Rental property income refers to the earnings generated from leasing residential or commercial properties to tenants. Rental income can provide a steady cash flow for property owners and contribute to overall investment income. Effective rental property income planning is essential for maximizing returns on investment, managing risks, and ensuring long-term financial success. A well-planned rental property investment strategy can lead to wealth accumulation, financial stability, and even passive income. Rental property investments offer numerous benefits, including consistent cash flow, potential for capital appreciation, tax advantages, and portfolio diversification. The location of a rental property plays a critical role in determining its investment potential. Factors to consider include proximity to amenities, employment opportunities, transportation, schools, and local market trends. Understanding market trends and demand in the area of a rental property is crucial for predicting rental income potential. Researching vacancy rates, rental rates, and population growth can help investors make informed decisions about property investments. Evaluating a property's current value and its potential for appreciation is essential for assessing its investment potential. This may involve conducting a comparative market analysis or working with a professional appraiser. Estimating the potential rental income of a property is critical for determining its viability as an investment. Factors to consider include market rental rates, vacancy rates, and tenant demand. The buy and hold strategy involves purchasing a rental property and holding it for an extended period, allowing for rental income and potential capital appreciation over time. Short-term rentals, such as vacation rentals, involve leasing properties for short periods, typically to tourists or travelers. This strategy can generate higher rental income but may require more active management. House hacking involves purchasing a multi-unit property, living in one unit, and renting out the others. This strategy can help property owners offset their living expenses while generating rental income. Rent-to-own agreements allow tenants to rent a property with the option to purchase it at a later date. This strategy can provide a steady income stream and potentially lead to a future sale of the property. Commercial property investments involve leasing properties to businesses or other commercial entities. These investments can generate higher rental income but may also involve higher risks and management responsibilities. Mortgage financing is a common method for purchasing rental properties. Investors should research different mortgage products and interest rates to secure the best financing terms. Home equity loans and lines of credit allow property owners to borrow against the equity in their primary residence to finance rental property investments. This financing method can offer lower interest rates and tax-deductible interest payments. Private loans and hard money lenders provide short-term financing for rental property investments, typically at higher interest rates. This financing option can be suitable for investors who need quick access to funds or have difficulty securing traditional financing. Real estate crowdfunding platforms allow investors to pool their resources and invest in rental properties collectively. This financing method can provide access to larger investments and diversify risk. Owner financing occurs when the property seller provides financing to the buyer, allowing them to make payments directly to the seller instead of obtaining a mortgage. This financing option can be advantageous for investors with limited access to traditional financing. Setting appropriate rental rates is crucial for maximizing rental income and ensuring properties remain competitive in the market. Factors to consider when setting rental rates include local market rates, property amenities, and property management costs. Effective tenant screening and selection are essential for maintaining a steady rental income and minimizing vacancies. A thorough screening process may include background checks, credit checks, employment verification, and references from previous landlords. Efficient rent collection and payment methods can help ensure consistent cash flow from rental properties. Property owners may choose to collect rent through various methods, such as online payments, direct deposit, or check. Lease agreements should be clear and comprehensive, outlining the rights and responsibilities of both the landlord and tenant. Property owners should familiarize themselves with local landlord-tenant laws to ensure their lease agreements comply with legal requirements. Minimizing vacancies and effectively managing tenant turnover are essential for maintaining consistent rental income. Strategies for reducing vacancies may include offering incentives to renew leases, promptly addressing maintenance issues, and marketing properties effectively. Rental income must be reported on property owners' income tax returns. Proper record-keeping and accurate reporting of income and expenses are essential for ensuring compliance with tax laws. Property owners can deduct various expenses related to rental properties, including mortgage interest, property taxes, insurance, repairs, and maintenance. Understanding and maximizing deductible expenses can help minimize tax liabilities. Depreciation is a tax deduction that allows property owners to recover the cost of their rental properties over time. Capital improvements, such as property upgrades or renovations, may also be eligible for tax deductions or credits. Effective tax planning can help rental property owners minimize their tax liabilities and maximize their investment returns. Strategies may include structuring investments as pass-through entities, utilizing tax-deferred investment accounts, or leveraging tax credits and deductions. Property owners should stay informed about changes to tax laws that may impact their rental property investments. Adjusting investment strategies to account for tax law changes can help ensure continued financial success. Regular maintenance and prompt repairs are essential for preserving the value of rental properties and maintaining tenant satisfaction. A proactive approach to maintenance can help prevent costly repairs and minimize vacancies. Upgrading and renovating rental properties can increase their value, attract higher-paying tenants, and improve rental income potential. Property owners should carefully consider the costs and potential returns of upgrades and renovations. Establishing a budget for maintenance and improvement costs can help property owners effectively manage their rental property investments. Allocating funds for routine maintenance and setting aside reserves for unexpected repairs can help ensure the financial stability of rental properties. Property owners may choose to handle maintenance and repairs themselves or hire professionals. Factors to consider when making this decision include the owner's skill level, time availability, and the complexity of the task. Property owners should be familiar with local landlord-tenant laws to ensure they understand their responsibilities and the rights of their tenants. Properly addressing tenant issues and adhering to legal requirements can help prevent disputes and maintain positive landlord-tenant relationships. Liability protection is essential for rental property owners to protect themselves against claims arising from injuries or property damage on their premises. Adequate liability coverage can help minimize financial risks associated with legal claims. Insurance coverage for natural disasters and catastrophic events, such as floods, hurricanes, and earthquakes, can help protect rental property investments from significant losses. Property owners should review their policies to ensure they have appropriate coverage for their specific location and risks. Loss of rental income insurance, also known as business interruption insurance or rent guarantee insurance, can help protect property owners against lost rental income due to covered events, such as property damage or forced vacancies. This type of insurance can provide financial stability during periods of reduced rental income. When selecting insurance coverage, property owners should carefully consider the costs and benefits of various policies. Comparing quotes from multiple insurance providers can help ensure the best coverage at the most competitive price. Building a diverse rental property portfolio can help investors manage risks and optimize their investment returns. Diversification strategies may include investing in different property types, locations, or market segments. Scaling rental property investments involves strategically increasing the number of properties in an investor's portfolio to maximize returns and achieve long-term financial goals. Effective scaling strategies may include leveraging financing options, building a strong property management team, and utilizing technology to streamline operations. Partnering with other investors can provide access to additional capital, expertise, and resources, enabling property owners to grow their rental property portfolios more quickly. Joint ventures, partnerships, or real estate investment clubs can provide opportunities for collaboration and shared success. Real estate investment trusts (REITs) are companies that own, operate, or finance income-producing real estate properties. Investing in REITs can provide investors with exposure to the rental property market without directly owning or managing properties. Real estate investment clubs and networks offer opportunities for investors to connect, share knowledge, and collaborate on rental property investments. Participating in these groups can provide valuable insights and resources for building and managing a successful rental property portfolio. Effective rental property income planning is crucial for achieving financial success and realizing the full potential of rental property investments. A well-planned investment strategy can provide consistent cash flow, capital appreciation, and financial stability. Property owners must consider various factors when making rental property investment decisions, including location, market trends, property valuation, financing options, and risk management. A thorough understanding of these factors can help investors make informed decisions and optimize their investment strategies. Maintaining and improving rental properties, managing tenant relationships, and staying informed about tax laws and market trends are essential for long-term rental property income growth. Ongoing management and planning can help property owners navigate challenges and seize opportunities, ensuring the continued success of their rental property investments.What Is Rental Property Income Planning?

Assessing Rental Property Investment Potential

Location Analysis

Market Trends and Demand

Property Valuation and Appreciation Potential

Rental Income Potential

Rental Property Income Strategies

Buy and Hold Strategy

Short-Term Rentals (Vacation Rentals)

House Hacking

Rent-To-Own Agreements

Commercial Property Investments

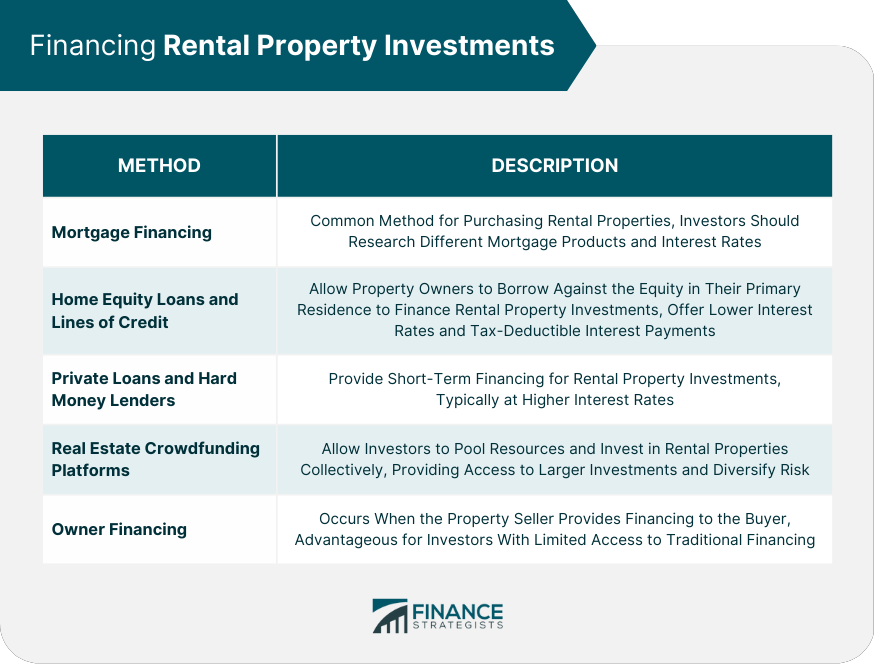

Financing Rental Property Investments

Mortgage Financing

Home Equity Loans and Lines of Credit

Private Loans and Hard Money Lenders

Real Estate Crowdfunding Platforms

Owner Financing

Managing Rental Property Income

Setting Rental Rates

Tenant Screening and Selection

Rent Collection and Payment Methods

Lease Agreements and Legal Considerations

Managing Vacancies and Turnover

Tax Implications and Planning

Reporting Rental Income

Deductible Expenses

Depreciation and Capital Improvements

Tax Strategies for Rental Property Owners

Impact of Tax Law Changes

Rental Property Maintenance and Improvement

Routine Maintenance and Repairs

Property Upgrades and Renovations

Budgeting for Maintenance and Improvement Costs

DIY vs Hiring Professionals

Tenant Responsibilities and Landlord-Tenant Laws

Risk Management and Insurance

Liability Protection

Natural Disaster and Catastrophic Event Coverage

Loss of Rental Income Insurance

Insurance Cost Considerations

Building a Rental Property Portfolio

Diversification and Risk Management

Scaling Rental Property Investments

Partnering With Other Investors

Real Estate Investment Trusts (REITs)

Real Estate Investment Clubs and Networks

Conclusion

Importance of Rental Property Income Planning for Financial Success

Key Factors to Consider in Rental Property Investment Decisions

Ongoing Management and Planning for Long-Term Rental Property Income Growth

Rental Property Income Planning FAQs

Rental property income planning is the process of creating a strategy to maximize the income generated from rental properties while minimizing expenses and taxes.

Factors to consider include rental rates, occupancy rates, expenses such as maintenance and repairs, property taxes, mortgage payments, insurance costs, and tax implications of rental income.

Strategies to increase rental property income include increasing rental rates, reducing vacancies, improving property management, minimizing expenses, and investing in property upgrades that will increase the property's value and appeal to renters.

Rental property income is generally taxed as ordinary income at the investor's marginal tax rate. However, there are some deductions and credits available, such as depreciation and the pass-through deduction for rental real estate activities.

Risks include changes in the real estate market, unexpected expenses, tenant turnover, and changes in tax laws. It is important to have a contingency plan in place to address these risks and to consult with a financial or tax professional to ensure that rental property income planning is aligned with long-term financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.