Financial therapy is a relatively new and growing field that combines the principles of psychology and personal finance to help individuals and couples navigate complex financial issues. Financial therapy is rooted in several theoretical frameworks, each contributing to a comprehensive understanding of the complex relationship between money and emotions. Behavioral finance is a field that studies the influence of psychology on financial decision-making. It seeks to understand why individuals often make irrational financial choices and explores strategies to help them make better decisions. CBT is a widely used form of psychological therapy that focuses on identifying and changing maladaptive thought patterns and behaviors. Financial therapists often draw on CBT techniques to help clients challenge and change their unhelpful beliefs about money. Financial social work is an approach that recognizes the social and cultural factors influencing a person's financial well-being. Financial therapists may use this framework to address systemic barriers that contribute to financial stress and difficulties. Money scripts are unconscious beliefs about money that shape an individual's financial behaviors and attitudes. Financial therapists work with clients to uncover and modify these scripts to promote healthier financial habits. Financial therapy can be beneficial for individuals and couples facing a variety of financial challenges, including: Overspending occurs when an individual spends beyond their means, often leading to debt or difficulty saving for future goals. Under-saving is the inability to save money consistently or adequately, which can hinder long-term financial security. Financial infidelity refers to dishonesty about money matters within a relationship, such as hiding debt or secret spending. Financial therapy can help individuals develop strategies to manage debt, improve credit scores, and avoid excessive borrowing. Financial stress is a common concern that can negatively impact mental health and overall well-being. Financial therapy can help individuals develop coping strategies and reduce financial anxiety. Money avoidance tends to ignore or minimize financial issues, which can exacerbate financial problems and inhibit financial growth. Compulsive buying is a pattern of excessive and impulsive spending that can lead to financial and emotional distress. Financial therapy typically involves three main stages: assessment, intervention, and evaluation and follow-up. During the assessment phase, financial therapists work with clients to: Identifying Client Goals: Establishing financial objectives and priorities Evaluating Financial Health: Reviewing income, expenses, assets, and liabilities Understanding Money Beliefs and Behaviors: Exploring money scripts and emotional patterns related to finances During the intervention stage, financial therapists collaborate with clients to develop and implement personalized strategies for improving their financial well-being: Setting Realistic Financial Goals: Creating achievable and measurable financial targets Developing a Personalized Financial Plan: Designing a comprehensive plan to address financial challenges and reach goals Addressing Emotional and Psychological Barriers: Utilizing therapeutic techniques to overcome unhelpful beliefs and behaviors related to money Implementing Money Management Strategies: Teaching clients practical skills to manage their finances effectively The final stage of the financial therapy process involves: Monitoring Progress: Regularly reviewing clients' financial situation and progress towards goals Adjusting Financial Plans: Making necessary changes to financial plans based on clients' evolving needs and circumstances Celebrating Achievements: Acknowledging clients' successes and milestones in their financial journey Financial therapists use various tools and techniques to help clients improve their financial well-being, such as: Assisting clients in developing and maintaining a realistic budget and tracking their spending habits. Advising clients on effective strategies for managing and reducing debt, including debt consolidation and repayment plans. Helping clients create a savings plan and providing guidance on investment options to grow their wealth. Teaching clients how to communicate effectively about money matters, particularly in relationships or within families. Introducing mindfulness practices and stress-reduction techniques to help clients manage financial anxiety and stress. Financial therapy offers a range of benefits for clients, including: By addressing the emotional and psychological factors that influence financial choices, financial therapy can help clients make more informed and rational decisions. Financial therapy equips clients with practical tools and techniques to manage their finances effectively, such as budgeting, saving, and investing. Financial therapists educate clients about financial concepts and products, empowering them to make informed decisions about their financial lives. By addressing financial concerns and improving money management skills, financial therapy can help alleviate financial stress and anxiety. Financial therapy can help couples improve communication about money, resolve financial conflicts, and work together towards shared financial goals. Financial therapy may face some challenges and limitations, including: Financial therapy services may not be accessible or affordable for all individuals, particularly those with limited financial resources. Some people may be hesitant to seek financial therapy due to stigma or misconceptions about the nature and purpose of the service. Financial therapy can be time-consuming, requiring clients to invest time and effort in self-reflection, learning, and change. Some clients may struggle to make lasting changes in their financial habits and behaviors, even with the support of a financial therapist. When selecting a financial therapist, clients should consider: Reviewing the therapist's qualifications, including education, certifications, and professional memberships. Determining if the therapist has experience with specific financial issues or client populations relevant to the client's needs. Understanding the therapist's fee structure and available payment options. Ensuring the therapist fits the client's personality, communication style, and values well. Financial therapy can be a valuable complement to other financial services, such as: Collaborating with a financial planner to develop a comprehensive financial plan that incorporates the client's emotional and psychological needs. Working with an investment advisor to align investment strategies with the client's financial goals and risk tolerance. Coordinating with a tax service professional to ensure tax-efficient financial planning and decision-making. Consulting with an estate planning attorney to create a plan that reflects the client's financial and personal priorities. Financial therapy is an innovative approach to personal finance that addresses the complex interplay between money and emotions. By helping clients develop healthier financial habits, improve money management skills, and address emotional barriers, financial therapy can contribute to greater financial well-being and overall life satisfaction. As the field of financial therapy continues to grow and evolve, it is essential to recognize its potential for promoting a holistic approach to financial health.Overview and Theoretical Foundations of Financial Therapy

Behavioral Finance

Cognitive-Behavioral Therapy (CBT)

Financial Social Work

Money Scripts

Identifying Issues That May Benefit From Financial Therapy

Overspending

Under-Saving

Financial Infidelity

Debt and Credit Management

Financial Anxiety and Stress

Money Avoidance

Compulsive Buying

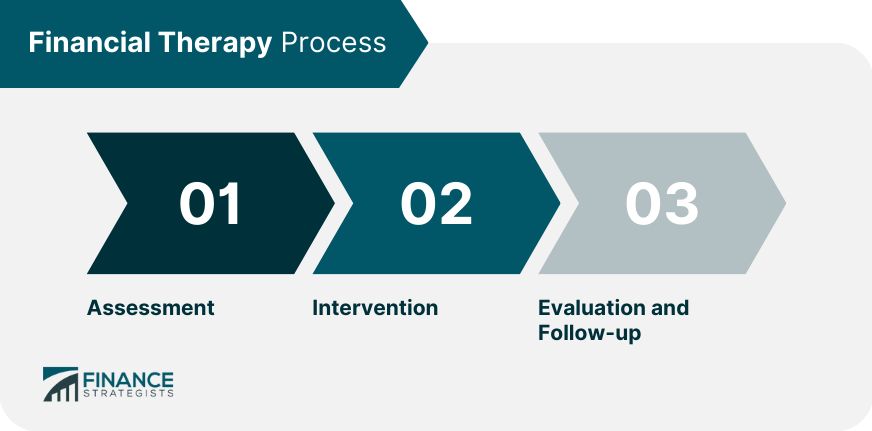

Financial Therapy Process

Assessment

Intervention

Evaluation and Follow-up

Financial Therapy Tools and Techniques

Budgeting and Expense Tracking

Debt Repayment Strategies

Savings and Investment Planning

Financial Communication Skills

Mindfulness and Stress Reduction Techniques

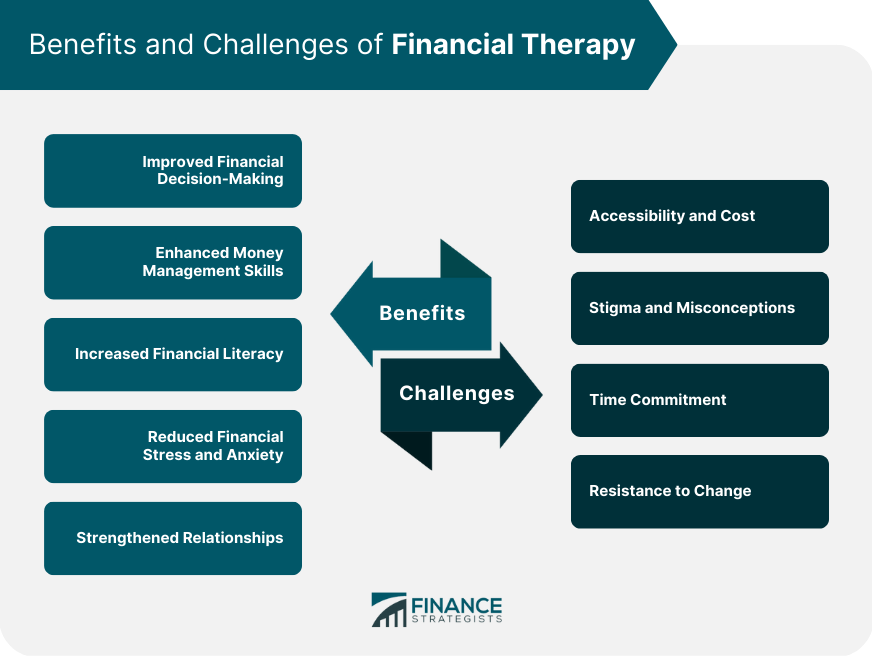

Benefits of Financial Therapy

Improved Financial Decision-Making

Enhanced Money Management Skills

Increased Financial Literacy

Reduced Financial Stress and Anxiety

Strengthened Relationships

Challenges of Financial Therapy

Accessibility and Cost

Stigma and Misconceptions

Time Commitment

Resistance to Change

Choosing a Financial Therapist

Credentials and Training

Areas of Expertise

Fees and Payment Options

Compatibility and Rapport

Integrating Financial Therapy With Other Financial Services

Financial Planning

Investment Management

Tax Planning

Estate Planning

Conclusion

Financial Therapy FAQs

Financial therapy is a form of therapy that focuses on helping individuals and couples overcome financial stress, anxiety, and other emotional issues related to money.

While traditional financial planning focuses on setting and achieving financial goals, financial therapy focuses on the underlying emotional and behavioral issues that affect a person's financial decisions and habits.

Anyone who experiences financial stress, anxiety, or conflict in their personal or professional life can benefit from financial therapy. This includes individuals, couples, and families.

Common issues addressed in financial therapy include debt management, budgeting, saving, spending habits, financial conflicts in relationships, financial trauma, and anxiety related to money.

You can start by asking for referrals from your healthcare provider, or financial advisor, or through professional organizations such as the Financial Therapy Association. You can also search online for licensed therapists who specialize in financial therapy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.