Passive income can significantly affect Social Security benefits, primarily through its impact on tax liabilities. While passive income—such as earnings from rental properties, dividends, or interest—is not directly considered when calculating Social Security benefits, it can influence the taxability of these benefits. If total income, including half of your Social Security benefits and all other incomes, exceeds certain thresholds, a portion of your Social Security benefits may become taxable. However, passive income can also positively supplement retirement income, reducing reliance on Social Security alone. For retirees, effectively managing and timing passive income streams is key to minimizing tax burdens and optimizing overall retirement income. It's crucial to be aware of how different passive income types are taxed and plan accordingly. Consulting with a financial advisor is advisable for personalized strategies to integrate passive income with Social Security benefits in a tax-efficient manner. Passive income is classified differently from active income for tax purposes. It often enjoys favorable tax treatment, which can be an attractive feature for retirees. The nature of passive income is such that it's generated from investments or businesses in which the individual is not materially involved. Passive income can influence Social Security benefits, especially when it comes to tax implications. While passive income itself is not directly factored into the Social Security benefit calculation, it can affect the taxability of Social Security benefits. Different types of passive income can have varying impacts on Social Security benefits. For instance, income from rental properties is typically treated as passive and may not affect Social Security benefits directly. One of the primary advantages of integrating passive income with Social Security benefits is the potential to significantly supplement retirement income. This can provide a more comfortable and financially secure retirement. Passive income streams, such as rental income or dividends from investments, can provide additional funds that reduce the reliance on Social Security benefits alone. By strategically planning the sources and timing of passive income, retirees can maximize their total retirement benefits. For example, delaying the withdrawal of certain retirement accounts or deferring the sale of assets can minimize the tax impact on Social Security benefits. One of the main challenges in balancing passive income with Social Security benefits is navigating the tax implications. As passive income increases, it can raise the taxable portion of Social Security benefits, leading to a higher overall tax liability. Another challenge is the risk of reduced or modified Social Security benefits. If passive income increases an individual's total income significantly, it may lead to a higher tax bracket, affecting the net amount of Social Security benefits received. The integration of passive income with Social Security benefits introduces complexities in financial planning. Retirees must carefully consider the timing and amount of passive income to optimize their overall financial situation. Effective timing and claiming strategies are crucial for optimizing Social Security benefits with passive income. For instance, delaying Social Security benefits while drawing on passive income sources can result in higher monthly benefits later. Similarly, timing the sale of investment properties or the withdrawal of dividends can minimize the tax burden on Social Security benefits. Tax planning becomes critical when dealing with multiple income streams, including passive income and Social Security benefits. Understanding how different income sources are taxed and how they collectively impact your tax liability can lead to significant savings. Strategic planning might include spreading income across various years or investing in tax-efficient vehicles. Legal and reporting considerations also play a key role in optimizing benefits. It's important to accurately report all forms of income to the IRS to avoid penalties. Additionally, understanding the legal nuances of passive income and how it interacts with Social Security benefits is essential. This might require consulting with a legal expert or a tax advisor. Adjusting investment strategies to align with retirement goals and Social Security benefits is a practical consideration for retirees. This might involve shifting towards more passive income-generating investments as retirement approaches or adjusting the portfolio to balance risk and return in the context of expected Social Security benefits. A financial planner can provide insights into how different forms of passive income will interact with Social Security benefits and help devise a plan that maximizes overall retirement income while minimizing tax liabilities. Effective financial planning and budgeting are crucial when integrating passive income with Social Security benefits. Creating a budget that accounts for all income streams, including passive income, can help retirees manage their finances more effectively. Risk management is another essential aspect of financial planning for retirees. This includes evaluating the stability and reliability of passive income sources and understanding how changes in the market or economy could affect them. Passive income plays a significant role in shaping the financial landscape of retirees, particularly in its interaction with Social Security benefits. While it offers the advantage of supplementing retirement income, thereby reducing dependency on Social Security, it also brings complexities, especially in tax implications. The nature of passive income, often favored in tax treatment, requires strategic management to optimize its benefits and minimize tax liabilities. Challenges such as the potential increase in taxable Social Security benefits and the need for meticulous financial planning are critical considerations. Effective strategies, including timing income streams and understanding the tax nuances, are essential for maximizing retirement benefits. Retirees should consider adjusting their investment approaches and seek professional advice to navigate these complexities. Overall, integrating passive income with Social Security benefits, when done thoughtfully, can lead to a more secure and financially stable retirement.How Does Passive Income Affect Social Security Benefits?

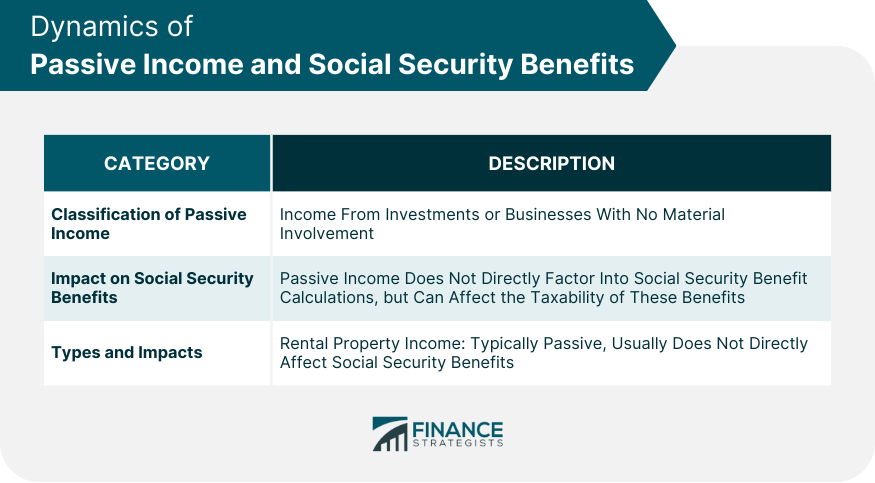

Dynamics of Passive Income and Social Security Benefits

Classification and Nature of Passive Income

Impact on Social Security Benefit Calculations

Types of Passive Income and Their Varied Impacts

Benefits of Integrating Passive Income With Social Security

Supplement to Retirement Income

Strategies to Maximize Total Retirement Benefits

Challenges in Balancing Passive Income With Social Security Benefits

Tax Implications on Combined Income

Risks of Reduced or Modified Benefits

Navigating Financial Planning Complexities

Optimizing Social Security Benefits With Passive Income

Effective Time and Claim Strategies

Tax Plan for Multiple Income Streams

Legal and Reports Considerations

Practical Considerations and Financial Planning

Adjusting Investment Strategies for Optimal Benefits

Seeking Professional Advice for Integrated Plan

Financial Plan and Budget

Risk Management Strategies

Conclusion

How Does Passive Income Affect Social Security Benefits FAQs

Passive income can affect the taxation of Social Security benefits. If your combined income, including passive income, exceeds certain thresholds, a portion of your Social Security benefits may be taxable.

Generally, passive income does not directly lead to a reduction in Social Security benefits. However, higher total income due to passive income can increase your tax liability, which might affect the after-tax value of your benefits.

Types of passive income that could impact your Social Security benefits include rental income, dividends, interest, and regular withdrawals from retirement accounts, which can increase your combined income and affect the taxability of your benefits.

Yes, the timing of passive income can influence your Social Security benefits, particularly regarding tax implications. Timing the receipt of passive income to avoid pushing your total income over certain thresholds can minimize taxes on your benefits.

Yes, consulting a financial advisor is advisable to understand how passive income affects Social Security benefits and to develop strategies for tax-efficient income management in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.