What Are Rainy Day Funds?

A rainy day fund, also known as an emergency fund, is a pool of money set aside for unexpected expenses or financial hardships.

It serves as a safety net for individuals and families to protect them from financial stress during unforeseen situations.

Having a rainy day fund is crucial for maintaining financial stability and reducing the risk of debt during emergencies.

It provides peace of mind and allows individuals to handle unexpected expenses without relying on high-interest debt or compromising their long-term financial goals.

Many people confuse rainy day funds with general savings or investments.

In reality, a rainy day fund is a separate account dedicated to emergencies, while general savings are meant for other financial goals like vacations, home purchases, or education expenses.

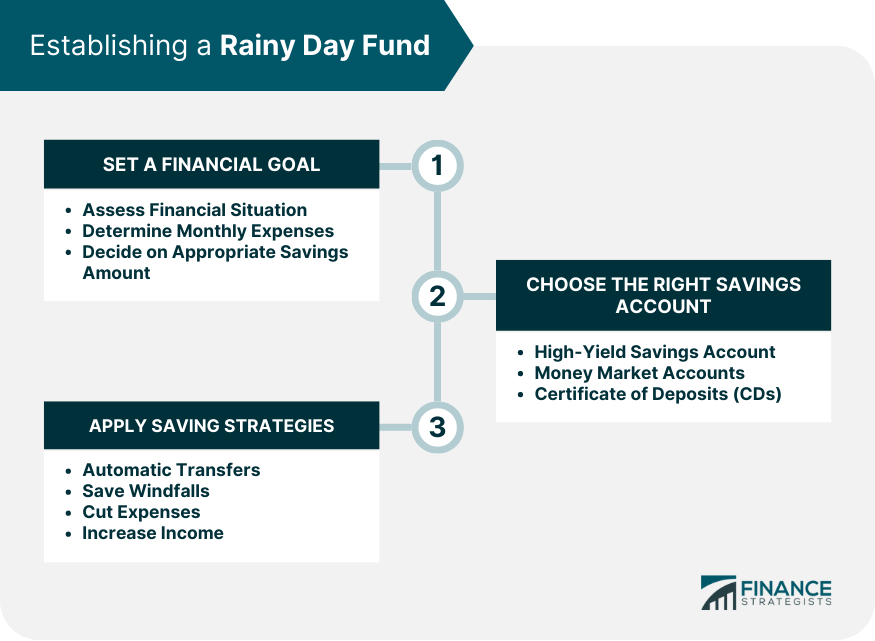

Establishing a Rainy Day Fund

Setting a Financial Goal

Assessing Your Financial Situation

Understanding your current financial situation is the first step in setting up a rainy day fund.

Evaluate your income, expenses, assets, and liabilities to determine how much you can afford to save and what amount you will need in case of an emergency.

Determining Your Monthly Expenses

To calculate the appropriate amount for a rainy day fund, you should first determine your monthly expenses. This includes essential living costs like housing, utilities, groceries, and transportation, as well as discretionary spending like entertainment or dining out.

Deciding on an Appropriate Amount to Save

Most financial experts recommend saving at least three to six months' worth of living expenses in a rainy day fund.

However, the specific amount you should save depends on your personal financial situation and the level of risk you are comfortable with.

Choosing the Right Savings Account

High-Yield Savings Accounts

A high-yield savings account is a type of bank account that offers higher interest rates than traditional savings accounts.

These accounts help your rainy day fund grow faster, making them an excellent option for emergency savings.

Money Market Accounts

Money market accounts are similar to high-yield savings accounts but may have additional features like check-writing or debit card access. They offer competitive interest rates and provide a balance between liquidity and growth for your rainy day fund.

Certificates of Deposit (CDs)

Certificates of deposit are time-sensitive savings accounts with fixed interest rates and maturity dates.

Although they typically offer higher interest rates, their lack of liquidity makes them less suitable for rainy day funds, as early withdrawal may incur penalties.

Apply Saving Strategies

Automatic Transfers

One effective strategy for building a rainy day fund is setting up automatic transfers from your checking account to your savings account. This method ensures consistent contributions and helps you prioritize savings over discretionary spending.

Saving Windfalls

Unexpected financial windfalls, such as bonuses, tax refunds, or inheritances, can be used to jump-start or boost your rainy day fund.

By allocating a portion of these windfalls to your emergency savings, you can quickly reach your financial goal.

Cutting Expenses

Reducing non-essential expenses, like dining out or subscription services, can help you save more for your rainy day fund.

By reevaluating your budget and prioritizing savings, you can make significant progress toward your emergency fund goal.

Increasing Income

Finding ways to increase your income, such as freelancing, part-time jobs, or selling items you no longer need, can accelerate your savings progress. The additional income can be directed toward your rainy day fund, helping you achieve financial security faster.

Using a Rainy Day Fund

Identifying Financial Emergencies

Unemployment or Income Loss

Job loss or a significant reduction in income is one of the primary reasons to use a rainy day fund. Emergency savings can help you cover living expenses and prevent debt accumulation while you search for a new job or alternative income source.

Medical Emergencies

Unexpected medical expenses, such as emergency room visits, surgeries, or treatments, can be financially devastating. A rainy day fund ensures you have the means to cover these costs without jeopardizing your financial stability.

Home or Car Repairs

Unplanned home or car repairs can be costly and disrupt your budget. Using your rainy day fund for these expenses helps you maintain your lifestyle and avoid incurring debt to cover the repair costs.

Natural Disasters

Natural disasters like floods, hurricanes, or wildfires can lead to significant property damage and financial loss. A rainy day fund can help you manage the financial impact of these events and facilitate a smoother recovery process.

Accessing Funds

Understanding Withdrawal Limits and Fees

Before accessing your rainy day fund, familiarize yourself with any withdrawal limitations or fees associated with your chosen savings account. This knowledge ensures you can withdraw the necessary funds without incurring additional costs or penalties.

Timely Access to Funds

In an emergency, timely access to your rainy day fund is crucial. Ensure your chosen savings account allows for quick and easy withdrawals, whether through online transfers, checks, or debit cards, to avoid delays during a crisis.

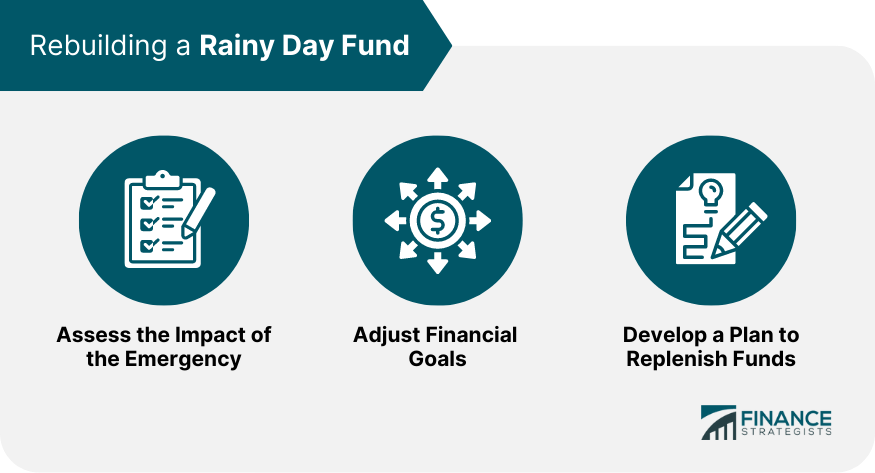

Rebuilding a Rainy Day Fund

Assessing the Impact of the Emergency

After using your rainy day fund, it's essential to assess the impact of the emergency on your financial situation.

Determine the remaining balance in your fund and how much you'll need to save to replenish it to its original amount or an updated target.

Adjusting Your Financial Goals

In some cases, the emergency may require you to adjust your financial goals.

Consider whether your priorities have shifted, and if necessary, reallocate your resources to accommodate new objectives, such as repaying debt or rebuilding your rainy day fund.

Developing a Plan to Replenish Your Fund

Re-evaluating Your Budget

To rebuild your rainy day fund, revisit your budget and identify areas where you can cut expenses or increase savings.

Adjust your spending habits to prioritize saving and allocate a portion of your income to replenish the fund.

Utilizing Savings Strategies

Employ the savings strategies mentioned earlier, like automatic transfers or saving windfalls, to accelerate your fund's replenishment.

Consistency and discipline are key to rebuilding your rainy day fund and ensuring you're prepared for future emergencies.

Monitoring Progress

Track your progress in rebuilding your rainy day fund and celebrate milestones along the way.

Regularly monitoring your progress will help you stay motivated and make adjustments as needed to reach your financial goal.

Rainy Day Funds and Long-Term Financial Planning

Balancing a Rainy Day Fund with Other Financial Goals

Retirement Savings

While building a rainy day fund is crucial, it's essential to balance it with long-term financial goals, such as retirement savings.

Contribute to your retirement accounts, like a 401(k) or IRA, while simultaneously building your emergency fund.

Paying Off Debt

Paying off high-interest debt should be a priority alongside establishing a rainy day fund. Allocate a portion of your income to both emergency savings and debt repayment to achieve financial stability and freedom from debt.

Saving for Major Life Events

As you save for emergencies, also consider major life events like buying a house, starting a family, or pursuing higher education. Develop a comprehensive savings plan that includes both your rainy day fund and these long-term financial goals.

Adapting Your Rainy Day Fund as Your Financial Situation Changes

Periodic Reassessment of Financial Goals

As your financial situation evolves, regularly reassess your financial goals and adjust your rainy day fund accordingly. This may involve increasing or decreasing the amount you save based on changes in income, expenses, or personal circumstances.

Adjusting Your Fund Based on Life Changes

Major life events, such as marriage, having children, or buying a home, can significantly impact your financial needs. Adjust your rainy day fund to accommodate these changes and ensure your emergency savings remain adequate for your evolving situation.

Final Thoughts

Maintaining a rainy day fund is crucial for financial stability and preparedness.

A well-funded emergency savings account helps you navigate unexpected expenses and financial challenges without jeopardizing your long-term financial goals.

The peace of mind provided by a rainy day fund is invaluable.

Knowing that you have the resources to handle emergencies allows you to focus on your financial goals and enjoy life without the constant worry of unforeseen expenses.

If you're unsure about how to start or manage your rainy day fund, consider seeking the guidance of a financial advisor. They can help you develop a personalized plan tailored to your financial situation and goals, ensuring you're prepared for whatever life throws your way.

Rainy Day Funds FAQs

Rainy day funds are emergency savings accounts designed to cover unexpected expenses or financial hardships. They are essential for maintaining financial stability, reducing the risk of debt during emergencies, and providing peace of mind in the face of unforeseen financial challenges.

Most financial experts recommend saving at least three to six months' worth of living expenses in your rainy day funds. However, the specific amount depends on your personal financial situation, monthly expenses, and the level of risk you are comfortable with.

High-yield savings accounts and money market accounts are ideal for rainy day funds, as they offer competitive interest rates and provide a balance between liquidity and growth. Certificates of deposit (CDs) are less suitable due to their lack of liquidity and potential early withdrawal penalties.

To balance your rainy day funds with other financial goals, such as retirement savings, paying off debt, or saving for major life events, develop a comprehensive savings plan that allocates a portion of your income to each goal. Utilize savings strategies like automatic transfers, cutting expenses, and increasing income to accelerate your progress.

Regularly reassess your financial goals and rainy day funds, especially when your financial situation evolves or you experience significant life changes, such as marriage, having children, or buying a home. Adjust your rainy day fund to ensure it remains adequate for your changing financial needs and priorities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.