Discretionary income is the amount of money left over after an individual or household has paid for their necessary expenses, like rent, food, and bills. This money can be used for leisure activities, investing, or saving for the future. To calculate discretionary income, you must subtract your necessary expenses from your disposable income or what remains of your salary after taxes. For example, if you earn $5,000 monthly after taxes and your rent, utilities, groceries, and other bills total $3,500, your discretionary income is $1,500. Several elements affect discretionary income, and understanding them is critical to managing it effectively. The more money you earn, the more discretionary income you will have. However, even high-income individuals can struggle with managing their discretionary income if they overspend or do not budget correctly. Expenses represent what you take from your income. The bigger your expenses, the lesser your discretionary income. It is crucial to track your expenses and find ways to reduce them if possible. Debt payments take up a significant portion of a person's income, reducing the amount of discretionary income available. It is essential to pay off debt as quickly as possible to increase discretionary income. The more savings you have, the more financial freedom you will have in the future. It forms part of what you can do with your discretionary income. However, saving money requires discipline and sacrifice in the present. Inflation refers to the overall increase in the price of goods and services in an economy over time. When inflation occurs, the value of a currency decreases, and the cost of living increases. It reduces the purchasing power of an individual's income, affecting their discretionary income. Taxes are compulsory payments made by individuals and businesses to the government to fund public services and infrastructure. The more an individual or household pays in taxes, the less disposable income they have, which in turn reduces their discretionary income. Different types of taxes can affect discretionary income, including income taxes, sales taxes, property taxes, and excise taxes. It refers to the percentage of the population that is currently employed. In a strong job market, there are more opportunities for income and benefits, leading to more discretionary income. Conversely, finding employment can be challenging in a weak job market, reducing overall income and discretionary income. A strong economy increases job opportunities, leading to higher incomes and more discretionary income. It gives individuals more money to spend on non-essential items and invest in the future, increasing their financial freedom and stability. Consider these practical tips for managing discretionary income effectively and achieving financial freedom and stability. Creating and sticking to a budget is essential to managing discretionary income. A budget helps you track your income and expenses and allows you to plan for future purchases or expenses. There are different types of budgeting, including the traditional budget, the 50/30/20 budget, and the envelope budget. The traditional budget involves tracking your income and expenses monthly and allocating money for each category, such as rent, food, utilities, and entertainment. The 50/30/20 budget allocates 50% of your income for necessities like rent and bills, 30% for discretionary expenses like entertainment and dining out, and 20% for savings. The envelope budget allocates cash for expenses like groceries, entertainment, and dining out. Once the cash in the envelope is gone, there is no more money available for that category until the next cycle. It forces you to limit your expenses and prevent unnecessary spending. It allows you to build an emergency fund and work towards long-term goals like retirement or buying a house. There are different types of savings, including short-term savings, intermediate-term savings, and long-term savings. Short-term savings include emergency funds, car repairs, or vacation funds. These funds should be easily accessible, so they can be used quickly if needed. Intermediate-term savings include money for a down payment on a house or for a child's college education. These funds should be kept in a relatively safe investment like a high-yield savings account or a certificate of deposit. Long-term savings include 401(k) accounts, annuities, and individual retirement accounts (IRAs). These funds should be invested in a diversified portfolio of stocks, bonds, and other investments. Investments allow you to put your money to work, earning a return on your investment. Different types of investments include stocks, bonds, mutual funds, and real estate. Stocks are a type of investment that represents ownership in a company. Stocks can provide significant returns, but they also come with risks, including volatility and the possibility of losing your investment. Bonds are a type of investment that represents a loan to a company or government. Bonds can provide steady returns, but they also come with the risk of default. Mutual funds are a type of investment that pools money from multiple investors to purchase a diversified portfolio of stocks and bonds. Mutual funds provide diversification, reducing risk. Real estate is a type of investment that involves purchasing and managing property. Real estate can provide significant returns but also comes with the risk of property damage, market fluctuations, and the possibility of bad tenants. Discretionary income is the amount left over after taxes and necessary expenses have been paid. Understanding discretionary income is crucial to managing your finances effectively. Factors affecting discretionary income include personal factors like income level, expenses, debt, and savings, and socio-economic factors like inflation, taxation, employment rate, and economic growth. Managing discretionary income involves budgeting, saving, and investing. Consider consulting a qualified financial advisor to learn more about discretionary income. By implementing these practical tips, you can achieve financial freedom and stability.What Is Discretionary Income?

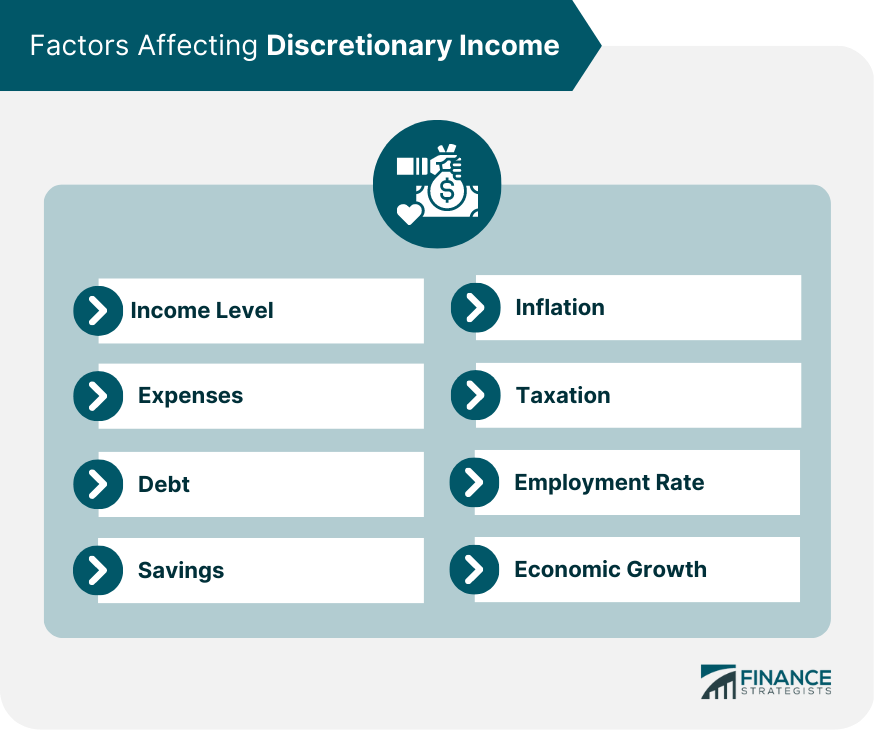

Factors Affecting Discretionary Income

Income Level

Expenses

Debt

Savings

Inflation

Taxation

Employment Rate

Economic Growth

Managing Discretionary Income

Budgeting

Saving

Investing

The Bottom Line

Discretionary Income FAQs

Discretionary income is the amount left over after paying for necessary expenses such as rent, bills, and groceries. To calculate discretionary income, subtract your necessary expenses from your disposable income or the amount of money you have left after paying taxes.

Understanding discretionary income is crucial to managing your finances effectively. It provides insight into your financial health and freedom, allowing you to make informed decisions about spending, saving, and investing.

Debt payments take up a significant portion of an individual's income, reducing the amount of discretionary income available. It is essential to pay off debt as quickly as possible to increase discretionary income and achieve financial freedom.

To increase discretionary income, you can reduce necessary expenses like rent, utilities, and groceries, find ways to increase your income through a higher-paying job or a side hustle and minimize debt payments. Additionally, developing a budget and sticking to it can help you allocate your income effectively, increasing your discretionary income.

Yes, inflation is a socioeconomic factor that affects discretionary income. When prices increase, the purchasing power of your money decreases, reducing the amount of discretionary income available. It is essential to account for inflation in your budget and invest in assets that can hedge against inflation to maintain the value of your investments and protect your discretionary income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.