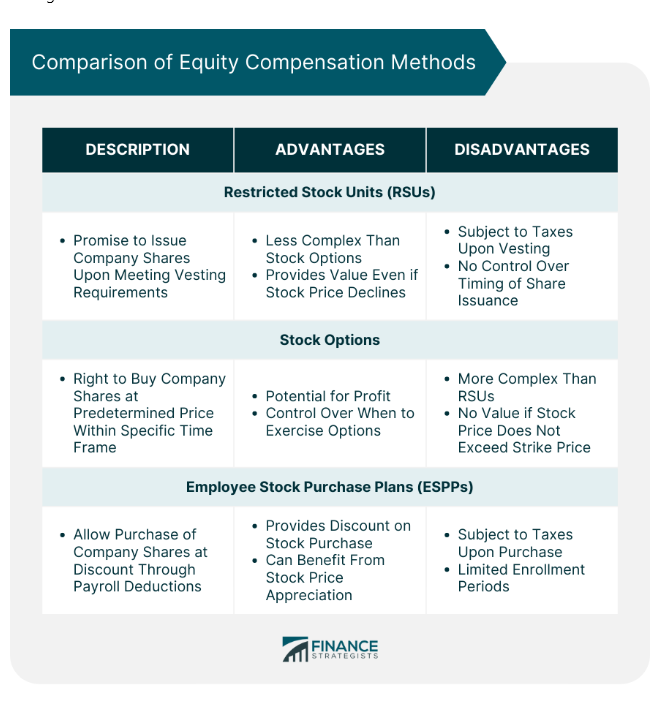

Restricted Stock Units are a form of equity compensation granted by employers to employees. They represent a promise to issue a specific number of company shares at a future date, typically upon meeting certain vesting requirements. RSUs are used to motivate, attract, and retain employees by aligning their interests with the company's growth and success. Stock options give employees the right to buy company shares at a predetermined price (called the strike price) within a specific time frame. They provide the potential for profit if the market value of the shares exceeds the strike price when the options are exercised. Employee Stock Purchase Plans (ESPPs) allow employees to purchase company shares at a discounted price through payroll deductions. ESPPs provide an opportunity for employees to acquire company shares and benefit from potential stock price appreciation. RSUs have several advantages, such as being less complex than stock options and providing value even if the stock price declines. However, RSUs are subject to taxes upon vesting, and employees have no control over the timing of when shares are issued. Equity compensation plays a crucial role in attracting and retaining top talent, as it provides employees with an ownership stake in the company. This encourages employees to work towards the company's success and fosters a sense of loyalty and commitment. RSUs are often included as part of a competitive compensation package, along with base salary, bonuses, and other benefits. RSUs can enhance the overall attractiveness of a compensation package, especially for employees who value long-term incentives and potential for financial growth. Time-based vesting requires employees to remain with the company for a specified period before their RSUs vest. This approach encourages employee retention and rewards long-term commitment to the company. Performance-based vesting ties RSU vesting to the achievement of specific company or individual performance goals. This approach incentivizes employees to achieve performance targets and aligns their interests with company success. Some companies use a combination of time and performance-based vesting schedules for RSUs. This approach balances the need for employee retention with the desire to encourage strong performance and drive company success. In most cases, RSUs are not taxed at the time of grant. Employees do not have any taxable income related to RSUs until they vest, at which point the value of the shares is considered taxable income. Upon vesting, the fair market value of the shares at the time of vesting is considered ordinary income and is subject to federal, state, and local income taxes. In addition to income taxes, the value of vested RSUs is also subject to Social Security and Medicare taxes (FICA). These taxes are typically withheld from the employee's paycheck or paid through the sale of a portion of the vested shares. When an employee sells shares acquired through RSUs, any difference between the sale price and the fair market value at the time of vesting is subject to capital gains tax. The tax rate depends on the holding period of the shares and the employee's income level. The holding period for capital gains tax purposes starts when the RSUs vest. To qualify for long-term capital gains tax rates, which are generally lower than short-term rates, employees must hold the shares for at least one year from the vesting date and two years from the grant date. Tax planning strategies for RSUs can include deferring vesting to minimize taxable income, utilizing tax-advantaged accounts, and managing the timing of share sales to maximize long-term capital gains. Proper tax planning can help employees minimize their tax liability and optimize the value of their RSUs. RSUs help align employee and shareholder interests by granting employees a financial stake in the company's performance. As the value of RSUs is tied to the company's stock price, employees have an incentive to work towards increasing shareholder value. The use of RSUs as part of compensation packages can positively impact company performance and valuation by motivating employees to focus on long-term success. However, excessive emphasis on equity compensation may lead to short-term decision-making or excessive risk-taking. Executive compensation packages often include significant RSU grants, which can sometimes lead to controversy and concerns about excessive pay and potential misalignment of incentives between executives and other stakeholders. Various regulatory and legal considerations apply to the use of RSUs in executive compensation, including disclosure requirements, tax implications, and corporate governance guidelines. Companies must carefully design and administer executive RSU programs to ensure compliance with applicable laws and regulations. The tax treatment of RSUs varies across different jurisdictions, with each country having its own rules and regulations governing the taxation of equity compensation. Employees working in multiple countries or relocating during their RSU vesting period may face additional tax complexities. Companies offering RSUs to employees in different countries must ensure compliance with local laws and regulations related to equity compensation, labor, and taxation. This may require the implementation of country-specific RSU plans or the use of alternative equity compensation methods. Cross-border equity compensation, including RSUs, presents unique challenges related to tax compliance, currency exchange, and legal considerations. Best practices include coordinating with local tax and legal experts, developing clear communication strategies, and adapting equity programs to local requirements. As the business landscape evolves, companies may explore innovative equity compensation methods beyond RSUs, such as performance share units (PSUs), restricted stock awards (RSAs), or tokenized equity offerings based on blockchain technology. Regulatory changes, such as updates to tax laws or corporate governance guidelines, can impact the use and administration of RSUs. Companies and employees must stay informed about relevant regulatory developments to ensure compliance and effective equity compensation strategies. The rise of remote work and increased globalization may lead to more cross-border equity compensation arrangements, including RSUs. This trend will require companies to navigate the complexities of international tax, legal, and regulatory frameworks when designing and administering RSU plans. RSUs play a vital role in modern compensation packages, offering employees long-term incentives and a financial stake in the company's success. As a result, they help attract and retain top talent while aligning employee and shareholder interests. While RSUs offer significant benefits for both employees and employers, it is essential to balance these advantages with potential risks, such as tax liabilities, market fluctuations, and potential misalignment of incentives. Careful planning and consideration can help optimize the value of RSUs within a compensation package. The landscape of equity compensation, including RSUs, continues to evolve in response to changes in the business environment, regulatory frameworks, and employee preferences. A financial advisor can provide personalized advice on managing RSUs and developing a comprehensive financial plan that aligns with individual goals and circumstances.What Are Restricted Stock Units (RSUs)?

Comparison to Other Equity Compensation Methods

Stock Options

Employee Stock Purchase Plans (ESPPs)

RSUs in the Context of Employee Compensation

Importance of Equity Compensation in Attracting and Retaining Talent

RSUs as a Component of a Competitive Compensation Package

Vesting Schedules and Terms

Time-Based Vesting

Performance-Based Vesting

Combination of Time and Performance-Based Vesting

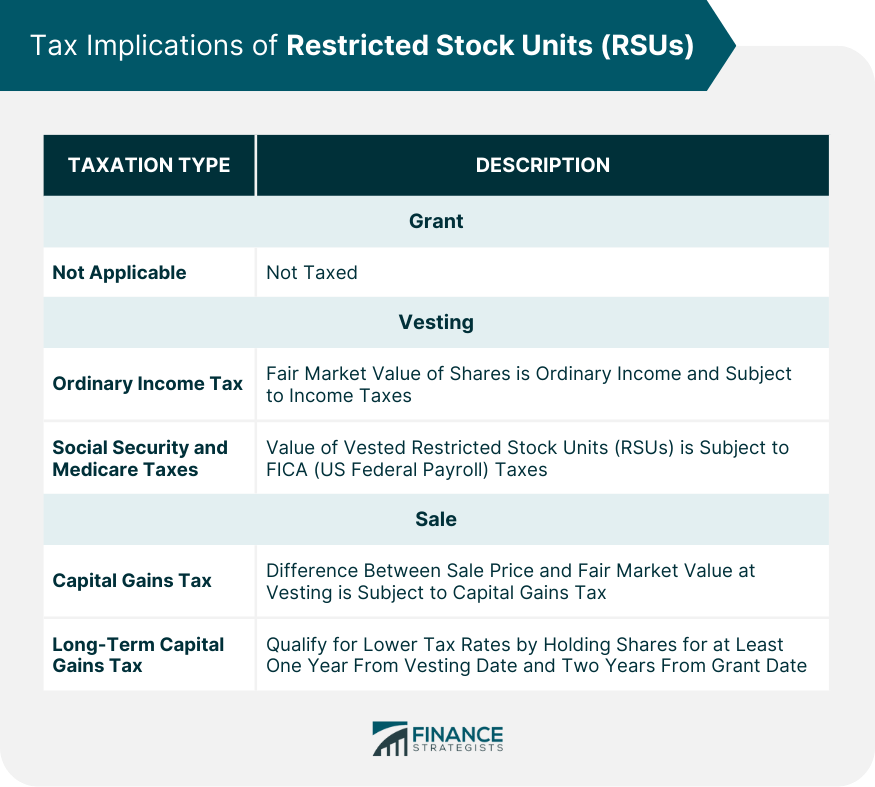

Tax Implications of RSUs

Taxation at Grant

Taxation at Vesting

Ordinary Income Tax

Social Security and Medicare Taxes

Taxation at Sale

Capital Gains Tax

Long-Term Capital Gains

Tax Planning Strategies for RSUs

RSUs and Corporate Governance

Role of RSUs in Aligning Employee and Shareholder Interests

Impact of RSUs on Company Performance and Valuation

Executive Compensation and RSUs

Controversies and Concerns

Regulatory and Legal Considerations

International Considerations for RSUs

Tax Treatment of RSUs in Different Jurisdictions

Compliance With Local Laws and Regulations

Cross-Border Equity Compensation Challenges and Best Practices

Future Trends and Developments in RSUs

Innovations in Equity Compensation

Regulatory Changes Affecting RSUs

Impact of Remote Work and Globalization on RSUs and Equity Compensation

Final Thoughts

Restricted Stock Units (RSUs) FAQs

Restricted Stock Units (RSUs) are a form of equity compensation granted by employers to employees, representing a promise to issue a specific number of company shares at a future date upon meeting certain vesting requirements. They are used to motivate, attract, and retain employees by aligning their interests with the company's growth and success.

RSUs represent a promise to issue company shares in the future, while stock options give employees the right to buy shares at a predetermined price within a specific time frame. ESPPs allow employees to purchase company shares at a discounted price through payroll deductions. Each type of equity compensation offers different benefits and risks.

RSUs are generally not taxed at the time of grant but are subject to federal, state, and local income taxes, as well as Social Security and Medicare taxes, upon vesting. When the shares are sold, any difference between the sale price and the fair market value at the time of vesting is subject to capital gains tax, depending on the holding period and employee's income level.

Common vesting schedules for RSUs include time-based vesting, which requires employees to remain with the company for a specified period before the RSUs vest; performance-based vesting, which ties vesting to the achievement of specific company or individual performance goals; and a combination of time and performance-based vesting.

When managing RSUs, employees should consider the vesting schedule, tax implications, and potential impact on their overall financial plan. Consulting with a financial advisor can help employees make informed decisions about managing RSUs and developing a comprehensive financial strategy that aligns with their individual goals and circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.