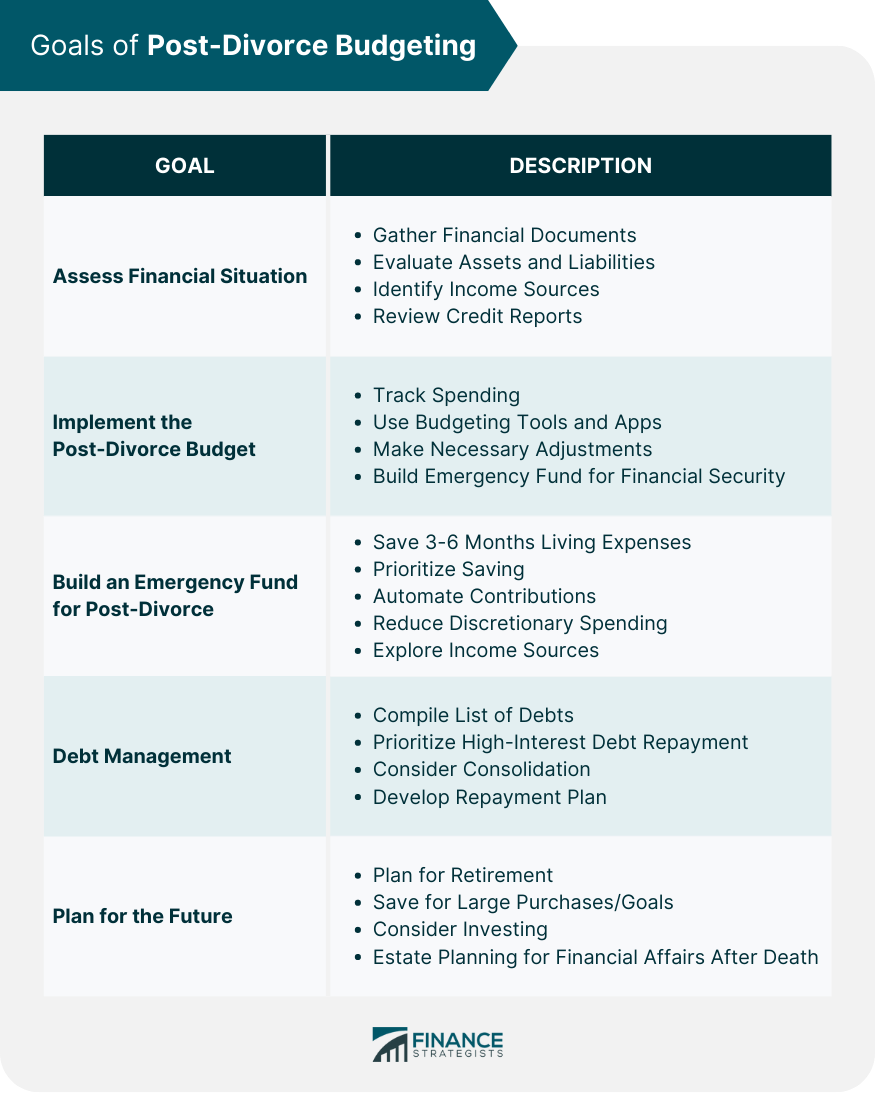

Post-divorce budgeting is crucial to ensure financial stability and independence after a marital separation. Managing finances effectively can help alleviate stress and provide a solid foundation for future financial decisions. The primary goals of post-divorce budgeting are to establish a clear understanding of one's financial situation, set realistic financial goals, create and implement a sustainable budget, and plan for future financial needs. The primary goals of post-divorce budgeting are to establish a clear understanding of one's financial situation, set realistic financial goals, create and implement a sustainable budget, manage debts, and plan for future financial needs. The first step in assessing your financial situation is to gather all relevant financial documents, including bank statements, tax returns, pay stubs, and investment account statements. This information provides a comprehensive overview of your financial health. Next, evaluate your assets (what you own) and liabilities (what you owe) to determine your net worth. Understanding your net worth helps to identify areas of focus for your post-divorce budget and financial goals. Identify all sources of income, such as employment earnings, alimony, child support, or rental income. Knowing your total income will aid in creating a realistic budget that supports your financial goals. Obtain and review your credit reports to identify any potential errors or discrepancies. Maintaining a good credit score is crucial for obtaining loans, renting properties, and securing favorable interest rates. Regularly track your spending to ensure you are adhering to your budget and making progress toward your financial goals. Monitoring your expenses can help identify areas for improvement and keep you accountable. Budgeting tools and apps can simplify the process of tracking expenses and managing your finances. Explore various options to find the one best suits your needs and preferences. As your financial situation changes, it's essential to make adjustments to your budget to reflect these changes. This may involve reallocating funds, revising goals, or modifying spending habits. Evaluate your financial progress regularly to ensure you stay on track and make any necessary adjustments. Frequent evaluations can help you stay motivated and focused on achieving your financial goals. An emergency fund is crucial for providing financial security in case of unexpected expenses, such as medical bills or job loss. Having a safety net can prevent you from accumulating debt and reduce financial stress. Typically, it's recommended to save three to six months' worth of living expenses in an emergency fund. The exact amount will vary depending on factors such as job stability, financial obligations, and personal comfort level. To build an emergency fund, prioritize saving by setting aside a portion of your income each month. Automate savings contributions, reduce discretionary spending, or explore additional income sources to accelerate your progress. Compile a list of all outstanding debts, including credit card balances, loans, and other liabilities. Identify the total amount owed, interest rates, and monthly payments to create a comprehensive overview of your debt situation. Focus on repaying high-interest debt first, as it can accumulate rapidly and prolong your debt repayment journey. Prioritizing debt repayment can save money on interest and help you achieve financial freedom sooner. Consider debt consolidation options, such as balance transfers or consolidation loans, to simplify repayment and potentially lower interest rates. This strategy can make managing debt more manageable and save money in the long term. Develop a realistic debt repayment plan that outlines monthly payments and a timeline for becoming debt-free. Regularly evaluate your progress and adjust your plan as needed to stay on track. Ensure long-term financial security by actively planning for retirement. This may involve contributing to employer-sponsored retirement plans, opening an individual retirement account (IRA), or exploring other investment options. Identify any large purchases or financial goals you have, such as buying a home or funding a child's education. Develop a savings plan to achieve these goals and allocate resources accordingly within your budget. Consider investing as a way to grow your wealth and achieve long-term financial goals. Research various investment options, assess risk tolerance, and develop a diversified portfolio to optimize returns. Estate planning is essential to ensure your financial affairs are in order, and your wishes are carried out after your death. This may involve creating a will, designating beneficiaries, and establishing a trust. Post-divorce budgeting is essential for achieving financial stability and independence after a marital separation. Establishing a clear understanding of your financial situation, setting realistic financial goals, creating and implementing a sustainable budget, and planning for future financial needs can help alleviate stress and provide a solid foundation for future financial decisions. Regularly evaluating your financial situation, tracking progress, and making necessary adjustments can help you stay on track and achieve long-term financial success. By prioritizing financial management and growth, you can build a secure financial future and enjoy greater peace of mind. Get professional help from a financial advisor for complex financial situations or achieving specific goals. What Is Post-Divorce Budgeting?

Assessing Your Financial Situation

Gathering Financial Documents

Evaluating Assets and Liabilities

Identifying Sources of Income

Reviewing Credit Reports

Implementing the Post-Divorce Budget

Tracking Spending

Utilizing Budgeting Tools and Apps

Making Necessary Adjustments

Evaluating Progress Regularly

Building an Emergency Fund for Post-Divorce

Importance of Having an Emergency Fund

Determining the Ideal Amount to Save

Strategies for Building an Emergency Fund

Debt Management

Assessing Your Debt Situation

Prioritizing Debt Repayment

Consolidating Debts, If Applicable

Creating a Debt Repayment Plan

Planning for the Future

Retirement Planning

Saving for Large Purchases or Goals

Investing

Estate Planning

Final Thoughts

Post-Divorce Budgeting FAQs

Post-divorce budgeting is crucial to ensure financial stability and independence after a marital separation. Managing finances effectively can help alleviate stress and provide a solid foundation for future financial decisions.

Some tips for creating a post-divorce budget include gathering financial documents, evaluating assets and liabilities, identifying sources of income, categorizing expenses, and allocating funds for savings and debt repayment.

To build an emergency fund, prioritize saving by setting aside a portion of your income each month. Automate savings contributions, reduce discretionary spending, or explore additional income sources to accelerate your progress.

Some common debt management strategies for post-divorce individuals include prioritizing debt repayment, consolidating debts if applicable, creating a debt repayment plan, and seeking professional help if needed.

To plan for the future after a divorce, consider retirement planning, saving for large purchases or goals, investing, and estate planning. Identifying specific financial goals and developing a comprehensive plan to achieve them can provide long-term financial security.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.