Dual listing, also known as cross-listing, refers to a company's shares being listed on two or more different exchanges. This can be within the same country or across international borders. By doing so, the company seeks to increase its visibility, expand its investor base, and potentially gain access to greater capital. The dual listing strategy can create added value for shareholders by providing them with more trading options and potentially improving liquidity. It's crucial for investors to understand that a company's dual listing also involves complexities such as differences in market regulations, trading hours, and currency risks. A dual listing might be adopted to exploit specific market conditions or regulations. By understanding the concept of dual listing, investors can make more informed investment decisions and better comprehend global financial markets. Before a company decides to go for dual listing, it needs to undertake an extensive preparatory process. This involves a thorough assessment of the potential benefits and drawbacks, a review of the target markets, and a detailed financial analysis. Once a company decides to proceed, it must follow the dual listing procedures of each target exchange. This includes preparing necessary documents, submitting them to the relevant authorities, and undergoing the necessary audits and checks. The documentation required for dual listing can be quite extensive. It typically includes financial statements, business plans, and information about the company's structure and governance, among others. These documents must comply with the regulations of each exchange the company intends to list. Dual listing often leads to enhanced liquidity for a company. By listing in different exchanges, the company can access more investors and trade in different time zones, thereby increasing the volume of shares traded. Firms that opt for dual listing can tap into foreign markets to raise additional capital. They can leverage the financial strength and reputation of more mature markets to attract more investors. Being listed on multiple exchanges raises a company's profile. It gives the company exposure to more media coverage, analyst attention, and potential investors, enhancing its visibility on the global stage. Dual listing allows companies to diversify their investor base. This can provide a buffer against local market downturns, making the company less dependent on the economic conditions of a single country. The main drawback of dual listing is the complexity involved in complying with the regulatory requirements of multiple jurisdictions. Each stock exchange has its own set of rules and regulations that the company needs to adhere to. The dual listing also involves higher costs. These can include listing fees for the additional exchanges, costs of regulatory compliance, as well as administrative costs of maintaining multiple listings. Arbitrage is a risk associated with dual listing. This is the practice of taking advantage of a price difference between two or more markets, in this case, different stock exchanges. If not managed correctly, arbitrage can lead to share price discrepancies and volatility. Dual listing can lead to market fragmentation, where the company's shares are distributed across multiple exchanges. This can lead to less efficient pricing and a decrease in overall liquidity. Dual listing in different jurisdictions comes with unique legal and regulatory requirements. Complying with these requirements is crucial for the company to maintain its listing status in each exchange. Also, the role of regulatory bodies is essential in ensuring that the company adheres to these requirements and maintains a fair and transparent trading environment. Prominent examples of dual-listed companies in the United States include BHP Group Limited, a global resources company that's listed on the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX). In Europe, Royal Dutch Shell, a global group of energy and petrochemical companies, is dual-listed on the London Stock Exchange and the Euronext Amsterdam. Asia has seen a rise in dual listings recently, with Alibaba Group being a noteworthy example. Alibaba is listed on the Hong Kong Stock Exchange and the NYSE. By listing on multiple exchanges, the company gains exposure to a broader investor base, potentially attracting more buyers and increasing demand for its shares. This increased visibility can lead to higher valuations and share prices, benefiting shareholders. By tapping into different markets, companies can diversify their investor base and attract investors who may have different preferences or investment strategies. This expanded access to capital can facilitate fundraising efforts and provide the company with additional financial resources for growth and expansion. Moreover, dual listing can enhance liquidity, making it easier for shareholders to buy or sell shares, which can be particularly beneficial for institutional investors and larger shareholders. When a company is listed on multiple exchanges, discrepancies in pricing can arise due to differences in supply and demand, trading hours, and regulatory environments. These disparities create opportunities for arbitrage, where investors exploit the price differences to make profits. As a result, the stock price may become more volatile as arbitrageurs buy and sell shares across different markets, potentially impacting shareholder value. Factors such as the company's industry, size, geographic location, and investor base can all influence the outcomes of dual listing on shareholder value. Additionally, the regulatory frameworks and listing requirements of the exchanges involved can shape the impact of dual listing. Dual listing can play a significant role in cross-border mergers and acquisitions (M&A). Companies that are dual-listed can be attractive targets for M&A because of their diverse investor base and increased liquidity. However, M&A can also present challenges to dual-listed companies, especially when it comes to navigating the regulatory requirements of different jurisdictions. Dual listing provides corporations an avenue to broaden their exposure, diversify their investor base, enhance liquidity, and access greater capital by listing on multiple stock exchanges. This strategy can lead to increased market capitalization and has the potential to be a significant factor in cross-border mergers and acquisitions. However, companies must navigate through the complexity of various regulatory frameworks, manage the risk of arbitrage, handle the additional costs, and mitigate the potential for market fragmentation. Although complex and challenging, with strategic planning and management, the dual listing can serve as a robust tool for companies aiming to expand globally. Future trends suggest an increasing prevalence of dual listing, driven by technological advancements and the interconnectedness of global markets. As such, understanding dual listing becomes even more crucial for investors, traders, and companies alike.What Is Dual Listing?

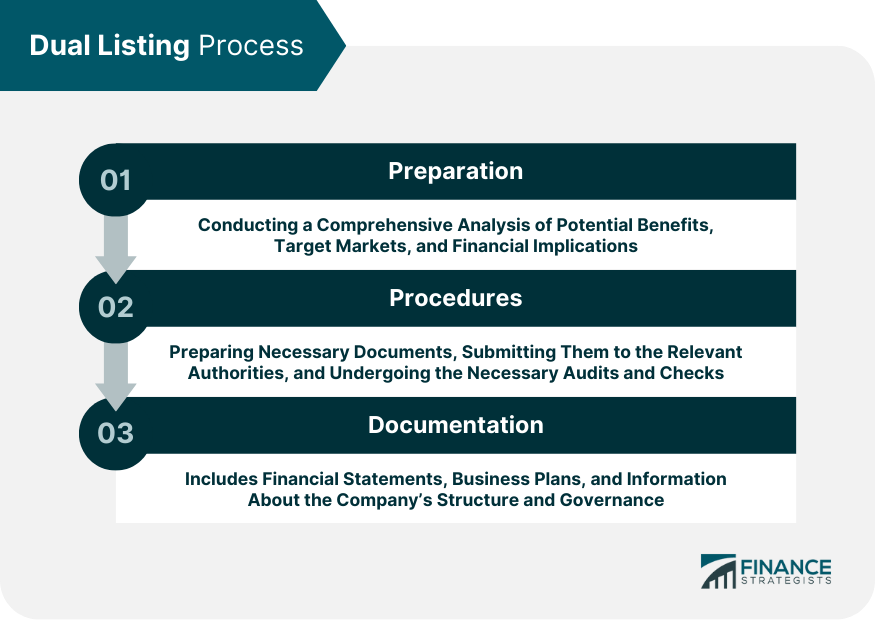

Process of Dual Listing

Preparation

Procedures

Necessary Documentation

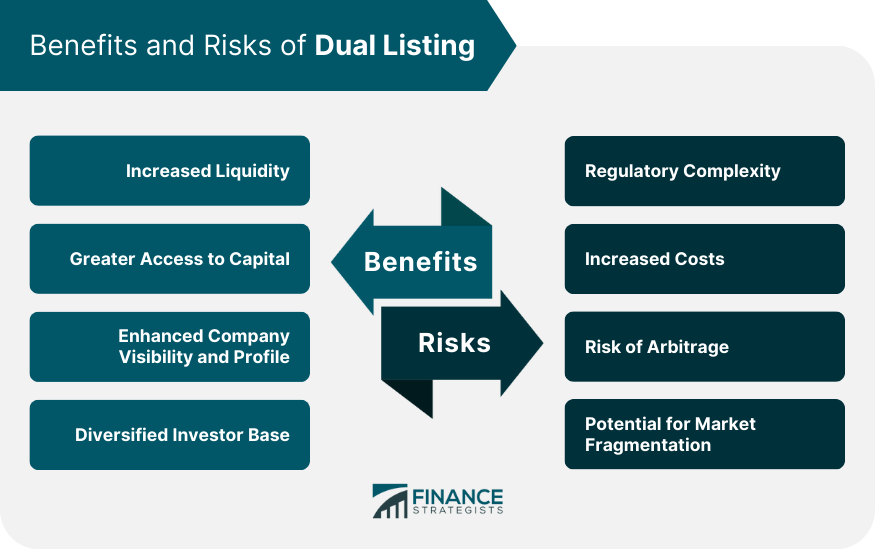

Benefits of Dual Listing

Increased Liquidity

Greater Access to Capital

Enhanced Company Visibility and Profile

Diversified Investor Base

Risks and Challenges of Dual Listing

Regulatory Complexity

Increased Costs

Risk of Arbitrage

Potential for Market Fragmentation

Legal and Regulatory Frameworks for Dual Listing

Notable Examples of Dual-Listed Companies

United States

Europe

Asia

Effects of Dual Listing on Shareholder Value

Increased Market Capitalization and Enhanced Visibility

Access to Capital and Liquidity

Stock Price Volatility and Arbitrage Risk

Company and Circumstance-Specific Effects

Role of Dual Listing in Mergers and Acquisitions

The Bottom Line

Dual Listing FAQs

Dual listing is the process where a company lists its shares on two or more different stock exchanges. Companies opt for a dual listing to increase liquidity, gain greater access to capital, enhance visibility, and diversify their investor base.

Dual listing can be complex and expensive due to the need to comply with the regulatory requirements of multiple jurisdictions. It also carries a risk of arbitrage, which can lead to stock price volatility, and it may lead to market fragmentation, which can impact the efficiency of share pricing.

Examples of dual-listed companies include BHP Group Limited, which is listed on the NYSE and the ASX; Royal Dutch Shell, listed on the London Stock Exchange and Euronext Amsterdam; and Alibaba Group, which is listed on the Hong Kong Stock Exchange and the NYSE.

Dual listing can affect shareholder value in various ways. It can lead to increased market capitalization due to enhanced company visibility and greater access to capital. However, it may also cause stock price volatility due to arbitrage risk. The effects can vary depending on the specific circumstances of the company and the markets where it is listed.

Dual listing can make a company an attractive target for cross-border mergers and acquisitions because of its diverse investor base and increased liquidity. However, such transactions can present challenges to dual-listed companies, particularly in terms of navigating the different regulatory requirements of the jurisdictions where they are listed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.