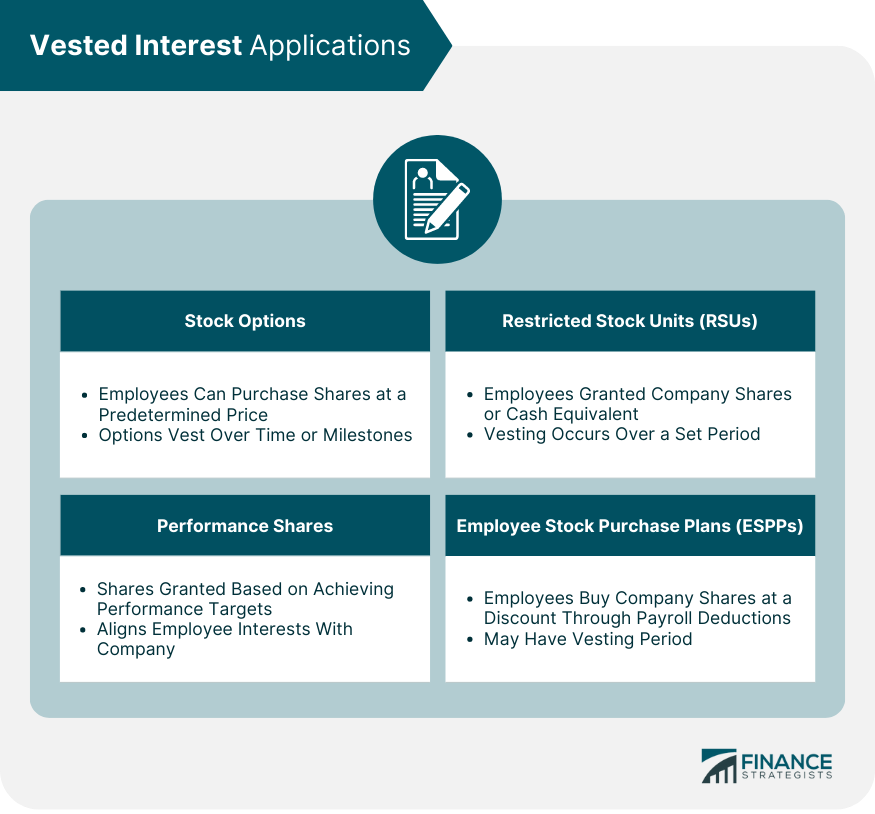

Vested interest refers to an individual's legal right to an asset or property, often granted over time or based on specific conditions being met. It represents a stake or ownership that is secure and cannot be easily revoked. Vested interests are commonly found in various areas, such as employment, pensions, and investments. In employment, employees may have vested interests in retirement plans or stock options, gaining ownership rights after a certain period of service. In investments, individuals may have vested interests in a company or project, entitling them to a share of profits or benefits. Vested interests provide individuals with a sense of security and potential rewards for their contributions. Stock options are financial contracts that give employees the right, but not the obligation, to buy a specified number of company shares at a predetermined price, known as the strike price, during a specified period. Companies use stock options as part of their long-term incentive plans to motivate and retain employees by offering them potential equity ownership in the organization. The granting of stock options is the process by which employers allocate options to employees. Vesting, on the other hand, is the gradual release of these options over time or upon achieving specific performance milestones. A typical vesting schedule might involve granting an employee a certain number of stock options that become exercisable over a period of three to five years. Exercising stock options refers to the act of purchasing company shares at the predetermined strike price. Employees can choose to exercise their vested stock options at any time during the option term, usually after a specified vesting period has passed. It is important to consider factors such as the current market price of the stock and potential tax implications before exercising stock options. When an employee exercises stock options, they may be subject to taxes on the difference between the strike price and the market price of the shares. This difference, known as the bargain element, is considered compensation income and is subject to ordinary income tax rates. Additionally, when the employee eventually sells the shares, they may be subject to capital gains tax on any profit made from the sale. Financial advisors help individuals navigate the complexities of stock options by offering guidance on when to exercise options, tax planning strategies, and integrating stock options into an overall investment portfolio. They can also provide insights into the potential risks and rewards associated with stock options, helping clients make informed decisions about their vested interests. RSUs are a type of long-term incentive plan where employers grant employees company shares or the cash equivalent, subject to vesting conditions. Unlike stock options, RSUs do not require employees to pay a strike price to acquire the shares. RSUs serve as a tool for companies to reward and retain key employees by offering potential ownership in the organization. Similar to stock options, RSUs are granted to employees and vest over time or upon achieving specific performance goals. The vesting schedule for RSUs varies depending on the company's policies and the terms of the individual's employment agreement. Once the RSUs vest, employees receive the underlying shares or the cash equivalent, which they can choose to hold or sell. When RSUs vest, the fair market value of the shares or the cash equivalent at the time of vesting is considered taxable income. This income is subject to ordinary income tax rates and is reported on the employee's W-2 form. If the employee decides to hold the shares after they have vested, any subsequent increase or decrease in the share value will be subject to capital gains or losses when the shares are eventually sold. A financial advisor can help individuals manage their RSUs by providing guidance on tax planning strategies, determining the best time to sell vested shares, and incorporating RSUs into their overall financial plan. Advisors can also help clients understand the potential risks and rewards associated with RSUs, allowing them to make informed decisions about their vested interests. Performance shares are a type of long-term incentive plan that grants employees company shares based on achieving specific performance targets. These targets can be related to the company's financial performance, stock price, or other predetermined metrics. Performance shares aim to align employee interests with the company's long-term objectives, encouraging productivity and driving growth. To implement a performance share plan, companies must establish performance goals and vesting criteria. These goals should be challenging yet achievable, ensuring that employees are motivated to contribute to the company's success. Vesting criteria may include a combination of time-based and performance-based conditions, depending on the company's objectives and the nature of the employee's role. When employees meet the performance goals set by the company, their performance shares vest, and they receive the underlying shares or the cash equivalent. The vesting of performance shares can be subject to additional time-based restrictions, such as a holding period after the performance goals have been met. The tax treatment of vested performance shares is similar to that of RSUs. When performance shares vest, the fair market value of the shares or the cash equivalent is considered taxable income and subject to ordinary income tax rates. Any subsequent gains or losses from the sale of the shares are subject to capital gains tax. Financial advisors can assist individuals in managing their performance shares by providing guidance on tax planning, determining the optimal time to sell vested shares, and incorporating performance shares into a broader investment strategy. They can also help clients understand the potential risks and rewards associated with performance shares, enabling them to make well-informed decisions about their vested interests. Employee stock purchase plans (ESPPs) are a type of long-term incentive plan that allows employees to purchase company shares at a discounted price through payroll deductions. ESPPs aim to promote employee ownership, engagement, and loyalty by providing an opportunity for employees to invest in the company's success. Employees participating in an ESPP can contribute a portion of their salary, typically up to a specified limit, to purchase company shares. The shares are usually purchased at a discount, often ranging from 5% to 15% below the market price. Some ESPPs may also have a vesting period, during which the employees must hold the purchased shares before they can sell them. When employees sell their vested ESPP shares, the difference between the purchase price and the sale price is subject to tax. The discount received at the time of purchase is considered compensation income and taxed at ordinary income tax rates, while any additional gains or losses are treated as capital gains or losses. The holding period of the shares determines whether the capital gains are classified as short-term or long-term, which impacts the applicable tax rate. Financial advisors play a crucial role in helping individuals manage their ESPP investments. They can provide guidance on maximizing the benefits of ESPP participation, including tax planning strategies, the timing of share sales, and integrating ESPP holdings into a diversified investment portfolio. Financial advisors can also help clients assess the potential risks and rewards associated with their ESPP investments, allowing them to make informed decisions about their vested interests. One of the essential principles of investing is diversification, which involves spreading investments across various asset classes and securities to minimize risk. For individuals with vested interests in their employer's stock, it is crucial to maintain a diversified portfolio to avoid overexposure to a single company's performance. Financial advisors can help clients balance their vested interests with other investments to create a well-rounded portfolio aligned with their financial goals and risk tolerance. It is crucial to regularly monitor and adjust vested interest investments to ensure they continue to align with an individual's financial objectives and market conditions. Financial advisors can help clients review their vested interests and make adjustments as needed, taking into consideration factors such as tax implications, vesting schedules, and changes in the company's performance. Managing vested interests can have significant tax implications, making it essential to implement tax planning and optimization strategies. Financial advisors can help clients navigate the complex tax rules associated with vested interests, such as stock options, RSUs, performance shares, and ESPPs. They can recommend strategies to minimize tax liability, including the timing of share sales, exercising options, and holding periods for capital gains. Financial advisors play a vital role in helping clients manage their vested interests effectively. They provide personalized guidance on maximizing the benefits of long-term incentive plans while minimizing tax liabilities and risk exposure. By working closely with clients, financial advisors can ensure that vested interests are integrated into a comprehensive financial plan that supports the client's long-term goals and objectives. Vested interest is a crucial aspect of long-term incentive plans, granting employees a legal right to assets or property over time or upon achieving specific conditions. This concept plays a vital role in various forms of employee compensation, including stock options, RSUs, performance shares, and ESPPs. Vested interest in stock options allows employees to purchase company shares at a predetermined price, while RSUs grant employees company shares or their cash equivalent upon vesting. Performance shares align employee interests with company performance by vesting based on specific performance targets. Lastly, ESPPs encourage employee ownership by offering company shares at a discounted price through payroll deductions. Understanding and effectively managing vested interests are essential for both employees and employers, as they encourage retention, loyalty, and alignment with long-term company objectives. By navigating the complexities of these various forms of vested interest, individuals can optimize their financial planning and make well-informed decisions about their investments.Definition of Vested Interest

Vested Interest in Stock Options

Definition and Purpose of Stock Options

Granting and Vesting of Stock Options

Exercising Stock Options

Tax Implications of Vested Stock Options

Financial Advisor's Role in Managing Stock Options

Vested Interest in Restricted Stock Units (RSUs)

Definition and Purpose of RSUs

Granting and Vesting of RSUs

Tax Implications of Vested RSUs

Financial Advisor's Role in Managing RSUs

Vested Interest in Performance Shares

Definition and Purpose of Performance Shares

Setting Performance Goals and Vesting Criteria

Achieving Performance Goals and Vesting of Shares

Tax Implications of Vested Performance Shares

Financial Advisor's Role in Managing Performance Shares

Vested Interest in Employee Stock Purchase Plans (ESPPs)

Definition and Purpose of ESPPs

Employee Contributions and Vesting in ESPPs

Tax Implications of Vested ESPP Shares

Financial Advisor's Role in Managing ESPPs

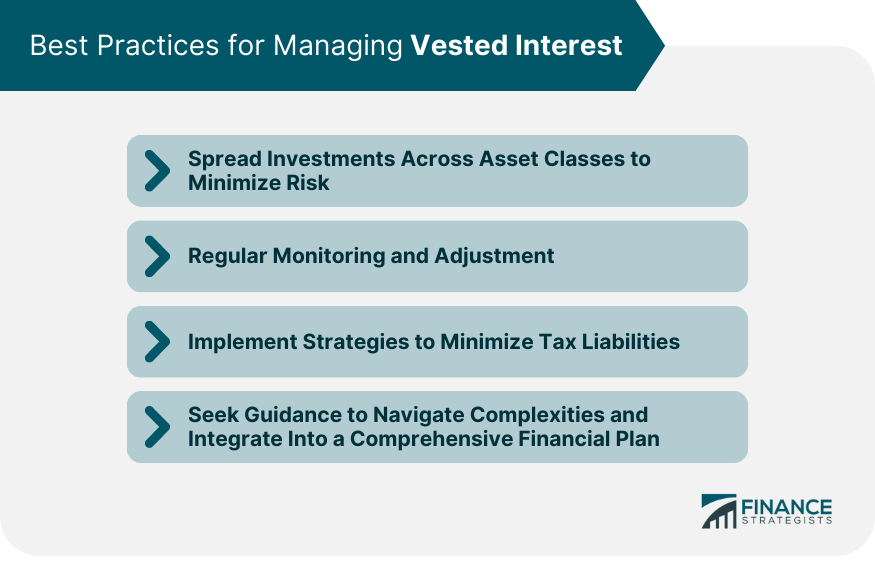

Best Practices for Managing Vested Interest

Importance of Diversification in Investment Portfolios

Monitoring and Adjusting Vested Interest Investments

Tax Planning and Optimization Strategies

Role of Financial Advisors in Managing Vested Interest

Conclusion

Vested Interest FAQs

Vested interest refers to an individual's legal right to an asset or property, often granted over time. In the context of long-term incentive plans, vested interest pertains to an employee's gradual ownership of benefits offered by their employer, such as stocks or options. These plans encourage employee retention, loyalty, and motivation by aligning employees' interests with the company's long-term goals.

Vested interest in stock options involves the gradual release of options over time or upon achieving specific performance milestones. Employers grant stock options to employees, allowing them to buy company shares at a predetermined price during a specified period. Once the options are vested, employees can choose to exercise them, purchasing the shares at the strike price and potentially profiting from the difference between the strike price and the market price.

When RSUs vest, the fair market value of the shares or the cash equivalent at the time of vesting is considered taxable income, subject to ordinary income tax rates. If the employee decides to hold the shares after they have vested, any subsequent increase or decrease in the share value will be subject to capital gains or losses when the shares are eventually sold.

Financial advisors can provide guidance on maximizing the benefits of long-term incentive plans, including tax planning, portfolio diversification, and investment strategies tailored to each client's financial goals and risk tolerance. They also help clients navigate the complexities of vested interests, such as stock options, RSUs, performance shares, and ESPPs, enabling them to make informed decisions about their investments.

To manage vested interest in ESPPs effectively, individuals should consider participating in the plan to take advantage of the discounted share price, regularly monitoring their investments, and maintaining a diversified portfolio to reduce risk. Financial advisors can help clients with tax planning strategies, the timing of share sales, and integrating ESPP holdings into a well-rounded investment portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.