An intra-family loan is a financial agreement between family members where one party lends money to another. This type of loan can provide flexible financing options for various purposes, often with lower interest rates than traditional loans. Intra-family loans serve various purposes, such as helping a family member buy a home, start a business, or pay for education. Benefits include lower interest rates, flexible repayment terms, and strengthening family relationships through financial support. Despite their advantages, intra-family loans can present risks and challenges, including potential misunderstandings, strained relationships, and tax implications. Proper documentation and communication are essential to mitigating these risks. Mortgage loans within families help relatives purchase a home or refinance an existing mortgage. This type of loan offers lower interest rates and flexible terms compared to traditional mortgage lenders. Intra-family student loans provide financial assistance for education-related expenses. These loans can offer more favorable interest rates and repayment options than traditional student loans or private lenders. Personal loans between family members can cover various expenses, such as debt consolidation or home improvements. These loans often have lower interest rates and more flexible repayment terms than traditional personal loans. Business loans within families support relatives in starting or expanding a business. These loans can provide more accessible and affordable financing than traditional business loans or investors, fostering entrepreneurship within the family. Medical loans can help family members cover medical expenses or procedures not covered by insurance. These loans can ease the financial burden associated with medical costs, offering more favorable terms than traditional medical loans or credit cards. Interest rates for intra-family loans should be set at or above the applicable federal rate (AFR) to avoid tax implications. The AFR is the minimum interest rate allowed by the IRS for loans between family members. The loan duration should be established based on the borrower's financial situation and the lender's expectations for repayment. Longer loan durations may provide more manageable monthly payments but could result in more interest paid over time. A clear repayment schedule should be established, specifying the frequency and amount of payments. This schedule helps ensure timely repayment and reduces the potential for misunderstandings between the parties involved. A written loan agreement outlines the terms and conditions of the intra-family loan, including interest rates, loan duration, and repayment schedule. This agreement provides a clear understanding of the loan terms and helps protect both parties. A promissory note is a legally binding document where the borrower promises to repay the loan according to the agreed-upon terms. This note serves as evidence of the loan and can be used to enforce repayment if necessary. Intra-family loans can trigger gift tax implications if the loan's interest rate is below the AFR or if the lender forgives the loan. Proper documentation and setting appropriate interest rates can help avoid these tax issues. Interest paid on intra-family loans may be considered taxable income for the lender. Both parties should consult a tax professional to understand their respective tax obligations related to the loan. Intra-family loans should comply with legal requirements and state laws, including usury laws and any applicable registration or reporting requirements. Consulting a legal professional can ensure the loan's terms and documentation meet these requirements. Open and honest communication is crucial for successful intra-family loans. Both parties should discuss the loan's purpose, terms, and repayment expectations, ensuring a mutual understanding and minimizing the potential for misunderstandings. Clearly defining expectations regarding repayment and responsibilities can help avoid conflicts and ensure a successful loan experience. Both parties should agree on the loan terms and document them in a written agreement to provide a clear understanding of their obligations. Setting boundaries is essential to maintain healthy relationships while navigating intra-family loans. Both parties should treat the loan professionally, keeping emotions separate from the financial agreement to prevent personal matters from affecting the loan terms. Regularly monitoring the loan's status and enforcing the agreed-upon terms can help ensure timely repayment and maintain a healthy financial relationship. If the borrower encounters difficulties, the lender should address the issue promptly and consider adjusting the terms if necessary. Instead of a loan, family members can provide financial support through gifts. Gifting money can avoid the complexities associated with loans and repayment but may have tax implications depending on the gift amount and tax laws. Co-signing a loan for a family member can help them secure financing from a traditional lender while providing the co-signer with a lower level of financial risk compared to directly lending the money. Family members can invest in a relative's business or property venture rather than provide a loan. This approach allows the investor to share in the potential success of the venture while mitigating some of the risks associated with intra-family loans. Providing financial education and support can empower family members to manage their finances more effectively, reducing the need for intra-family loans. This support can include budgeting assistance, credit counseling, or guidance on saving and investing. Intra-family loans offer numerous benefits, such as lower interest rates and flexible terms, but they also present challenges and risks, including strained relationships and tax implications. Weighing these pros and cons is essential when considering intra-family lending. By following best practices, understanding alternatives, and learning from case studies, individuals can make informed decisions about intra-family lending. A successful loan experience requires clear communication, proper documentation, and a mutual understanding of the terms and expectations. Consulting with a financial advisor can provide valuable guidance and expertise when considering intra-family loans. A professional can help navigate the complexities of lending within families and ensure that both parties make informed decisions that protect their financial interests and relationships.What Are Intra-Family Loans?

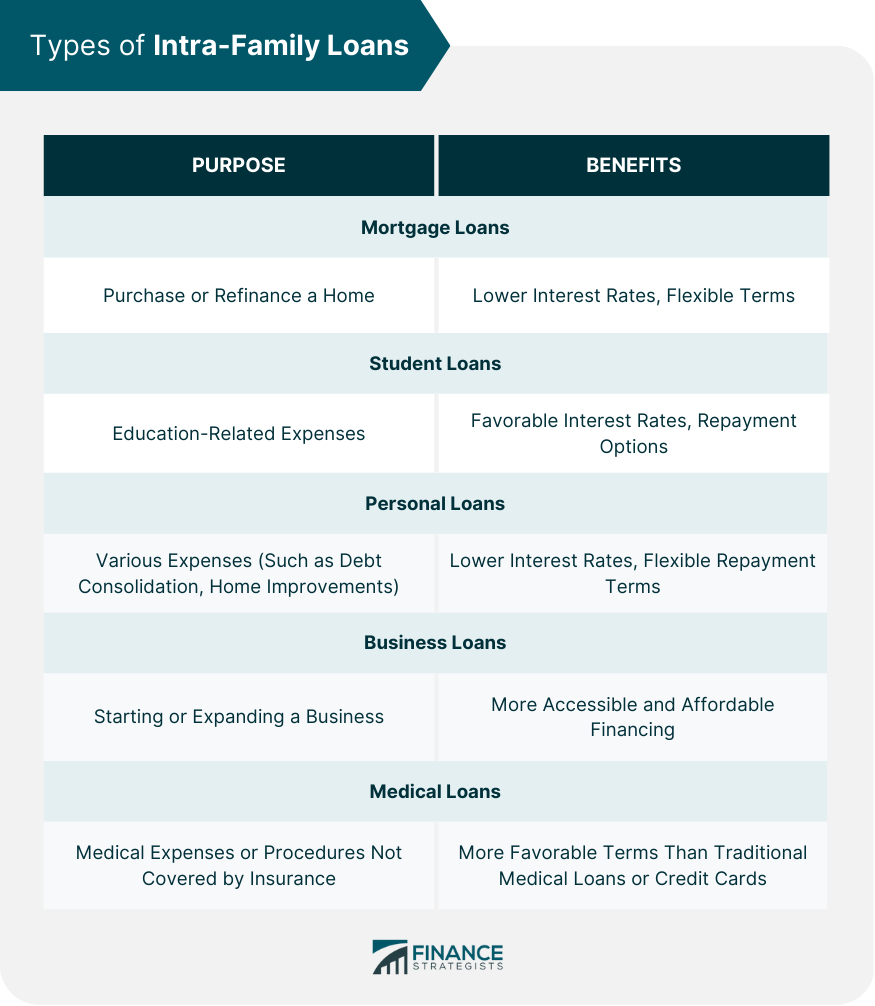

Types of Intra-Family Loans

Mortgage Loans

Student Loans

Personal Loans

Business Loans

Medical Loans

Establishing an Intra-Family Loan

Determining Loan Terms

Interest Rates

Loan Duration

Repayment Schedule

Documentation

Loan Agreement

Promissory Note

Legal and Tax Considerations

Gift Tax Implications

Income Tax Considerations

Legal Requirements and State Laws

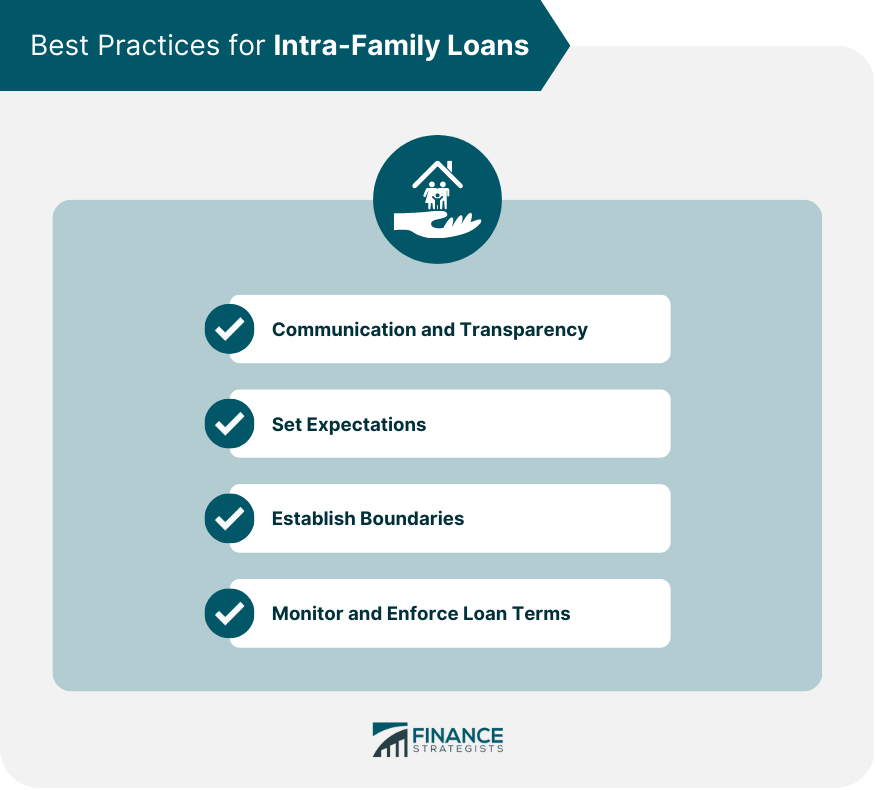

Best Practices for Intra-Family Loans

Communication and Transparency

Setting Expectations

Establishing Boundaries

Monitoring and Enforcing Loan Terms

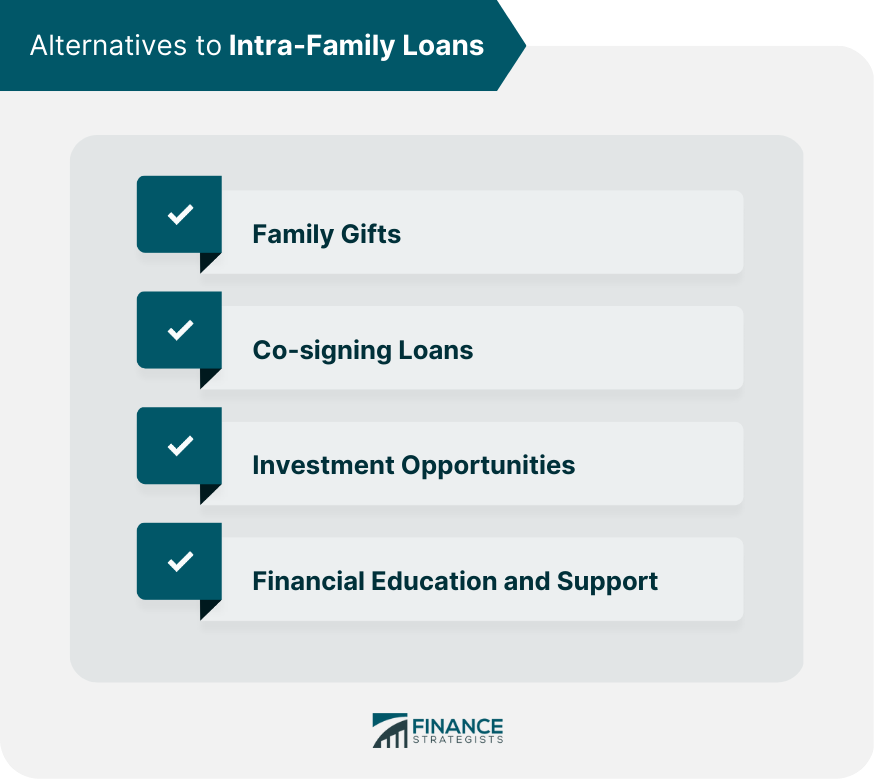

Alternatives to Intra-Family Loans

Family Gifts

Co-signing Loans

Investment Opportunities

Financial Education and Support

Final Thoughts

Intra-Family Loans FAQs

Intra-family loans offer several advantages compared to traditional loans, including lower interest rates, flexible repayment terms, and the opportunity to strengthen family relationships through financial support.

To minimize risks and challenges, ensure open communication, proper documentation, and clear expectations regarding loan terms and repayment. Establishing boundaries and treating the loan professionally can also help maintain healthy relationships.

Common types of intra-family loans include mortgage, student, personal, business, and medical loans. Each type serves a different purpose, offering flexible financing options for family members.

When setting up intra-family loans, be aware of gift tax implications, income tax considerations, and compliance with legal requirements and state laws. Consulting with a tax professional and legal advisor can help ensure compliance with these considerations.

To ensure a successful intra-family loan experience, maintain open communication, create a written loan agreement and promissory note, set clear expectations and boundaries, and regularly monitor the loan's status. If necessary, seek advice from a financial advisor for guidance and expertise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.