result in a sudden large sum of money, resulting in significant tax implications, particularly if it coincides with a severance package. Such unexpected payout accelerations can also lead to additional retirement income planning complications. NQDC plans are often compared to qualified plans such as 401(k)s and pension plans. While both types of plans offer retirement savings benefits, there are some key differences. One of the main differences between NQDC plans and qualified plans is the tax treatment. Qualified plans receive preferential tax treatment, allowing employees to contribute pre-tax dollars and defer taxes until retirement. NQDC plans do not receive these tax benefits, and deferred compensation is taxed at the time it is paid out to the employee. Another difference is the contribution limits. Qualified plans such as 401(k)s have contribution limits, while NQDC plans do not. This makes NQDC plans a more flexible option for highly compensated employees who may be subject to contribution limits on qualified plans. NQDC plans have several tax implications for both employers and employees. Employers are not allowed to take a tax deduction for deferred compensation until the compensation is paid out to the employee. The employer must pay taxes on the deferred compensation until it is paid out. For employees, deferred compensation is taxed at the time it is paid out, not when it is earned. This can be an advantage for employees who are in a lower tax bracket when they receive the deferred compensation. However, it can also be a disadvantage for employees who are in a higher tax bracket at the time of payment. When designing and implementing NQDC plans, it is important to consider the tax implications for both employers and employees. Employers should consult with tax professionals to ensure that the plan is structured in a way that maximizes tax benefits and minimizes tax liabilities. Below are some best practices related to nonqualified deferred compensation plans: Structuring the nonqualified deferred compensation plan in compliance with legal and regulatory requirements is crucial for its success. This involves following the guidelines set forth by the Internal Revenue Service (IRS) to avoid penalties and ensure that the plan is legally binding. Make sure that the deferred compensation is not held in a trust but rather payable only from the general assets of the employer. This helps to mitigate the risk of loss if the employer goes bankrupt. Consulting with tax professionals is also crucial in structuring the NQDC plan in a tax-efficient manner, considering both employer and employee tax implications. Finally, educating employees about the tax implications of the plan and their options is important to ensure that they understand how the plan works and can make informed decisions about their deferred compensation. A nonqualified deferred compensation is an arrangement where employees can defer receiving a portion of their compensation until a later date, typically retirement. Nonqualified deferred compensation plans can provide a valuable tool for high-earning individuals to save for retirement and mitigate current income taxes. These plans offer greater flexibility and customization options than qualified plans such as 401(k). They also come with risks, such as reduced protections. Also, they have unexpected payout accelerations. To ensure the success of an NQDC plan, employers should follow best practices, including complying with legal and regulatory requirements. They should ensure that the plan is unfunded, consult with tax professionals or a financial advisor, and educate employees on the tax implications of the plan. While NQDC plans may not be suitable for everyone, they can provide a valuable additional source of retirement income for high-earning individuals looking to maximize their savings potential.What Is a Nonqualified Deferred Compensation?

How Does Nonqualified Deferred Compensation Work?

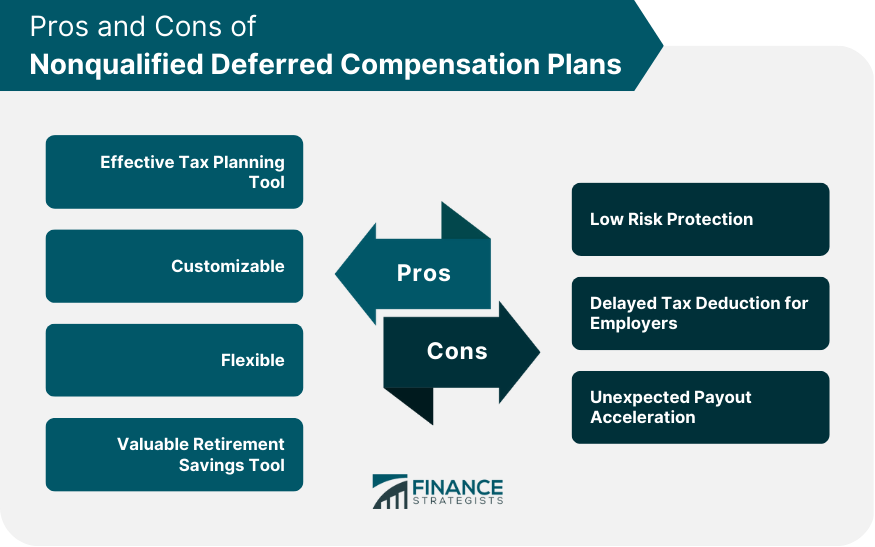

Advantages of Nonqualified Deferred Compensation Plans

Effective Tax Planning Tool

Customizable

Flexible

Valuable Retirement Savings Tool

Disadvantages of Nonqualified Deferred Compensation Plans

Low Risk Protection

Delayed Tax Deduction for Employers

Unexpected Payout Acceleration

Comparison With Other Retirement Savings Plans

Tax Implications of Nonqualified Deferred Compensation

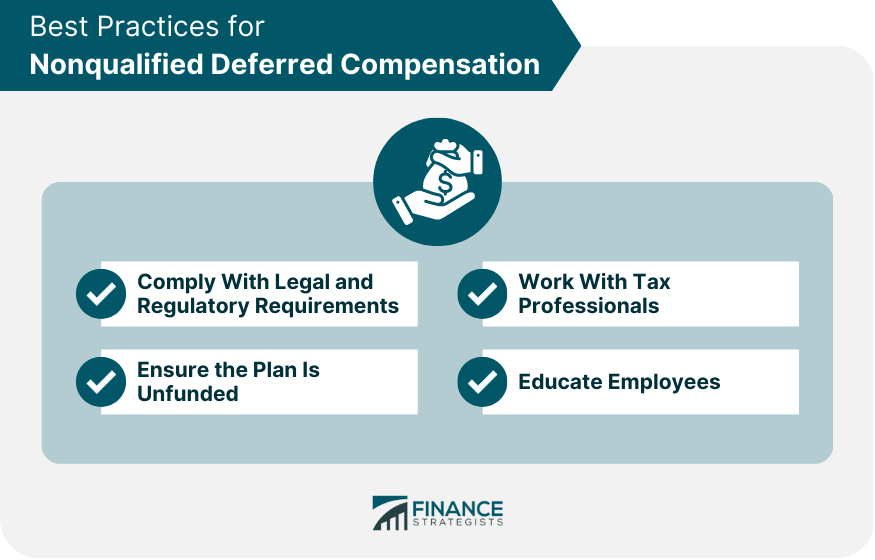

Best Practices for Nonqualified Deferred Compensation

Comply With Legal and Regulatory Requirements

Ensure the Plan Is Unfunded

Work With Tax Professionals

Educate Employees

Final Thoughts

Nonqualified Deferred Compensation FAQs

Nonqualified deferred compensation (NQDC) is a type of executive compensation plan that allows high-earning individuals to defer a portion of their income until retirement.

Nonqualified deferred compensation plans allow employees to defer a portion of their income until retirement. This deferred compensation is not taxed until it is paid out to the employee, allowing for potential tax savings.

The plans offer greater flexibility, customization options, and retirement savings potential than qualified plans. They also allow individuals to defer income and potentially move into a lower tax bracket in retirement.

NQDC plans come with risks such as reduced protections, lack of investment diversification, and unexpected payout accelerations. They also do not receive the same tax benefits as qualified plans.

NQDC plans offer more flexibility in terms of contribution limits than qualified plans such as 401(k)s. However, qualified plans offer preferential tax treatment for contributions, while NQDC plans do not.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.